Birla Sun Life Balanced 95: One of the best Balanced Funds of all times is still going strong

Balanced Funds are ideal investment options for first time mutual fund investors and also investors with a moderate appetite for volatility. Over a long time horizon top Balanced Funds have given investors excellent returns and helped them meet a variety of long term investment goals. These funds are essentially hybrid funds with both debt and equity in its portfolio mix, to balance the portfolio risk. These portfolios typically hold up to 65 - 75% of its portfolio assets in equities or equity related securities and the balance in fixed income securities.

The asset allocation of Balanced Funds, allow them to create wealth in the long term for investors, while giving investor’s portfolios a degree of stability in volatile markets. In our post, Why Balanced Funds may be the best investments for new mutual fund investors, we showed that over long time period balanced funds were able to give better risk adjusted returns than diversified equity funds. While balanced funds are certainly one of the best investment options for new investors, they are equally good investment options for even experienced investors who can use these funds for managing their asset allocation between equity and debt.

Birla Sun Life Balanced 95 Fund is one of the oldest Balanced Fund schemes with a superb track record of strong and stable performance over a long period of time. Birla Sun Life Balanced 95 Fund is in the Top 5 Balanced funds in terms of performance over the last 10 years (please see Top Performing Balanced Funds in our MF Research Section). It has continued its top performance even in the last one and is ranked right on the edge of the Top 5 Balanced Funds in the last one year.

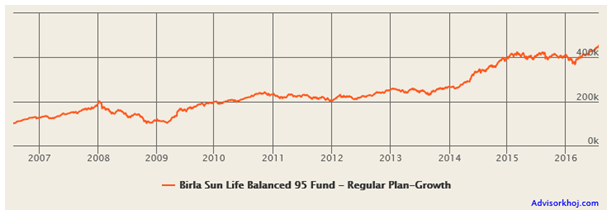

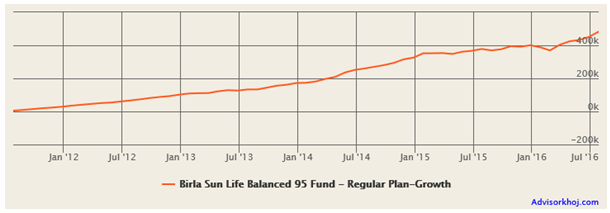

The chart below shows the growth of र 1 lac lump sum investment in Birla Sun Life Balanced 95 Fund over the last 10 years (latest NAV as on July 25, 2016).

Source: Advisorkhoj Research

You can see in the chart above that, the fund has grown over 4 times in value over the last 10 years, a compounded annual return of over 16%. You can also see that, the growth is fairly stable, except the big dip in the 2008, when the market conditions were extreme due to the collapse of Lehman Brothers and other financial institutions. Even in the bear markets of 2011 and 2015 – 2016, the fund performance was fairly stable, at least on a relative basis.

Fund Overview of Birla Sun Life Balanced 95 Fund

As one of the oldest schemes in its category, Birla Sun Life Balanced 95 Fund has Rs 3,140 crores of assets under management with an expense ratio of 2.44%. As an asset management company Birla Sun Life is amongst the top performers across several mutual fund categories. The fund management of Birla Sun Life Balanced 95 Fund went through a number of changes in the last few years. The fund managers of this scheme are Mahesh Patil and Pranay Sinha. The fund has been ranked in the top two quartiles for the last 3 consecutive quarters (including the current one) in terms of trailing 3 year returns. In fact, the fund was ranked in the top quartile for the 2 most recent consecutive quarters (please see our Quartile Ranking tool for Balanced Funds).

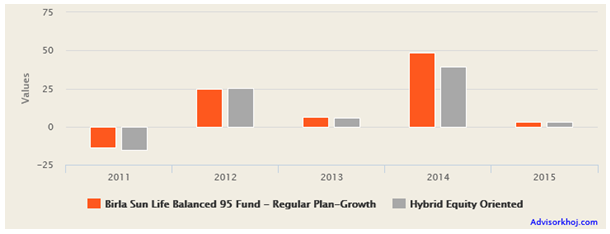

The chart below shows the annual returns of Birla Sun Life Balanced 95 Fund and the Balanced Fund Category over the last 5 years.

Source: Advisorkhoj Research

The chart below shows the NAV movement of Birla Sun Life 95 Fund over the last 5 years.

Source: Advisorkhoj Research

Rolling Return of Birla Sun Life Balanced 95 Fund

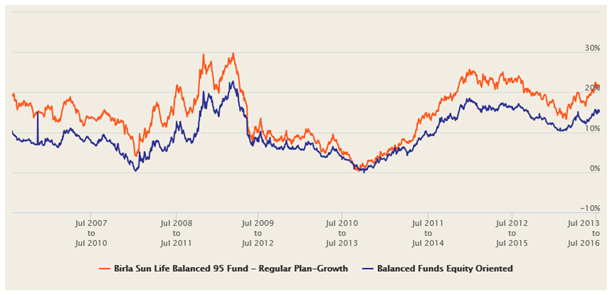

The chart below shows the 3 year rolling returns of Birla Sun Life Balanced 95 Fund over the last 10 years. We have chosen a three year rolling returns period, because investors must have a long investment horizon for investing in Balanced Funds.

Source: Advisorkhoj Rolling Returns Calculator

You can see in the chart above that, the 3 year annualized rolling returns of Birla Sun Life Balanced 95 Fund, over the last 10 years, never dipped below zero. Therefore, investors with a three year investment horizon never made a loss by investing any time in Birla Sun Life Balanced 95 Fund over the last 10 years.

We have reiterated time and again in our blog that, rolling return is the best measure of a fund’s performance consistency, and is an useful measure, especially from a future performance perspective. The rolling returns of the fund, relative to the Balanced Fund category, is a conclusive evidence of the strength of the fund within the category and why it is has been rated a top Balanced Fund for many years. Birla Sun Life Balanced 95 Fund consistently beat Balanced Fund category average 3 year rolling returns over the last 10 years. The fund gave tax free double digit returns more than 70% of the times, over the last 10 years.

Portfolio Construction of Birla Sun Life Balanced 95 Fund

In terms of portfolio construction stocks comprise 69% of Birla Sun Life Balanced 95 Fund portfolio mix in value terms, while debt securities comprise 18%. 12.5% of the fund assets are held in cash or cash equivalents. The equity portion of the fund has a predominantly large cap bias and the investment style is growth oriented. It is fairly well diversified with its top 5 holdings, G-Sec (2045 maturity, 8.13% coupon rate), Infosys, HDFC Bank, Tata Motors and G-Sec (2044 maturity, 8.17% coupon rate) accounting for less 22% of the total portfolio value. The quality of its debt portfolio is also quite high with moderate interest rate sensitivity. The yield to maturity (YTM) of the fixed income portion of Birla Sun Balanced Life 95 Fund is higher than the category average. While the average maturity of the Birla Sun Life Balanced 95 Fund fixed income portfolio securities is also higher than the category average, in the current interest rate environment, it might get good returns for investors.

Risk & Return of Birla Sun Life Balanced 95 Fund

In terms of risk or volatility measures, the annualized standard deviations of monthly returns of Birla Sun Life Balanced 95 Fund are higher than the average standard deviations of Balanced Fund category. However, in terms of risk adjusted performance, as measured by Sharpe Ratio, Birla Sun Life Balanced 95 Fund outperforms the Balanced Fund category.

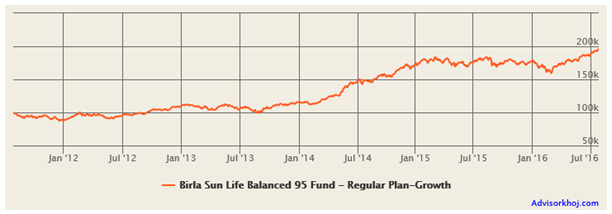

The chart below shows the growth of र 1 lac lump sum investment in Birla Sun Life Balanced 95 Fund over the last 5 years.

Source: Advisorkhoj Research

In the last 5 years, a lump sum investment in Birla Sun Life Balanced 95 Fund (Growth Option) would have almost doubled in value.

The chart below shows the returns of र 5,000 monthly SIP Birla Sun Life Balanced 95 Fund (Growth Option) over the last 5 years.

Source: Advisorkhoj Research

You can see in the chart above that, a र 5,000 monthly SIP in Birla Sun Life Balanced 95 Fund (Growth Option) over the last 5 years, would have grown to over र 4.8 (by July 25, 2016); the investor would have made a profit of nearly र 1.8 lakhs on an investment of just over र 3 lakhs. The SIP XIRR, over the last 5 years, is nearly 19%, beating the SIP returns of many purely equity funds.

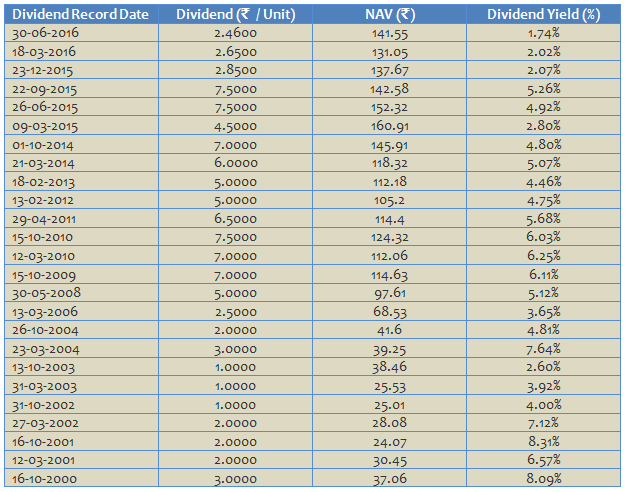

Dividend Payout Track Record of Birla Sun Life Balanced 95 Fund

Birla Sun Life 95 Fund (Dividend Option) has an excellent dividend payout track record. The table below shows the dividend pay-out track record of Birla Sun Life 95 Fund (Dividend Option) since the beginning of this millennium.

Source: Advisorkhoj Historical Dividends

SWP Performance of Birla Sun Life Balanced 95 Fund

If you had invested र 10 lakhs in Birla Sun Life 95 Fund (Growth Option) on January 1, 2001 and withdrawn र 8,000 per month from January 2, 2002, then the current value of your investment would have been र 60 lakhs, even after withdrawing र 14 lakhs. We assumed that the monthly SWP withdrawal of र 8,000 was started after one year (starting date January 2, 2002) from the date of investment (January 1, 2001) and thereafter on the 2nd day of every month so that each and every SWP amount in the hands of the investor is tax free. To know more about the SWP performance of Birla Sun Life Balanced 95 Fund, please see our recent post, SWP returns of Birla Sun Life Balanced 95 Fund has been excellent over the last 15 years.

Conclusion

Birla Sun Life Balanced 95 Fund recently completed 20 years of great performance. The fund has been ranked 2 by CRISIL in the Balanced Fund category (as per their latest mutual fund rankings). Morningstar has a 4 star rating for this fund. Investors should consult with their financial advisors, if Birla Sun Life 95 Fund is suitable for their mutual fund portfolios.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team