ELSS investments can help you with both: tax saving and retirement planning

For many investors tax saving is usually a once in year investment exercise to save up to र 46,350 in taxes under Section 80C of Income Tax Act. However, tax saving investments can also help you meet your long term financial goals like retirement planning. If you look at the various investment options under Section 80C, you will observe that many of these investments are meant to serve your retirement planning needs in addition to tax savings. Employee provident fund, public provident fund, life insurance policies (both traditional and unit linked), National Pension Scheme and mutual fund Equity Linked Savings Schemes are all investments in Section 80C that are in some ways or other associated with long term financial planning, either in rhetoric or results.

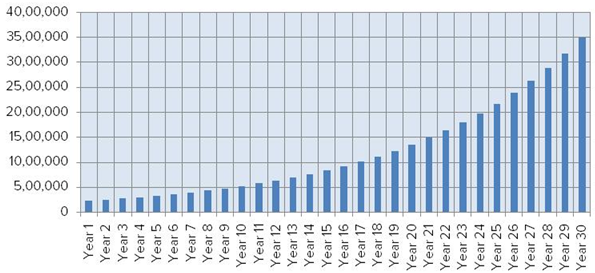

Unfortunately in our country, retirement planning is not given the due importance that it deserves. Over the years, employee provident fund, public provident fund and traditionally life insurance policies have been the investment options, commonly associated with retirement planning in India. All these investments are seen as risk free investment, and retirement planning as such in India is usually associated with these investments. As far as retirement planning is concerned there is a thumb rule called the 30 – 30 rule. The 30 – 30 rule in very simple terms means that you have 30 years of working life, in which you have to save and invest enough to provide for 30 years of retirement. The rule sounds simple and obvious. So what is the big deal? Let us walk through an example with numbers and hopefully you will understand that, it is not as easy as it sounds. Let us assume you are 30 years old. You will retire at 60. Your current income is र 10 lacs per year. Let us assume that, your basic salary is 50% of your gross salary (it is usually in the 40% to 50% range). You contribute 12% of your basic salary to Employee Provident Fund. Your employer makes a matching contribution. In addition, let us assume you will save another 10% of your gross income for retirement planning. Let us further assume that you get a salary increment of 10% every year. The chart below shows how much you will save till your retirement.

If you get a return of 8% (compounded) on your savings, you will accumulate a corpus of र 8.1 crores at retirement. It is impressive so far. Let us now see, how long this amount will last after your retirement. Here we come back to one of the key objectives of retirement planning, which is to maintain a certain lifestyle. Let us assume you want to maintain the lifestyle you had towards the end of your working career. Assuming you get 8% pre tax returns on your retirement savings, your corpus will last 10 years at best. It does not look that impressive any more. But it is about to get worse, once we factor the ugly 9 letter word, inflation. Factor in 5% inflation and your corpus will last only about 7 – 8 years. As per the 30 – 30 rule, retired lives can be as long as 30 years. In this example, you are losing your financial independence, even before you reach the half way stage of your retired life. Hopefully, this example will help you appreciate the importance of the 30 – 30 rule. The simple point is that, in your working life, you have income from your profession, you also have living expenses and other financial commitments and you save a portion of your income. In your retired life, you have no income from your profession, some income from your savings, you still have the living expenses and you have to deal with inflation. The point is simple, but challenge is far from simple.

So what is the solution?

You can save more towards retirement. However, you will agree with me that it is easier said than done. Inflation, home loan EMIs, children’s education and marriage, and last but not the least, taxes consume a big chunk of our incomes and leave less for savings. If you are a big spender, maybe you should try to save more but if you are judicious spender already, saving more towards retirement is not always feasible. The solution lies in getting better returns on your retirement planning investment and that is the crux of this blog post. If instead of 8% returns you get 15% returns, your retirement corpus will last for around 20 years instead of 7 – 8 years. Is it possible to get 15% return on your investment? Some of my relatives and friends asked me, can they get 12% guaranteed returns? The 10- year Government Bond yields over the last 10 years average around 8% return. If the Government of India cannot guarantee an average more than 8%, maybe a few basis points here or there, how can you expect to get more than that in risk free guaranteed returns? In fact, if you look at all risk free 80C investment options, the maximum return is 8.7% (except for special 80C investments for the girl child and senior citizens where the interest is 9.2 – 9.3%).

So we come back to the question, is it possible to get 15% return on your investment? The answer is yes, but not without taking risks. Mutual Fund equity linked savings schemes (ELSS) have given excellent returns over the long term. SIPs in top performing ELSS funds have given around 20% or more compounded annual returns (based on yesterday’s NAVs) in the last 15 to 20 years. You should note that mutual fund investments, including ELSS are subject to market risks. The last 10 year period in equity markets included three bear markets, in 2008, in 2011 and in 2015 – 2016. Therefore, the last 10 years, by no means, represent a dream run for equities. However, even in the last 10 years, monthly SIPs in top performing ELSS funds gave nearly 15% returns (based on yesterday’s NAVs), despite the challenging conditions. The performance of ELSS over the last 10 years speaks to the fact that, equity is the best asset class to create wealth in the long term for investors, irrespective of the interim periods of volatility.

Equity Linked Savings Scheme (ELSS)

ELSS is a mutual fund equity scheme that qualifies for tax savings under Section 80C up to a limit of र 150,000. An ELSS is essentially a diversified equity scheme with a lock in period of three years from the date of the investment. Capital gains in ELSS are tax exempt. Dividends paid by ELSS are also tax free. If you invest in an ELSS through a systematic investment plan (SIP), each investment will be locked in for 3 years from their respective investment dates. Compared to other retirement planning investments under Section 80C, ELSS offers higher liquidity and potentially superior post tax returns. However, as with all mutual fund investments ELSS are subject to market risk. ELSS funds have given an average of 16% trailing annualized returns over the last 3 years and 12% annualized returns over the last 5 years. Top performing ELSS funds have given 25% and 19% annualized over the last 5 years. Whether we take the average or top performer returns, either ways, they are much higher than the returns of any of the risk free 80C investment options. Even if we compare the ELSS returns with National Pension Scheme returns, ELSS beats NPS on a pre-tax basis. A major advantage which ELSS enjoys over NPS is the tax treatment on maturity. While capital gains in ELSS are tax free, NPS maturity amount is taxable on withdrawal, subject to taxation norms for NPS.

Why is ELSS the best tax saving investment to create a retirement corpus over a long investment horizon?

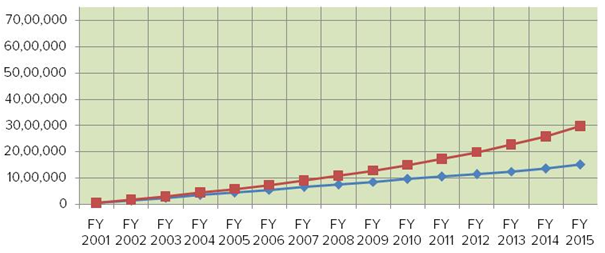

Let us see how much wealth could have created in the last 15 years from FY 2001 to FY 2015 by investing in ELSS or Equity Linked Saving Scheme versus a risk free investment like PPF. We have considered PPF as our 80C risk free investment, since it beats all other risk free 80C investments in terms of interest rate and tax treatment. PPF like ELSS, from a tax standpoint is what is known as E-E-E (Exempt – Exempt – Exempt). E-E-E means that investment is exempt from tax at the time of investment, during the tenure of the investment and on maturity. For our analysis we have assumed an annual investment of र 70,000 in FY 2000 – 2001, र 100,000 from FY 2001 – 2002 to FY 2013 – 2014 and र 150,000 in FY 2014 – 2015, as per Section 80C limits for the respective years. Let us first see how much maturity amount one would have accumulated in the last 15 years by investing up to the maximum 80C investment limit in PPF. The chart below shows the cumulative deposit amount and value of the investment in PPF. The blue line shows the cumulative deposits made by the investor in his or her PPF account every year.

The total deposit made by the investor is र 15,20,000 (र 15.2 lacs) over the duration of the PPF. The maturity amount of the investor is about र 29,82,000 (around र 29.8 lacs).

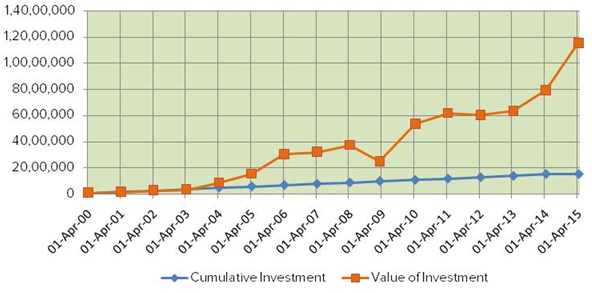

Let us now see how much corpus would an investor have accumulated by investing up to the maximum 80C investment limit in ELSS. In this example, we have chosen an average ELSS fund which completed 15 years. The chart below shows the cumulative investment amount and value of the investment in ELSS. The blue line shows the cumulative deposits made by the investor in the ELSS fund every year. The orange line shows the value of the ELSS investment based on prevailing NAVs.

The total investment made by the investor from 2000 – 2015, is र 15,20,000 (र 15.2 lacs), the same amount deposited in PPF in the previous example. As we can see from the chart above, the ELSS returns are of a very different order of magnitude compared to PPF. In fact, the current value of the first two ELSS investments made in 2000 and 2001 itself is much more than the total maturity amount accumulated in PPF in the previous example. The value of the ELSS investment as on Apr 2, 2015 is over र 1.15 crores, nearly four times the PPF maturity amount. Will the current market downturn affect the value of ELSS investments? We had discussed, ELSS is a market linked investment; the value of your ELSS investment will be affected by the market performance. In the last one year Nifty is down almost 14%. If we assume the performance of your ELSS investment to reflect market performance in the last one year, then the value of your investment may be down to slightly less than र 1 crore, but still it is many times higher than the PPF corpus with the same investment.

Conclusion

We had discussed a number of times on our blog that, asset allocation plays the most important role compared to a multitude of other factors, in how much returns you get from your portfolio in the long term. Equity is undoubtedly the most desirable asset class for young and earning investors. As such ELSS is one of the best investment options not only for tax saving but for retirement planning also under Section 80C of the Income Tax Act, as far as young and earning investors are concerned.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team