ICICI Prudential Balanced Fund: Superb performance over the last 5 years

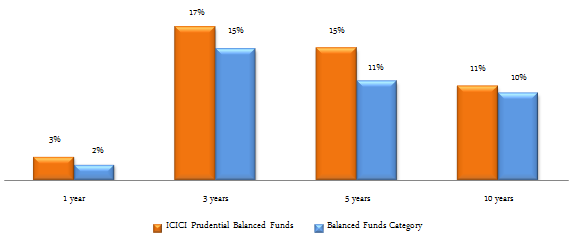

Balanced funds are ideal investment options for first time mutual fund investors. In equity markets there will always be periods when volatility will be very high. Depending on our investing temperament, some investors find high volatility very stressful. Balanced funds have always created a cushion as against equity funds when the market corrects. This can also be considered as a hedging technique as 35% of the portfolio is almost at all times in debt securities which is unaffected by the equity market volatility. Balanced funds also usually give superior risk adjusted returns compared to other equity fund categories (please see our article, Why Balanced Funds may be the best investments for new mutual fund investors). Finally, despite being significantly less risky than pure equity funds Balanced funds enjoy equity taxation. Profits from Balanced Funds held for a period of over 1 year is tax free. Balanced Fund dividends are also tax free. Balanced funds are essentially hybrid funds with both debt and equity in its portfolio mix, to balance the portfolio risk. These portfolios typically hold up to 70% of its portfolio assets in equities and the balance in fixed income. Within the balanced funds category, ICICI Prudential Balanced fund has been a very strong performer over the last 5 years. The chart below shows the trailing annualized returns of ICICI Prudential Balanced Fund versus the Balanced Funds category over different time-scales (based on May 10, 2016 NAVs)

Source: Advisorkhoj Research

The chart above tells us why this fund is considered to be a top pick. The fund has outperformed its peers across different market conditions.

ICICI Prudential Balanced Fund – Fund Overview

This fund is suitable for investors looking for long term capital appreciation with moderate levels of risk. As such the fund is suitable for investors in the moderate risk category planning for retirement or other long term financial objectives. The fund was launched in 1999 and has र 2,752 crores of assets under management (AUM) with an expense ratio of just 2.37%. The asset management company, ICICI Prudential is the largest mutual fund house in India. Mutual Funds from the ICICI Prudential stable are amongst the top performers across several mutual fund categories. The fund managers of this scheme are Yogesh Bhatt, Manish Banthia and Sankaran Naren. The scheme is open for subscription for growth, yearly dividend, half yearly dividend and monthly dividend options. Morningstar has a four star rating for this fund.

Annual Returns of ICICI Prudential Balanced Fund versus category

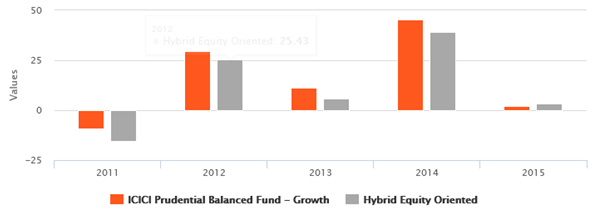

The chart below shows the annual returns of ICICI Prudential Balanced Funds and the Balanced Fund category over the last 5 years.

Source: Advisorkhoj Research

You can see that, ICICI Prudential Balanced Fund outperformed the Balanced Fund category in both bull market and bear market periods.

Rolling Returns of ICICI Prudential Balanced Fund

Readers who follow our blog regularly know that we believe Rolling Return is the most unbiased performance measure of mutual fund returns. Rolling returns are the annualized returns of the scheme over a specified investment tenure on every day and taken till the last day of the duration. In this chart we are showing the 3 year rolling returns period of ICICI on every day from May 11, 2008 to May 11, 2016. We have chosen 3 year rolling returns because we believe investors should have sufficiently long investment horizon (at least 3 years) when investing in balanced funds.

Source: Advisorkhoj Research

We have deliberately chosen the period May 2008 to May 2016, to see how the fund performed in difficult market conditions. The last eight year period has been one of the most difficult periods for equity markets ever, globally as well as in India. You can see that the rolling returns performance of ICICI Prudential Balanced Fund has been very strong in the last 5 years, January 2011 onwards. Over the last 5 years, not only has the fund always given tax free double digit rolling returns, but from July 2011 onwards, the 3 year rolling returns of the fund never dipped below 14 – 15%. This shows strong performance consistency.

Portfolio Construction of ICICI Prudential Balanced Fund

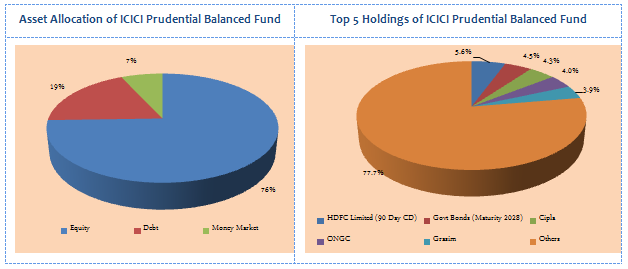

Investors should note that ICICI Prudential Balanced Fund is a more aggressive balanced fund relative to others in the category. In terms of asset allocation equity comprises little over 75% of the portfolio value, while debt and money market securities comprise the rest. The equity portfolio of the fund has a predominantly large cap bias with a value focus. From a sector perspective the fund managers favour cyclical sectors like Banking and Finance, Oil and Gas, Power etc. While cyclical sectors tend to suffer more during market corrections, like we saw in 2015, they tend to outperform in bull markets. In fact, cyclical stocks have been the biggest gainers in the post Budget market recovery. With the revival of economic growth in India, cyclical stocks are expected to do well over the coming years.

The fixed income portfolio has moderate interest rate sensitivity and high credit quality. With improving inflation trajectory, prospect of good monsoon and improving fiscal situation, interest rates are expected to be in a downward trajectory. This will also be beneficial for ICICI Prudential Balanced Fund fixed income portfolio.

From a company concentration perspective, ICICI Prudential Balanced Fund is very well diversified with its top 5 holdings, HDFC Limited certificate, Govt Bonds of 2028 maturity, Cipla, ONGC and Grasim accounting for less 23% of the total portfolio value (As on 31st March 2016).

Source: Advisorkhoj Research

Risk & Return of ICICI Prudential Balanced Fund

We had mentioned earlier that, ICICI Prudential Balanced Fund is a more aggressive balanced fund relative to others in the category. Therefore, from a risk perspective, the volatility of the fund is on the higher side compared to the category average. The annualized standard deviation of monthly returns of ICICI Prudential Balanced Fund is 12.3%, while that of balanced funds category is 11.3%. On a risk adjusted basis, as measured by Sharpe Ratio, however, the fund has outperformed the balanced funds category. Sharpe ratio is defined as the ratio of excess return (i.e. difference of return of the fund and risk free return) and annualized standard deviation of returns. Higher the Sharpe ratio better is the risk adjusted performance of the fund. Sharpe Ratio of ICICI Prudential Balanced Fund is 1.19, whereas that of Balanced Funds category is 1.05.

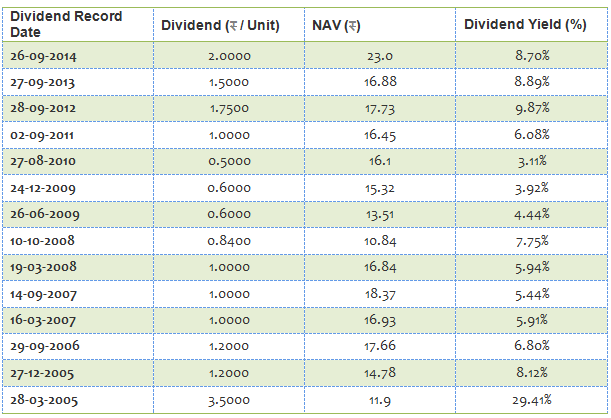

Dividend Payout Track Record of ICICI Prudential Balanced Fund

ICICI Prudential Balanced Fund has an excellent dividend payout track record. For the last 10 years the fund has paid dividends every year.

Source: Advisorkhoj Historical Dividends

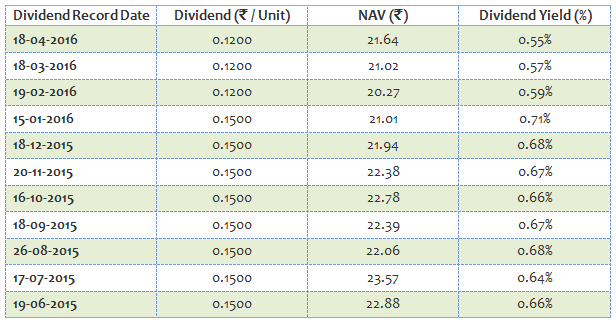

The average historical dividend yield has been around 8%. From 2015 ICICI Prudential Balanced Fund started paying monthly dividends. The old Annual Dividend Option of the fund was renamed Monthly Dividend Option in December 2015. The table below shows the monthly dividends paid by the fund over the past one year.

Source: Advisorkhoj Historical Dividends

The annual dividend yield of the monthly dividend option has been 7.7%.

In January 2016, ICICI Prudential Mutual Fund re-introduced Annual Dividend frequency. Dividend payout and dividend reinvestment sub-option are available under the Annual Dividend frequency.

Money Back Option

In December 2015 ICICI Prudential Mutual Fund announced a new option called the Money Back option for ICICI Prudential Balanced Fund. In this option investors can get a fixed monthly cash flow by withdrawing a fixed amount from the scheme depending on prevailing NAV’s of the options selected by the investor. It is the first mutual fund scheme to have an option like this. Investors should understand that the money back feature does not imply assured returns from the scheme. Investors should also note that all withdrawals from the scheme within 1 year of investment will be subject to short term capital gains tax. This option is also available for the other balanced fund in ICICI Prudential Mutual Fund stable, ICICI Prudential Balanced Advantage Fund

Lump Sum Returns

The chart below shows the growth of र 100,000 lump sum investment in ICICI Prudential Balanced Fund (Growth Option) over the last 5 years. As you can see, in the chart below, your investment would have almost doubled in value in 5 years (based May 10, 2016 NAVs).

Source: Advisorkhoj Research

SIP Returns

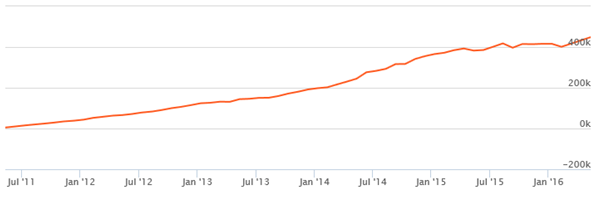

The chart below shows returns of Rs 5,000 monthly SIP in ICICI Prudential Balanced Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

You can see in the chart above that, a monthly SIP of र 5,000 in ICICI Prudential Balanced Fund (Growth Option) would have grown to almost र 450,000 over the last 5 years. This implies that, you would have made a profit of nearly र 150,000 on a cumulative investment of little over र 300,000. On an annualized basis, SIP returns have beaten the lump sum returns of this fund. SIP is an attractive mode of investment in this fund, especially in volatile market conditions.

Conclusion

ICICI Prudential Balanced Fund has a solid 17 year track record. The performance of the fund over the last 5 years has been exceptionally strong. While the fund is more aggressive relative to average balanced funds, investors may consider this product for their retirement planning and other long term financial objectives, through systematic investment plans or lump sum route with a long investment horizon. Given its good dividend pay-out track record, investors who prefer dividends can select from the various dividend options or the money back option of the ICICI Prudential Balanced Fund, depending on their cash flow requirements. Investors should consult with their financial advisors, if this scheme is suitable for their financial planning objectives.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team