HDFC Arbitrage Fund: A tax-efficient solution for parking your idle funds

Of late, Arbitrage funds have been gaining popularity amongst investors this year. As per AMFI November data, arbitrage funds received the highest monthly inflows (Rs 9,404 crores in November 2023) among all mutual fund categories. Arbitrage funds are low risk investment options for parking your short-term funds instead of keeping it idle in your savings or current account. Due to their tax efficiency, arbitrage funds are better placed when compared to other comparable products. In this article, we will review HDFC Arbitrage Fund, one of the top performing funds in the category in 2023.

What are arbitrage funds?

Arbitrage funds are hybrid mutual fund schemes which aim to generate arbitrage profits by exploiting price differences of the same underlying assets in different capital market segments. These funds can also invest in debt and money market instruments. As per SEBI’s directive, arbitrage funds must invest at least 65% of their assets in equity and equity related securities (e.g. stock futures, index futures etc). Since 65% of the assets of these funds are invested in equity and equity related securities, they are subject to equity taxation.

How does arbitrage work?

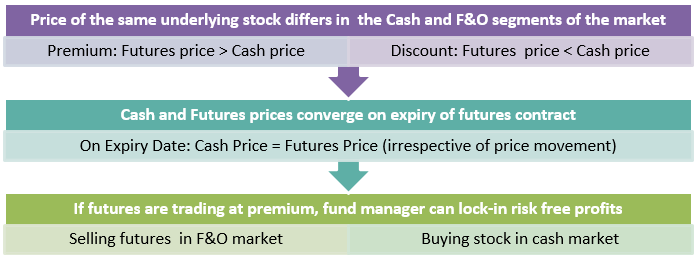

One of the most popular arbitrage strategies is known as cash and carry arbitrage. The diagram below shows how the cash and carry arbitrage works.

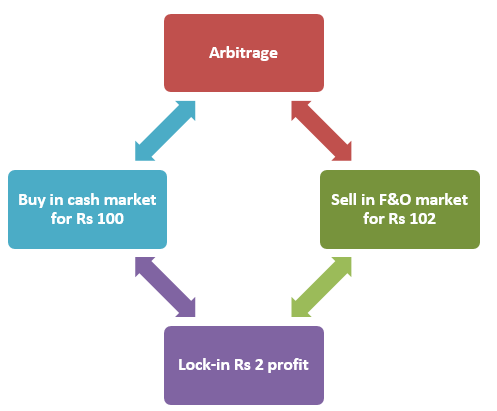

Example of Arbitrage

Let us assume the price of a stock in the cash market is Rs 100 and its price in the futures market is Rs 102.

Share Price Movement will have no impact on the arbitrage profit when held expiry to expiry

Why invest in Arbitrage Funds now?

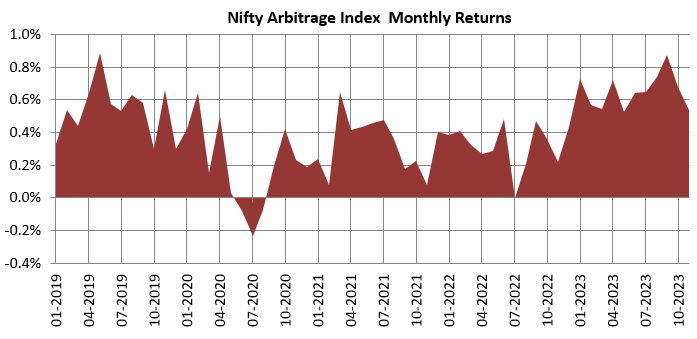

Arbitrage returns depend on the spread between the cash segment of the market and the futures segment (as explained in the schematic above). This spread narrows or widens depending on market conditions (see the chart below). Usually arbitrage spreads are higher when volatility is high. You can see in the chart below that arbitrage returns are now higher compared to returns in the previous few years. Arbitrage returns also depend on short term interest rates (yields) since futures premium depend on cost of funds (which increases when short term interest rates go up). High volatility and high short term interest rates make arbitrage funds attractive in current market conditions.

Source: National Stock Exchange, Advisorkhoj Research, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future.

About HDFC Arbitrage Fund

HDFC Arbitrage fund was launched in October 2007 and has Rs 8,810 crores of assets under management (AUM), as on 30th December 2023. The Total Expense Ratio (TER) of the regular plan is 0.97% while that of the direct plan is 0.47%. Arun Agarwal, Anil Bamboli, Nirman S. Morakhia and Dhruv Muchhal are the fund managers of this scheme. The fund maintains 100% hedged exposure to equities.

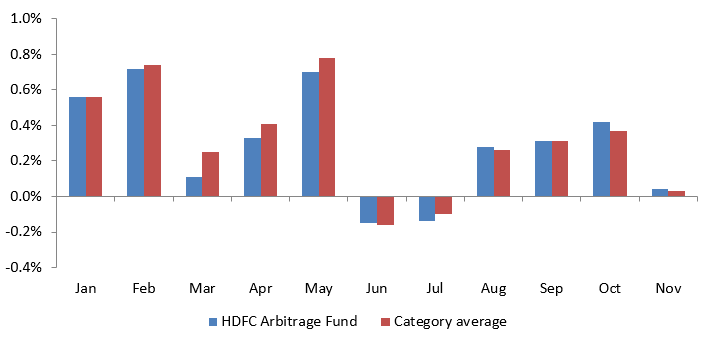

Monthly performance

The chart below shows the monthly returns of HDFC Arbitrage Fund versus the category average (as on 30th November 2023). You can see that the fund has consistently beaten the category average returns for the past 4 months.

Source: Advisorkhoj Research, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future.

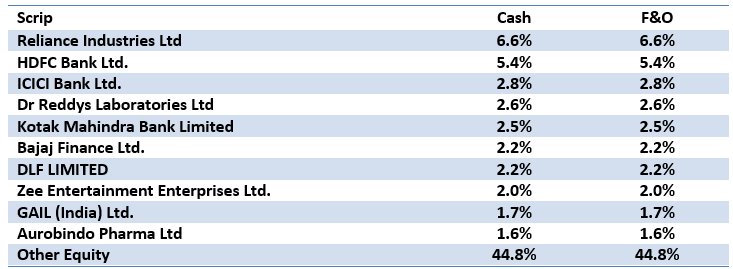

Current portfolio positioning

HDFC Arbitrage Fund currently has 74.33% exposure to equities (hedged), 2.93% exposure to debt (money market) and 22.7% exposure to cash / cash equivalent. The table below shows the equity exposure in cash and F&O segments.

Source: HDFC MF Factsheet, as on 30th November 2023. Disclaimer: Past performance may or may not be sustained in the future.

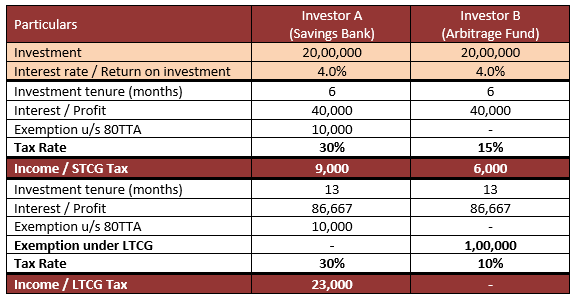

Taxation Advantage

Let us assume that Investor A has Rs 20 lakhs in his savings bank account. The bank pays 4% interest on savings bank account balance. Investor B invested Rs 20 lakhs in an arbitrage fund. For the purpose of comparison, let us assume that investor B also gets 4% return on investment. Further, let us assume that both the investors are in the 30% tax bracket. Let us compare their post tax returns. You can see that arbitrage funds enjoy a clear tax advantage for investors in the higher tax brackets.

Disclaimer: The table above is purely illustrative to show the different taxation for arbitrage funds and savings bank account. Taxation of your investment gains will depend on profits / capital gains and your holding period. You should consult with your tax advisor to know the tax consequences of your investment.

Why invest in HDFC Arbitrage Fund

- The Fund maintains a completely hedged position with no naked exposure to equities and managed a market neutral portfolio.

- The Fund follows a conservative approach in stock selection, i.e. Large Caps v/s Mid & Small Cap stocks. The stock selection is based on liquidity, spreads and rollover volumes.

- Active management by experienced Fund Management Team to capitalize on the best of arbitrage opportunities.

- Arbitrage Funds may offer better returns when compared with returns in traditional fixed income / savings products with investment horizon of 3 to 6 months, due to the equity taxation advantage available in the category.

Investors should consult their financial advisors or mutual fund distributors if HDFC Arbitrage Fund is suitable for parking their idle / short term funds.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Multi Cap Fund

Apr 29, 2025 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC CRISIL IBX Financial Services 3 to 6 Months Debt Index Fund

Apr 28, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Silver ETF Fund of Fund

Apr 28, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team