Best 4 Short Duration Debt Funds for 2019

Over the last 2 months we have covered top performing mutual funds in two equity fund categories – large cap (Top 5 best Large Cap Mutual Funds to invest in 2019) and multi-cap (Top 6 Multi Cap Mutual Funds to invest in 2019). In both the posts, we have identified top performing funds based on our internal methodology and proprietary research tools.

One of the most important aspects of our best fund selection is performance consistency and not necessarily highest returns in a particular year or a given period of time. Based on evidence provided by back-testing of historical performance, we think consistent performers are likely to continue outperforming in the future. In this blog post, we will discuss top 4 short duration debt funds for 2019.

While our traffic statistics shows more interest in equity funds among our readers, we think that debt mutual funds should also form an important part of your investment portfolio for the following reasons:-

- Debt mutual funds help you achieve optimal asset allocation which is crucial for achieving your short term, medium term and long term goals.

- Debt mutual funds provide liquidity, income (if you need) and balances overall portfolio risk. Debt mutual funds are also counter-cyclical to equity funds in certain stages of market cycles and therefore, provide stability to your portfolio in volatile conditions.

- Debt funds are more tax efficient than traditional fixed income investment options like bank FDs and government / post office small savings schemes over 3 years plus investment tenures. Long term capital gains (investment holding period of more than 3 years) in debt mutual funds are taxed at 20% after allowing for indexation benefits.

Suggested reading: Why you cannot ignore debt mutual funds in your investment portfolio AND Why are debt mutual funds better investments than bank FDs

What are Short Duration Debt Funds?

SEBI mandates the short duration funds to invest in debt and money market instruments such that the Macaulay Duration of the portfolio is between 1 to 3 years. Macaulay Duration is closely related to interest rate sensitivity of the fund. We have discussed a number of times in our blog that debt fund returns (except overnight, liquid and ultra-short duration funds) are inversely related to interest rate changes. If interest rate falls most debt funds give higher returns and vice versa. Short duration funds have limited to moderate interest rate sensitivity – even if interest rate movement is adverse, the impact on short duration funds is limited compared to longer duration funds. Another related but important point that investors should note for short duration funds is that, these funds aim to hold the underlying securities in their portfolio till maturity accruing the interest payment promised by issuer (borrower). Accrual strategy ensures stability, provided your investment horizon matches with the duration profile of the fund – investors should keep this in mind when planning their investments.

How we selected the best short duration funds?

As discussed earlier, performance consistency is the most important aspect of our fund selection. We have looked at performance consistency over last 5 years using rolling returns methodology. Measuring rolling returns over 5 years is a good test for short duration funds performance because it is most likely to include periods of rising interest rates (adverse) and falling interest rates (favourable). We have discussed many times in our blog that rolling returns is the best measure of performance consistency - we looked at average rolling returns and rolling returns outperformance consistency versus peers for short-listing funds based on performance consistency (please see our Most consistent performers tool).

For the benefit of average retail investors, who do not have sufficient experience in debt mutual fund investing, we applied a second filter to identify the best funds from among the most consistent performers, so that we come up with a fairly short list of funds. This additional filter is quartile ranking of short duration funds based on trailing 2 and 3 year returns (please see our quartile ranking tool). Why did we look at quartile ranks based on 2 – 3 year trailing returns and not 1 year trailing returns? This is because 2 – 3 years is the recommended investment tenures for these funds since Macaulay Duration of these funds is 1 – 3 year. 1 year trailing returns are likely to be biased by prevailing interest rate environment, which may or may not prevail in the future. We selected funds from among the most consistent short duration funds, which were in the top two quartiles in terms of both 2 and 3 year trailing returns.

We will now discuss the 4 best short duration funds based on the methodology explained above. We will list and discuss briefly about these funds in an alphabetical order of the scheme names. Please note that the listing of the schemes is strictly alphabetical and has bearing on relative performances or future potential. All he 4 funds in our selection have been highly rated by other research portals also.

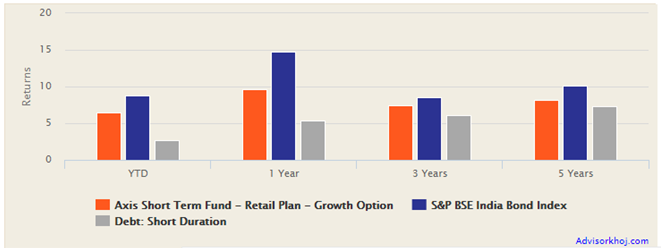

Axis Short Term Fund

The fund has given 9.6% returns in the last 1 year and 7.5% annualized return over the last 3 years. It has outperformed the short duration funds category across both time-scales and even on an YTD basis. Please see the chart below:-

Source: Advisorkhoj Research

The fund has over Rs 2,500 Crores of assets under management (AUM) with an expense ratio of 0.9%. Devang Shah is the fund manager of this scheme. Credit risk is a serious concern for investors nowadays. Axis Short Term Fund scores highly in terms of credit quality – 95% of the portfolio has either Sovereign (Government) or AAA / A1+ credit rating. AAA and A1+ are the highest credit ratings for debt and money market papers, just behind Sovereign (risk free). The modified duration of the fund portfolio is 1.85 years, while the yield to maturity is around 8%. Investors should have minimum 2 – 3 years investment horizon for this fund. Value Research has 4 star rating for this fund.

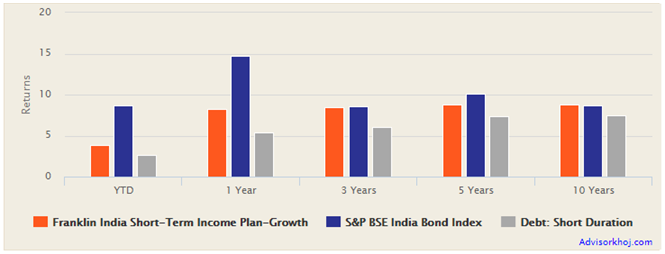

Franklin India Short-term Income Plan

The fund has given 8.3% returns in the last 1 year and 8.5% annualized return over the last 3 years. It has outperformed the short duration funds category across both time-scales and even on YTD basis. Please see the chart below:-

Source: Advisorkhoj Research

The fund has over Rs 13,000 Crores of assets under management (AUM) with an expense ratio of 1.5%. Santosh Kamath and Kunal Agrawal are the fund managers of this scheme. About 50% of the portfolio in value terms is rated below AA. The slightly lower credit quality profile of Franklin India Short-Term Income Plan enables it to capture higher yields (yield to maturity is around 11.7%) but also raises concerns in the current credit risk environment. Investors should be comfortable with credit risk when making investment decision. The modified duration of the fund portfolio is 2.23 years; investors should have minimum 2 – 3 years investment horizon for this fund. Value Research has 5 star rating for this fund.

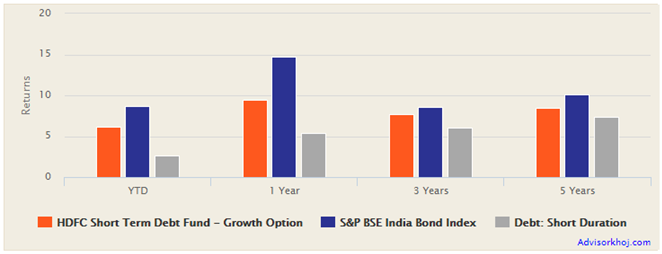

HDFC Short Term Debt Fund

The fund has given 9.4% returns in the last 1 year and 7.7% annualized return over the last 3 years. It has outperformed the short duration funds category across both time-scales and even on YTD basis. Please see the chart below:-

Source: Advisorkhoj Research

The fund has nearly Rs 8,000 Crores of assets under management (AUM) with an expense ratio of 0.4%. Anil Bamboli and Rakesh Vyas are the fund managers of this scheme. HDFC Short Term Debt Fund scores highly in terms of credit quality – 92% of the portfolio has AAA / A1+ or Sovereign credit rating. The modified duration of the fund portfolio is 2.2 years, while the yield to maturity is around 8%. Investors should have minimum 2 – 3 years investment horizon for this fund. Value Research has 5 star rating for this fund.

ICICI Prudential Short Term Fund

The fund has given 9.2% returns in the last 1 year and 7.4% annualized return over the last 3 years. It has outperformed the short duration funds category across both time-scales and even on YTD basis. Please see the chart below:-

Source: Advisorkhoj Research

The fund has nearly Rs 8,700 Crores of assets under management (AUM) with an expense ratio of 1.15%. Manish Banthia is the fund manager of this scheme. ICICI Prudential Short Term Fund scores highly in terms of credit quality – over 90% of the portfolio has AAA / A1+ or Sovereign credit rating. The modified duration of the fund portfolio is 1.9 years, while the yield to maturity is around 7.95%. Investors should have minimum 2 – 3 years investment horizon for this fund. Morningstar has a 5 star rating for this fund, while Value Research has rated it 3 star.

Conclusion

In this blog post, we have reviewed 4 top performing short duration funds for investments in 2019. As stated in our previous best funds posts, there may be other good funds which have not found a mention in this post. We want to limit our top funds selection to a small number of funds (selected using a rigorous analytical methodology) for the sake of new and less experienced investors. If you have short duration funds in your portfolio which have performed well over the last 2 – 3 years, you can continue with them. You should consult with your financial advisor if you have any doubt about suitability of funds for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team