Canara Robeco Small Cap Fund: A consistent small cap fund

Small caps have outperformed ever since the market started recovering after the COVID-19 crash in 2020. Small caps outperformed in CY 2020 and 2021, but they underperformed in CY 2022. The 2022 correction made small caps attractive, and they bounced back strongly in 2023. Small cap funds saw a huge amount of investor interest. As per AMFI monthly data, small cap funds have received the largest inflows among all equity fund categories in FY 2023 – 24 with more than Rs 19,370 crores of net inflows on FY 24 August YTD. Small cap inflows constituted nearly 42% of net inflows of actively managed equity fund categories (source: AMFI monthly data, April to August 2023). In this article, we will review a consistent small cap fund, Canara Robeco Small Cap Fund.

About Canara Robeco Small Cap Fund

If you had invested Rs 10 lakhs in Canara Robeco Small Cap Fund at the time of its launch, your investment would have multiplied nearly 3 times to Rs 29.57 lakhs (as on 20th September 2023, source: Advisorkhoj Research). Canara Robeco Small Cap Fund was launched in February 2019 and has Rs 7,577 crores of assets under management (AUM) as on 31st August 2023. The Total Expense Ratio (TER) of the scheme is 1.73%. Canara Robeco Small Cap Fund has given 26.7% CAGR returns (as on 20th September 2023, source: Advisorkhoj Research) since inception Ajay Khandelwal and Shridatta Bhandwaldar are the fund managers of the scheme.

Strong performance relative to peers

The chart below shows the annual performance of the Canara Robeco Small Cap Fund since its inception. You can see that the scheme has been in the top performance quartiles for 3 consecutive (ranking in top 5 funds in two out of the last three years). The scheme has underperformed in the past few months, but we should not judge an equity scheme based on short-term performance. The performance of an equity fund should be evaluated over a minimum investment horizon of 3 years.

Source: Advisorkhoj.com Quartile Ranking

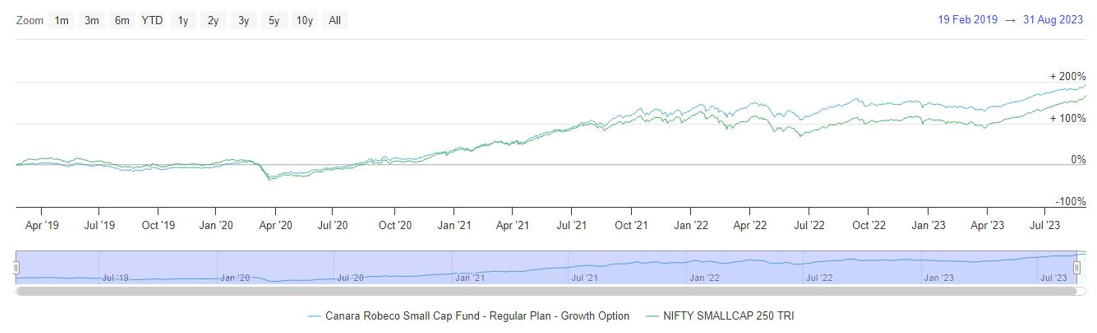

Canara Robeco Small Cap Fund has been able to outperform the benchmark since inception

You can see that Canara Robeco Small Cap Fund was able to outperform its benchmark index Nifty Small Cap 250 TRI since the inception of the scheme and create substantial alphas for investors.

Source: NSE, mutualfundtools.com, as on 31.08.2023

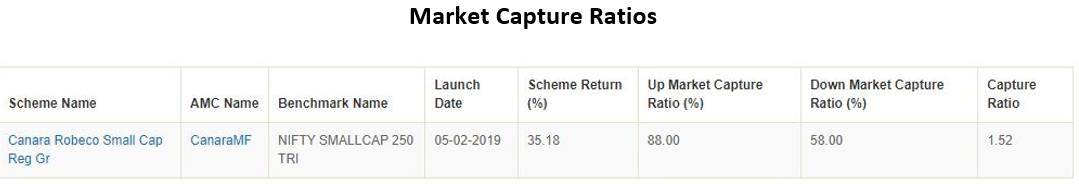

Superior down market performance

In the chart below, we are showing the 1 year rolling returns of Canara Robeco Small Cap Fund versus the benchmark index Nifty Small Cap 250 TRI since the inception of the scheme. You can see that the scheme was able provide better downside risk limitation compared to the benchmark index. Since the inception of the scheme, the benchmark gave negative 1 year returns 28% of the time, while the scheme gave negative 1 year return only 13% of the time. The superior down market performance can be seen also in the market capture ratios. The market capture ratio of the scheme over the last 3 years is 51%. This means that when the benchmark fell 1%, the scheme fell by only 0.5%. Research show that schemes with low market capture ratios can deliver higher alphas over sufficiently long investment horizons.

Source: NSE, Advisorkhoj Rolling Returns, as on 20.09.2023

Source: NSE, Advisorkhoj Market Capture Ratio, as on 20.09.2023

Consistence outperformance versus peers across market conditions

Rolling returns show how consistent a scheme’s performance is relative to benchmark or other schemes. You can see that Canara Robeco Small Cap Fund was consistently able to beat the small cap category average across 3 year investment tenures.

Source: NSE, Advisorkhoj Rolling Returns, as on 20.09.2023

Investment strategy

- Invest in companies with higher return on capital that tends to creates long term value for shareholders

- Invest in small cap companies having growth potential and headroom for further growth

- Invest in companies that are competitive in their business based on niche market positioning, strong brands or high market share

- Invest in companies that display high standards of corporate governance

Broad investment themes

- India affluent consumption story

- Global supply chain realignment

- Domestic Infrastructure activity ramp-up

- Capex cycle revival and the Industrial Renaissance

- Improving digitisation & financial inclusion

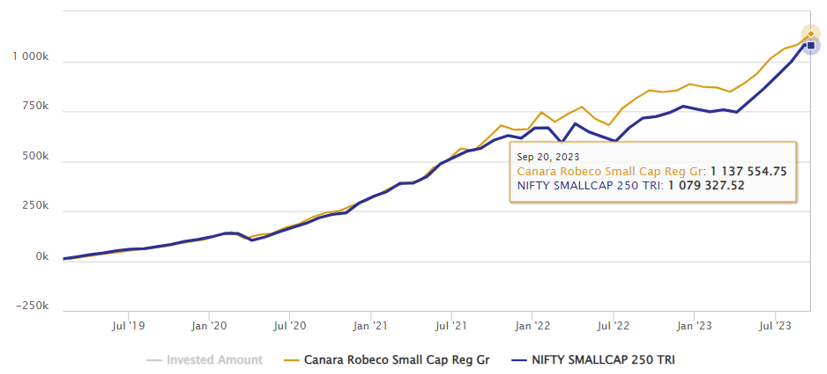

Wealth creation by Canara Robeco Small Cap Fund

The chart below shows the wealth created by Rs 10,000 monthly SIP in Canara Robeco Small cap Fund since the inception of the scheme. With a cumulative investment of than Rs 5.7 lakhs over the last 4 years, you could have accumulated a corpus of more than Rs 11 lakhs (as on 20th September 2023). The SIP XIRR since inception is 32.12%.

Source: NSE, Advisorkhoj Research, as on 20.09.2023

Why invest in Canara Robeco Small Cap Fund?

- Historical data shows that small cap stocks have the potential to deliver higher returns than large caps and midcap stocks.

- A stock which is small cap today can become midcap and large cap in the future. There is potential of significant valuation re-rating a stock moves from one market cap segment to a higher market cap segment.

- Small caps will be the main beneficiaries of the India Growth Story. They will benefit from rising affluence and changing consumer preferences, GST transformation of unorganized sectors to organized, financial inclusion and digitization of payments, capex spending by the Government and other structural changes in our economy.

- Canara Robeco’s expertise in selecting companies seeks to deliver better risk-adjusted returns.

- Strong risk control process. The investment team carries out rigorous in-depth analysis of the securities proposed to be invested in.

Who should invest in Canara Robeco Small Cap Fund?

- Investors looking for capital appreciation over long investment horizon.

- Investors with high to very high risk appetites

- Investors with minimum 5 years investment tenures

- You can invest in SIP or lump sum. You can also invest through 6 – 12 month STP from Canara Robeco Liquid Fund

- Investors should consult with their financial advisors or mutual fund distributors if Canara Robeco Small Cap Fund is suitable for their investment needs

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team