How SIPs in Top 7 Best Mid and Small Cap Mutual Funds have created wealth in last 10 years

As discussed in our last post How SIPs in Diversified Equity Mutual Funds have created wealth over the last 15 years, Systematic Investment Plans (SIPs) were introduced by Franklin Templeton Investments around two decades back. Since then, investing in SIPs has become the most preferred way of investments in Mutual Funds. Indian Mutual Fund investors are contributing around Rs. 3,000 Crore on a monthly basis through SIPs through over One Crore active SIP accounts as of now.

Assets under management (AUM) by the Indian mutual fund industry have grown from Rs. 11.93 trillion in April 2015 to Rs. 13.86 trillion in April 2016. That represents a 16% growth in assets over April 2015. SIPs have made a significant contribution to this growth and currently the retail investor’s hold a total share of 46.30% (Data of April 2016 – Source www.amfiindia.com) to the total Mutual Fund industry AUM.

The main reason, apart from a habit of investing small amount every month, the retail Indian investors have also realised that timing the equity market is not only difficult but impossible and thus investing a small amount systematically makes sense in equity assets which has given historically the best return compared to other asset classes.

But before we discuss how SIPs in Mid and Small caps have created wealth for the investors, let us once again recap the key benefits of investing through SIPs.

- SIP brings a disciplined approach to investing. You can invest a fixed amount as low as

र500, and can build a decent corpus for your long term financial needs. - Through SIPs you can also choose to select in various kind of schemes such as Equity Funds, Balanced Funds, ELSS Tax Saving Schemes, Debt Funds or Liquid Funds depending upon your risk profile

- The biggest advantage of SIPs is that, you need not time the market. By investing in regular frequency, e.g. weekly, fortnightly or monthly, you are actually investing at the different points of the markets. This helps in rupee cost averaging of the investment.

- SIPs in Equity oriented mutual funds are far more tax efficient than most other investment options as long term capital gains for equity mutual funds are tax exempt. Dividends received form equity mutual funds are also tax free.

- Few Asset Management Companies even offer Free Life Insurance Cover if you invest through SIP route. This is just to encourage the habit of regular savings and this has no effect on the overall return on the SIPs.

In our last post we have seen How SIPs in Diversified Equity Mutual Funds have created wealth over the last 15 years. Today we will explore how Mid and Small Cap Mutual Funds have also helped investors create wealth over a period of 10 years. In this post we have taken the SIP investment period as 10 years only as the total number of funds which completed 15 years is very limited in Mid and Small Cap category.

For our topic of today, we have selected 7 Mid and Small Cap Funds that have given excellent returns in the last 10 years. However, this is, by no means, a comprehensive list of all the funds that gave good returns in the last 10 years. This is just an illustration to show how long investment terms in SIPs, have created wealth for investors.

To see the comprehensive list, please click here Top Performing Systematic Investment Plans – Mid and Small Cap Funds

Each of the funds in our selection has given SIP returns ranging from 18 - 21% annualized. Since SIP investments are made over a period of time, the method of calculating SIP returns is different than that of Lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except XIRR can calculate returns on investments that are not necessarily strictly periodic.

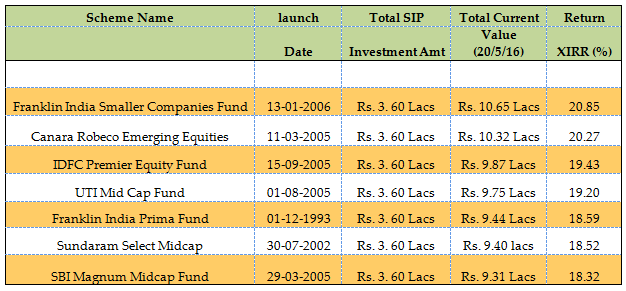

For our examples, we have assumed a monthly SIP of र 3000 made on the first working day of every month. Assuming that the SIP start date was 10 years back in June 2006, therefore, the investor would have invested Rs 3.60 Lakhs through 120 SIP instalments of र 3,000 each. Now, let us see how much wealth investors would have accumulated by investing in the selected funds (Growth option).

Source: Advisorkhoj Top Performing Sip – Mid and Small Cap Funds (data as on 20/5/16)

Franklin India Smaller Companies Fund

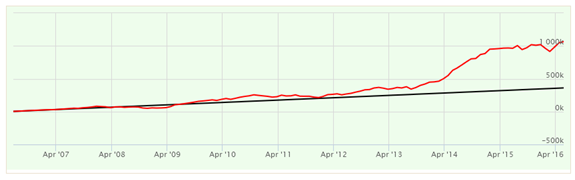

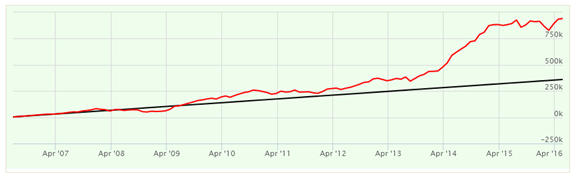

The Franklin India Smaller Companies Fund was launched in January 2006. This fund from Franklin Templeton stable has an AUM base of nearly र 2,798 Crores (As on April 30, 2016). The chart below shows the SIP returns of the Franklin India Smaller Companies fund, Growth option, over the last 10 years.

Source: Advisorkhoj

If you had started a monthly SIP of र 3000 in Franklin India Smaller Companies Fund in June 2006, by now you would have accumulated a corpus of nearly र 10.65 Lakhs with an investment of only र 3.60 Lakhs.

You would have accumulated a corpus of र 2.33 Lakhs, by the end of 2010, a corpus of over र 4.44 Lakhs, by the end of 2013 and र 10.65 at the end of the SIP period. Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 21%.

The fund has been ranked No. 1 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. This is the highest ranking by CRISIL. However, it is a 4 Star rated fund by Valueresearch

Canara Robeco Emerging Equities Fund

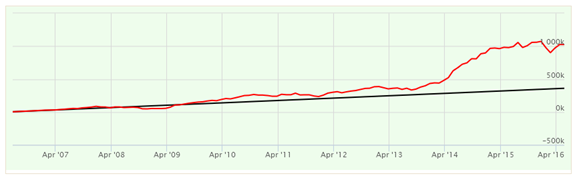

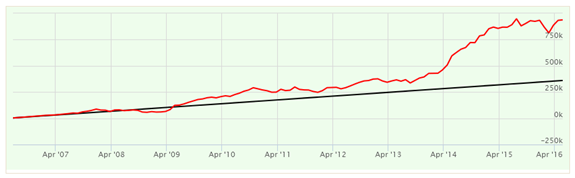

The Canara Robeco Emerging Equities Fund was launched in March 2005. This fund from Canara Robeco Mutual Fund has an AUM base of nearly र 993 Crores (As on April 30, 2016). The chart below shows the SIP returns of the Canara Robeco Emerging Equities Fund over the last 10 years.

Source: Advisorkhoj

If you had started a monthly SIP of र 3000 in this Fund in June 2006, by now you would have accumulated a corpus of nearly र 10.32 Lakhs with an investment of only र 3.60 Lakhs.

You would have accumulated corpus of र 2.53 Lakhs, by the end of 2010, a corpus of over र 4.29 Lakhs, by the end of 2010 and at the end of SIP tenure र 10.32 Lakhs. Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 20%.

The fund has been ranked No. 2 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is a 3 Star rated fund by Valueresearch.

You may read the detailed Fund Review – 5 years of strong performance by this Mid and Small Cap Fund

IDFC Premier Equity Fund

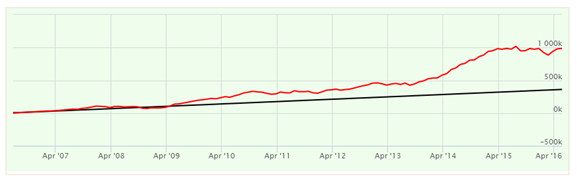

The IDFC Premier Equity Fund was launched in Sept 2005. This fund from IDFC Mutual Fund has an AUM base of nearly र 5,999 Crores (As on April 30, 2016). The chart below shows the SIP returns of the IDFC Premier Equity Fund over the last 10 years.

Source: Advisorkhoj

If you had started a monthly SIP of र 3000 in this Fund back in June 2006 by now you would have accumulated a corpus of nearly र 9.87 Lakhs, with an investment of only र 3.60 Lakhs.

You would have accumulated corpus of र 3.17 Lakhs, by the end of 2010, a corpus of over र 5.21 Lakhs, by the end of 2013 and र 9.87 Lakhs at the end of the SIP period. Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 19.50%.

The fund has been ranked No. 4 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is a 3 Star rated fund by Valueresearch

You may like to read this Fund review – Consistent Performance makes IDFC Premier Equity Fund a top pick

UTI Mid Cap Fund

The UTI Mid Cap Fund was launched in April 2004. This fund from UTI Mutual Fund has an AUM base of र 3,227 Crores (As on April 30, 2016). The chart below shows the SIP returns of the UTI Mid Cap Fund over the last 10 years.

Source: Advisorkhoj

If you had started a monthly SIP of र 3000 in this Fund back in May 2006 by now you would have accumulated a corpus of nearly र 9.75 Lakhs, with an investment of only र3.60 Lakhs.

You would have accumulated corpus of र 2.50 Lakhs, by the end of 2010, a corpus of over र 4.29 Lakhs, by the end of 2013 and र 9.75 Lakhs at the end of the SIP period. Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 19%.

The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is a 4 Star rated fund by Valueresearch

Franklin India Prima Fund

The Franklin India Prima Fund was launched in Dec 1993 and is one of the oldest Mid Cap funds. This fund from Franklin Templeton Investments has an AUM base of र 3,846 Crores (As on April 30, 2016). The chart below shows the SIP returns of the Franklin India Prima Fund over the last 10 years.

Source: Advisorkhoj

If you had started a monthly SIP of र 3000 in this Fund back in June 2006 by now you would have accumulated a corpus of nearly र 9.44 Lakhs, with an investment of only र 3.60 Lakhs.

You would have accumulated a corpus of र 2.44 Lakhs, by the end of 2010 and a corpus of over र 4.31Lakhs, by the end of 2013. Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 18.50%.

The fund has been ranked No. 2 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is a 4 Star rated fund by Valueresearch

You may like to read this – Consistent Mid cap picker for last 20 years

Sundaram Select Midcap Fund

The Sundaram Select Midcap Fund was launched in July 2002 and is also one of the oldest Mid Cap funds. This fund from Sundaram Mutual Fund has an AUM base of र 3,440 Crores (As on April 30, 2016). The chart below shows the SIP returns of the Sundaram Select Midcap Fund over the last 10 years.

Source: Advisorkhoj

If you had started a monthly SIP of र 3000 in this Fund back in June 2006 by now you would have accumulated a corpus of nearly र 9.40 Lakhs, with an investment of only र 3.60 Lakhs.

You would have accumulated corpus of र2.70, by the end of 2010, a corpus of over र 4.24 Lakhs, by the end of 2013 and finally र 9.40 Lakhs at the end of the SIP tenure. Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 18.50%.

The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is a 3 Star rated fund by Valueresearch

You may like to read the latest review of this fund – Consistent Performance Makes it a big wealth Creator

SBI Magnum Midcap Fund

The SBI Magnum Midcap Fund was launched in March 2005. This fund from SBI Mutual Fund has an AUM base of र 1,777 Crores (As on April 30, 2016). The chart below shows the SIP returns of the SBI Magnum Midcap Fund over the last 10 years.

Source: Advisorkhoj

If you had started a monthly SIP of र 3000 in this Fund back in June 2006 by now you would have accumulated a corpus of nearly र 9.31 Lakhs, with an investment of only र 3.60 Lakhs.

You would have accumulated corpus of र 2.09 Lakhs, by the end of 2010, a corpus of over र 4.06 Lakhs, by the end of 2013 and a final corpus of र 9.31 Lakhs at the end of the SIP period. Over the 10 year period the compounded annual returns on your SIP investment in this fund would be around 18.32%.

The fund has been ranked No. 3 by CRISIL in its recent mutual fund ranking for the quarter ending Mar 31, 2016. It is a 3 Star rated fund by Valueresearch.

Conclusion

In this article, we have seen how SIPs in Mid and Small Cap funds over the long term have created wealth for the investors. SIPs benefit from the power of compounding, and therefore the earlier we start our SIP, the greater is the potential for wealth creation. However, it is important to select a good Mid and Cap fund for our SIPs. Remember, Small and Mid Cap Funds are more volatile than Diversified Equity Funds. However, over a sufficiently long time horizon these funds have the potential to outperform Diversified Equity Funds.

Your financial advisers can help you select a good Mid and Small Cap Fund that is suitable for your risk profile. You may like to check your risk profile here. As your risk profile changes over time, you should re-balance your portfolio to align with your risk profile.

In our next post, we will discuss How SIPs in ELSS Tax Savings Funds have created wealth for the investors.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team