Canara Robeco Manufacturing Fund: Invest in manufacturing growth

Canara Robeco Mutual Fund has launched a thematic fund NFO, Canara Robeco Manufacturing Fund. The fund will invest in companies from different industry sectors that come under the manufacturing theme. The Government with its “Make in India” policy aims to make India a global manufacturing hub. Changing global supply chain dynamics e.g. China + 1 strategy is also likely to benefit India in the long term.

In this article, we will review Canara Robeco Manufacturing Fund. The NFO will be open for subscription on 16th February 2024 and close on 1st March 2024.

Importance of manufacturing in India’s economic growth

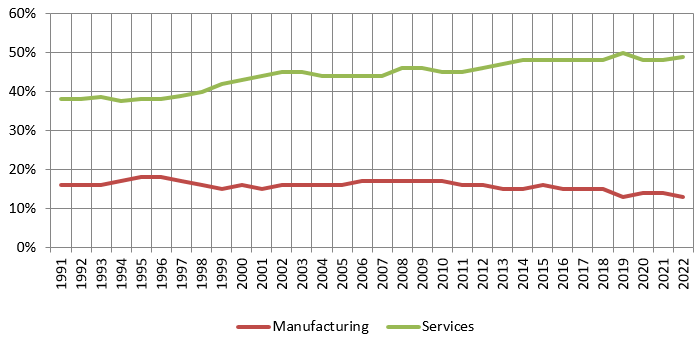

Since the dawn of industrial age in 18th and 19th century, manufacturing has played an important role in the progress and prosperity of nations. Manufacturing is one of the leading drivers of employment growth and reduces income inequality in a country. China’s high economic growth over last 40 years was driven mainly by manufacturing. Though India has also experienced high GDP growth since liberalization of our economy in 1991, contribution of service sector leads manufacturing in terms of employment (31% of India’s workforce versus 25%) and GDP growth. Manufacturing sector will play a key role in the next stage of India’s economic growth by addressing our external sector imbalance and demographic e.g. employment, rising working age population etc.

Source: World Bank

Drivers of Manufacturing Growth in India

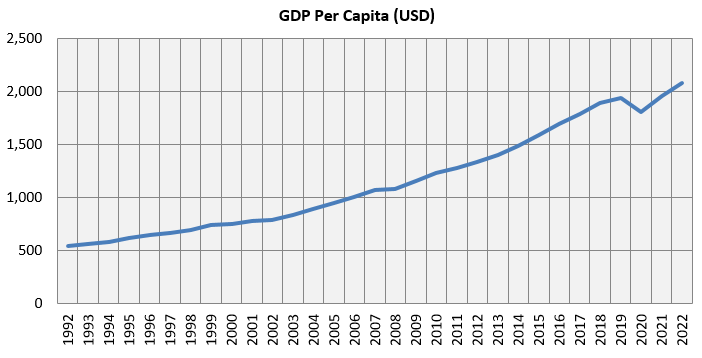

- India’s per capita GDP has risen from $500 in early 90s to more than $2,000 in 2022. It is believed that $2,000 per capita income marks an inflection point in a nation’s economic progress. As income goes up $2,000 the discretionary part of spending goes up. From this level per capita income is expected to grow at faster pace and reach $4,700 by 2030 (source: Canara Robeco MF).

Source: World Bank

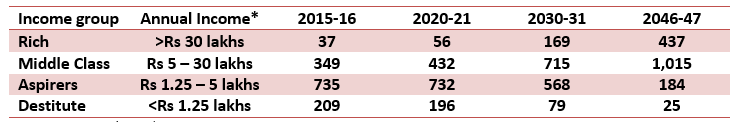

- India’s growing middle class will fuel massive growth in consumption. By 2046-47, the population of rich and middle class will be larger than our entire population today (around 150 crores by 2046-47). This will drive huge growth in demand for manufacturing goods.

Source: Canara Robeco, * At 2020-21 prices

- Government’s policy reforms will also play key role in transforming India into a manufacturing hub. Production Linked Incentive (PLI) Schemes witnessed over Rs. 1.03 lakh crore of investment till November 2023, which has led to production/ sales of Rs. 8.61 lakh crore and employment generation (direct & indirect) of over 6.78 lakhs (source: Ministry of Commerce).

- Restrictive labor laws have been seen as one of the main reasons for relatively low investments, especially Foreign Direct Investments (FDI), in manufacturing sectors. The Government has rationalized labor laws making it relatively easy for firms to hire and fire staff.

- Corporate balance sheets are getting healthier with deleveraging continuing for the past few years.

- Globally Competitive Corporate Tax Structure can also attract foreign investments in India’s manufacturing sector.

- Globally competitive Businesses and repositioning of global supply chains e.g. China + 1 strategy are likely to benefit manufacturing sector in India.

Why invest in thematic fund dedicated to manufacturing?

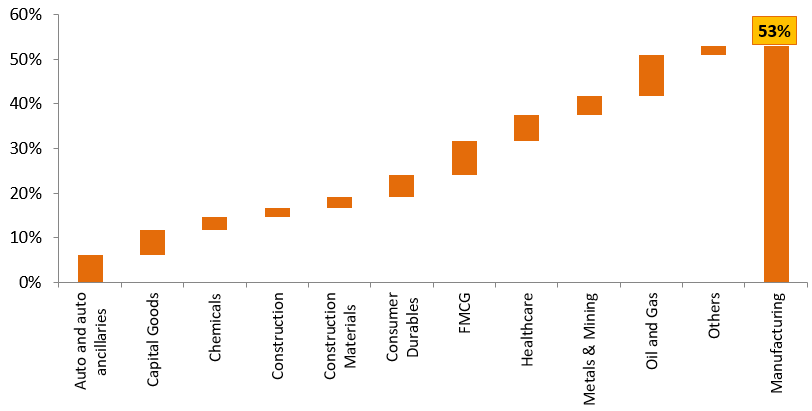

- Share of manufacturing industries in BSE 500 is only 53% (see the chart below). A thematic fund that is dedicated to manufacturing will provide higher exposure to manufacturing, which is likely to be integral to the India Growth Story.

Source: S&P Global, as on 31st January 2024.

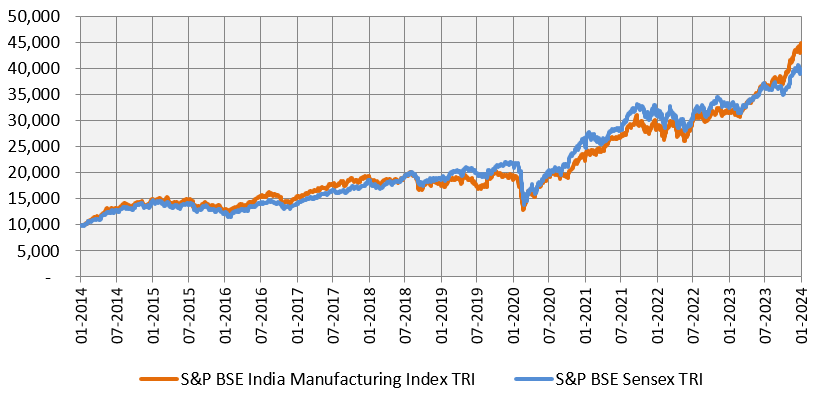

- Manufacturing as an investment theme has outperformed the broad market. The chart below shows the growth of Rs 10,000 investment in S&P BSE India Manufacturing TRI versus BSE Sensex TRI, over the last 10 years (ending 31st January 2024). Manufacturing as a theme has outperformed.

Source: S&P Global, as on 31st January 2024. Disclaimer: Past performance may or may not be sustained in the future

Canara Robeco Manufacturing Fund – Salient features

- Portfolio Allocation - Minimum 80% into Manufacturing & Allied Stocks.

- Portfolio Concentration - Diversified Portfolio.

- Market Capitalization Bias - Flexible across Market capitalization.

- Investment Style - Growth biased.

- Stock Selection - Top-Down Overlay + Bottom-up Stock Selection.

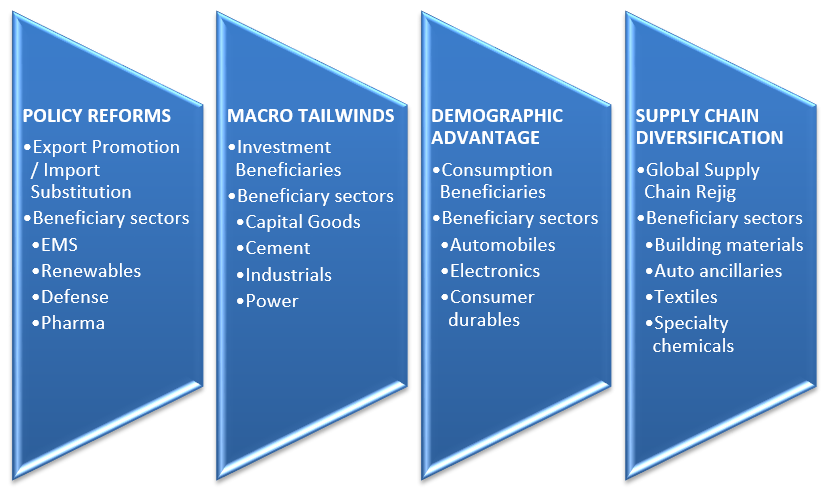

Fund Strategy & Sectoral Beneficiaries

Why invest in Canara Robeco Manufacturing Fund?

- Manufacturing will play a central role in India’s future economic growth. Rising prosperity, favourable demographics, macro tailwinds and global supply chain realignments are likely to boost manufacturing in India.

- Government thrust on “Atmanirbhar Bharat”, “Make in India” and through other reforms and incentives has improved growth potential of many manufacturing-oriented sectors and companies.

- Manufacturing as an investment theme has outperformed the broad market.

- The scheme aims to invest in companies which are beneficiaries of growing domestic demand, favorable policy reforms, robust private sector, and alternative supply chain.

- The scheme aims to capitalize on manufacturing trends and opportunities investing across relevant sectors representing the Manufacturing theme.

Who should invest in Canara Robeco Manufacturing Fund?

- Investors willing to have Tactical Allocation to overall equity portfolio.

- Investors looking for capital appreciation over long investment tenures from manufacturing theme.

- Investors with very high risk appetites.

- Investors with minimum 5+ years investment tenures.

- You can invest either in lumpsum and / or SIP depending on your investment needs.

Investors should consult with their financial advisors or mutual fund distributors if Canara Robeco Manufacturing Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team