Financial Services: Driving India Growth Story

Financial Services plays a critical role in the economic growth and development of any country. Efficient financial systems with focus on financial inclusion is essential for the long-term development of emerging economies. For example, China has the largest banking sector in the world with bank assets nearly 3 times of its GDP (source: Financial Stability Board, HSBC MF, 2023). Investors usually associate financial services with banking and non-banking financial companies (NBFCs). However, the financial services sector is broader and includes asset management companies, stock and commodity exchanges, life and general insurance companies, Fintechs etc.

Financial Services landscape in India at a glance

India has a large banking system. The Indian banking system comprises of 12 public sector banks, 21 private sector banks, 44 foreign banks, 43 regional rural banks, 34 state cooperative banks, 352 district cooperative banks, 11 small finance banks and 6 payment banks (source: RBI). In addition to banks, there are 9,306 NBFCs and 27 Asset Reconstruction Companies (ARCs) registered with RBI (source: RBI, 30th June 2024).

Financial inclusion is crucial for fostering economic growth, employment, promoting economic empowerment of weaker sections of the society, and poverty alleviation. The Pradhan Mantri Jan Dhan Yojana aimed at providing financial inclusion to all Indians has brought nearly 55 crore Indians under the banking system. 13.55 lakh Bank Mitras delivering branch-less banking services in the country (source: Ministry of Finance, as on 30th January 2024).

As far as the asset management industry is concerned, there are 44 asset management companies with nearly Rs 67 lakh crores of assets under management (AUM) as on 31st December 2024 (source: AMFI). Assets under management of the mutual fund industry has grown at of CAGR of more than 20% in the last 10 years (source: AMFI, as on 31st December 2024).

The insurance industry in India comprises of 27 life insurance, 7 health insurance and 27 general insurance companies (source: IRDA). As per IRDA, a total of 36.5 crore policies were issued in FY 2023-24. Total insurance premium collected in FY 2023-24 was around Rs 11 lakh crores (out of which Rs 8.3 lakh crores was towards life insurance premiums). AUM of the insurance industry as on 31st March 2024 stood at nearly Rs 68 lakh crores.

India has also made great strides in payments, especially mobile payments through the Unified Payments Interface (UPI), which has emerged as the largest payment system in the world. In December 2024 alone, nearly 17 billion transactions and Rs 23 lakh crores of payment was made through UPI (source: NCPI, 31st December 2024).

Shifting paradigms in financial services in India

- Traditional preference towards physicals assets (e.g. real estate, gold etc) is now incrementally shifting towards financial assets. Percentage of household savings invested in financial assets grew from 41% in 2013 to 46% in 2023 (source: MoSPI, CRISIL).

- Within financial assets, we are seeing a shift from traditional savings (e.g. deposits) to capital market and insurance assets. Percentage of household financial assets invested in capital markets (e.g. mutual funds, equity, debt) grew from 8% in 2019 to 11% in 2024 (source: RBI).

- There is also noticeable shift in investment preferences of Millennials and Gen Z compared to previous generations. Millennials and Gen Z seem to be less risk averse compared to previous generations and are open to investment avenues which aim at wealth creation.

- Technology has reshaped the financial landscape with increased adoption of digital banking, demat accounts and online transactions, mobile payments, online claims. This has not only reduced transaction costs and created efficiencies, increased convenience and transparency has the potential to drive business growth in this sector.

- India has one of highest smartphone penetration rates among large economies along with one of the lowest data costs. With increasing digitalization of financial services, financial services companies have improved operational efficiencies e.g. Aadhaar based e-KYC, Digi Locker for documents verification and accelerated their pace of growth.

- Due to paradigm shifts mentioned above, as well as the economic growth of India, the mix of lending (banks, NBFCs) and non-lending institutions in terms of market capitalization is evolving. Over the last 10 years, the market capitalization of non-lending institutions (including new listings) grew faster than market cap of the lending institutions.

Huge growth potential

Though the evolution and growth of financial services sector in India has been impressive, there is still a long way to go for financial services in India’s aspiration to become a developed economy (Viksit Bharat) by 2047.

- Financial assets of United States and China are 4 – 5 times of their GDP. India’s financial assets is less than 2 times of her GDP (source: Financial Stability Board report 2023). Since financial services is one of the most important drivers of economic growth, India’s financial services sector needs to grow at 2X of GDP growth rate in the next two decades to achieve the aspiration of Viksit Bharat by 2047.

- Both lending and non-lending sectors will important roles to play in the financial services sector and its contribution to India’s economic growth.

- The financial services sector in the United States experienced a tectonic in the last 2 decades. The market cap mix of the top 15 financial services companies in S&P 500 (top 500 large cap companies listed in the US) was 66% for lending and 34% for non-lending companies in 1999. By January 2025, that market cap mix has changed to 30% for lending and 70% for non-lending. Going by the US example, India’s non-lending financial services companies have a long way to go in our journey to becoming a developed economy.

- Penetration of financial services product (as % of GDP) in India is still very low compared to developed economies like the United States. For example, penetration of mutual funds as percentage of GDP in the US is 80% versus only 15% in India. Similarly, penetration of credit cards as percentage of the population in the US is 74% versus only 3% in India.

There is a long runway for growth of financial services in India.

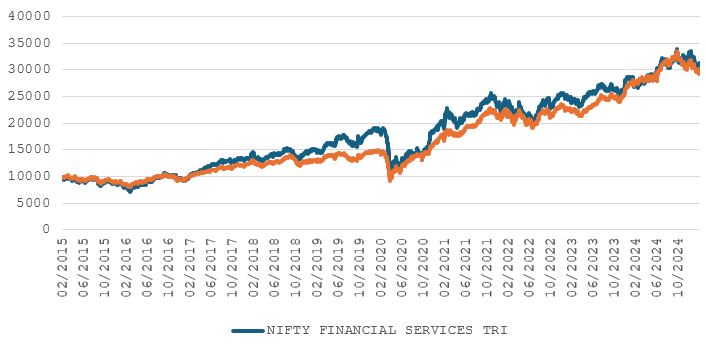

Financial services as an investment theme outperformed the broad market

Financial services, as an investment theme has outperformed the broad market index, Nifty 50 TRI 95% of times over long investment tenures (10 years).

Source: NSE, Advisorkhoj Research. Disclaimer: Past performance may or may not be sustained in future. The information provided is purely for investor education purposes and does not constitute investment recommendation. Investors should consult with their financial advisors before investing.

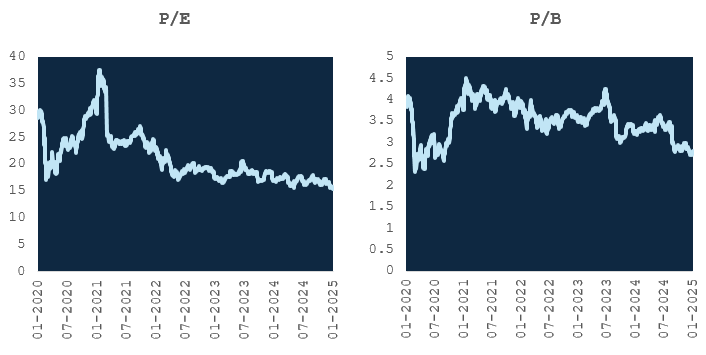

Why invest now – Valuations are attractive

The market correction over the last few months, have brought down valuations (Price to Earnings and Price to Book ratios) of Nifty Financial Services Index considerably. Currently, the P/E ratio of Nifty Financial Services Index is lower than peak COVID-19 level valuations. In terms of P/B ratios also, the Financial Services Index is trading close to peak COVID-19 level valuations. These valuations may provide attractive entry levels to long term investors.

Sources: NSE, Advisorkhoj Research. Disclaimer: Past performance may or may not be sustained in future. The information provided is purely for investor education purposes and does not constitute investment recommendation. Investors should consult with their financial advisors before investing.

Conclusion

While diversified equity funds should form part of your core equity investment portfolio, allocations to different investment themes which have the potential to outperform the broad market in the long term in your satellite portfolio, can boost your overall portfolio returns. In this article, we discussed about financial services as an investment theme and its prospects in the India Growth Story. You should consult with your financial advisor or mutual fund distributor if financial services thematic funds can be suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty 500 Low Volatility 50 ETF

May 28, 2025 by Advisorkhoj Team

-

Falling Interest Rates Prompt Union Mutual Fund to Launch Tax-Efficient** Income Oriented Fund: Union Income Plus Arbitrage Active FOF

May 26, 2025 by Union Mutual Fund

-

Can surplus banking liquidity lead to a steeper yield curve?

May 26, 2025 by Axis Mutual Fund

-

Union Mutual Fund launches Union Income Plus Arbitrage Active FOF

May 22, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India BSE Sensex Next 30 ETF

May 21, 2025 by Advisorkhoj Team