Canara Robeco Consumer Trends Fund: Participating in the India Consumption Growth Story

India is largely a domestic consumption driven economy and as per Economic Survey 2023-24, India’s private final consumption expenditure (at constant 2011-12 prices) is 55.80% of the GDP. With the latest rollouts in the Union Budget 2025, domestic consumption is expected to play a pivotal role in India’s economic growth, making it an attractive theme for long term investors.

In this article, we will look at the Canara Robeco Consumer Trend Fund as an attractive option for investing in India’s Consumption growth. Before we delve into the fund details, let us first take a look at the consumption trends in India.

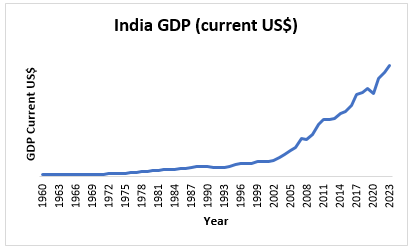

The growth of the Indian Economy

India’s growth rate has accelerated over the past few decades. The graph below shows how the GDP has grown over the years. According to S&P Global, India’s nominal GDP will grow to $7.3 Trillion by 2030, almost double of our current nominal GDP.

Source: MOSPI 31st Dec 2023

10 Vectors of Growth

Economic growth is a function of different sectors. The illustration below demonstrates the key vectors for growth with estimation on how India is projected to grow by 2034.

Source: Canara Robeco MF: World Bank, government websites, PwC analysis

Drivers of Consumption Growth

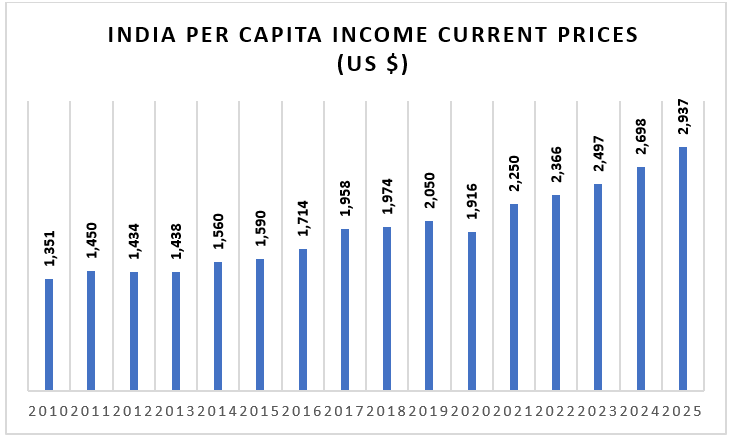

- Rising income on a per capita basis is a major driver of Personal Consumption Expenditure growth rate. India’s per capita GDP grew from sub $1,000 levels in the mid-2000s to around $2,937 in FY 2024-25 (source: IMF). Per capita income of up to $2,000 is an inflection point because income up to $2,000 is mostly spent on basic needs. As the income keeps growing above $2,000, discretionary spending rises. After crossing the inflection point, per capita income can rise at a faster rate based on historical per capita income growth of emerging economies like Japan, South Korea and China.

Source: IMF (WEO data) as on January 2025

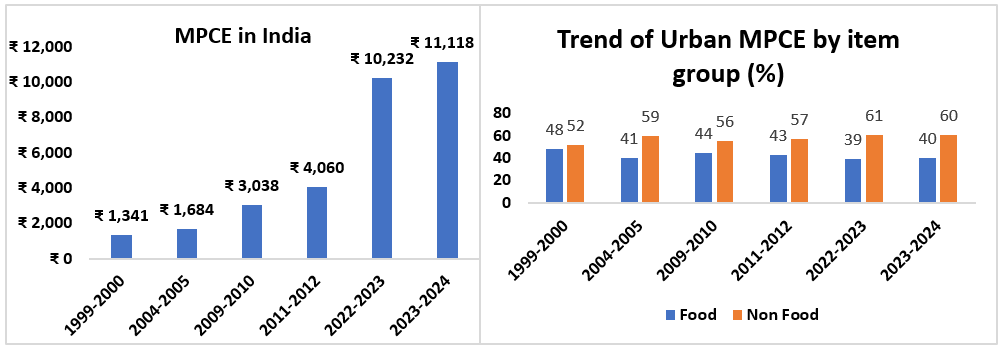

- ‘India is the fifth largest consumer market. We are also the fastest growing economy. India's household consumption nearly doubled in the past decade at a CAGR of 7.2%.’ (Source: As published in ET from India’s Consumption Story: The big divide by Tanvee Gupta Jain, UBS Securities). The chart below shows how the Monthly per Capita Consumption Expenditure (MPCE) has increased manifold since 1999-2000. Change in aspirational buying is another driver of economic growth leading to boost in consumption. When the population starts spending on non-food items, it is an indication of changed aspirations of the consumers. The chart below shows the changing trend of demand for food and non-food items in the rural and urban households since 1999 to the year 2024.

Source: MOSPI: HCES Survey 2023-24

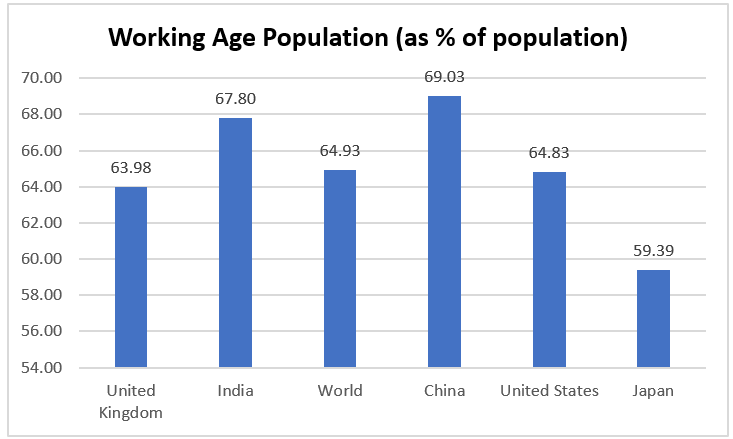

- One of the drivers of high PCE growth rate is the demographic dividends of our population. Nearly 68% of the population is in the working age group (see the chart below).

Source: OECD data as on 31st December 2022

Other noteworthy drivers of economic growth rate are digitization, improved access to finance where also India is advancing in leaps and bounds.

Why thematic fund for consumption?

Consumption is under-represented in the broader market indices like Nifty 50 or Nifty 500. Consumption as an investment theme has only 32% weightage in Nifty 50 and 41% weightage in Nifty 500. A thematic fund will provide comprehensive exposure to consumption.

Canara Robeco Consumer Trends Fund Regular Growth

The Canara Robeco Consumer Trends Fund is a thematic fund predominantly investing in companies which directly or indirectly benefit from the growing consumption demand in India and looks for opportunity to invest in companies which benefit from aspirational consumption and financial penetration theme. The fund will invest in stocks across the Market Capitalisation range and will look to follow 'Growth' style of investing. The fund was launched in September 2009 and the fund managers are Ms. Ennette Fernandes and Mr. Shridatta Bhandwaldar.

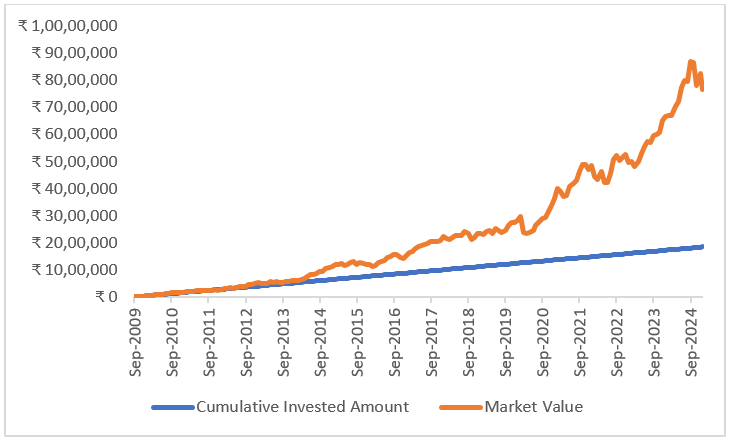

Wealth creation with Canara Robeco Consumer Trends Fund

If you had invested a lumpsum of Rs 1 lakh into the growth option of the fund at the time of its inception, your investment would have grown to Rs 9,92,400. (As on 11th Feb 2025)

A monthly SIP of Rs 10,000/- into the fund started from its inception would have grown to Rs 74,26,820.48 against a cumulative investment of Rs 18,50,000 lakhs, giving a XIRR of 16.33% (As on 11th Feb 2025)

Source: Advisorkhoj Research as on 11th Feb 2025

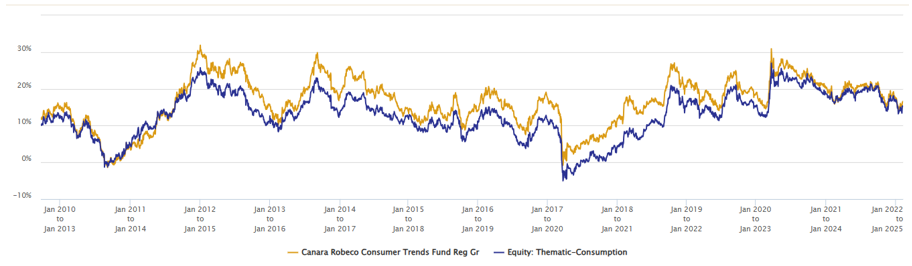

Consistent Returns over long term: Rolling Returns

The Canara Robeco Consumer Trends Fund has beaten the category average since its inception. The scheme gave a return more than 15% in 61.62 times as compared to above 15% performance of 37.66 times given by the category average.

Source: Advisorkhoj Research as on 11th Feb 2025

Good risk adjusted returns: Market Capture ratio

Up-Market Capture Ratio and Down-Market Capture ratio can give us a sense of risk adjusted returns. We looked at the market capture ratios of Canara Robeco Consumer Trends Fund over the last 3 years. For the benefit of new investors and mutual fund distributors who may not be familiar with the concept of market capture ratios, Up Market Capture Ratio tells us how much percentage of the market’s upside was captured by the fund, while Down Market Capture Ratio tells us how much percentage of the market’s downside was arrested by the fund.

The Up Market Capture Ratio of Canara Robeco Consumer Trends Fund over last 3 years was 100% which implies that the fund was able to capture the entire market upside. The Down-Market Capture Ratio of the fund was only 81% which implies that if the benchmark index went down by 1% in a month, then the fund’s NAV went down by only 0.81%; in other words, the fund was able to limit the downside risk of investors in falling markets.

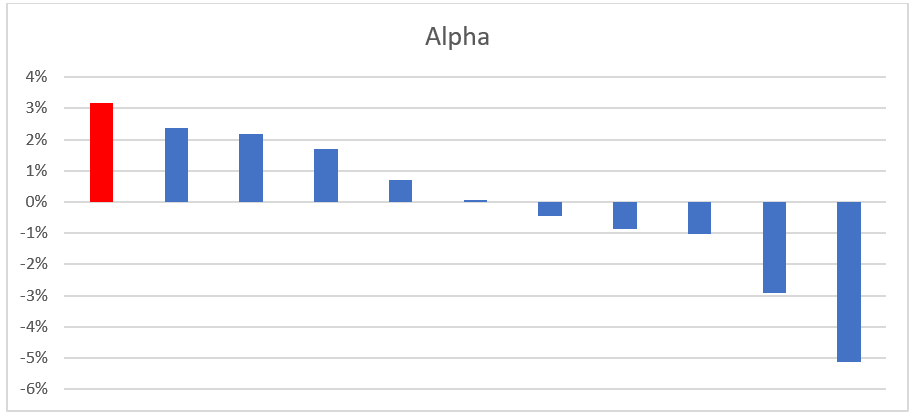

Superior alphas

We looked at the alpha created by consumption oriented thematic funds, which have completed 3 years. Canara Robeco Consumer Trends Fund (coloured in red) delivered higher alpha relative to its peer funds.

Source: Advisorkhoj Research as on 31st January 2025

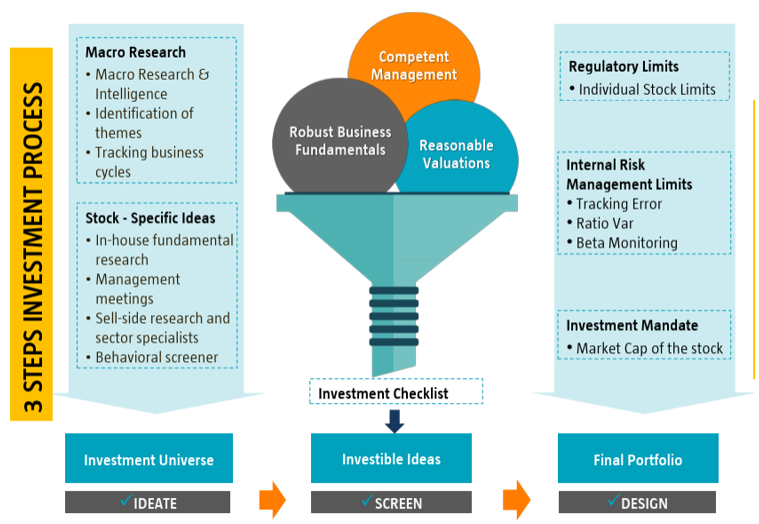

Investment Process and strategy

The investment process of the Canara Robeco Consumer Trends Fund is designed to achieve the investment objective in a disciplined manner following the 3 steps investment process as illustrated below:

Source: Canara Robeco AMC

Portfolio Construct

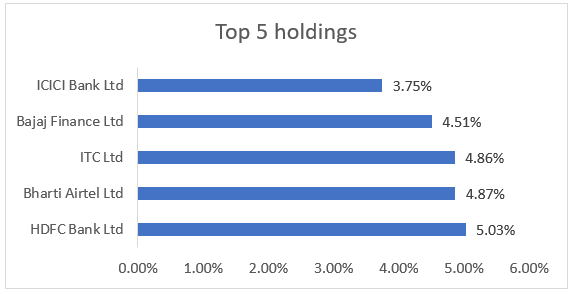

The fund invests across market caps but has a large Cap bias. The Top 5 stocks held under the fund are illustrated in the figure below.:

Source: Canara Robeco MF as on 31st January 2025

Why should you invest in Canara Robeco Consumer Trends Fund?

- Consumption is a broad theme, with sector representation beyond FMCG – like Consumer discretionary, Retail, Auto, Realty. The Fund makes investments in a niche space identifying trends in the consumption and finance space and follows a ‘Growth’ style of investing.

- The Fund allows to participate in the expected turnaround in the economic cycle leading to increase in employment which in turn is likely to boost discretionary consumption and benefit the sectors that the fund invests in.

- The Fund would invest in stocks across the Market Capitalization range and seek to generate ‘compounding’ returns from investing in high growth and competently managed companies.

- The government's emphasis on significant capital expenditure is leading to a chain reaction: more jobs, higher per capita income & a consequent increase in consumer demand. Coupled with our demographic strength & changing consumer face could result in a significant consumption boom. The fund is synonymous to the Indian Growth story and provides an opportunity to the investor to generate potentially higher returns than other equity funds.

Who should invest in Canara Robeco Consumer Trends Fund?

- Investors looking for capital appreciation over long investment tenures from India’s consumption growth theme

- Investors with very high-risk appetite

- Investors with minimum 5-years of investment horizon

- You can invest either through lump sum or SIP as per your investment needs.

Investors should consult their financial advisors or mutual fund distributors if Canara Robeco Consumer Trends Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team