How SIPs in Top 7 Best Thematic Equity Mutual Funds have created wealth for investors

In our last four posts in this series we had discussed How SIPs in Top and Best Diversified Equity Mutual Funds have created wealth, How SIPs in Top and Best Mid and Small Cap Mutual Funds have created wealth over last 10 years,

How SIPs in Top and Best ELSS Mutual Funds have created wealth over last 10 years and

How SIPs in Top and Best Large Cap Mutual Funds have created wealth over last 12 years

Today let us explore how SIPs in Thematic Equity Mutual Funds have created wealth for the investors over the last 10 years. But, let us first understand what Thematic Funds are.

Thematic Funds are equity mutual funds that invest in stocks based on a particular theme. Unlike sectoral funds, the thematic fund does not invest in just one sector. It invests across sectors that are woven around a common theme. In terms of the number of stocks and portfolio construction, thematic funds look as diversified as diversified equity schemes, but they have fewer sectors. Thematic funds are based on a particular theme which varies from being multi - sector, international exposure, export oriented and rural India, etc.

Thematic funds are riskier than diversified equity funds or large cap equity funds. Many financial advisors suggest that the investment tenure for such funds should be minimum 5 years or more as a particular theme may not play well for a long period. Therefore, they suggest that some amount of timing is required to enter and exit thematic funds. They also suggest that it should not be the part of your core mutual fund portfolio and the total exposure to thematic funds should not be more than 10 – 15% of your total portfolio.

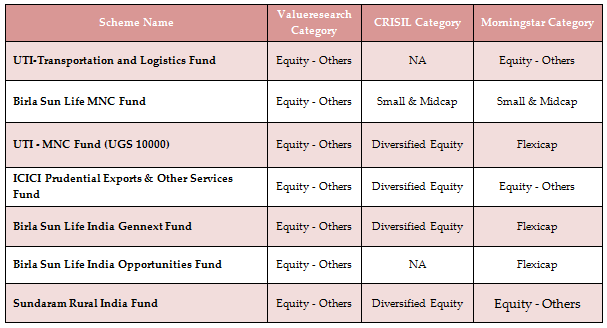

Now coming back to today’s topic, we could select 7 thematic funds based on their 10 year SIP returns (For selection, we have used Valueresearch fund category – Equity Fund – Others). However, CRISIL and Morningstar have classified some of these schemes as Diversified / Flexi or Small & Midcap. Let us look at the following chart to understand how they are categorised by each research agency –

NA = Not available. (Diversified Equity and Flexicap fund categories are same)

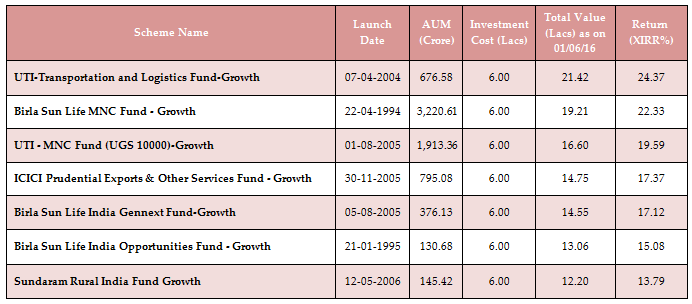

To see the exhaustive list, please click here Top Performing Systematic Investment Plans – Equity Funds - Others. For our study, we have assumed a monthly SIP of र 5000 made on the 1st day of every month starting from July 2006 and ending on 1st June 2016, i.e. 10 years. Therefore, the investor would have invested र 6.00 Lakhs through 120 SIP instalments of र 5,000 each.

For the benefit of our readers, we have also studied if all these thematic funds could beat NSE NIFTY INDEX returns in the chosen period even if it is not the benchmark of the respective funds. We will discuss this more when analyzing the funds individually.

The funds in our study have given SIP returns ranging from 13.79 - 24.37% annualized. Since SIP investments are made over a period of time, the method of calculating SIP returns is different than that of lump Sum returns. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except XIRR can calculate returns on investments that are not necessarily strictly periodic.

See the chart below to know the complete details -

Source: Advisorkhoj Top Performing SIPs – Equity Fund Others

UTI Transportation and Logistics Fund

UTI Transportation and Logistics Fund was launched in April 2004 by UTI Mutual Fund. The fund invests in the companies engaged in manufacturing, distribution and sale of transportation equipments and the logistics companies. The top 5 holdings of this fund are, Tata Motors, Hero Motocorp, Mahindra & Mahindra, Bosch and Maruti Suzuki. Automobile, Services and Engineering are the 3 top sectors that the fund has invested in.

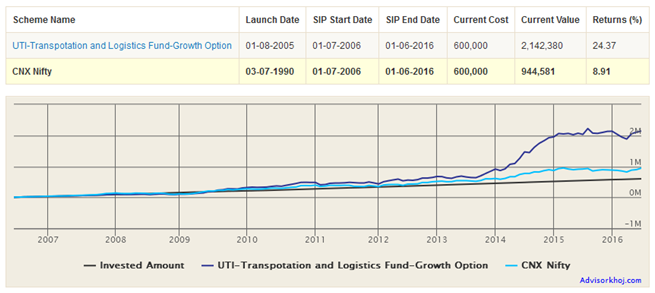

The fund has an AUM base of nearly र 677 Crores (As on April 30, 2016) and has given the best return in Equity Thematic category in the last 10 years. If you had started a monthly SIP of र 5000 in UTI Transportation and Logistics Fund in July 2006 by now you would have accumulated a corpus of nearly र 21.42 Lakhs with an investment of only र 6.00 Lakhs over 5 years. A whopping return of 24.37%!

Look at the chart below, you will observe that UTI Transportation and Logistics Fund has beaten the returns of CNX NIFTY with a huge margin. Had you invested in CNX NIFTY you would have got only an annualized return of 8.91% and your total corpus would be only र 9.45 Lacs, a huge difference of र 11.97 Lacs!

Source: Advisorkhoj research (comparison of fund returns with CNX NIFTY)

Birla Sun Life MNC Fund

Birla Sun Life MNC Fund was launched in April 1994. This fund from Birla Sun Life Mutual Fund invests in securities of multinational companies through a research based investment approach in order to achieve long term growth of capital at relatively moderate levels of risks. The top 5 holdings of this fund are, Bayer Cropscience, ICRA, GlaxosmithKline Pharma, Bosch and Maruti Suzuki. Automobile, Financial and FMCG are the 3 top sectors that the fund has invested in.

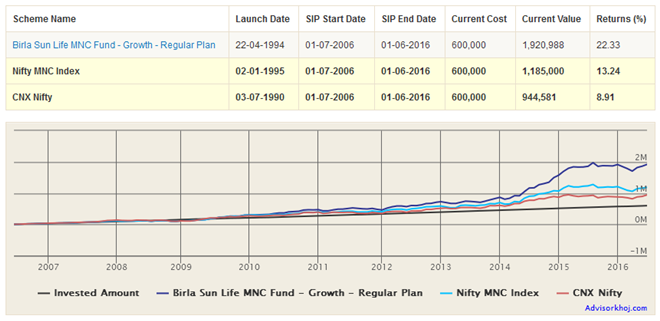

The fund has an AUM base of nearly र 3,221 Crores (As on April 30, 2016) and is the oldest in our selection and has given the second best return in Equity Thematic category in the last 10 years. If you had started a monthly SIP of र 5000 in Birla Sun Life MNC Fund in July 2006 by now you would have accumulated a corpus of nearly र 19.21 Lakhs with an investment of only र 6.00 Lakhs over 5 years. A whopping return of 22.33%!

Look at the chart below, you will observe that Birla Sun Life MNC Fund has beaten the Benchmark NIFTY MNC Index as well as the CNX NIFTY returns with a huge margin. Had you invested in CNX NIFTY you would have got only an annualized return of 8.91% and your total corpus would be only र 9.45 Lacs, a huge difference of र 9.67 Lacs! Whereas the benchmark would have given you a return of 13.24% annualised with a final corpus of 11.85 Lacs, a huge difference of र 7.36 Lacs!

Source: Advisorkhoj research (Comparison of returns with Benchmark NIFTY MNC Index and CNX NIFTY)

We reviewed this fund in April 2014 but you may still find it relevant.

UTI MNC Fund (UGS 10000)

UTI MNC Fund (UGS 10000) was launched in August 2005. This fund from UTI Mutual Fund invests predominantly in securities of multinational companies in diverse sectors such as FMCG and pharmaceutical. The top 5 holdings of this fund are, Hindustan Unilever, Ambuja Cements, Cummins India, Bosch and Maruti Suzuki. Automobile, Engineering and FMCG are the 3 top sectors that the fund has invested in.

The fund has an AUM base of nearly र 1,913 Crores (As on April 30, 2016). If you had started a monthly SIP of र 5000 in UTI MNC Fund (UGS 10000) in July 2006 by now you would have accumulated a corpus of nearly र 16.60 Lakhs with an investment of only र 6.00 Lakhs over 5 years. A whopping return of 19.59%!

Look at the chart below, you will observe that UTI MNC Fund (UGS 10000) has beaten the Benchmark NIFTY MNC Index as well as the CNX NIFTY returns with a huge margin. Had you invested in CNX NIFTY you would have got only an annualized return of 8.91% and your total corpus would be only र 9.45 Lacs, a huge difference of र 7.21 Lacs! Whereas the benchmark would have given you a return of 13.24% annualised with a final corpus of 11.85 Lacs, a difference of र 4.75 Lacs!

Source: Advisorkhoj research (Comparison of returns with Benchmark NIFTY MNC Index and CNX NIFTY)

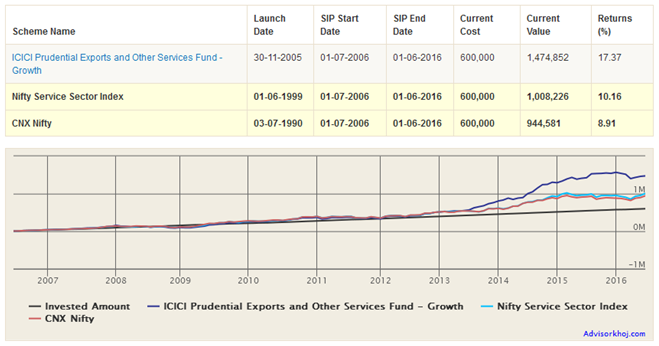

ICICI Prudential Exports and Other Services Fund

ICICI Prudential Exports and Other Services Fund was launched in November 2005. This fund from India’s biggest AMC, ICICI Prudential, invests predominantly in securities of service industry and companies in Pharma and IT sector benefiting from exports etc. The top 5 holdings of this fund are, Cipla, Motherson Sumi Systems, Tech Mahindra, Astrazeneca Pharma and Narayana Hrudayalaya. Healthcare, Technology and Services are the 3 top sectors that the fund has invested in.

The fund has an AUM base of nearly र 837 Crores (As on April 30, 2016). If you had started a monthly SIP of र 5000 in ICICI Prudential Exports and Other Services Fund in July 2006 by now you would have accumulated a corpus of nearly र 14.75 Lakhs with an investment of only र 6.00 Lakhs over 5 years.

Look at the chart below, you will observe that ICICI Prudential Exports and Other Services Fund has beaten the Benchmark NIFTY Service Sector Index as well as the CNX NIFTY returns with a huge margin. Had you invested in CNX NIFTY you would have got only an annualized return of 8.91% and your total corpus would be only र 9.45 Lacs, a huge difference of र 5.30 Lacs! Whereas the NIFTY Service Sector Index would have given you a return of 10.16% annualised with a final corpus of र 10.08 Lacs, a difference of र 7.21 Lacs!

Source: Advisorkhoj research (Comparison of returns with Benchmark NIFTY Services Sector Index and CNX NIFTY)

Would you like to read how this fund is an outstanding performer?

Birla Sun Life India Gennext Fund

Birla Sun Life India Gennext Fund was launched in December 2005 by Birla Sun Life Mutual Fund. The fund invests in companies that are expected to benefit from the rising consumption patterns in India which is getting benefited by high disposable incomes of the young generation. The top 5 holdings of this fund are, HDFC Bank, ITC, Indusind Bank, Maruti Suzuki and Eicher Motors. Financial, FMCG, Healthcare and Automobile are the 3 top sectors that the fund has invested in.

The fund has a small AUM base of र 376 Crores (As on April 30, 2016). If you had started a monthly SIP of र 5000 in Birla Sun Life India Gennext Fund in July 2006 by now you would have accumulated a corpus of nearly र 14.55 Lakhs with an investment of only र 6.00 Lakhs over 5 years.

Look at the chart below, you will observe that Birla Sun Life India Gennext Fund has beaten the Benchmark NIFTY 50 Index with a huge margin. Had you invested in NIFTY 50 INDEX you would have got only an annualized return of 8.91% only and your total corpus would be only र 9.45 Lacs, a huge difference of र 5.10 Lacs!

Source: Advisorkhoj research (Comparison of returns with NIFTY 50 Index)

We suggest you to read how Birla Sun Life Gennext Fund is creating wealth from rising consumption

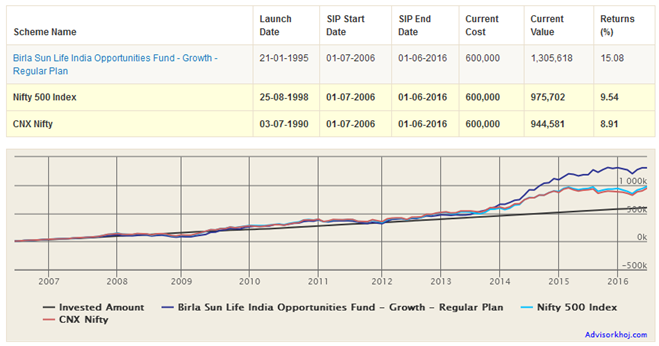

Birla Sun Life India Opportunities Fund

Birla Sun Life India Opportunities Fund was January 1995 by Birla Sun Life Mutual Fund. The fund invests in companies that are expected to benefit from emerging opportunities in the global outsourcing filed which includes sectors like IT, Telecom, Pharma, Auto ancillaries and Biotechnology. The top 5 holdings of this fund are, Cummins India, Reliance Industries, Sanofi India, Infosys and Honeywell Automation. Technology, Healthcare and Engineering are the 3 top sectors that the fund has invested in.

The fund has a small AUM base of र 131 Crores only (As on April 30, 2016). If you had started a monthly SIP of र 5000 in Birla Sun Life India Opportunities Fund in July 2006 by now you would have accumulated a corpus of nearly र 13.05 Lakhs with an investment of only र 6.00 Lakhs over 5 years.

Look at the chart below, you will observe that Birla Sun Life India Opportunities Fund has beaten the Benchmark NIFTY 500 Index as well as CNX NIFTY with a very good margin. Had you invested in CNX NIFTY you would have got only an annualized return of 8.91% and your total corpus would be only र 9.45 Lacs, a huge difference of र 6.17 Lacs! An investment in the Benchmark of this fund, NIFTY 500 Index would have got you a return of 9.54% and the final corpus would have been र 9.76 Lacs, a good difference of र 3.30 Lacs

Source: Advisorkhoj research (Comparison of returns with Benchmark NIFTY 500 Index and CNX NIFTY)

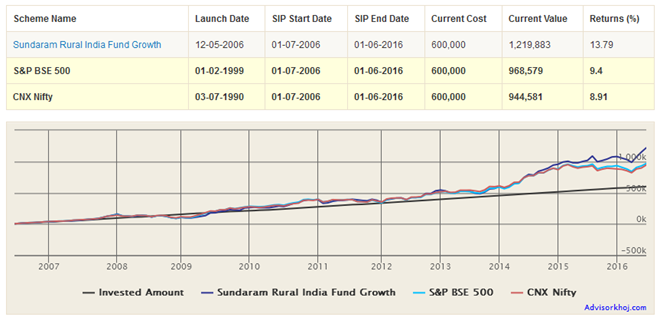

Sundaram Rural India Fund

Sundaram Rural India Fund was launched in May 2006. This fund from Sundaram Mutual Fund, invests predominantly in companies that are focussing on rural India. The top 5 holdings of this fund are, UPL, Heritage Foods, V-Guard Industries, Asian Paints and Mahindra & Mahindra. Chemicals, Financial and FMCG are the 3 top sectors that the fund focuses on.

The fund has a small AUM base of only र 145 Crores (As on April 30, 2016). If you had started a monthly SIP of र 5000 in Sundaram Rural India Fund in July 2006 by now you would have accumulated a corpus of nearly र 12.20 Lakhs with an investment of only र 6.00 Lakhs over 5 years.

Look at the chart below, you will observe that Sundaram Rural India Fund has beaten the Benchmark S&P BSE 500 Index as well as the CNX NIFTY returns with a good margin. Had you invested in CNX NIFTY INDEX you would have got only an annualized return of 8.91% and your total corpus would be only र 9.45 Lacs, a big difference of र 2.75 Lacs! Whereas the Benchmark S&P BSE 500 Index would have given you a return of 9.40% annualised with a final corpus of र 9.68 Lacs, a difference of र 2.52 Lacs!

Source: Advisorkhoj research (Comparison of returns with Benchmark S&P BSE 500 Index and CNX NIFTY)

You may also like to read how Sundaram Rural India Fund is aiming good long term returns

Conclusion

In this article, we have seen how SIPs of Thematic Funds have created wealth for the investors. We have discussed why Thematic Funds are riskier than diversified equity funds and that investors should have an investment horizon of minimum 5 years or more if they decide to invest in these funds. We have also discussed that thematic funds should not be part of your core portfolio. However if you are willing to take higher risk in the anticipation of higher returns than maybe you can take an exposure to the extent of 5 – 10% of your total portfolio.

While doing this series on SIPs we found that the SIP returns of thematic funds (XIRR 12.20 – 21.42%) were superior in comparison to SIP returns of large cap funds which were in the range of XIRR 13.39 – 16.35% in the same period. However, Large Cap Funds are less volatile and best suited to investors who do not like to take much risk yet want to enjoy superior returns from equity investing!

We have always suggested our readers that investing in equity mutual funds gives you the best returns in the long run, but before investing in them you should check your risk profile and select funds based on that parameter. Do you know your risk profile? You may like to check your Risk profile here

Investors with high risk taking ability can consider investing in thematic funds. However, they should consult with their financial advisor if thematic funds are suitable for them or not.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team