ICICI Prudential Banking and PSU debt fund: A good short term debt fund for stable income

ICICI Prudential Banking and PSU debt fund has been a strong performer in the short term debt funds category over the last few years. In the last one year this short term debt mutual fund scheme gave 9.7% return, which was much higher than bank fixed deposit and small savings scheme interest rates over the same period. Some people can argue that, one should not compare debt mutual funds with assured return schemes (like FDs, small savings etc.). While I agree that, schemes subject to market risks cannot be compared to risk free / assured return schemes, at the same time, we must also understand that there are various grades of risks in a debt mutual fund. There are two types of risk factors in debt mutual funds versus risk free investments – interest rate risk and credit risk. In terms of both the risk factors, of ICICI Prudential Banking and PSU debt fund ismoderately low to low risk, relative to other debt funds. Let us understand these two risk factors in more details.

What is interest rate risk?

We have discussed a number of times in our blog that, interest rates and prices of fixed income securities (bonds or Non-Convertible Debentures) are inversely correlated. If interest rates go up, prices of fixed income securities decline and vice versa. Since fixed income securities form the underlying portfolio of debt mutual funds, the returns of debt mutual funds are dependent on both the interest rates (yields) of the underlying securities, as well as the interest rate movement. The sensitivity of returns of debt funds to changes in interest rates is the interest rate risk.

Sensitivity of prices of fixed income securities (or debt funds) to interest rates depends on the interest (coupon) payment schedule of the securities and the maturity of the securities. The combined effect of the interest (coupon payment schedule) and the maturity, in relation to the price of the fixed income security (bonds or NCDs) is known as the duration. Duration is the approximately, the discounted payback period of a fixed income investment. Shorter the duration of a fixed income security, lower is the interest rate risk and vice versa. Therefore, we urge investors to look at the portfolio duration of a debt fund, to understand the interest rate risk of the fund. Lower the portfolio duration, lesser is the interest rate risk.

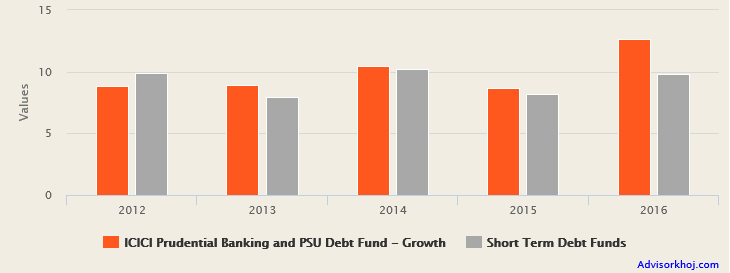

Schemes which have lower durations, aim to hold the bonds till maturity and get the yield to maturity of the fixed income securities (bonds and NCDs) in the scheme portfolio. This investment strategy is known as accrual and has low interest rate risk. Schemes with longer duration, aim to get both the yield to maturity and the price appreciation due to interest rate changes; the downside of schemes with longer duration is price decline, when interest rates rise. Hence schemes with shorter duration have lower interest rate risk. The modified duration of ICICI Prudential Banking and PSU debt fund is 3.87 years, which implies that, interest rate sensitivity, while not low, is limited (moderate). The chart below shows the annual returns of ICICI Prudential Banking and PSU debt fund over the last 5 years (in different interest rate conditions).

Source: Advisorkhoj Research

Credit Risk

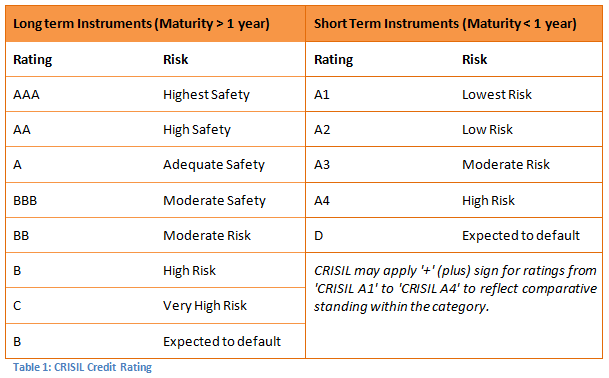

Credit risk is the other major risk of fixed income investment. Credit risk, as the name suggests, refers to the risk of the bond or debenture issuer, not fulfilling their debt obligations, i.e. inability to pay interest or principal. Usually debt fund managers in India invest in high quality securities, i.e. in fixed income securities, where the risk of default is low. Credit rating assigned by the rating agencies is a measure of credit risk of a security. Higher the credit rating, lower the yield but the risk is also lower. The price of a security is directly correlated to credit rating; if the credit rating of a security improves, the price of the security rises and vice versa. Let us understand how credit rating scale works. The table below describes the credit rating scale used by CRISIL to rate debt securities.

100% of ICICI Prudential Banking and PSU debt fund holding is rated AA or higher (of which AAA, the highest capital safety grade, constitutes 93% of the portfolio).

From both interest rate risk and credit risk perspectives, therefore, ICICI Banking and PSU debt fund belongs to the moderately low to fairly low risk grade.

Fund Overview

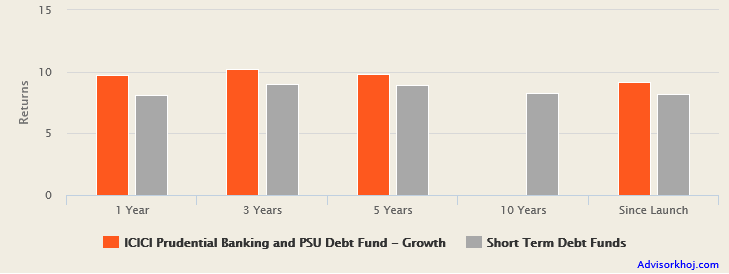

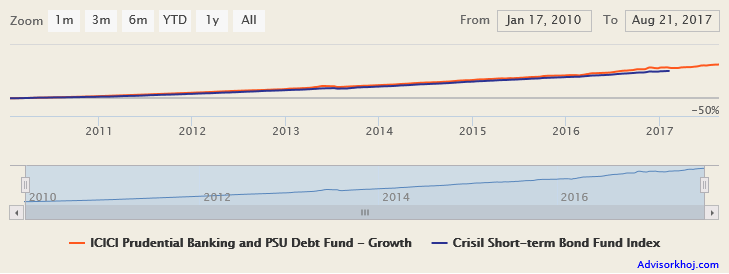

ICICI Prudential Banking and PSU debt fund was launched in January 2010 and has Rs 9,413 Crores of assets under management. The expense ratio of the fund is 0.54%. Rahul Goswami and Chandni Gupta are the fund managers of the scheme. The Scheme seeks to generate regular income through investments in a basket of debt and money market instruments consisting predominantly of securities issued by entities such as Banks and Public Sector Undertakings (PSU) with a view to providing reasonable returns, while maintaining an optimum balance of safety, liquidity and yield. The fund has given 9.2% compounded annual returns since inception. Morningstar and Value Research, the two leading mutual fund research firms, rate this fund very highly. The chart below shows the trailing returns of the scheme over the last few years.

Source: Advisorkhoj Research

You can see that, the fund gave double digits or near double digits annualized returns over various trailing time periods. The chart below shows the NAV growth of the scheme since inception.

Source: Advisorkhoj Research

Rolling Returns

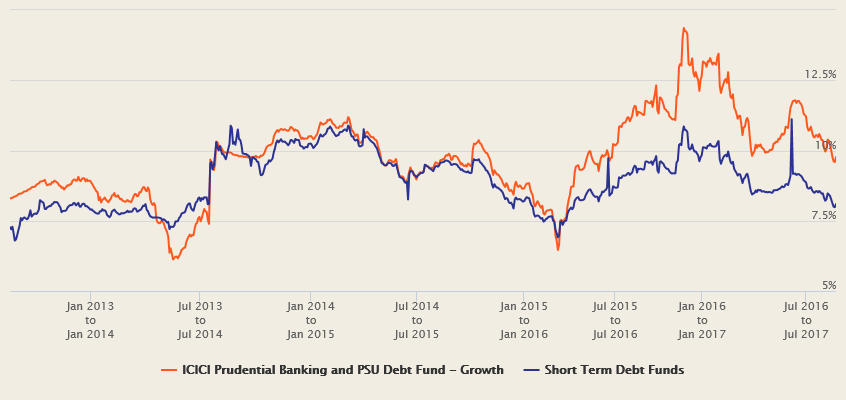

The chart below shows the 1 year rolling returns of ICICI Prudential Banking and PSU debt fund over the last 5 years. You can see that, the fund was able to beat the category average rolling returns consistently most of the times, over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see in the rolling returns chart above that, ICICI Prudential Banking and PSU Debt Fund has almost consistently beaten the category 1 year rolling returns, over the last 5 years in different interest rate scenarios. The 1 year rolling return of this fund exceeded 7.5%, nearly 97% of times over the last 5 years, in different interest rate scenarios. The rolling returns chart of ICICI Prudential Banking and PSU Debt Fund shows the limited interest rate sensitivity of this fund.

The maximum 1 year rolling return of this fund over the last 5 years was 14.4% and the minimum 1 year rolling return of the fund was 6.1%. The average 1 year rolling return of ICICI Prudential Banking and PSU Debt Fund over the last 5 years was 9.8%; the median 1 year rolling return of this fund was also 9.8%. The rolling returns of the ICICI Prudential Banking and PSU Debt Fundover the last 5 years show good performance stability and consistency.

Relatively longer investment tenures may be more suitable for this fund

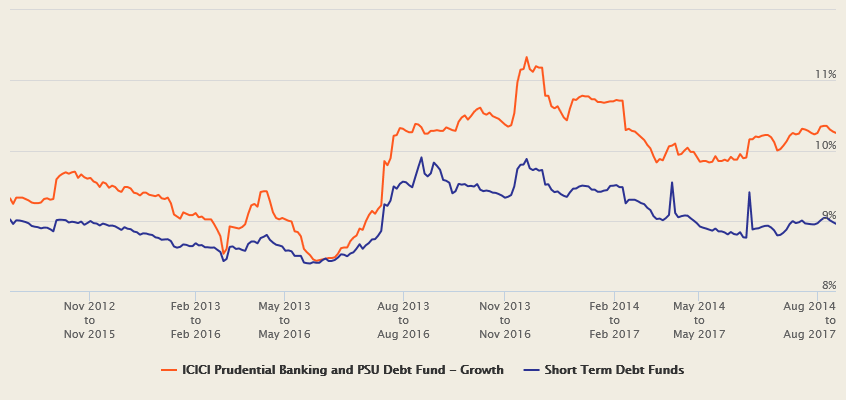

The chart below shows the three year rolling returns of ICICI Prudential Banking and PSU Debt Fundover the last 5 years. Compare the three year rolling returns chart (below) with the 1 year rolling returns chart (shown above).

Source: Advisorkhoj Rolling Returns Calculator

You can see that the three year rolling returns of the fund is less volatile than the 1 year rolling returns. The three year rolling returns of this always exceeded 8% over the last 5 years, irrespective of the interest rate scenarios. Over a sufficiently long period, we have periods of both increasing and declining interest rates; effects of increasing and decreasing interest rates tend to average out over sufficiently long investment tenure.

The maximum 3 year annualized rolling return of ICICI Prudential Banking and PSU Debt Fundover the last 5 years was 11.3% (versus 14.4% maximum 1 year rolling return) and the minimum 3 year annualized rolling return of the fund was 8.4% (versus minimum 6.1% minimum 1 year rolling return). The average 3 year annualized rolling return of ICICI Prudential Banking and PSU Debt Fund over the last 5 years was 9.8% (same as average 1 year rolling return); the median 3 year rolling return of the fund was 9.9% (slightly higher than the median 1 year rolling return). From the analysis of 3 year rolling returns of the fund versus 1 year rolling returns, it seems that longer investment tenuresare more suitable for ICICI Prudential Banking and PSU Debt Fund.

A three year plus investment tenure is also very advantageous from a tax perspective. Interest income from most traditional fixed income schemes (e.g. bank FDs, Post Office small savings schemes) are taxed as per the income tax slab rate of the investor. In the 2014 Budget the taxation of debt funds was changed. Capital gains in debt funds, held for less than 3 years, are taxed as per the income tax slab of the investor. Long term capital gains (investment tenure of more than 3 years) in debt funds are taxed at 20% after allowing for indexation benefits; indexation benefits can reduce the tax obligation of the investor considerably. Therefore, three year investment tenures are hugely beneficial for investors from a tax standpoint. In our view, tax considerations, should not determine your investment tenure. Your investment tenure should be based on your financial needs; at the same time, you should be mindful of tax considerations and take advantage of tax benefits whenever possible.

One of the most debt fund consistent performers

The strong performance consistency of ICICI Prudential Banking and PSU Debt Fund based on rolling returns is further reinforced by our Research Tool, Top Consistent Mutual Fund Performers. In our Top Consistent Mutual Fund Performers tool, we rank the annual performance of funds in each year over the last 5 years, in 4 performance quartiles (top, upper middle, lower middle and bottom) based on their annual returns relative to other mutual fund schemes in the same category. Using our proprietary ranking methodology, we then rank the most consistent fund based on their quartile ranking in each year over the last 5 years. Based on our Top Consistent Mutual Fund Performers research tool, in the short term debt funds category, ICICI Prudential Banking and PSU Debt Fundis one of the most consistent performers. The fund was always in the top 2 quartiles, every year in the last 5 years. In fact, in 4 out of the last 5 years, including the current year, the fund has been a top quartile performer.

Conclusion

If you are looking to invest over a short (1 to 2 years) to medium term (2 to 3 years or longer) investment horizon, then ICICI Prudential Banking and PSU Debt Fund can be a good investment option. This short term debt fund can give investors stable returns, at moderately low levels of capital risk. In our view, a medium term horizon (2 to 3 years or longer) is more suitable for this fund, provided it matches with your financial goals. You should discuss with your financial advisor if ICICI Prudential Banking and PSU Debt Fund is suitable for your fixed income investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team