Birla Sun Life Tax Relief 96 Fund: 135 times growth in 21 years

Personal finance bloggers often give hypothetical examples of wealth creation to demonstrate the power of compounding in equity. Here is a real example – If you had invested Rs 1 lakh in Birla Sun Life Tax Relief 96 Fund at its inception around twenty one years back the value of your investment today (assuming dividends re-invested in the scheme) would be around Rs 1.35 Crores!

We have often seen that, mutual fund schemes, which were once star performers 10 or 15 years back, being unable to sustain their strong performance in more recent times. However, Birla Sun Life Tax Relief 96 is among the top 3 ELSS funds in terms of 3 years trailing returns even today. This Equity Linked Savings Scheme (ELSS) has over Rs 3,500 Crores of assets under management (AUM), with an expense ratio of 2.27%. Just a few days back, we discussed why Equity Linked Savings Schemes are the best tax saving investments for long term wealth creation in our post, What are Equity Linked Savings Schemes and their benefits.

You can invest in Birla Sun Life Tax Relief 96 for tax savings under Section 80C of Income Tax Act 1961 and also for long term financial goals like children’s education, retirement planning and wealth creation. Read how ELSS Mutual Funds can be your best tax saving option.

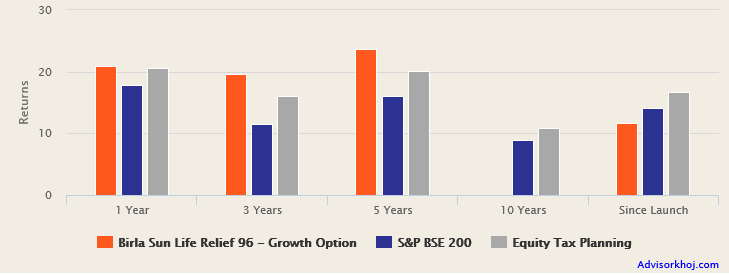

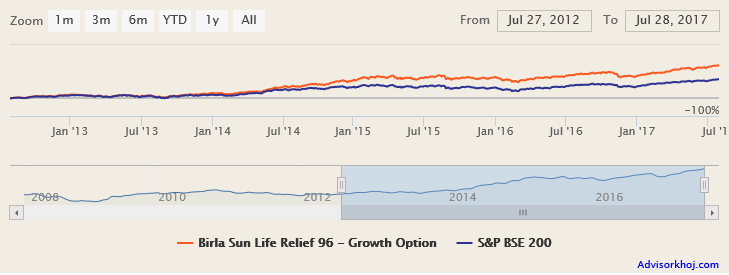

At the time of launch of Birla Sun Life Tax Relief 96, only dividend option was available. The growth option was launched in 2008. The chart below shows the returns of Birla Sun Life Tax Relief 96 (Growth Option) versus the ELSS category and the benchmark BSE – 200 over different time-scales like last 1 year, 3 years, 5 years, 10 years and since launch.

Source: Advisorkhoj Research

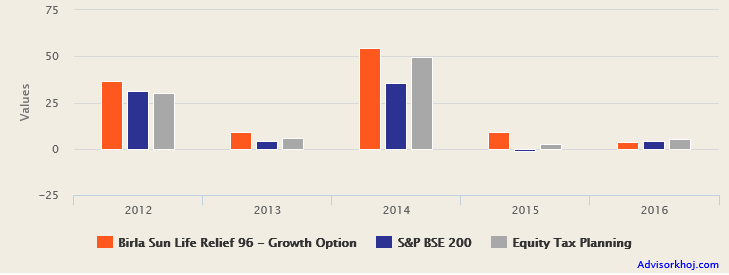

You can see that, Birla Sun Life Tax Relief 96 has outperformed the ELSS funds category and the benchmark over the last 1, 3 and 5 years. The charts below show the annual returns of Birla Sun Life Tax Relief 96 fund compared to the ELSS fund category and the NAV movement over the last 5 years.

Source: Advisorkhoj Research

Again the fund has outperformed the ELSS category and benchmark in most years. Birla Sun Life Tax Relief 96 is one of the most consistent ELSS performers. The fund has been able to occupy the top quartiles in the ELSS category in 4 years out of the last 5 years (please see our tool, Top Consistent Mutual Fund Performers – ELSS).

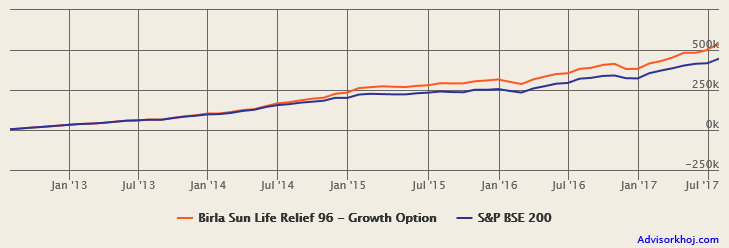

Veteran fund manager Ajay Garg manages Birla Sun Life Tax Relief 96 Fund. The minimum investment amount in this scheme is Rs 500 only. The chart below shows the NAV growth of Birla Sun Life Tax Relief 96 (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

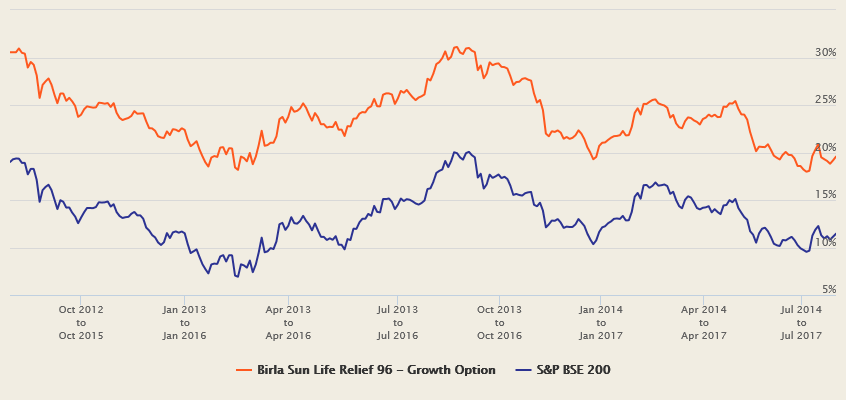

Rolling Returns

The 3 year rolling returns of Birla Sun Life Tax Relief 96 Fund over the last 5 years show how consistent the performance of the fund has been relative to its benchmark (BSE – 200). We have chosen a 3 year rolling returns period because Equity Linked Savings Schemes (tax saver funds) have a lock-in period of 3 years.

Source: Advisorkhoj Rolling Returns Calculator

You can see that the fund has beaten the index 100% of the times over the last 5 years. The outperformance gap has also been quite stable over the past 5 years, which shows that the fund manager employs stable consistent strategy. Let us now see the 3 year rolling returns of Birla Sun Life Tax Relief 96 over the last 5 years versus the ELSS funds category.

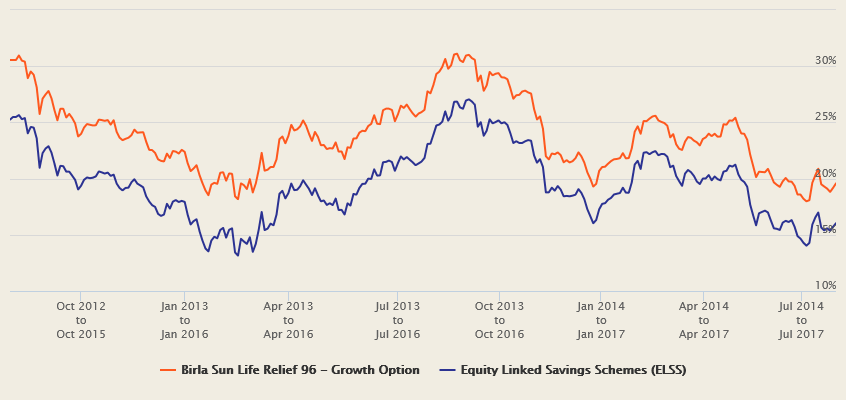

Source: Advisorkhoj Rolling Returns Calculator

You can see that the fund has also beaten the category average 100% of the times over the last 5 years in terms of three year rolling returns. The maximum 3 year rolling return of Birla Sun Life Tax Relied 96 Fund over the last 5 years was 31%, while the minimum 3 year rolling return of Birla Sun Life Tax Relief 96 Fund over the last 5 years was 18%. The average 3 year rolling return of the fund over the last 5 years was 23.9%, while the median 3 year rolling return of the fund was 23.7%. The fund gave more than 20% three year rolling returns nearly 87% of the times over the last 5 years. This is truly exceptionally strong performance.

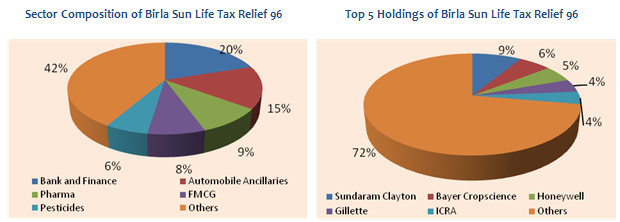

Portfolio Construction

Birla Sun Life Tax Relief 96 has a very well diversified portfolio. The portfolio is well balanced between large cap and small / midcap stocks. A portfolio that is well balanced between large cap and small/midcap stocks tend to do well across different market conditions, as is evident from the rolling returns of Birla Sun Life Tax Relief 96 Fund over the last years. From a sector composition viewpoint, the fund is biased towards cyclical sectors like automobile ancillaries, banks, finance, cement etc. Over the past 12 months or so, the scheme has reduced its exposure to IT,Banking and Finance, while increasing its exposureto FMCG, pesticides, cement etc. From a company concentration perspective, the fund is very well diversified with the top 5 holdings, Sundaram Clayton, Bayer Crop science, Honeywell, Gillette and ICRA, accounting for only 28% of the portfolio holdings.

Source: Advisorkhoj Research

In terms of volatility measure, as measured by annualized standard deviation of monthly returns over a three year, Birla Sun Life Tax Relief 96 is in line with that of average volatility of ELSS funds. Yet in terms of Sharpe Ratio, the fund outperformed the ELSS funds category bygood margin; a hallmark of a well managed fund.

SIP Returns

The chart below shows the returns of Rs 5,000 monthly Systematic Investment Plan (SIP) in Birla Sun Life Tax Relief 96 fund over the last 5 years.

Source: Advisorkhoj Research

With a monthly SIP of Rs 5,000 over the last 5 years, you would accumulated a corpus of around Rs 5.4 lakhs with a cumulative investment of Rs 3 lakhs; a profit of nearly Rs 2.3 lakhs; the annualized SIP returns over the last 5 years was around 23%. Equity market in India is more volatile than equity market in developed markets and therefore SIP is one the best investment modes in India. Not only does SIP ensure that you remain disciplines in your tax planning investments and avoid last minute hassles, it also enables that you take advantage of market volatility through rupee cost averaging.

You may also like to read Systematic Investment Planning mistakes to avoid.

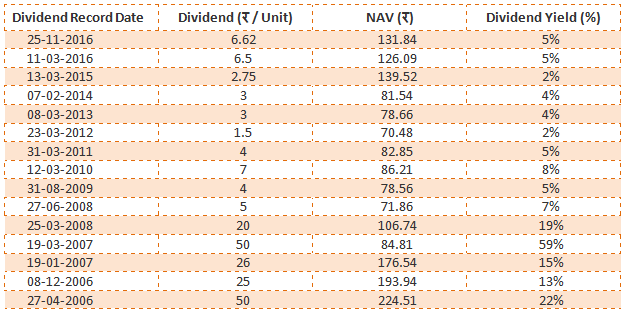

Dividend Payout Track Record

Birla Sun Life Tax Relief 96 has a terrific dividend pay-out record. The dividend option of the scheme has paid dividends every year over the last 10 years, even during the bear market periods.

Source: Advisorkhoj Historical Dividends

Conclusion

The returns generated by Birla Sun Life Tax Relief 96 clearly indicate that ELSS is simply the best investment for tax savings and wealth creation. Birla Sun Life Tax Relief 96 has completed 20 years of outstanding wealth creation last year. The fund has sustained it strong performance on a consistent basis over the last 5 years. This fund is highly rated by the mutual fund research firms. Investors should consult with their financial advisors if Birla Sun Life Tax Relief 96 is suitable for their tax planning needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team