Best Mutual Funds SWP returns: Superb performance by ICICI Prudential Value Discovery Fund

If you had invested र 10 Lacs in the NFO of ICICI Prudential Value Discovery Fund – Regular Growth, 12 years back on the launch date of August 16, 2004 and started withdrawing र 8,000 per month after one year then the current value of your investment would have been र 84.08 Lacs even after withdrawing र 10.48 Lacs through 131 SWP instalments of र 8,000 each in the last 11 years (Based on June 17, 2016 NAV).

To come to this conclusion we assumed that the lumpsum investment of र 10.00 was made on August 16, 2004, the launch date of the fund. We have also presumed that the monthly Systematic withdrawal of र 8,000 was started after one year i.e. on the 17th of every month (starting from August 17, 2005) so that each and every SWP withdrawal amount is treated as tax free!

At Advisorkhoj, we are doing this study to show our readers how the SWP works in mutual funds and how it could help those investors who look for regular returns from their lumspum investments.

Please look at the chart below to understand how we have selected the different options in the SWP Research Tool to get the results. You can also like to explore our SWP Return Calculator to know the SWP returns of any fund of your choice.

Source: Advisorkhoj SWP Calculator – ICICI Prudential Value Discovery Fund - Growth

SWP (Systematic Withdrawal Plan) results of ICICI Prudential Value Discovery Fund - Growth

From the above chart you can see that you would have withdrawn a total of Rs. 10.48 Lacs in last 11 years, through 131 equal monthly SWP instalments of Rs. 8,000 each, thus, you would have got a tax free return of 9.6% every year. Even after withdrawing a tax free amount of Rs. 10.48 Lacs, the current value of your investment in ICICI Prudential Value Discovery Fund - Growth is amazing Rs. 84.08 Lacs! Based on June 17, 2016 NAV.

On August 17, 2015, ICICI Prudential Value Discovery Fund - Growth hit the highest NAV of र 119.57 (considering all the NAVS on the SWP date of 17th of every month) and the value of your investment on that day was र 87.19 Lacs! After that you have withdrawn 10 more SWP instalments of र 8,000 each and the current value as on June 17, 2016 stands at an amazing र 84.08 Lacs!

Download the cash flow in excel showing the details of SWP withdrawals, NAVs and values on respective dates Click here

We have analysed similar samples with other Diversified Equity Funds and found that SWP returns of ICICI Prudential Value Discovery Fund - Growth so far is one of the best amongst its peers and certainly one of the biggest wealth creators amongst diversified equity funds.

About ICICI Prudential Value Discovery Fund

ICICI Prudential Value Discovery Fund is one of the marquee funds in the Indian Mutual Fund industry. Launched on August 16, 2004 by ICICI Prudential Mutual Fund, India’s No.1 Asset Management Company, the Fund has a huge AUM of Rs. 12,377 Crores (as on May 31, 2016). The Fund is being managed by well known fund manager, Mr. Mrinal Singh since February 2011 well known for value investing and his ability to pick mid cap stocks.

ICICI Prudential Value Discovery Fund - Growth is one of the most consistently performing diversified equity mutual funds. The fund follows a value and contrarian investment style and identifies stocks that have a huge potential but are currently available at discount to their inherent value. The fund tends to maintain around 50-75% per cent weightage to mid and small cap stocks but in the last one year the portfolio is tilting towards large cap stocks also as the AUM has grown significantly.

It is a Valueresearch 5 Star rated fund. CRISIL has given it Rank 2 in the diversified fund category as well in the consistent performers – equity funds category.

ICICI Prudential Value Discovery Fund is bullish on sectors like Financial, Diversified, Energy, Technology and Services and invested 55% of its total assets in these sectors. The fund manager’s top 5 picks are L&T, ICICI Bank, NTPC, Axis bank and Container Corporation of India.

The 3, 5 and 10 years annualised returns of the fund is quite impressive at 30.78%, 19.37% and 18.98% respectively (Based on NAV of June 17, 2016). The fund has beaten the Benchmark S&P BSE 500 with a wide margin.

Lumpsum returns of ICICI Prudential Value Discovery Fund

ICICI Prudential Value Discovery Fund - Growth has given exceedingly well lumpsum returns as well. The current value of investment of र 10 Lacs made on the fund launch date of August 16, 2004, is around र 1.16 Crores! A CAGR growth of whopping 23% since inception (Based on June 17, 2016 NAV).

If you had invested the same amount in S&P BSE 500 and CNX NIFTY then your current investment value would have been only Rs. 52.61 Lacs and र 51.09 Lacs respectively (Based on June 17, 2016 NAV). Therefore, it has beaten the return of both - the Benchmark of the fund as well as the CNX NIFTY Index by a huge margin.

Source: Advisorkhoj Lumpsum Return Calculator – ICICI Prudential Value Discovery Fund - Growth (Data as on 17/6/16)

Simply speaking your lumpsum investment in ICICI Prudential Value Discovery Fund - Growth has grown by whopping 11.60 times in little less than 12 years!

Please check here Lumpsum Returns of ICICI Prudential Value Discovery Fund – Growth

To know lumpsum return of any fund, you may like to check our LUMPSUM RETURNS OF MUTUAL FUNDS - CALCULATOR

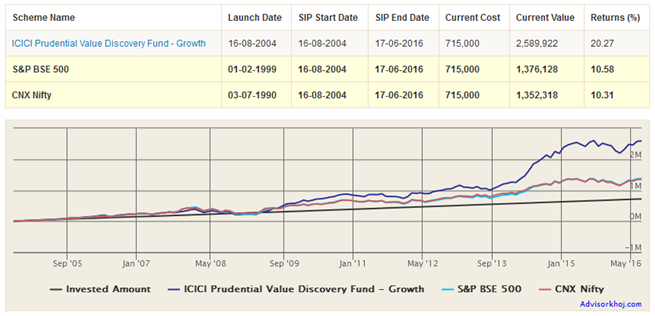

SIP Returns of ICICI Prudential Value Discovery Fund - Growth

The SIP returns of ICICI Prudential Value Discovery Fund - Growth have also been excellent! If you had started a monthly SIP of र 5,000, 12 years back on the launch date of August 16, 2004, you would have accumulated a very decent corpus of Rs. 25.90 Lacs as of June 17, 2016 whereas you had invested only र 7.15 Lacs through 143 instalments of र 5,000 each. During this period the fund has given excellent XIRR return of 20.27% which is one of the best amongst the peer group of schemes. Check Advisorkhoj SIP RETURN CALCULATOR

Further, if you see the chart below, you will notice that SIP in ICICI Prudential Value Discovery Fund - Growth has also beaten the CNX NIFTY and S&P BSE 500 Index SIP returns with a huge margin.

Source: Advisorkhoj SIP Return calculator – ICICI Prudential Value Discovery Fund Growth

You may try this tool Top Performing SIP Funds to check Top Funds of any category.

What is Systematic Withdrawal Plan

In a Systematic Withdrawal Plan (SWP), you regularly withdraw a fixed amount on a fixed date or dates from a fund. The amount to be withdrawn and the frequency of withdrawal/s are decided by you. You can withdraw a fixed amount, based on your requirement, weekly, fortnightly, monthly, and quarterly or annually from your investment.

SWP withdrawals from an equity fund, after one year from the date of investment, is totally tax free as it is treated as long term capital gains. It is a good investment option for investors willing to take moderately high risk and looking for regular income from their lumpsum investments while also want to see their investments grow in value.

Try our SWP RETURN CALCULATOR to know SWP returns of your favourite funds.

Conclusion

ICICI Prudential Value Discovery Fund - Growth has given excellent SWP returns since inception and may be a good choice for investors looking for regular income from their lumpsum investible surplus. The lumpsum and SIP returns of ICICI Prudential Value Discovery Fund - Growth have also been exceedingly well and it has proved to be one of the best wealth creators for the investors who remain invested with the fund for long. Needless to mention it has also beaten the Benchmark S&P BSE 500 and CNX NIFTY with huge margin.

The since launch annualised return of 23% + certainly makes it the fund of choice for the retail investors in India!

The fund is suitable for investors with moderately high risk taking appetite, looking for long term wealth creation by investing in high growth large and midcap stocks.

Investors should note that past performance of mutual funds is no guarantee for future returns. Mutual fund investments are also subject to market risk and therefore investors must consult their financial advisors and check if investment in ICICI Prudential Value Discovery Fund is suited for their investment needs based on their risk profile.

If not sure about your risk profile, you may like to Try this

You may like to read more about this fund –

Top 10 Best Diversified Equity Mutual Funds to invest in 2016

Consistent strong performance makes it a great midcap value fund

Best performing diversified equity fund in the last 10 years

Should I remain invested in the ICICI Prudential Value Discovery Fund

Those readers interested in knowing more about SWP, should read the following –

Mutual Funds are ideal investment option for retirement planning

Mutual Fund systematic withdrawal plans are smart option for income needs

Related SWP articles –

Reliance Equity opportunities Fund, Birla Sun Life Frontline Equity Fund, ICICI Prudential Dynamic Fund, SBI Magnum Global fund and Sundaram Select Midcap Fund

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty Next 50 Index Fund

Apr 22, 2025 by Advisorkhoj Team

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund