ICICI Prudential Balanced Advantage Fund: Stability through dynamic asset rebalancing

This has been a great year for Indian stocks. Year to date the Nifty has given nearly 25% returns. While years like 2017 are great for investor sentiment, we would like to reiterate that equity as an asset class is volatile in nature. Over the last 28 years, Sensex has given negative annual returns in 9 years. Returns were less than 8% (which historically has been the return expectation of conservative investors) in 7 years. So in 16 out of the last 28 years, investors may have been disappointed with performance of the Sensex. Of course, the returns in the good years, more than compensated the underperformance in the not so good years and over the last 28 years BSE Sensex has grown at a compounded annual growth rate of over 16%.

Historical data shows that equity is the best performing asset class in the long term, but in the short term equity has been volatile. The volatility is likely to continue in the future. Global macro developments, commodity (like crude) prices, Foreign Institutional Investors fund flows, Government policy, RBI policy, elections, corporate earnings are some of the multiple factors which can contribute in the near to medium term. While the long term India Growth Story remains intact, as evinced by the Moody’s rating upgrade, it will not be unidirectional move for equities; equity prices will move upwards but with volatility.

Volatility affects different investors in different ways. Investors with high risk appetites are less affected by volatility but volatility can be stressful for investors with more moderate risk appetites. Balanced funds are good investment option for investors with moderate risk capacities, since the debt component of balanced funds reduces downside risks and provides stability to the portfolio. While balanced funds have a lower risk profile than equity funds, most balanced funds in India are aggressive in nature because they have minimum 65% exposure to equities to enjoy equity taxation.

ICICI Prudential Balanced Advantage fund has a more moderate risk profile compared to aggressive balanced funds, because its active equity allocation can range between 30 – 80% based on dynamic asset allocation strategy determined by equity valuations. Hence this fund is an ideal investment option for investors with moderate risk capacity. The other major advantage of ICICI Prudential Balanced Advantage funds is that despite a more moderate risk profile compared to aggressive balanced funds, the scheme enjoys equity taxation. Short term capital gains (investments held for less than 1 year) from the scheme are taxed at 15% while long terms capital gains (investments held for more than 1 year) are totally tax free. Dividends paid by ICICI Prudential Balanced Fund are tax free.

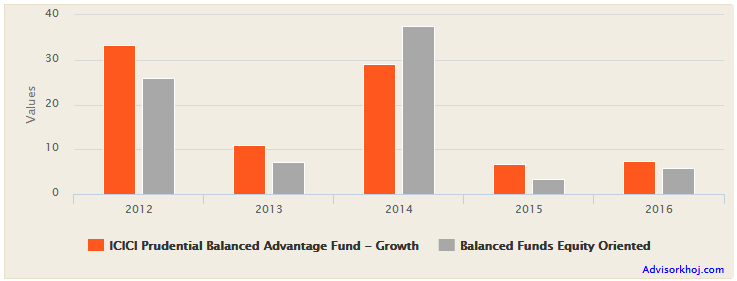

ICICI Prudential Balanced Advantage Fund was launched in December 2006 and has more than Rs 21,580 Crores of Assets under Management (AUM). The expense ratio of the fund is 2.2%. The turnover ratio of the fund is nearly 400%, but it is consistent with the investment strategy of the fund, which will explain later in this blog post. The dynamic asset allocation strategy of ICICI Prudential Balanced Advantage Fund has enabled it to outperform balanced fund category in different market conditions. Please see the annual returns of the fund versus the hybrid equity oriented funds (balanced fund) category over the past 5 years.

Source: Advisorkhoj Research

You can see that, ICICI Prudential Balanced Advantage Fund outperformed the equity oriented balanced funds category every year over the last 5 years except in 2014, which as most of our readers may know, was a momentum year for stock market in India (due to the Modi election effect). In 2017 year to date also, ICICI Prudential Balanced Advantage Fund is underperforming versus the balanced funds category. The fund is likely to underperform aggressive balanced funds in momentum years, but is likely to outperform in the volatile years. We had discussed earlier that the equity as an asset class is volatile. The investment objective of ICICI Prudential Balanced Advantage Fund is to generate steady (not spectacular returns) and to limit downside risks. The fund has given around 11.5% annualized returns since inception.

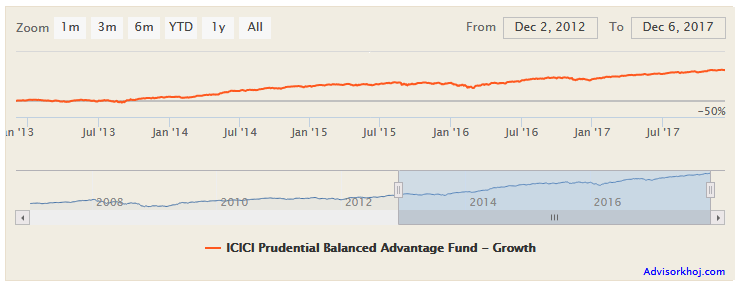

The chart below shows the NAV growth of ICICI Prudential Balanced Advantage Fund over the last 5 years.

Source: Advisorkhoj Research

Manish Banthia, Rajat Chandak, Sankaran Naren and Vinay Sharma are the fund managers of ICICI Prudential Balanced Advantage

Investment Strategy

The fund employs the buy low sell high strategy through dynamic asset rebalancing between equity and debt. The active (net) equity allocation of ICICI Prudential Balanced Advantage Fund ranges between 30 – 80% based on dynamic asset allocation strategy determined by Price / Book ratio of the equity market. Buying low and selling high is the mantra of equity investing success. However, it is very difficult to execute because basic greed and fear psychology prevents investors from buying low (due to fear) and selling high (due to greed).

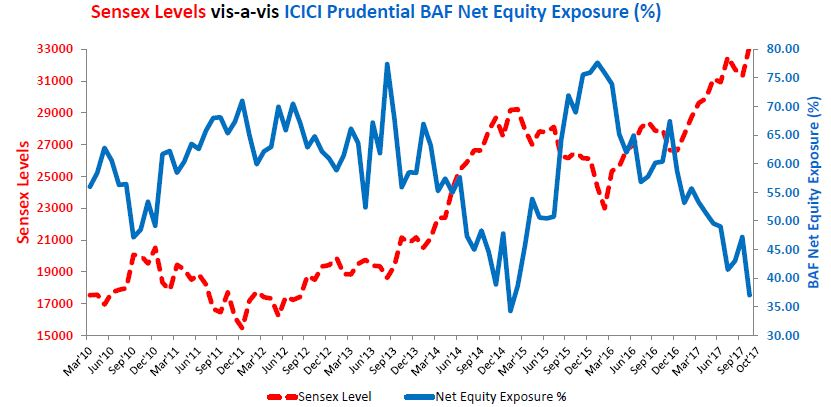

ICICI Prudential Balanced Advantage Fund removes the psychological barrier for investors and makes investing a disciplined process through the dynamic Price to Book based asset rebalancing strategy. The fund shifts its asset allocation from equity to debt when equity valuations (Price / Book) rise and from debt to equity when valuations (Price / Book) fall. The chart below shows the net equity allocation of ICICI Prudential Balanced Advantage Fund versus Sensex over the last 7 - 8 years.

Source: ICICI Prudential

You can see that the active (net) equity exposure is high when Sensex is low and low when Sensex is high. In other words, ICICI Prudential Balanced Advantage Fund is buying low and selling high. Investors should remember that unlike most aggressive balanced funds, ICICI Prudential Balanced Fund does not seek to ride market momentum and hence its performance may be low key in market rallies.

How does the fund achieve twin objectives of downside risk limitation and tax efficiency?

We have reviewed ICICI Prudential Balanced Advantage Fund a few times over the last 3 years or so. One of the questions regarding this scheme from one of our readers was that, how is the fund able to enjoy equity taxation if the equity allocation of this fund is below 65%?

Please note that we have used the term “active” or “net” equity exposure in this post. Active or net equity exposure refers to the un-hedged equity exposure of this fund. The un-hedged equity exposure is the component of the equity portfolio which is exposed to risk; it is also the component of the equity portfolio which generates returns for investors. The hedged portion of the portfolio is not subject to risk.

ICICI Prudential Balanced Advantage employs derivatives (futures and options) to hedge its portfolio. For the benefit of all our readers let us understand how hedging works. Suppose you own 100 shares of a company. Let us assume the current market price is Rs 100. The total value of your holding is therefore Rs 10,000. Let us now assume that the share price falls to Rs 80; you will make a loss of Rs 2,000 (Rs 20 X 100 shares). If you want to limit your losses, you can hedge your holdings through derivatives. For example, you can sell a futures contract which has lot size of 80 shares. If the share price falls to Rs 80 you will make a loss of Rs 2,000 on the shares you own, but you will make a profit of Rs 1,600 on the futures contract (Rs 20 X 80). Therefore, your net loss is only Rs 400. Investors should note that while hedging reduces risks, it also limits capital appreciation. If the share price rose to Rs 120 from Rs 100, you would make a profit of Rs 2,000 on the shares you own but you will make a loss of Rs 1,600 on the futures contract; hence net profit will be only Rs 400.

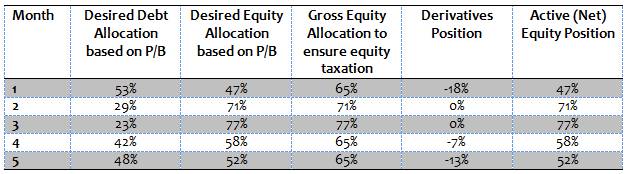

In this example, the net equity exposure at current market price is Rs 2,000 (Rs 100 X 20 net shares) while your gross exposure is Rs 10,000. From a taxation standpoint, the gross equity exposure is considered when determining whether a scheme is eligible for equity taxation. Hedging therefore helps in ensuring equity taxation at all times. The table below shows a hypothetical example of how hedging ensures equity taxation for ICICI Prudential Balanced Advantage Fund.

You can see that the active (net) equity position is always the desired equity allocation based on the P/B dynamic asset allocation model. But the minimum gross equity allocation is always above 65% to ensure equity taxation.

Rolling Returns

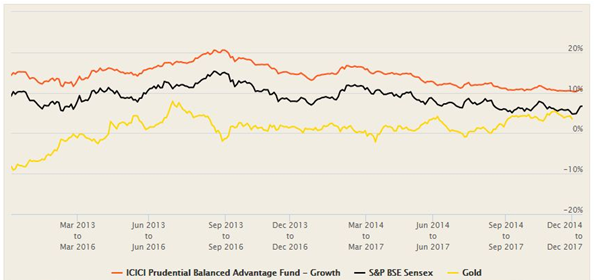

The rolling returns of ICICI Prudential Balanced Advantage Fund will reveal useful characteristics of the fund performance. The chart below shows the 3 year rolling returns of the fund over the last 5 years. We chose a 3 year rolling return period because, investors should have a sufficiently long time horizon (3 years at least) for balanced funds.

Source: Advisorkhoj Rolling Returns Calculator

Our regular blog readers know that, rolling returns is the best measure of the performance of fund, because it is not biased by specific market conditions. You can see that, the 3 year rolling returns of ICICI Prudential Balanced Advantage Fund has consistently outperformed the 3 year rolling returns for Sensex. Many investors in India believe that Gold is the safest asset class. You can see in the chart above the rolling returns of the ICICI Prudential Balanced Advantage Fund is less volatile (more stable) than Gold. Further observe that, over the last 5 years, the 3 year rolling returns of ICICI Prudential Balanced Advantage Fund has always been in double digits.

Let us now discuss some other interesting rolling return characteristics of the fund. The 3 year rolling returns of ICICI Prudential Balanced Advantage Fund was in double digits more than 90% of the time, irrespective of interim bear market periods. This shows that, the fund was able to generate steady returns for investors over a 3 year investment horizon. In fact, 3 year rolling returns of ICICI Balanced Advantage Fund was over 15% nearly 50% of the times. The strong rolling returns performance of this fund is a result of the investment strategy.

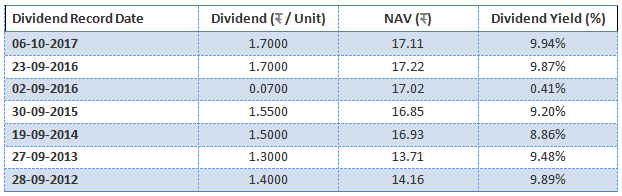

Dividend Payout Track Record

ICICI Prudential Balanced Advantage Fund has an excellent dividend payout track record over the past few years. The table below shows the dividend payout history of the fund over the past 5 years. You can see that the dividend yield is quite good. Investors should know that, balanced fund dividends are tax free for investors.

Source: Advisorkhoj Historical Dividends

You can see that the average annual dividend yield has been quite good, nearly 10%. The monthly dividend option of the fund has been paying regular dividends since May 2013. The monthly tax free dividend yield is also quite good. To see that monthly dividend payout track record of ICICI Prudential Balanced Advantage Fund, please click on this link, Mutual Funds Historical Dividends of ICICI Prudential Balanced Advantage Fund - Monthly Dividend.

Regular cash-flows through AWP Option

Investors should know that mutual fund dividends are not assured. If you need fixed cash-flows every month then, Automatic Withdrawal Plan of ICICI Prudential Balanced Advantage Fund can be a smart efficient option. Using the Automatic Withdrawal Plan (AWP) investors can draw a fixed sum of money (0.75% of the invested amount per month or 9% of the invested amount per annum) from the investment every month or any other frequency (the money gets credited to your bank account on T+3 day). Minimum Rs 1 lakh investment amount is required for availing the AWP facility. A major advantage of Automatic Withdrawal Plan compared to Systematic Withdrawal Plans of many other mutual funds is that there is no exit load for early withdrawals.

You can also opt for AWP from monthly dividend options. ICICI Prudential AMC will not initiate AWP redemption in the months in which the scheme has declared dividends. If for any reason, the AMC does not declare dividend in any particular month, it will initiate AWP and generate cash-flow for the investors. Clubbing monthly dividend with AWP will ensure that you get tax free dividends from the accumulated profits of the scheme and at same ensure cash-flows every month, if the AMC does not declare dividends every month.

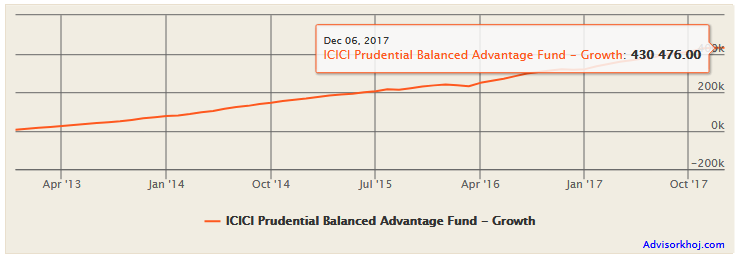

SIP Returns

The chart below shows returns of Rs 5,000 monthly SIP started in ICICI Prudential Balanced Advantage Fund, Growth Option, over the past 5 years. By investing Rs 5,000 monthly, the investor would have accumulated Rs 4.3 lakhs. The annualized SIP return over the past 5 years was around 14% annualized.

Source: Advisorkhoj Research

Conclusion

ICICI Prudential Balanced Advantage Fund has completed 10 years since inception. The popularity of the fund among retail investors has sky-rocketed in the last few years. While the returns of ICICI Prudential Balanced Advantage is slightly on the lower side relative to its more aggressive peers in the category, the stability of returns and outstanding tax free dividend track record makes this fund an ideal investment choice for investors with moderate risk appetite. Investors should consult with their financial advisors if this fund is suitable for their investment objectives.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team