How much importance should mutual fund investors give to expense ratios

From time to time we see debates on expense ratios in the investment community. For the average retail investor in India, however, expense ratio is not an important factor in investment decision making. The average investors base their mutual fund investment on the fund track record, the fund house reputation and most importantly on the recommendation of their financial advisor. Investment experts urge investors to pay attention to expense ratios because expense ratios can impact your final returns. On the other hand there are many examples of terrific outperformance by relatively expensive funds. In today’s blog we will discuss, how much importance should mutual fund investors give to expense ratios in the investment decision making process.

At the outset, let us understand what expense ratio is. Expense ratio of a fund is the cost of managing and operating the fund on a per unit basis. It is calculated by dividing the total expense of the fund with the assets under management (AUM). The expenses of the fund include fund management, registrar and transfer agent fees, custodian fees, marketing and distribution expenses. There is no denying the logic that these expenses impact your returns, because they are deducted from your net asset value. However, if a high expense ratio fund delivers exceptional outperformance relative to the benchmark and low expense ratio peers, then the investor would not mind the high expense ratio. We will try to objectively analyze, if there is statistical evidence of low expense ratio funds delivering superior performance relative to high expense ratio funds. Our analysis will be focused on equity mutual funds and will discuss other fund categories later. For our analysis, we have selected at random a fairly large sample of 150 equity funds, across various equity funds categories like large cap funds, diversified equity funds and small / midcap funds. We have ensured that there is enough representation from each category, lest there be any category specific bias in the results.

We will employ two analytical tools to examine the relationship between expense ratio and returns of a fund, relative to other funds. One tool is a visual statistical tool known as the Scatter Plot. The other analytical tool is the statistical measure of correlation between the two variables, expense ratio and returns in our sample.

Scatter Plots of Expense Ratio

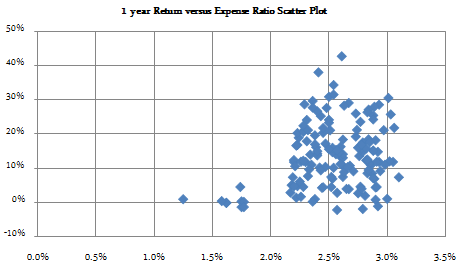

The chart below shows the scatter plot of expense ratio and 1 year trailing returns (as on August 29, 2015). The vertical axis represents the returns and the horizontal axis represents the expense ratio.

We can see in the scatter plot that all the points are bunched together and there is no pattern. This implies that statistically there is no significant relationship between expense ratio and 1 year return of a fund, relative to other funds. If there was a relationship we would have expected to see the points more or less form a line or curve, either upward sloping or downward sloping.

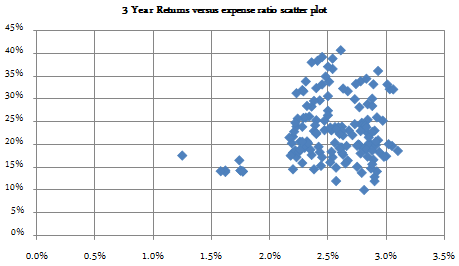

Does expense ratio and returns have a stronger relationship over a longer investment horizon? The chart below shows the scatter plot of expense ratio and 3 year trailing returns.

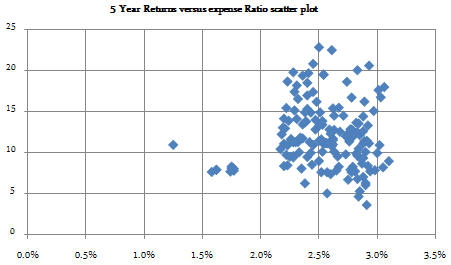

Again we do not see any pattern and therefore we can statistically infer that there is no significant relationship between expense ratio and 3 year return of a fund, relative to other funds. Similarly, the chart below shows the scatter plot of expense ratio and 5 year trailing returns. Again we cannot decipher any pattern.

Correlation Coefficient

Correlation coefficient is the statistical measure of the relationship between two variables. It ranges between 1 to -1. If the correlation coefficient is 1 or close to 1, we can infer that the two variables, expense ratio and returns in our case, exhibit strong positive relationship. If the correlation coefficient is -1 or close to -1, we can infer that the two variables, expense ratio and returns in our case, exhibit strong negative relationship. Correlation coefficients in between these two boundaries exhibit weaker relationship. If correlation coefficient is zero or close to it on either side, we can infer that there is no relationship between the two variables. The correlation coefficient between expense ratio and 1 year returns is 0.25, which implies there is no relationship between these two variables. The correlation coefficient between expense ratio and 3 year returns is 0.15, whereas that between expense ratio and 5 year returns is 0.02. Therefore, we can conclude that there is no statistical evidence of low expense ratio funds delivering superior performance relative to high expense ratio funds.

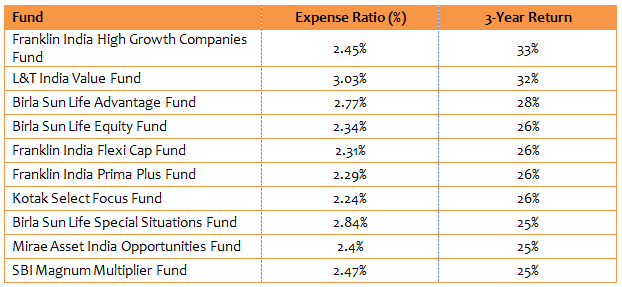

Expense Ratio of some top Diversified equity funds in terms of 3 year returns

In the table above we can see that among some of the top diversified equity funds in terms of 3 years, we have a mix of expense ratios ranging from as high as 3% to around 2.2%.

Is expense ratio not important

In our analysis, we have seen that, as far as equity funds are concerned, there is no statistical evidence of low expense ratio funds delivering superior performance compared to high expense ratio funds. If as an investor, you have selected equity funds based on the track record of the scheme, fund manager and the AMC, in our opinion, you have done the right thing. Unlike the US, fund managers in India have the ability to deliver pretty substantial alphas because of the nature of the equity market in India. As such, the ability to deliver to high alphas is more important that fund expenses as far as performance attribution is concerned. That said, one simply cannot ignore expense ratios for many other types of funds. Expense ratio is crucial to the performance of passive funds like ETFs and Index Funds. These funds merely track the index and the fund objective is to minimize the tracking error. Higher expense ratios in such funds will impact the investor’s returns, relative to other funds with lower expenses. Similarly for certain types of debt fund like liquid funds and fixed maturity plans (FMPs), investors should look at expense ratios of the funds before investing. Since the potential outperformance of these funds relative to their benchmark is limited, a fund with a higher expense ratio is at a disadvantage to the fund with a lower expense ratio.

Conclusion

Expense ratio is an important concept which mutual fund investors should understand. As far as equity mutual funds are concerned there is no statistical evidence to suggest that, low expense ratio funds deliver superior performance compared to high expense ratio funds. The fund manager’s ability to deliver high alphas is a bigger driver of relative outperformance for these funds. On the other hand, for certain types of debt funds and passive equity funds (e.g. index funds), expense ratios are critically important.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team