Franklin India Multi Cap Fund: A promising new multicap fund for long term investors

Franklin Templeton MF has launched a new diversified equity fund, Franklin India Multi Cap Fund. The New Fund Offer opened for subscription on 8th July and will close on 22nd July 2024. This open ended equity mutual fund scheme will invest in all three market cap segments, large cap, midcap and small cap, with minimum 25% allocation to each of the three market cap segments.

The multicap fund category is a relatively new equity category, less than 4 years old. Some investors get confused between multicap and flexicap funds. Unlike multicap funds, flexicap has no market cap limits. Multicaps on the other hand must maintain minimum allocations to each of the three market cap segments. All three market cap segments have important roles to play in investor’s portfolios, as well as in the India Growth Story. As such, multicap funds can play an important role in long term wealth creation for investors.

Why invest in Indian equities?

- India is in a macroeconomic sweet spot with benign inflation, improve fiscal situation (narrowing fiscal deficit), strong GDP growth (highest GDP growth among G-20 economies in FY 2024 and FY 2025 forecasts), strong manufacturing and services sector growth etc. India is expected to become the 3rd largest economy by 2027 (as per IMF projection).

- The external factors are also favourable for economic growth driven by moderating trade deficit, stable currency and strong forex reserves.

- Corporate profit is a leading indicator of an economy’s health. India’s corporate profits to GDP ratio has been continuously improving from 2020 after a long period of decline.

- There is a strong correlation between GDP growth rate of an economy and equity market returns. India’s equity market cap is expected to double over the next few years to USD 10 Trillion by 2030.

- India’s favourable demographics (e.g. young population, growing percentage of workforce in the population mix, rising per capita income) and changing consumption trends, along with significant Government and private sector capex spending is creating a favourable condition for a long term secular bull market.

- The Government’s PLI scheme will enhance the opportunities in ancillaries industries in themes like Energy Transition (e.g. solar modules, hydrogen electrolysers, Advanced Chemistry Cell Battery), Import Substitution (e.g. white goods, IT hardware) and Sunrise Sectors (e.g. semiconductors, electronic manufacturing systems).

Why Multicap?

- Multicap strategy can exploit a much larger and more diverse opportunity set spread across large, mid and small cap stocks. The top 5 sectors in Nifty 500, which have a large cap tilt accounts for about 60% by weight in the index. This implies that there is a substantial investment universe across many sectors, which have small and midcap cap tilt. These sectors include Healthcare, Consumer Durables, Industrial Products, Services, Realty, Chemicals etc.

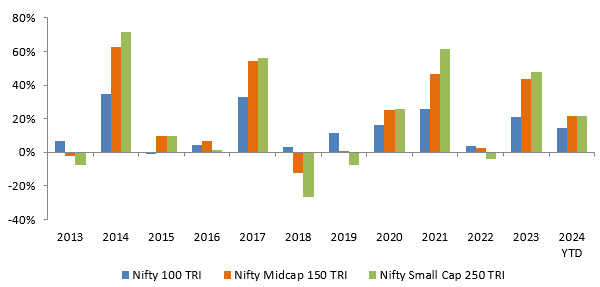

- Winners rotate across market cap segments (see the chart below). Multicap Funds cover all segments, providing stability to your investment portfolio.

Source: NSE, as on 28th June 2024. Disclaimer: Past performance may or may not be sustained in the future

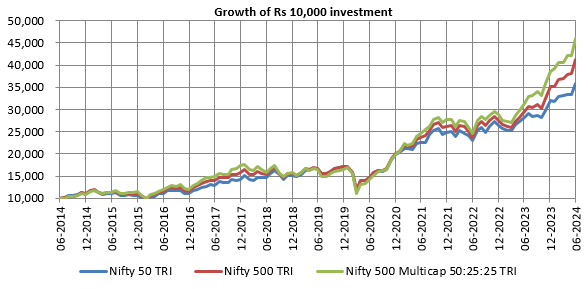

- Wealth creation: The chart below shows the growth of Rs 10,000 in Nifty 50 TRI, Nifty 500 TRI and Nifty 500 Multicap 50:25:25 TRI over the last 10 years. You can see the multicap index was able to create greater wealth for investors.

Source: NSE, as on 28th June 2024. Disclaimer: Past performance may or may not be sustained in the future

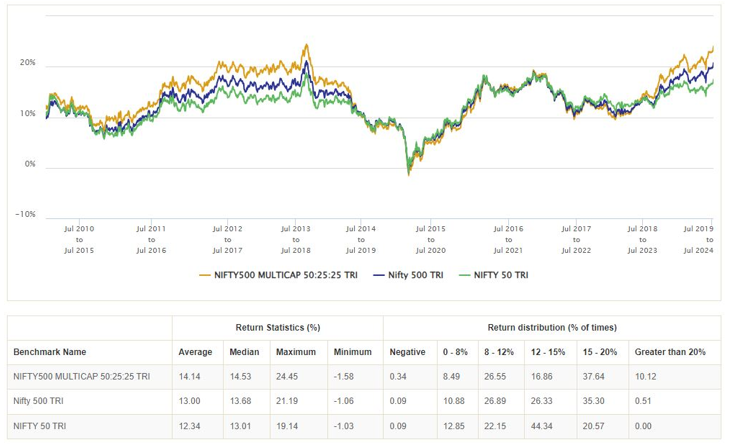

- Better Risk Return Trade-off: The chart below shows the 5 year rolling returns of Nifty 500 Multicap 50:25:25 TRI versus broad market indices like Nifty 50 TRI and Nifty 500 TRI over last 15 years or so (01.01.2010 to 31.05.2024). The average rolling returns of Nifty 500 Multicap 50:25:25 TRI across different market conditions is higher than Nifty 50 TRI and Nifty 500 TRI. Furthermore, observe that there is not much differences percentage of negative return instances of Nifty 500 Multicap 50:25:25 TRI, Nifty 50 TRI and Nifty 500 TRI over 5 year investment tenures (all are less than 0.5%). However, the percentage of 15%+ CAGR returns instances of Nifty 500 Multicap 50:25:25 TRI is significantly higher than those of Nifty 50 TRI and Nifty 500 TRI. In other words, Multicap strategy offers superior risk return trade off over sufficiently long investment tenures.

Source: National Stock Exchange, Advisorkhoj Research, as on 28th June 2024.

- Over the last 5 years or so, there have many new investment opportunities in the listed universe. There have been 100+ Initial Public Offerings (IPOs) from 2020 till 2023, with most Issuances in Mid and Small Cap segments. In the last 5 years BSE IPO index gave 28% CAGR returns versus 16% CAGR returns for Nifty. In the last 5 years, digital companies have debuted on the bourses across sectors like Retail, Food Tech, Software, Insurance, Fintech, Logistics etc.

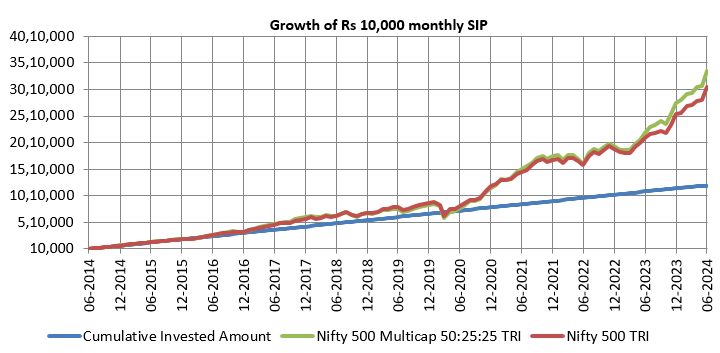

- Suitable for SIPs: Multicap funds are suitable for systematic investment plans since they tend to be more volatile (due to higher midcap and small cap allocations) than diversified equity funds with large cap tilt. The chart below shows the growth of Rs 10,000 monthly SIP in multicap index versus the broad market index Nifty 500 TRI.

Source: National Stock Exchange, Advisorkhoj Research, as on 28th June 2024.

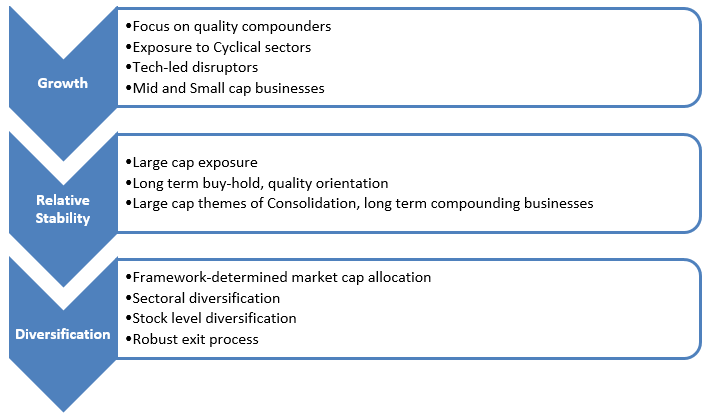

Franklin India Multicap Fund – Investment Strategy

How will the fund manager determine market cap allocation?

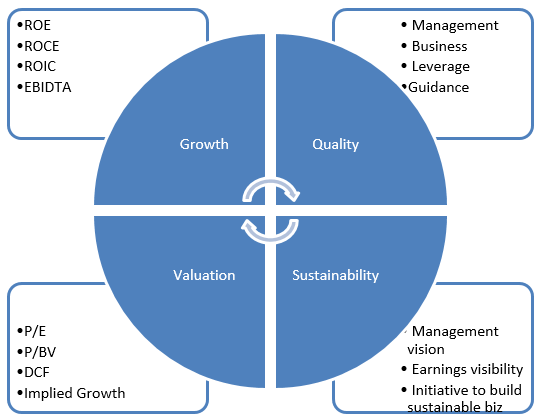

Stock Selection QGSV Framework

Franklin Templeton follows a disciplined stock screening process based on Quality (Q), Growth (G), Sustainability (S) and a Valuation (P) framework.

Why invest in Franklin India Multicap Fund?

- Franklin Templeton is a 76 year old global brand with global AUM of $1.6 Trillion (as on April 2024, source: Franklin Templeton)

- The AMC has a high quality equity team with Robust and steadfast investment philosophy

- The AMC has a long track record of successfully managing funds in the large cap, midcap and small cap segments.

- Experience in early identification of upcoming high growth themes and timely shuffling between themes

- Line up of key potential themes for the fund that yield diversification, high growth and scope for alpha generation

- 3-factor framework for efficient allocation between market capitalization segments and strong stock selection framework – QGSV

- A fresh portfolio (NFO) with no baggage of legacy stocks can capture best opportunities for future growth

Who should invest in Franklin India Multicap Fund?

- Investors with investment horizon of 5 years or longer for long term wealth creation

- Investors looking to capitalise on the potential of emerging businesses benefitting from India’s economic growth

- Investors seeking to participate in high growth themes leading the markets

- Investors seeking a fund with disciplined allocation to all market cap segments at all points of time

- Investors with very high risk appetites

- You can invest either in lump sum or from your regular savings through Systematic Investment Plan

Investors should consult their financial advisors or mutual fund distributors if Franklin India Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF

Apr 3, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team