How tax saver mutual funds can help save taxes and grow wealth

Section 80C of Income Tax Act 1961 allows investors to claim deductions from their taxable income by investing in certain eligible investment schemes. The amount of money invested in the schemes eligible u/s 80C can be claimed as deduction from the taxable income subject to a maximum limit of Rs 150,000. For example, if you invest Rs 50,000 in a scheme u/s 80C, your taxable income will be reduced by Rs 50,000 for the purpose of tax calculation – if you are in 30% tax bracket you can save Rs 15,600 in tax including 4% cess. You can save a maximum amount of Rs 46,800 in taxes every year by investing Rs 150,000 in schemes u/s 80C (if you are in 30% tax bracket).

There are broadly two categories of investments u/s 80C – risk free and market linked. Risk free investment schemes under Section 80C are Public Provident Fund, National Savings Certificates, tax saver FDs etc. Traditional life insurance plans, another investment scheme u/s 80C, are also considered to be risk free investments because the investor will get the sum assured in the event of an unfortunate or sum assured plus bonus (declared every year) upon the maturity of the policy.

The market linked investments under Section 80C are mutual fund equity linked savings schemes (ELSS) or tax saver funds, Unit Linked Insurance Plans and National Pension Scheme.

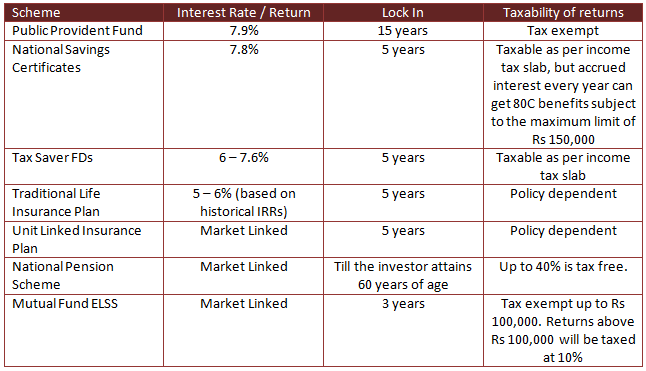

The table below summarizes the interest rates / returns and other characteristics of the popular Section 80C investment schemes.

Saving taxes should not mean locking up your money for long periods of time. Longer lock in periods constrains your flexibility. You can see that tax saver funds or ELSS schemes provides superior liquidity compared to all other 80C investment options. Though we do not suggest that you redeem your ELSS investments immediately after the lock in period, the shorter lock in period is a significant advantage for ELSS vis a vis other 80C investments, if you need liquidity from your investment for any planned or unplanned reason.

Tax saver funds or ELSS is also one of the most tax friendly investment options u/s 80C. Though long term capital gains tax has been introduced in this year’s budget, the taxability of ELSS is still more attractive than some of the other 80C investment options.

ELSS or tax saver funds invest in equity or equity related securities with the objective of generating capital appreciation for investors. Historical data shows that, equity is the best performing asset class in the long term. In the last 20 years, the Sensex has given 11.66% return which is considerably higher than what risk free investments have given. While equity markets are volatile, as we are seeing right now, over a sufficiently long period of time, equity has the potential to beat inflation.

Equity Linked Savings Schemes are essentially diversified equity funds with a lock in feature. ELSS funds as a category has given nearly 25% returns in the last one year, 11% returns in the last 3 years and 19% returns in the last 5 years.

While as a product category, tax saver funds or ELSS outperformed other 80C investments over the last 1 to 5 years, the performance differential among different ELSS funds can be quite substantial. Investors should select funds based on the long term track record of the fund manager. Good fund managers have a consistent investment strategy and have conviction in their strategy.

In this article, we will look at Indiabulls Tax Savings Fund, as an example of a recently launched ELSS fund with a robust investment strategy. The fund was launched in December 2017 and has Rs 67 Crores of assets under management (AUM). The expense ratio of the fund is 2.96%. While it is too early to make any comment on the fund, we found that the fund has a well defined investment strategy. The salient features of the investment strategy of the fund are as follows:-

- The fund will invest in a high quality portfolio of reputed “brands”

- Ideally companies that are segment leaders or challengers would be part of the fund’s portfolio

- The fund will be managed as a Diversified Multicap fund, ideally 50% in large and balance in Mid/small caps

- Stocks would be picked up after detailed fundamental research

The fund manager’s central investment hypothesis is that, stronger brands typically grown faster than the Sensex. This is because these companies command high customer loyalty & bargaining power. They can enter new segments or markets. They can generate substantial royalties through brand licensing. As a result, these companies enjoy higher profit margins & long term growth prospects. These companies also have higher market valuations, but superior earnings growth can give superior returns to shareholders.

We recently interviewed Mr. Suren Kochhar, Chief Business Officer of Indiabulls Asset Management Limited and this is what he has to say about the unique proposition that Indiabulls Tax Savings Fund offers – “Indiabulls Tax Savings Fund is a fund which aims to ride the ‘Brand’ story. Companies that are or have strong brands will benefit the most from the growth that India will experience in coming years. As indicated in the recent IMF reports, India would be one of the fastest growing countries in the world. Further companies with strong brands will be able to tide over the volatility that the broader markets experience”.

The Indiabulls Tax Savings Fund has a robust stock selection process. The first step of the process is to determine whether the company is or has strong brands. This is followed by in-depth Fundamental Analysis covering difference aspects like growth prospects, earnings analysis, Balance sheet analysis, Valuations, peer comparison etc. Qualitative Analysis is also performed to evaluate Management, Corporate Governance, Business strategy and Competitive positioning. Then the investment team meets with the management of the companies and also conducts industry channel checks. Finally, the recommendation is forwarded to the investment committee of the AMC for approval. The next step is Portfolio Allocation - Investment restrictions, position sizing, exposure and risk control. Finally, there is regular monitoring and review of the investment portfolio.

Understanding the investment strategy and process of a mutual fund scheme is as important as analyzing past performance, because investment strategy and process determines the future performance potential of a fund. We encourage investors to understand the investment strategy of a scheme so that, they can select the right funds for investments.

Conclusion

In this post, we discussed different tax saving investment options under Section 80C. We saw that, tax saver funds or ELSS scores above other 80C investments on a number of parameters. In this post also discussed, how investors should look at the investment strategy and process of a mutual fund before selecting funds for investment.

While understanding the investment strategy and fund selection process is important, according to Mr. Suren Kochhar, Chief Business Officer of Indiabulls Asset Management Limited “Tax savings should ideally be a round the year investment plan, but unfortunately most investors tend to do it towards the last quarter of the financial year”. Read his full interview.

Investors should discuss with their financial advisors, if tax saver funds or ELSS fund as it is popularly known, is suitable for their investment needs of saving taxes under Section 80C.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team