DSP BlackRock Focus 25: One of the best large cap funds

In its latest mutual fund ranking (September 2016), CRISIL has ranked DSP BlackRock Focus 25 Fund among the best performing large cap equity mutual fund schemes (Rank 1). Some large cap funds with concentrated or focused portfolios have been doing quite well over the last few years. Some investors may ask whether the fund manager can achieve the desired level of unsystematic risk diversification in such focused funds. Funds with concentrated portfolios aim to generate higher alphas or outperformance versus the benchmark index, through stock picking abilities of their fund managers with optimal risk diversification. Typically, these funds tend to be more volatile relative to more diversified funds. However, over the long term the fund managers of these funds can generate higher alphas and give superior returns to investors.

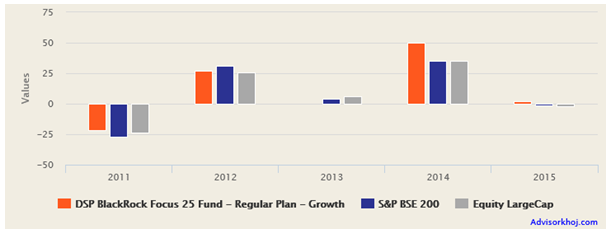

The DSP BlackRock Focus 25 fund, a large cap oriented diversified equity fund, has been a good performer on a relative basis, even in the last two years, when market has been quite volatile. In the initial years of the fund, its performance of the fund was relatively modest, which is not unexpected due to its focused investment strategy. However, the fund delivered outstanding returns in 2014 and in even difficult market conditions of 2015. The chart below shows the annual returns of the fund from 2011 to 205 relative to the large cap funds category and the benchmark (BSE -200).

Source: Advisorkhoj Research

DSP BlackRock Focus 25 Fund has continued its outperformance in 2016 beating both large cap funds category average returns and BSE – 200 returns over the last 1 year.

Fund Overview of DSP BlackRock Focus 25 Fund

The DSP BlackRock Focus 25 Fund was launched in June 2010 and has an AUM base of र 1,867 Crores (grown almost 80% in the last one year). Expense ratio of the fund is 2.6%. Till the end of 2014, the DSP BlackRock Focus 25 fund was managed by veteran fund manager Apoorv Shah. Now the fund is managed by Harish Zaveri and Jay Kothari. The chart below shows the NAV movement of this large cap fund since inception.

Source: Advisorkhoj Research

Rolling returns

Rolling returns is the best measure of a fund’s performance in terms of consistency. The chart below shows the 3 year rolling returns of the fund over the last 5 years. Rolling returns are the absolute returns of the scheme taken for a specified period on every day/week/month and taken till the last day of the duration. We have chosen 3 years as the rolling returns time period because it is always recommended that long term investors should hold equity funds for at least 3 years.

In this chart we are showing returns on every day during the specified period and comparing it with the category average rolling returns. The orange line shows the 3 year rolling returns of DSP BlackRock Focus 25 fund (Growth Option) and the blue line shows the 3 year rolling returns of the large cap funds category.

Source: Advisorkhoj Research

We can see that DSP BlackRock Focus 25 fund, despite underperforming in the initial period has been consistently outperforming the large cap funds category in terms of three year rolling returns since 2012.

Portfolio Construction

The fund managers have made concentrated bets in high conviction stocks. From a market capitalization perspective, the fund portfolio has a large cap bias. The mandate of the fund is to invest in companies, which are amongst the top 200 companies by market capitalization. The portfolio will limit exposure to companies beyond the top 200 companies by market capitalization up to 20% of the net asset value. The scheme will also have at least 95% of the invested amount across the top 25 holdings in the portfolio which excludes debt & money market securities.

Over the past one year, midcap funds have given higher returns than large funds because large cap stocks have been more severely impacted by the FII outflows over the last 18 to 20 months. Though large cap funds have underperformed relative to mid/small cap funds, many market experts and fund managers believe that large cap funds are likely to give very strong returns in the moderate term, once risk sentiments and FII flows stabilises.

In terms of sectoral allocation of the portfolio, the portfolio is strongly oriented to cyclical sectors like Banking and Finance, Automobiles and Auto Ancillaries, Oil and Gas, Cement and Construction, Consumer durables etc. As the capex cycle picks up in the economy the portfolio is expected to deliver stronger returns. From a company concentration standpoint, the top 5 holdings, HDFC Bank, State Bank of India, Maruti Suzuki, Indusind Bank and Tata Motors comprise around 35% of the fund’s portfolio.

Source: Advisorkhoj Research

One of the questions that investors have regarding focused funds is, whether these funds are really diversified funds or if they fall within the gamut of thematic funds. While it is true that, given its concentrated portfolio holdings, the DSP BlackRock Focus 25 Fund is less diversified than majority of diversified funds, it cannot be classified as a thematic fund because though banking and finance constitutes a significant portion of the portfolio holding, the fund has significant allocations to other sectors as well.

Risk

In terms of risk measures, the volatility of the DSP BlackRock Focus 25 Fund is on the higher side, relative to the average volatility of large fund oriented diversified equity funds. This is consistent with the concentrated portfolio holding of this fund. Investors need to have a long investment horizon to get maximum return from this fund.

Further since focused funds tend to be more volatile than more diversified funds, investment through Systematic Investment Plan (SIP) is the ideal mode of investing for such funds, since the investor can take advantage of the volatility in NAVs.

The fund managers have delivered strong Sharpe Ratio and Alpha in this scheme. For more scheme performance details, visit the scheme details page of DSP BlackRock Focus 25 Fund,in the MF Research Section of our website.

Strong SIP returns of DSP BlackRock Focus 25 Fund

The chart below shows the returns of र 5,000 monthly SIP in the DSP BlackRock Focus 25 Fund (growth option), over the last 5 years.

Source: Advisorkhoj Research

The chart above shows that a monthly SIP of र 5,000 started 5 years ago in DSP BlackRock Focus 25 Fund (growth option) would have grown to nearly र 4.3 Lakhs by December 27 2016, while the investor would have invested in total about र 3 Lakhs. The SIP return of the fund (as measured by XIRR) over the last 5 years is nearly 14%.

Conclusion

DSP BlackRock Focus 25 Fund has completed 6 years in June 2016. Though the performance of the fund was relatively modest in the first 2 – 3 years, the fund manager’s conviction paid off in 2014 and the fund has delivered strong outperformance in difficult market conditions. The fund is ideal for investors looking for capital appreciation over a long time horizon for a variety of financial objectives. As discussed earlier, given the concentrated portfolio of this fund, investors in this fund should be prepared for volatility. However, if they are invested over a long time horizon, investors can expect good returns. Investors should consult with their financial advisors if DSP BlackRock Focus 25 Fund is suitable for their mutual fund investment portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

HDFC Mutual Fund launches HDFC CRISIL IBX Financial Services 3 to 6 Months Debt Index Fund

Apr 28, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Silver ETF Fund of Fund

Apr 28, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team