Canara Robeco Multicap Fund NFO

Canara Robeco Mutual Fund is launching a multicap fund, Canara Robeco Multicap Fund. The NFO opens for subscription on 7th July 2023 and closes on 21st July 2023. Multicap funds are diversified equity mutual fund schemes which invest across market cap segments i.e. large cap, midcap and small caps, with minimum portfolio allocations to each of the three market cap segments. As per SEBI’s circular in September 2020, multicap funds must invest at least 25% of their assets in large cap stocks, at least 25% in midcap stocks and at least 25% in small cap stocks.

What are the different market cap segments and their characteristics?

As per SEBI, top 100 stocks by market cap are classified as large cap stocks, 101st to 250th stocks by market cap are classified as midcap stocks, while 251st and smaller stocks by market cap are classified as small cap stocks. Large-cap stocks represent industry titans and have relatively lower volatility compared to midcaps and small caps. Midcap companies are the ones with established business models with structural stories and a runway for growth. Small cap stocks, when chosen right, represent companies with the potential for accelerated growth; these stocks can be potential multi-baggers.

Why invest in Multicap Funds?

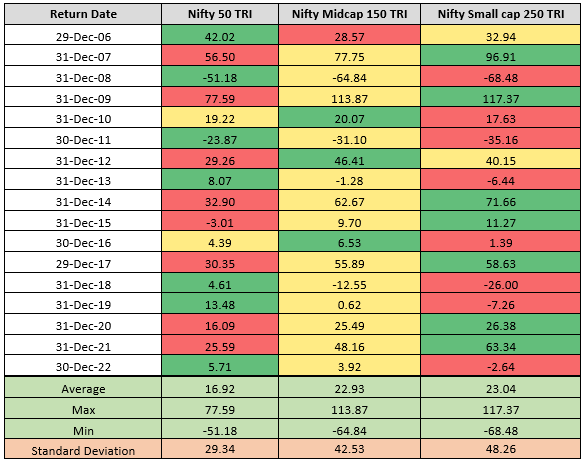

- Winners rotate across market cap segments: It is difficult to predict which of the three-market capitalisation will perform in a year – Large-Cap, Mid-Cap & Small-Cap. If we refer to the table below, it is clear that there are no set patterns. Another observation that can be derived is that a small cap can help generate higher returns but is also more volatile. At the same time, large-cap is relatively more stable.

Data Source: MFI Explorer

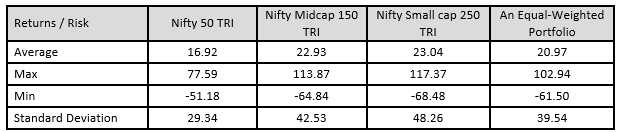

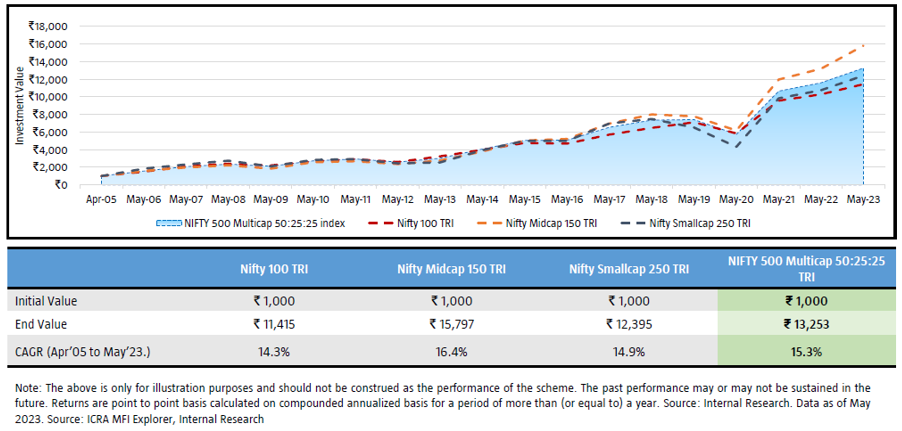

- Balance risk and returns: An equity fund with a proportionate investment level across all three market caps can give superior returns while limiting downside risk. Please see the table below showing the returns of benchmark indices for different market cap segments, as well as equal weighted portfolio of all three market cap segments, over a period of 17 years.

Data Source: MFI Explorer

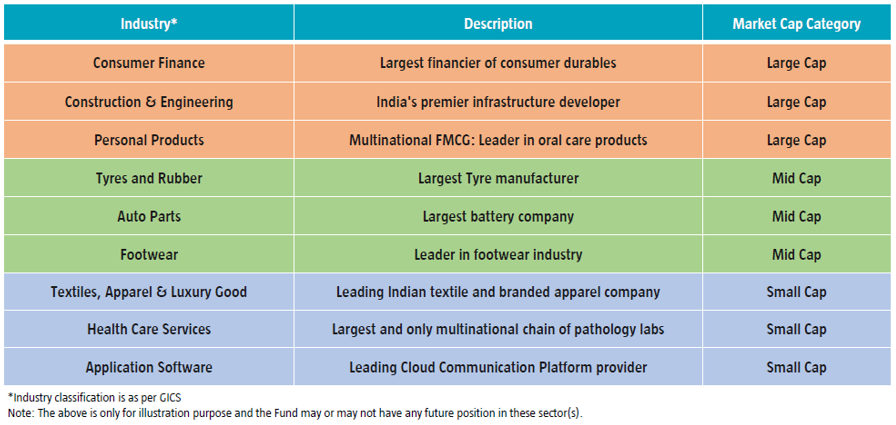

- Exposure to a wider set of sectors: There are several sectors where large caps have no presence. A multi-cap strategy will have exposure to a wider set of sectors (see the table below).

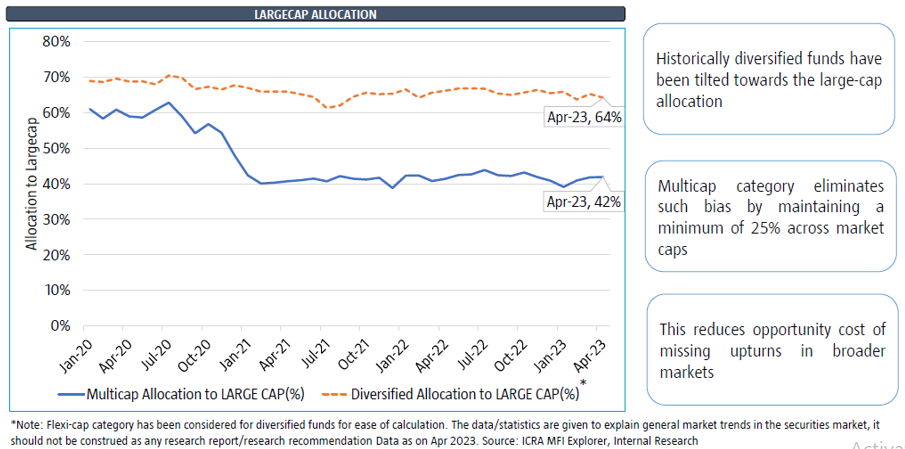

- Reduce large cap bias & risk of missing upturns in broader markets: Conceptually a Flexicap fund should have the freedom to manoeuvre across the market cap, but data shows that is not the case. Often the bias towards the large-cap is much more. Therefore, a fund where the mandate binds it to have a minimum level of exposure to large and midcap will have less bias towards large-cap. The main advantage of this fund will be during a turnaround or early stage of the bull market when high-quality mid-cap and small-caps tend to perform better.

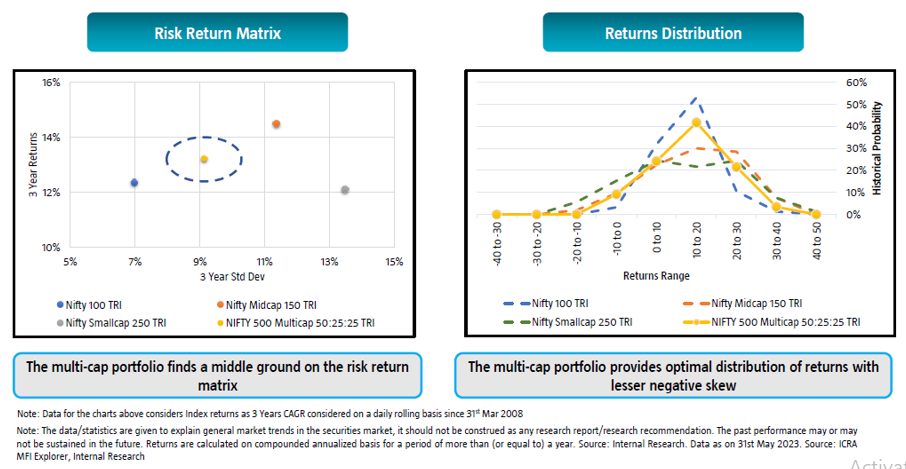

- Balanced risk-return metrics with a lower concentration of returns: The Risk Return Matrix chart (see below) highlights how returns relatively increase more than the level of risk taken, in other words, potential of superior risk adjusted returns. Returns distribution highlights how the right tail, i.e. higher returns, is better compared to the large-cap in a multi-cap strategy meanwhile, in the range of 0-20% returns, the multi-cap has a higher participation compared to mid and small-cap.

- Opportunity to create long-term wealth: This chart below shows the growth of Rs 1,000 investment in Nifty 100 TRI (large cap), Nifty Midcap 150 TRI (midcap), Nifty small cap 250 TRI (small cap) and Nifty 500 Multicap 50:25:25 (multicap) indices over the last 18 years or so. Multicap is a clear winner over such long investment period.

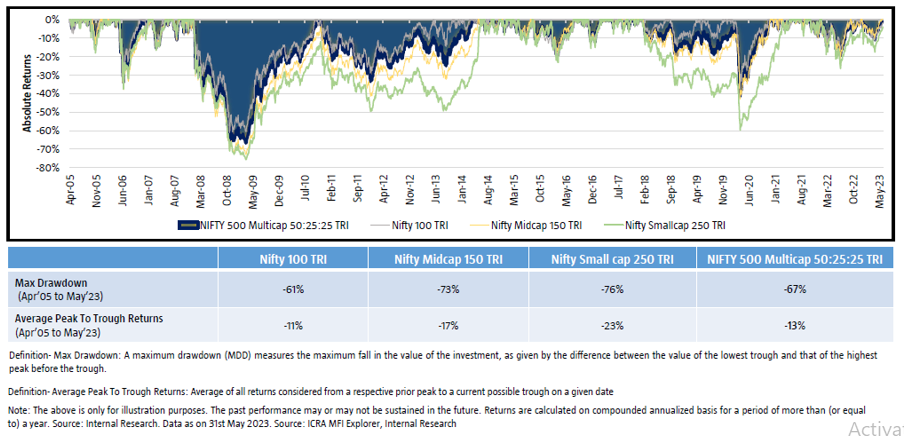

- Broader market participation with relatively lower drawdowns: The chart below shows the drawdown of the Multicap index versus large cap, midcap and small cap indices. You can see that multicap was able to lower downside risks compared small caps and even midcaps.

About Canara Robeco Mutual Fund

Canara Robeco AMC has a strong long term record (more than 15 years) of outperformance across several equity fund or equity oriented hybrid fund categories. Canara Robeco’s large cap, flexicap, tax saver (ELSS) and hybrid aggressive funds, among others, have consistently been top quartile performers. However, the fund house did not have a scheme in the Multicap category. With this NFO, the fund house is offering investors one more choice within its product portfolio that may suitable for the investor’s risk appetite and investment needs. In fund house’s opinion “while there may be no holy grail in the markets, a balanced portfolio is what works best to weather the cyclical nature of markets. As such, winners keep rotating, and to benefit most, a portfolio having constant allocation across Large, Mid, and Small-cap is one of the right ways”. Shridatta Bhandwaldar & Vishal Mishra are the fund managers of this scheme. Shridatta Bhandwaldar has strong performance track record managing several top performing equity funds like Canara Robeco Bluechip Equity Fund, Canara Robeco Flexicap Fund and Canara Robeco Equity Tax Saver Fund. Vishal Mishra is also the co fund manager of several top performing funds.

Canara Robeco Multicap Fund - Investment Strategy

- Leaders & Challengers across market cap that are likely to outpace industry growth

- Cyclicals and turnaround companies

- Small cap companies with superior growth to ensure portfolio captures returns over the company’s lifecycle

- Higher exposure in mid/small caps in sectors with high conviction

- The fund will avoid companies which do not have high corporate governance standards, Lack of Free Cash-flow (FCF) through business cycles, Low ROE and ROCE, very high leverage, very high working capital cycles

- With the aim of managing risks, the investment team will carry out rigorous in-depth analysis of the securities proposed to be invested in

Why invest in Canara Robeco Multicap Fund?

- Exposure to all 3 market caps across Indian Equities thereby minimizing market-cap bias

- The category has the potential to deliver consistent risk adjusted returns across market cycles

- The fund will reduce the investor's concern of taking a call on market-cap exposure

- Provides an opportunity to participate through the life-cycle of a company

- Canara Robeco has over 15 years of experience in Indian equities and strives to adhere to risk management in order to deliver meaningful risk adjusted returns

Why is this a good time to invest in Canara Robeco Multicap NFO?

- The earnings growth / valuation expectations context is turning more and more favourable for anyone who has 18-24 months view from here on

- Indian economy is in a structural up cycle which will come to fore as global macroeconomic challenges recede over next few quarters.

- Corporate and bank balance sheets are now in best possible shape to drive capex and credit respectively

- Consumer spending remains resilient through cycle

- The Government is focused on driving growth through direct investments in budget as well as through reforms like GST, lower corporate tax and ease of doing business, PLIs for import substitution or export ecosystem creation

- Accentuated benefits to India due to global supply chain re-alignments due to geopolitics.

As such this is a good time to invest in Canara Robeco Multicap Fund with 5 year investment horizon

Who should invest in Canara Robeco Multicap NFO?

- Investors looking for capital appreciation over long-term investment horizon

- Investors who are looking for a one-stop solution with disciplined exposure to Large Caps, Mid Caps and Small Caps as a part of their asset allocation

- Investors with high to very high risk appetites

- Investors with minimum 5 years investment tenures

- You can invest in this scheme either in lump sum or SIP depending on your investment needs

Investors should consult with their mutual fund distributors or financial advisors if Canara Robeco Multicap Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team