ICICI Prudential Banking and PSU Debt Fund: A good debt fund for short term investments

Mutual fund reclassification directive by SEBI has brought a lot of clarity about different types of mutual funds for investors. In our view, retail investors had little awareness about different types of debt mutual funds and were often confused when selecting debt funds for investments. New debt fund classification has brought a lot of clarity for investors in terms of understanding interest rate and credit risk of different types of debt mutual funds.

We have discussed a number of times in our blog, that the debt fund investors should consider two risks, interest rate risk and credit risk when making investment decisions. Second half of 2017 and most of 2018 saw adverse interest rate (bond yield) movement, which affected performance of debt mutual fund schemes which had high interest rate sensitivity. Credit risk is another concern which bubbles up from time to time.

A couple of weeks back we saw, how defaults hit returns of a few debt fund schemes. Banking and PSU Fund is a category of debt mutual fund schemes in which investors can expect low credit risk, low to moderate interest rate risk and high liquidity. As per SEBI’s mandate, Banking and PSU Funds must invest at least 80% of their assets in debt instruments of banks, Public Sector Undertakings and Public Financial Institutions. These securities have relatively low credit risk. These funds are good 2 – 3 year investment options for moderately conservative investors, who want high liquidity, relatively low risk and stable returns.

Suggested read: which mutual fund is best to invest in lieu of fixed deposits

ICICI Prudential Banking and PSU debt fund

ICICI Prudential Banking and PSU Debt Fund has been one of the top performers in the banking and PSU funds category in terms of last 3 years returns (please see our tool, Top Performing Mutual Funds (Trailing returns) - Debt: Banking and PSU). In terms of both, interest rate and credit risk factors, ICICI Prudential Banking and PSU debt fund is moderately low to low risk, relative to other debt funds.

We have stated a number of times in debt fund related blog posts that, schemes which have lower durations, aim to hold the bonds till maturity and get the yield till maturity of the fixed income securities in the scheme portfolio, irrespective of price changes in the interim – this lowers the interest rate risk of the scheme.

The modified duration of ICICI Prudential Banking and PSU debt fund is 1.6 years, which implies that, interest rate sensitivity is limited; the average modified durations of other Banking and PSU funds are higher. Hence, ICICI Prudential Banking and PSU debt fund has lower than average interest rate risk. We also observed that the fund manager of the scheme reduced the duration profile of the scheme over the last 1 – 2 years, reducing downside risks for investors during the volatile period.

Credit risk is the other major risk of fixed income investment. Credit risk, as the name suggests, refers to the risk of the bond or debenture issuer, not fulfilling their debt obligations, i.e. inability to pay interest or principal. 100% of ICICI Prudential Banking and PSU debt fund portfolio is rated AA or higher. 80% of the scheme portfolio has the highest credit rating (AAA, A1+ and Sovereign), while the balance is rated AA. From a credit risk perspective also, the scheme portfolio is of very high quality.

From both interest rate risk and credit risk perspectives, therefore, ICICI Banking and PSU debt fund belongs to the moderately low to fairly low risk grade.

About ICICI Prudential Banking and PSU debt fund

This scheme was launched in January 2010 and has Rs 4,943 Crores of assets under management. The expense ratio of the fund is 0.85%. Rahul Goswami and Chandni Gupta are the fund managers of the scheme. The Scheme seeks to generate regular income through investments in a basket of debt and money market instruments consisting predominantly of securities issued by entities such as Banks and Public Sector Undertakings (PSU) with a view to providing reasonable returns, while maintaining an optimum balance of safety, liquidity and yield. The fund has given 8.5% CAGR returns since inception.

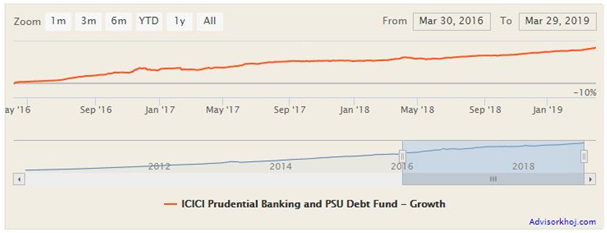

The chart below shows the NAV growth of the scheme over the last 3 years.

Source: Advisorkhoj Research

Scheme Performance

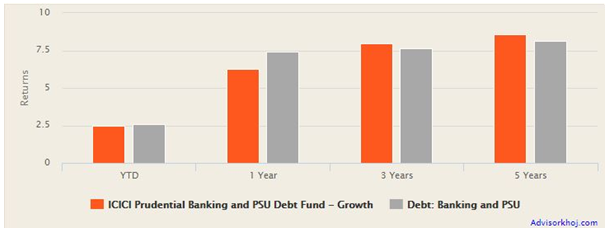

The chart below shows the annualized returns of the scheme versus the Banking and PSU fund category over various trailing time periods (ending March 29, 2019). You can see that the scheme outperformed the category over longer periods (3 years and 5 years). In the last 1 year, the scheme underperformed versus the category, but if you look at the year to date performance of the scheme, it has recovered from the underperformance and has caught up with the category average. Based on our experience of mutual fund research over the years, good recovery from temporary underperformance often creates positive momentum for a scheme, resulting in future outperformance.

Source: Advisorkhoj Research

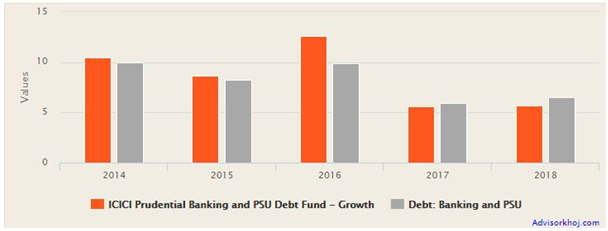

The chart below shows the annual returns of the scheme over the last 5 years. You can see that the scheme outperformed the category fairly consistently over the last 5 years. Though the scheme underperformed a bit in 2018, it has recovered its performance versus the category on a year to date basis this year (Please see the chart above).

Source: Advisorkhoj Research

Invest for 3 year plus tenures for tax advantage

A three year plus investment tenure is also very advantageous from a tax perspective. Capital gains in debt funds, held for less than 3 years, are taxed as per the income tax slab of the investor. Long term capital gains (investment tenure of more than 3 years) in debt funds are taxed 20% after allowing for indexation benefits; indexation benefits can reduce the tax obligation of the investor considerably. Therefore, three year investment tenures are hugely beneficial for investors from a tax standpoint. In our view, tax considerations, should not determine your investment tenure. Your investment tenure should be based on your financial needs; at the same time, you should be mindful of tax considerations and take advantage of tax benefits whenever possible.

Conclusion

If you are looking to invest over a short to medium term (2 to 3 years) investment horizon, then ICICI Prudential Banking and PSU Debt Fund can be a good investment option. This debt fund can give investors stable returns, at moderately low levels of capital risk. In our view, a medium term horizon of 3 years plus is more suitable for this fund, as it provides tax advantage provided it matches with your financial goals. You should discuss with your financial advisor if ICICI Prudential Banking and PSU Debt Fund is suitable for your fixed income investment needs.

Suggested reading: Debt mutual fund investments – What are the myths versus reality

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team