Canara Robeco Focused Equity Fund: Potential to create Alphas in your portfolio

Current market context

As we approach the end of CY 2024, the market is in consolidation phase after a sharp correction which saw the Nifty fall below the 24,000 level. With the major events behind us the market will look at global and domestic cues to make a decisive directional move. Though the sharp correction has brought down valuations but concerns remain due to corporate earnings outlook. The Reserve Bank of India has revised India’s GDP growth outlook for fiscal year 2025 down to 6.6% (source: RBI MPC 6th December 2024). Foreign Institutional Investors (FIIs) may also look at relative valuations of India versus China in their capital allocation decisions. The market will also watch closely the impact of the new US Republican Administration’s trade policies on the Indian economy.

Domestic investors continue to support Indian equities, with SIP flows hitting a record high. From the long term perspective, India is in a macro sweet spot due to moderating inflation, narrowing fiscal deficit, strong forex reserves, healthy corporate balance sheets, as well as structural factors like rising per capita income, favourable demographics and growing consumption. India can also benefit from the changing global supply chain dynamics e.g. China + 1 strategy and can likely emerge as a global manufacturing hub. Given the near term concerns and the long term outlook, a stock selection based focused investment strategy can create superior returns (alphas) for investors over sufficiently long investment horizon.

What are Focused Funds?

Focused funds are equity mutual fund schemes that invest in maximum 30 stocks (as per SEBI’s mandate). There are no market cap restrictions for these funds, in other words, they can invest across market capitalization segments. Though focused funds have higher concentration risks compared to more diversified funds which invest in a larger portfolio of stocks (e.g. 50 – 60 stocks), slightly concentrated holdings allow the fund manager to allocate higher weights to high conviction stocks which have the potential of creating alphas for investors over long investment horizon. Each stock is expected to contribute significantly to the Scheme's overall performance. Adding a focused fund to your equity mutual fund portfolio may increase potential portfolio alphas. In this article, we will review Canara Robeco Focused Equity Fund, which has a strong track record of creating alpha for its investors.

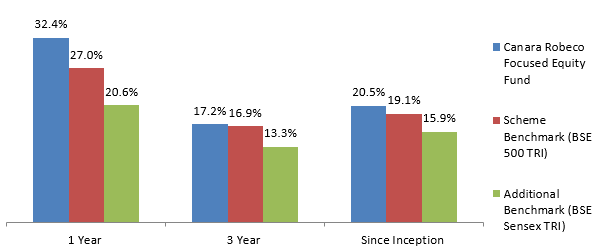

Canara Robeco Focused Equity Fund outperformed its benchmark

Canara Robeco Focused Equity Fund was launched in 2021 and has beaten its benchmark index since the inception of the fund. The fund has also outperformed the benchmark index over different investment periods.

Source: Advisorkhoj Research, returns are in CAGR, as on 30th November 2024

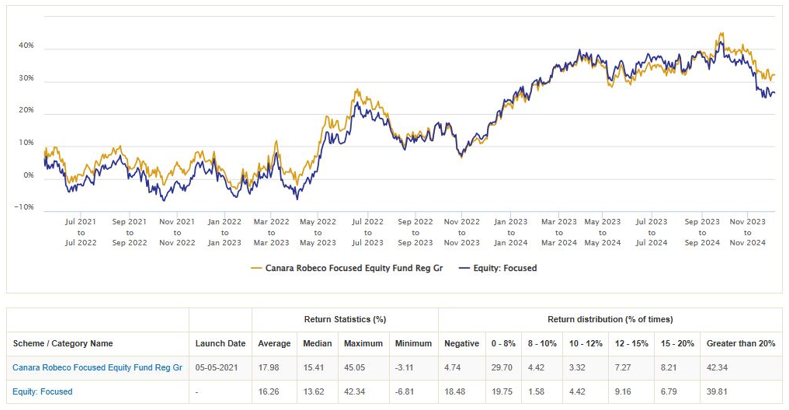

Consistency in performance versus peers

Consistency is one of the most important performance attributes of a mutual fund scheme. Rolling returns is one of the most unbiased measures of mutual fund performance. Point to point returns is biased by market conditions during the period, but rolling returns include performances in different market conditions. The chart below shows the 1 year rolling returns of Canara Robeco Focused Equity Fund versus the focused fund category average, since the inception of Canara Robeco Focused Equity Fund. You can see that fund not only outperformed the peers (on average) in terms of higher average returns (17.98% versus 16.26%), the percentage of negative return instances of the fund, was significantly lower than the category average.

Source: Advisorkhoj Rolling Returns, as on 30th November 2024

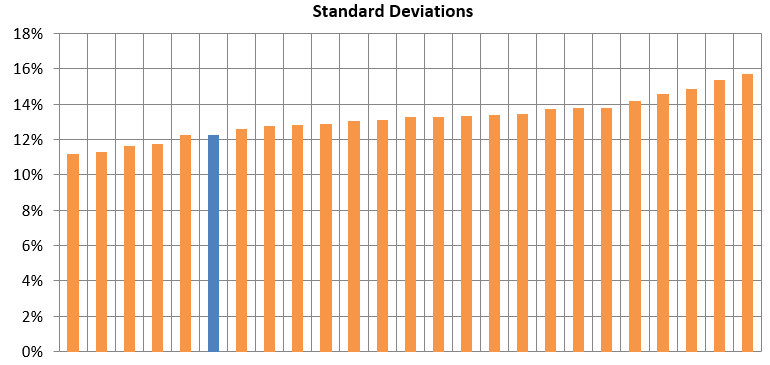

Lower volatility compared to peers

We looked at the standard deviation (a measure of volatility) of all focused funds which have completed 3 years (see the chart below). Canara Robeco Focused Equity Fund (marked in blue) seems to have lower volatility compared to most of its peers.

Source: Advisorkhoj Research, as on 30th November 2024

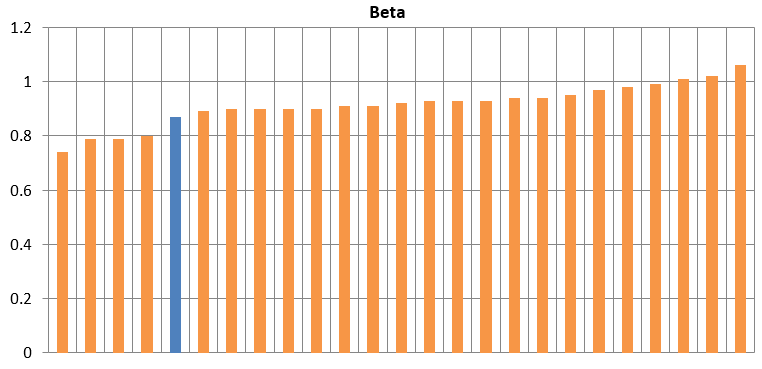

Lower systematic risk compared to peers

Beta is a measure of systematic risk of a fund. We looked at the beta of large and midcap funds which completed minimum 3 years (see the chart below). Canara Robeco Focused Equity Fund (marked in blue) seems to have lower beta compared to most of its peers.

Source: Advisorkhoj Research, as on 30th November 2024

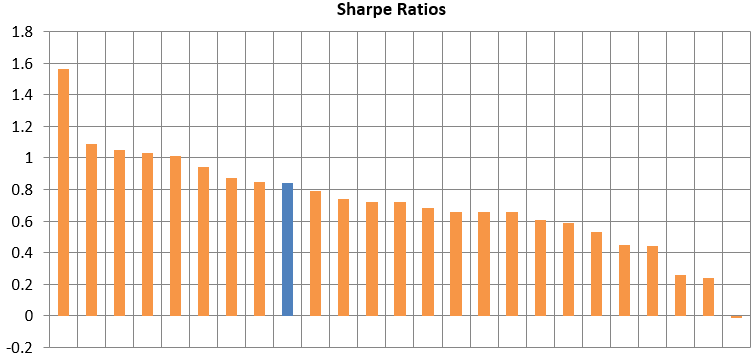

Superior risk adjusted returns compared to peers

Sharpe ratio is a measure of risk adjusted returns of a fund. We compared the Sharpe Ratio of large and midcap funds which completed minimum 3 years (see the chart below). Canara Robeco Focused Equity Fund (marked in blue) has delivered a higher Sharpe Ratio relative to most of its peers. Historical data shows that a fund which is able to limit downside risks (lower volatility) and at the same time, produces superior risk adjusted returns, has the potential to generate higher returns in the long term (across multiple investment cycles).

Source: Advisorkhoj Research, as on 30th November 2024

Market capture ratios

Market capture ratio is a measure of the performance of a mutual fund scheme relative to its benchmark index in rising and falling markets. Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund. Up Market Capture Ratio and Down Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of Canara Robeco Focused Equity Fund over the last 3 years.

The Up Market Capture Ratio of Canara Robeco Focused Equity Fund over last 3 years was 94% which implies that if the benchmark index went up by 1% in a month, then the scheme’s Net Asset Value (NAV) went up by 0.94%. The Down Market Capture Ratio of the fund was 88% which implies that if the benchmark index went down by 1% in a month, then the scheme’s Net Asset Value (NAV) went down by 0.88%. The market capture ratios of Canara Robeco Focused Equity Fund are a clear indication of the potential of the fund to give superior risk adjusted returns of the fund.

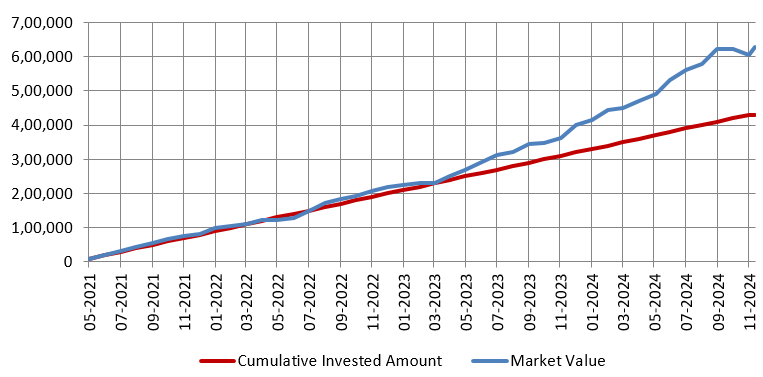

Wealth creation through SIP

The chart below shows the growth of Rs 10,000 monthly SIP in the Canara Robeco Focused Equity Fund since the inception of the fund. With a cumulative investment of Rs 4.3 lakhs you could have accumulated a corpus of Rs 6.3 lakhs (as on 30th November 2024) in the last 3 years or so.

Source: Advisorkhoj Research, as on 30th November 2024

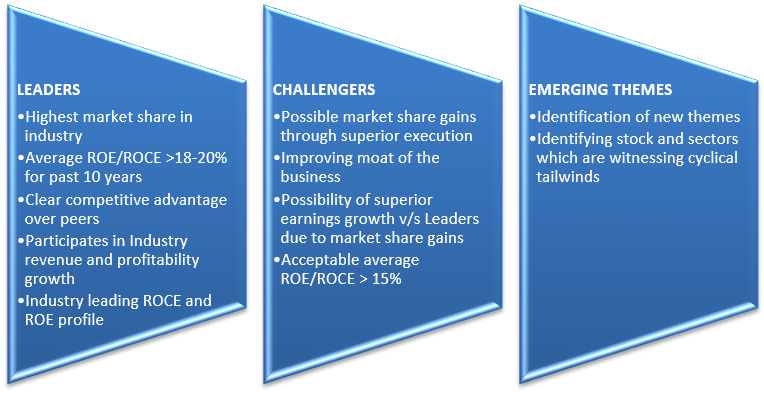

Portfolio creation approach

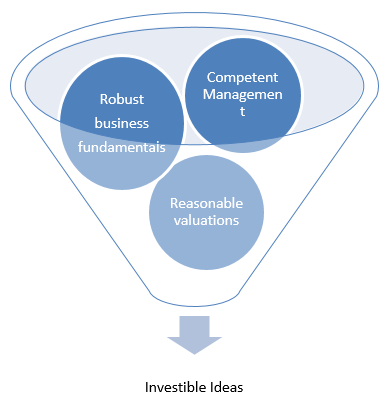

Investment Process

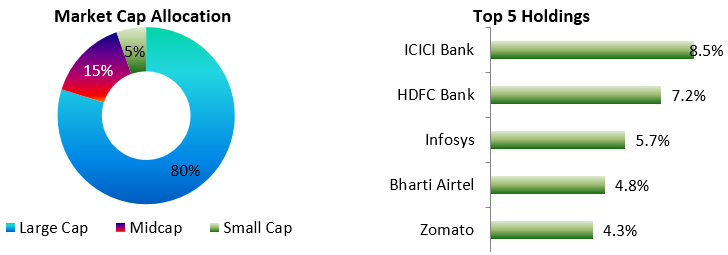

Current portfolio positioning

Source: Canara Robeco MF, as on 30th November 2024

Who should invest in Canara Robeco Focused Equity Fund?

- Investors looking to invest in Focused Portfolio as a part of their Asset Allocation

- Investors having relatively higher risk appetite

- Investors with a long term investment horizon of 5 years or above

- Investors seeking potential higher returns with ability to withstand higher volatility.

Investors should consult with their financial advisors or mutual fund distributors if Canara Robeco Focused Equity Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team