ICICI Prudential Balanced Fund: Best performing Balanced Fund in the last 5 years

Balanced funds have at least 65% asset allocation in equity or equity related securities and the remaining portion in fixed income securities. Fixed income (or debt) as an asset class is subject to less price volatility relative to equity and therefore, balanced funds have a moderate risk profile compared to stocks or equity mutual funds. As such these funds are ideal long term investment products for new investors and investors who do not have high risk appetites.

Launched in 1999, ICICI Prudential Balanced Fund is a very popular product in this category and is the best performing balanced fund in the last 5 years (please see Top performing Balanced Funds in our MF Research Section). Over the last 5 years, ICICI Prudential Balanced Fund gave more than 20% annualized returns. The Assets under Management of this fund has skyrocketed in the last couple of years, on the back of its strong performance and now stands at over Rs 14,200 Crores. The expense ratio of the regular plan of this scheme is 2.25%.

The asset management company, ICICI Prudential is the largest mutual fund house in India. Mutual Funds from the ICICI Prudential stable are amongst the top performers across several mutual fund categories. The fund managers of this scheme are Atul Patel, Manish Banthia and Sankaran Naren. The scheme is open for subscription for growth, yearly dividend, half yearly dividend and monthly dividend options.

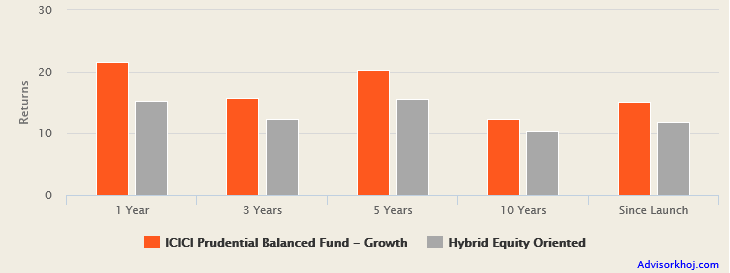

ICICI Prudential Balanced Fund has given over 15% compounded annual returns since inception. The performance over the last 5 years is truly exceptional. The chart below shows the trailing returns of ICICI Prudential Balanced Fund versus the Balanced Fund category across different time-scales.

Source: Advisorkhoj Research

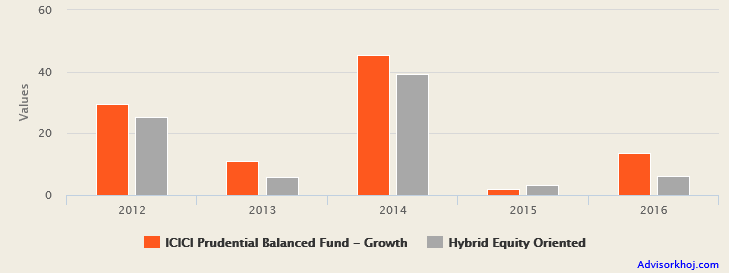

The chart below shows the annual returns of ICICI Prudential Balanced Fund versus the product category in the last 5 years.

Source: Advisorkhoj Research

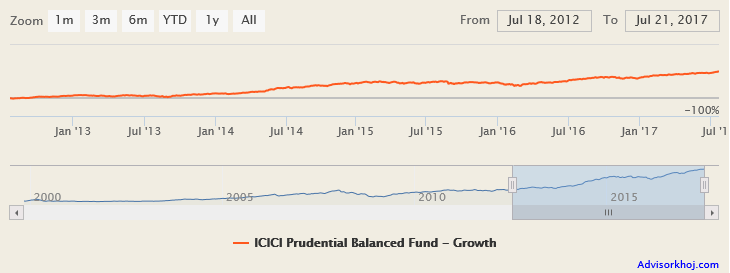

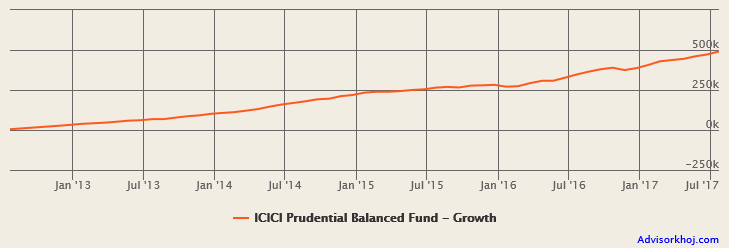

You can see that ICICI Prudential Balanced Fund outperformed the category in all years except 2015. The chart below shows the NAV growth of this scheme over the last 5 years.

Source: Advisorkhoj Research

Rolling Returns

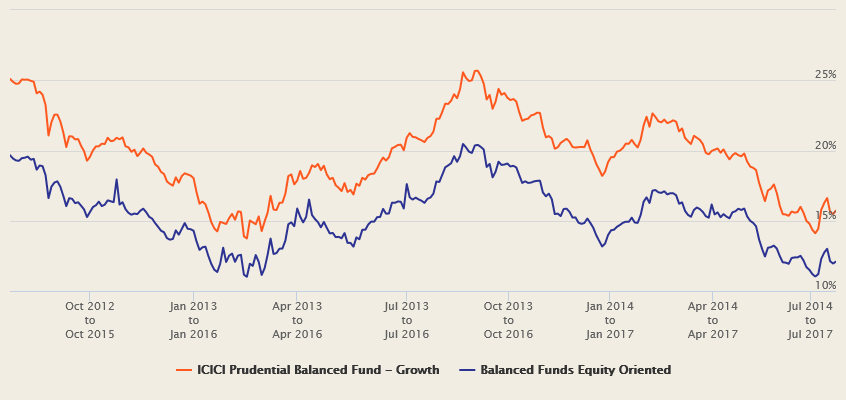

The 3 year rolling returns chart shows why ICICI Prudential Balanced Fund is such a strong performer. The chart below shows the 3 year rolling returns of the fund versus the balanced fund category over the last 5 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that the 3 year rolling returns of this fund has consistently outperformed the balanced fund category. You can also see that, the fund has almost always given more than 15% three year rolling returns over the last 5 years. This shows strong performance consistency. The fund has given more than 20% three year rolling returns nearly 50% of the times in the last 5 years. The maximum three year rolling returns of ICICI Prudential Balanced Fund is around 26%, while the minimum three year rolling returns of ICICI Prudential Balanced Fund is around 14%. The average three year rolling returns of the fund is around 20%, while the median three year rolling returns is also around 20%. Such high rolling returns from a balanced fund, with minimum fixed income exposure of 20%, is indeed exceptional performance.

Portfolio

The stated investment objective of the scheme is seeking to generate long-term capital appreciation and current income by investing in a portfolio that is investing in equities and related securities as well as fixed income and money market securities. The approximate allocation to equity would be in the range of 60 to 80%. The minimum debt allocation will be 20%. The current asset allocation of the scheme is 66% equity, 29% debt (fixed income), 1.6% money market and the balance is cash equivalents.

The equity portfolio of ICICI Prudential Balanced Fund is large cap oriented. Banks, power, automobiles, pharmaceuticals and chemicals are the top sector in the equity portfolio. The fund managers employ a blend of growth and value investing styles. The debt portion of the scheme portfolio has excellent credit quality. More than 97% of the debt securities are rated either AAA or AA. The interest rate sensitivity of the debt portfolio is moderate. The modified duration of the debt portfolio is around 4.5 years and the yield to maturity is 7.7%.

SIP Return

The chart below shows the returns of Rs 5,000 monthly SIP in ICICI Prudential Balanced Fund for the last 5 years.

Source: Advisorkhoj Research

With a cumulative investment of just Rs 3 lakhs you could have accumulated a corpus of almost Rs 5 lakhs in the last 5 years (a profit of nearly Rs 2 lakhs). The SIP return (XIRR) of ICICI Prudential Balanced Fund in the last 5 years was more than 19%.

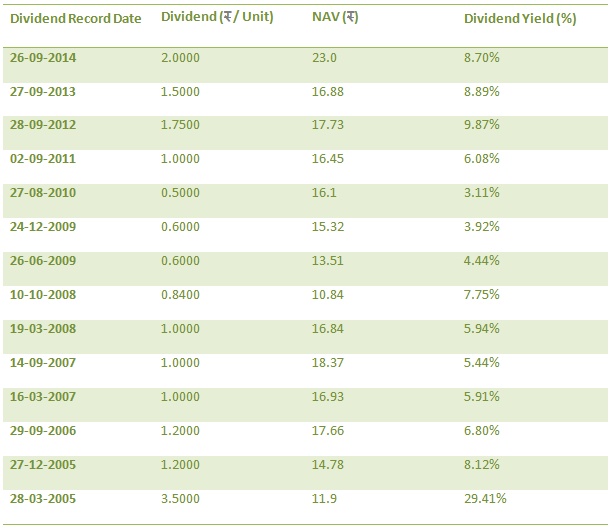

Dividend Payout Track Record

ICICI Prudential Balanced Fund has an excellent dividend payout track record. For the last 10 years the fund has paid dividends every year.

Source: Advisorkhoj Historical Dividends

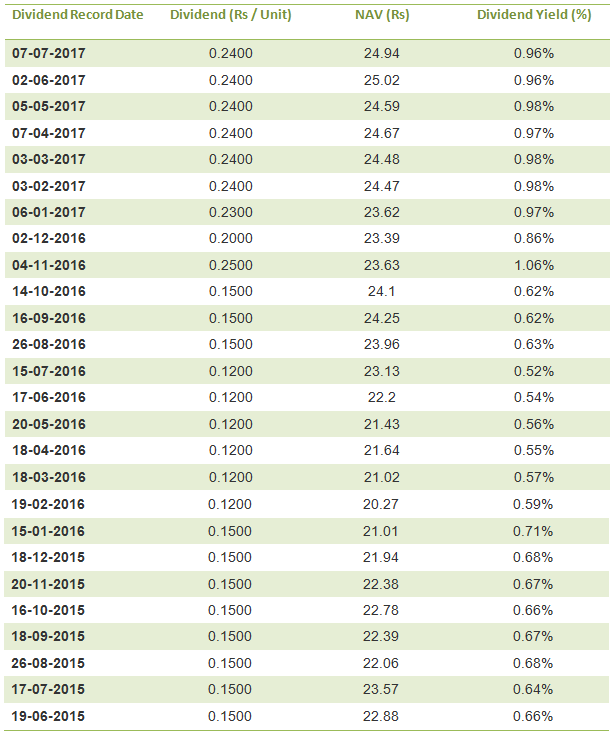

The average historical dividend yield has been around 8%. From 2015 ICICI Prudential Balanced Fund started paying monthly dividends. The old Annual Dividend Option of the fund was renamed Monthly Dividend Option in December 2015. The table below shows the monthly dividends paid by the fund over the past one year.

Source: Advisorkhoj Historical Dividends

The annual dividend yield of the monthly dividend option has been 8.9%. In January 2016, ICICI Prudential Mutual Fund re-introduced Annual Dividend frequency and paid dividends in December 2016.

Money Back Option

In December 2015 ICICI Prudential Mutual Fund announced a new option called the Money Back option for ICICI Prudential Balanced Fund. In this option investors can get a fixed monthly cash flow by withdrawing a fixed amount from the scheme depending on prevailing NAV’s of the options selected by the investor. It is the first mutual scheme to have an option like this. Investors should understand that the money back feature does not imply assured returns from the scheme. Investors should also note that all withdrawals from the scheme within 1 year of investment will be subject to short term capital gains tax. This option is also available for the other balanced fund in ICICI Prudential Mutual Fund stable, ICICI Prudential Balanced Advantage Fund.

Conclusion

While ICICI Prudential Balanced fund is a tad more aggressive relative to average balanced funds, investors may consider this product for their retirement planning and other long term financial objectives, through systematic investment plans or lump sum route with a long investment horizon. Given its good dividend pay-out track record, investors who prefer dividends can select from the various dividend options or the money back option of the ICICI Prudential Balanced Fund, depending on their cash flow requirements. Investors should consult with their financial advisors, if this scheme is suitable for their financial planning objectives.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team