Do new mutual funds tend to perform better than old mutual funds

Two years back Wall Street Journal, the leading business and finance journal, published an article covering a study done by Lubos Pastor of the University of Chicago's Booth School of Business and Robert Stambaugh and Lucian Taylor of the University of Pennsylvania's Wharton School. The conclusion of the study was provocative. The researchers analyzed more than 3,000 actively managed US equity mutual funds between 1979 and 2011. They found that mutual funds that were less than three years old are likely to outperform funds that were more than 10 years old, on an average by 1% every year. In a mature equity market like the US, a 1% performance differential is quite significant. But does the same apply here in India too? We will examine this question in today’s blog post.

As always we will be data driven and analytical in our approach to this topic. But before we deep dive into the performance analysis in relation to age of mutual funds, I wanted to know the reasons attributed to the outperformance conducted by the two American professors. The study suggested that mutual fund industry in the US keeps getting more competitive and therefore, new funds, especially ones managed by young fund managers, are more desperate to outperform the market benchmark. On the face of it, this argument may have some merit. However, the flip side is whether in their desperation to outperform, the new funds are taking more risks. The conclusion of the study on this question is rather counterintuitive. The newer funds seemed to invest in less risky stocks compared to their older peers. Finally, the researchers suggested that younger fund managers are armed with better analytical and technology based techniques taught in business schools. I find it difficult to agree with the last observation, because a fund manager is not a one man army. He or she has access to all the research and analytical capabilities of the fund house. I should remind you that, these observations were based on a study of US equity mutual funds. Let us examine whether new mutual funds tend to perform better than old mutual funds in India as well.

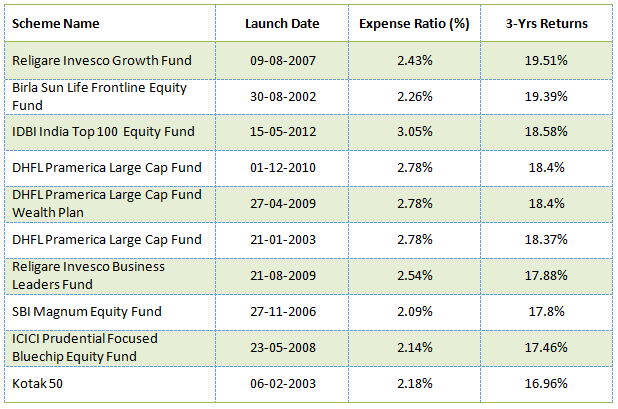

Let us look at the top equity mutual funds across various categories, to compare the performance and age of these individual funds. Let us start with large cap equity funds. The table below shows the top 10 large cap equity mutual funds ranked in order of trailing 3 years annualized returns. We have looked at 3 years annualized returns, because a longer time horizon would automatically exclude the newer funds. Returns over a short time horizon, like one year, can be misleading in case of mutual funds, especially given the market conditions in the last one year.

Source: Advisorkhoj Research

You can see in the top 10 list of large cap equity funds, 4 funds are more than a decade old. The youngest fund is 4 years old. The average age of the top 10 funds is 8.9 years old. Based on the analysis of ages of the top 10 fund, it does not seem that younger funds are outperforming older funds in this category.

Let us now look at the top 10 diversified equity (or multicap / flexicap) mutual funds based on trailing three years annualized returns.

Source: Advisorkhoj Research

You can see in the top 10 list of diversified equity funds, 6 funds are more than a decade old. The youngest fund is 6.5 years old. The average age of the top 10 funds is 11.6 years old. Again it does not seem that younger funds are outperforming older funds.

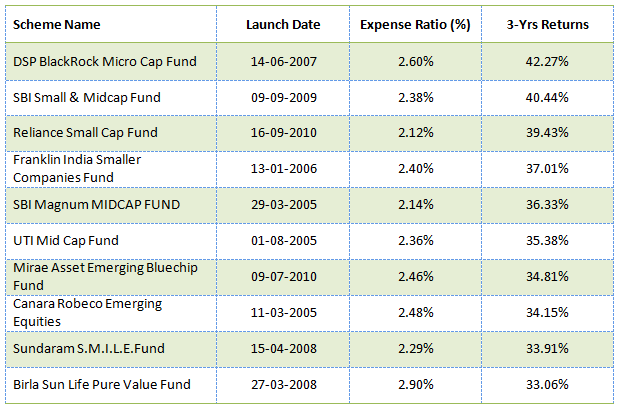

Let us now look at the top 10 small and midcap equity mutual funds based on trailing three years annualized returns.

Source: Advisorkhoj Research

You can see in the top 10 list of small and midcap funds, 4 funds are more than a decade old. The youngest fund is 5.6 years old. The average age of the top 10 funds is 8.6 years old.

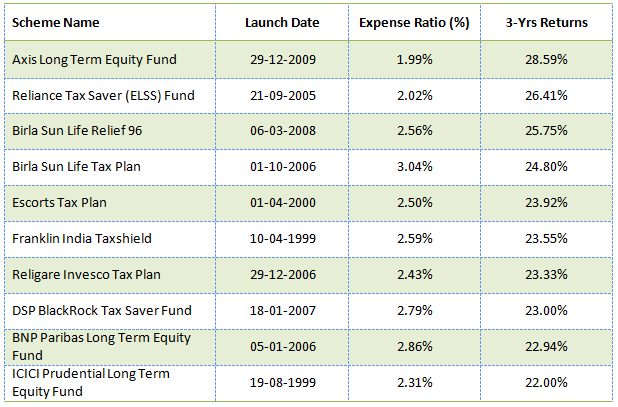

Let us now come to Equity Linked Savings Schemes (ELSS) or tax saver funds. This is one category where some mutual fund experts argue that, the younger funds have the potential to outperform because of the 3 year lock-in period, where the investor cannot redeem. The table below lists the top 10 ELSS funds based on trailing three years annualized returns.

Source: Advisorkhoj Research

You can see in the top 10 list of ELSS funds, 5 funds are more than a decade old. The youngest fund is 6.3 years old. The average age of the top 10 funds is 11.3 years old. Thus we can see that, even in the case of ELSS there is no evidence that younger funds outperformed older funds. So far we have seen that, there is no analytical evidence that younger funds tend to outperform older funds based on the last 3 years returns.

Let us examine the reverse hypothesis. Do older funds outperform younger funds? To examine this question, let us look at returns of top performing equity mutual in some categories over a very long investment horizon, say over a 10 year period. A 10 year investment horizon will automatically exclude the funds launched in the last 10 years, but in this analysis we will examine the age of the top 10 funds in terms of trailing 10 year annualized returns and how old each of these funds were 10 years back.

Source: Advisorkhoj Research

5 out of the Top 10 funds were less than 2 years old, 10 years back, which seems to give a slight edge to newer funds. However, this evidence is not conclusive enough, since 4 funds in the top 10 were more than 7 years old. Further the average age of the top 10 diversified equity funds in terms of trailing 10 year returns was over 5 years in April 2006.

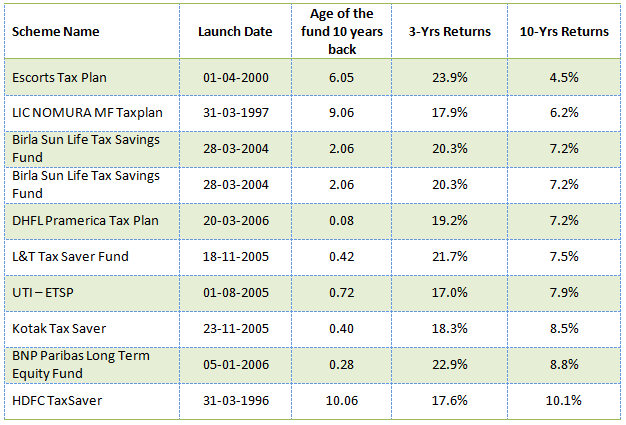

Let us examine the top 10 ELSS Fund in terms of trailing 10 year annualized returns.

Source: Advisorkhoj Research

Here the results are very interesting. 7 out of the top 10 funds were less than 2 years old in April 2006. The average age of the top 10 ELSS funds in terms of trailing 10 year returns in April 2006 was little over 3 years.

Conclusion

Statistical analysis can throw bizarre results. Statistically butter production in Bangladesh has a strong correlation with S&P 500. When certain teams win the Super Bowl, the annual American Football championship, the US stock market rises. Obviously butter production in Bangladesh or Super Bowl results have nothing to do with the US stock market returns from a rational viewpoint. These are cases of spurious correlations. Therefore, unless there is very conclusive analytical evidence backed by rational understanding, we can conclusively prove any hypothesis. In this blog post, we have tried to examine whether younger funds outperform older funds or vice versa in India. There is no conclusive evidence that they do, as far as mutual funds in India are concerned. Neither is there sufficient evidence that older funds outperform younger funds over a long investment horizon. When selecting mutual funds, therefore one should look at a variety of factors, like the fund’s performance track records over various time scales, rolling returns, risk adjusted returns and most importantly the track record of the fund manager in creating alphas.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team