How Nippon India Nifty 50 Value 20 Index Fund can be a good passive fund in current market context

Though index funds have experienced huge growth in assets under management (AUM) over the last few years, there is relatively less awareness about factor based index funds or smart beta index funds. Factor indices are constructed based on quantitative, rule based investment strategies based on factors which historically driven portfolio returns and risk. The factor based indices have the potential to generating superior returns compared to broad market indices. Factor indices are constructed based on quantitative, rule based investment strategies based on factors which historically driven portfolio returns and risk. In this article we will review, Nippon India Nifty 50 Value 20 Index Fund.

Suggested reading importance of investing in factor-based Index Funds

About Nippon India Nifty 50 Value 20 Index Fund

Nippon India Nifty 50 Value 20 Index Fund was launched in February 2021. As the name suggests the fund is tracking the Nifty 50 Value 20 Index. The fund has given 18.52% CAGR returns since its inception (as on 31st May 2024). The expense ratio of the fund is only 0.76% (as on 31st May 2024).

About Nifty 50 Value 20 Index

Nifty 50 Value 20 is a multi-factor index which selects 20 value stocks from the Nifty 50 index. The Nifty 50 index comprises top 50 stocks by market capitalization. Value stocks are stocks which are trading at discount to their intrinsic valuation. Value stocks are selected on the basis of 4 factors:-

- P/E ratio (30% weight)

- P/B ratio (20% weight)

- Return on capital employed (40% weight)

- Dividend Yield (10% weight)

Why invest in value stocks?

- Value stocks can give superior returns in the long term across market cycles because these stocks can be bought at discount and benefit from valuation rerating as well as earnings growth

- The downside risk of value funds is lower than growth funds, since the underlying stocks are already trading at a discount to the intrinsic valuation

- Value stocks can help investors diversify their equity portfolio. Value stocks should not be seen as substitute of growth stocks, but rather as a complement to growth stocks / funds.

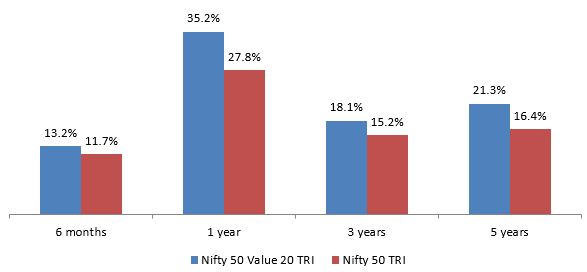

Performance

Nifty 50 Value 20 TRI has outperformed Nifty 50 TRI over different investment tenures.

Source: Advisorkhoj Research, as on 26th June 2024

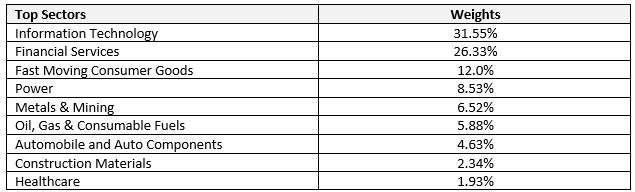

Sector representation

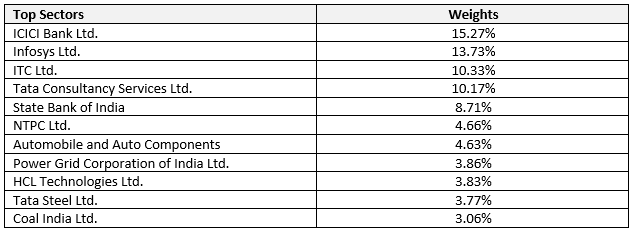

Top constituents

Source: National Stock Exchange, as on 31st May 2024

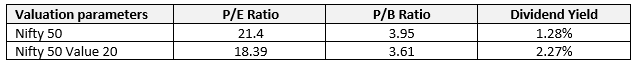

Valuation Statistics

Source: National Stock Exchange, as on 31st May 2024

Nippon India Nifty 50 Value 20 Index Fund – Low tracking error

Tracking error is one of the most important performance metrics in index funds because the objective of the index funds is to track the benchmark market index as closely as possible. We have compared the tracking error of Nippon India Nifty 50 Value 20 with tracking errors of other index funds (you can use our tool https://www.advisorkhoj.com/mutual-funds-research/index-corner). You can see that Nippon India Nifty 50 Value 20 Index Fund has amongst the lowest tracking errors among equity index funds.

Is this a good time to invest in Nippon India Nifty 50 Value 20 Index Fund?

The Nifty is trading at its record high crossing 23,800 (as on 26th June 2024). The broader market has outperformed the frontline indices, Nifty and Sensex. When the market goes through a prolonged rally and hits new highs every other day, there are concerns about valuation. In such a market scenario Nippon India Nifty 50 Value 20 Index Funds can be a good choice for long term investors. The valuation of Nifty 50 Value 20 index is much more attractive than Nifty 50 in the current market scenario, despite outperforming the Nifty 50 in the last 1, 3 and 5 years.

The Total Expense Ratio (TER) of Nippon India Nifty 50 Value 20 Index Fund is significantly lower than actively managed equity funds. Since Nippon India Nifty 50 Value 20 Index Fund invests only in blue-chip stocks (stocks that are part of the Nifty 50 index), they can be expected to be less volatile and provide relative stability to your investment portfolio. Nippon India Nifty 50 Value 20 Index Funds has among the lowest tracking errors. Low tracking error is one of the most important considerations in index funds.

You may also like to read how to select the right Index Funds for your portfolio

Who should invest in Nippon India Nifty 50 Value 20 Index Fund?

- Investors looking for capital appreciation over long investment horizon

- Investors with high risk appetites

- Investors with minimum 3 – 5 years investment tenures

- This fund is suitable for both first time and seasoned investors

- You can invest in this fund either in lump sum or SIP depending on your investment needs and financial situation

Investors should consult their financial advisors or mutual fund distributors if Nippon India Nifty 50 Value 20 Index Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund