ELSS is simply the best investment for tax savings and wealth creation

Section 80C of Income Tax Act allows tax payers to claim deductions from their taxable income by investing in certain instruments. The investment limit eligible for tax deduction in Section 80C has been increased to र 150,000 from FY 2014 – 2015 onwards, allowing tax payers to save up to र 46,350 in taxes. The eligible investments in Section 80C include, Employee Provident Fund (EPF) deducted by the employer, Voluntary Provident Fund (VPF), Public Provident Fund (PPF), National Savings Certificates (NSC), 5 year tax saving bank fixed deposits, 5 year tax saving post office deposits, Senior Citizens Savings Scheme (SCSS), Life Insurance Premiums, National Pension Scheme, notified mutual fund Pension Plans and Equity Linked Savings Schemes (ELSS). In this blog, we will compare and contrast some of the most popular tax saving investment options under Section 80C, and determine the best investment option for wealth creation. When comparing the popular 80C investment, we will factor in three important considerations:-

- Returns, in other words, wealth creation potential

- Tax treatment of the investment

- Liquidity of the investment

In this blog we will review five popular eligible investment options under Section 80C

- Public Provident Fund

- National Savings Certificate

- Traditional Life Insurance Plan

- Unit Linked Insurance Plan

- Equity Linked Savings Scheme

Public Provident Fund

PPF is one the most popular choices under Section 80C, since it offers one of the best interest rates, ensures capital safety and tax exemption of maturity proceeds. PPF interest rate has been fixed at 8.7% for this fiscal year (2015 – 16). Though rates may vary from year to year, the yield has been pegged at 25 basis points above the 10 year Government Bond yield. The tenure of this instrument is 15 years, and is extendable in blocks of 5 years. Withdrawals not exceeding 50% of 4th year balance are permitted after a lock-in period of 7 years. PPF also offers loan facilities. The maximum and minimum investments currently allowed under PPF is र 150,000 and र 500/- respectively.

National Savings Certificate

NSC has been a popular investment choice for many years. In the new NSC scheme the interest rates at 8.5% and 8.8%, for the 5 and 10 year maturities respectively. However, the effective returns are lower, since interest earned in NSC is fully taxable, at your income tax slab rate.

Traditional Life Insurance Plan

Life insurance premiums are eligible for tax savings under 80C. You / your nominees get life cover in the event of an untimely death and survival benefits on completion of the policy term. The policy term ranges from 15 to 25 years. Life insurance plans have a lock in period of three years. You can surrender your policy after three years, but usually surrender charges apply. On maturity of the policy you get sum assured plus applicable bonuses. There are primarily two types of bonuses paid by traditional plans. A simple reversionary bonus is accrued every year as a percentage of sum assured and paid at the maturity of the policy. You should note that the bonus accrued is not compounded, it is only accumulated. In addition, a final additional bonus or terminal bonus is paid on the maturity of the policy. The bonus rates paid by traditional endowment plans usually range from 2 – 5% of the sum assured. The final bonus is usually around 1%. Historically traditional plans have given around 6% internal rate of return.

Unit Linked Insurance Plan

Unit linked insurance plans (ULIPs) are market linked instruments. In addition to providing life cover, a portion of your premiums are invested in purchasing units of a fund of your choice. Like mutual funds, ULIPs are also subject to market risks. However, on an average equity oriented ULIP funds have given 15 – 18% annualized returns over a 10 year investment horizon. However, your effective returns can be much lower because of your premium will go towards the mortality charges (life cover) and various fees like premium allocation, policy administration, fund management etc. These fees are deducted from your premium and only the balance amount is invested in the units of the fund. In the initial years of your policy life as much as 10% of your premium can go towards these fees and not be invested to buy units. Mortality charges depend upon the age and health of the investor. For a 30 year old investor, on an average it is र 1.4 – 2 per र 1,000 of sum assured per annum.

Equity Linked Savings Scheme

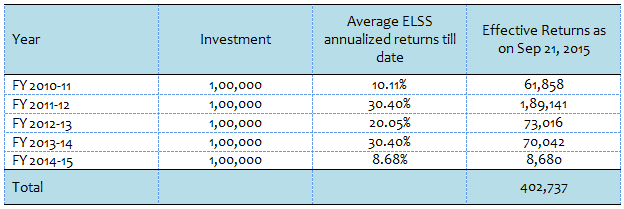

ELSS is a mutual fund scheme that qualifies for tax savings under Section 80C up to a limit of र 150,000. An ELSS is essentially a diversified equity scheme with a lock in period of three years from the date of the investment. If you invest in an ELSS through a systematic investment plan (SIP), each investment will be locked in for 3 years from their respective investment dates. Compared to other retirement planning investments under Section 80C ELSS offers higher liquidity and potentially superior post tax returns. However, as with all mutual fund investments ELSS are subject to market risks. ELSS funds have given an average 20% trailing annualized returns over the last 3 years, 10% annualized returns over the last 5 years and 12% annualized returns over the last 10 years. The table below shows the return from Rs 100,000 annual investment in ELSS funds over the last 5 years. The investment date each year has been assumed to be at the beginning of the year.

Therefore purely in terms of returns ELSS is the best tax saving investment option.

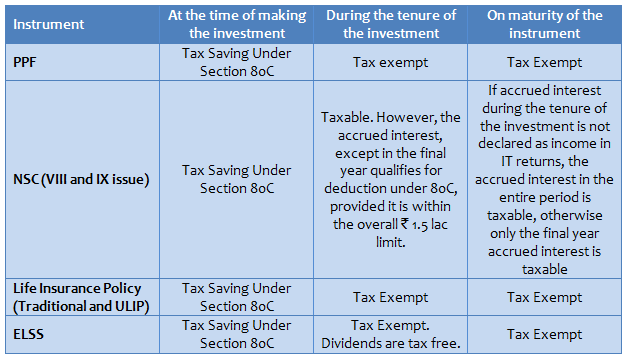

Tax Treatment

To fully evaluate the return on investment, one must also factor in the impact of taxes on these instruments. Accordingly, one must understand the tax treatment at three different stages of investment:-

- At the time of making the investment

- During the tenure of the investment

- On maturity of the instrument

The table below shows the tax treatment at each stage for various investment options

Therefore, even in terms of tax treatment ELSS is one of the best investment options under Section 80C.

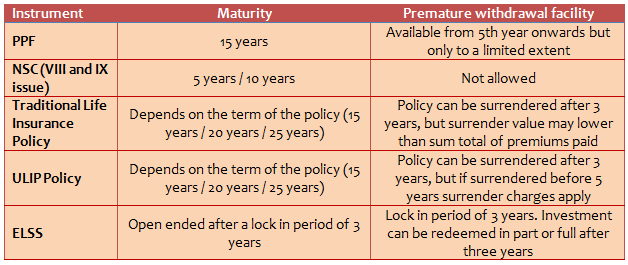

Liquidity

Liquidity is an important investment consideration. There is no general financial planning guidance on liquidity. It depends on the financial situation of the investor like, income, fixed expenditure, savings pattern, existing assets, liquidity of those assets etc. When you make an investment, you should make sure that you are comfortable with the liquidity of the investment that you are making. The table below shows the liquidity related considerations for these 80C investment options.

From a liquidity perspective, ELSS is the best tax saving investment option.

ELSS versus NPS

The only 80C investment option that has the potential to give returns comparable to ELSS is the National Pension Scheme (NPS). In this budget the Government has provide additional tax savings for investment in NPS. Investors can get an additional tax benefit of र 50,000 over and above the 80C limit of र 1.5 lacs, under Section 80CCD by investing in NPS. This makes NPS an attractive investment option for tax payers. While fund management costs in NPS is lower than that of mutual funds, a major disadvantage of NPS versus ELSS is the tax treatment on maturity. While capital gains in ELSS are tax free, NPS maturity amount is taxable on withdrawal. The other problem is that, under the current rules, 40% of the NPS maturity amount must compulsorily be used to purchase annuities and the annuity income is taxable. There are also limits on equity allocations in NPS, which younger investors may find too conservative relative to their risk profile. These disadvantages notwithstanding, NPS is a good long term investment option. In fact tax payers can maximize their tax savings by both in ELSS (up to 80C Limit) and NPS to get additional tax benefit under Section 80CCD.

Conclusion

In this blog we have objectively reviewed several tax saving options available to investors. We have seen that ELSS is one of the best tax saving investments for investors looking to create wealth in the long term.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Sundaram Mutual Fund launches Sundaram Income Plus Arbitrage Active FoF

Jan 5, 2026 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Dividend Yield Fund

Jan 5, 2026 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team