Bank of India Manufacturing and Infrastructure fund: A thematic fund which can benefit from India Growth Story

The Bank of India Manufacturing and Infrastructure Fund was launched in March 2010. This is a thematic fund which invests in stocks in the infrastructure and manufacturing sector. With assets under management of 338.69 Cr as on 31st May 2024, the TER of the Regular Growth option of the fund stood at 2.41% as on the same date.

Why invest in a manufacturing and infrastructure fund?

The industrial revolution in the 18th and 19th century positioned manufacturing as an important driver of progress and prosperity of nations. Manufacturing is an important constituent of employment growth and reduces income inequality in a country. China’s high economic growth over the last 40 years was driven mainly by manufacturing. Though India has also experienced high GDP growth since liberalization of our economy in 1991, the contribution of the service sector leads manufacturing in terms of employment (31% of India’s workforce versus 25%) and GDP growth. Manufacturing sector will play a key role in the next stage of India’s economic growth by addressing our external sector imbalance and demographic e.g. employment, rising working age population etc.

Drivers of Manufacturing Growth in India

Manufacturing and Infrastructure go hand in hand as development of one is dependent on the other. Infrastructure also plays a crucial role in the progress of a country. Given India’s aspiration to become a developed economy by 2047, infrastructure development is crucial in achieving that vision. The Government recognizes the infrastructural needs and has developed various policies in this regard. The National Infrastructure Pipeline (NIP), introduced in 2019 emphasizes social and infrastructure projects including energy, roads, railways, and urban development projects worth Rs 102 lakh crores (source: National Investment Promotion and Facilitation Agency, Government of India). Some of the major policies and schemes announced by the Government to boost infrastructure are setting up a Rs 20,000 crores National Investment and Infrastructure Fund (NIIF), the National Infrastructure Pipeline, PM Gati Shakti Master Plan, National Logistics Policy, RCS-UDAN, Sagar Mala, Bharat Mala, Digital India scheme, Telecom Technology Development Fund, and PLI.

The Government emphasized the need for increased spending in the infrastructure sector in the Union Budget of 2023-24, and nearly tripled its infrastructure spending to 3.3% of GDP compared to its spending in 2019-20. However, Government spending needs to be supplemented by private sector capex spending. With improving balance sheets (lower debt to equity ratios) and lower interest rates in the near to medium term, the time is ripe for private sector capex spending. With impetus of Government spending and potential private sector, infrastructure sector companies as well as manufacturing sectors are likely to play a key role in the India Growth Story.

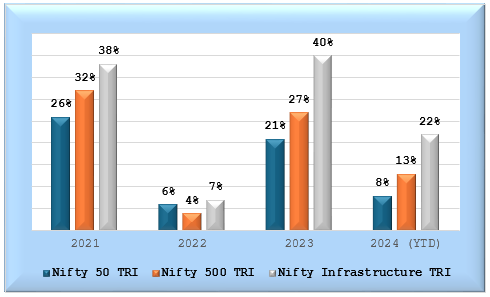

Infrastructure Sector has outperformed the broad market

The chart below shows that the infrastructure sector has outperformed the broad market indices since the economy opened up after the COVID 19 pandemic in 2020-21. Since the Union Budget 2021, the Government spending on infrastructure sector has benefited the stocks in the sector leading to their outperforming the market.

Source: Advisorkhoj Research (as on 31st May 2024)

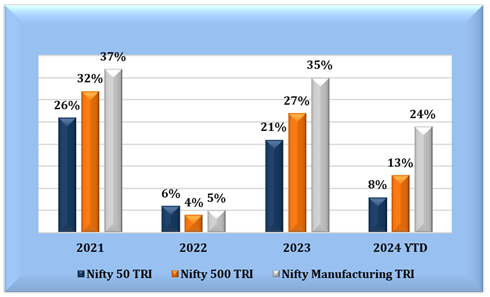

Manufacturing Sector has outperformed the broad market

The chart below shows that the manufacturing sector has outperformed the broad market indices since the economy opened up after the COVID 19 pandemic in 2020-21.

Source: Advisorkhoj Research (as on 31st May 2024)

Bank of India Manufacturing and Infrastructure Fund

The scheme seeks to generate long term capital appreciation through a portfolio of predominantly equity and equity related securities of companies engaged in manufacturing and infrastructure related sectors. The fund is managed by Mr. Nitin Gosar who has more than 16 years of experience in equity research and fund management.

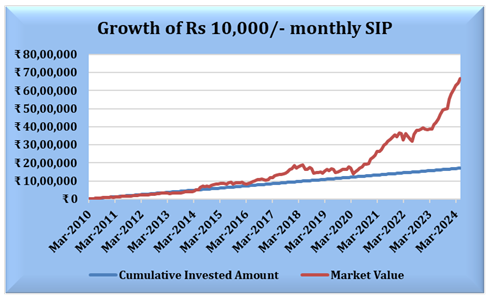

Wealth Creation with Bank of India Manufacturing and Infrastructure Fund

If you had invested Rs 1 lakh in the fund at its inception, you would have a corpus of Rs 5.23 lakhs as on 31st May 2024. This is a return of more than 5X times in a span of 14 years.

A monthly SIP of Rs 10,000/- started at its inception would have grown to a value of Rs 69 Lakhs against a cumulative investment of Rs 17 lakhs (as on 31st May 2024)

Source: Advisorkhoj Research (as on 31st May 2024)

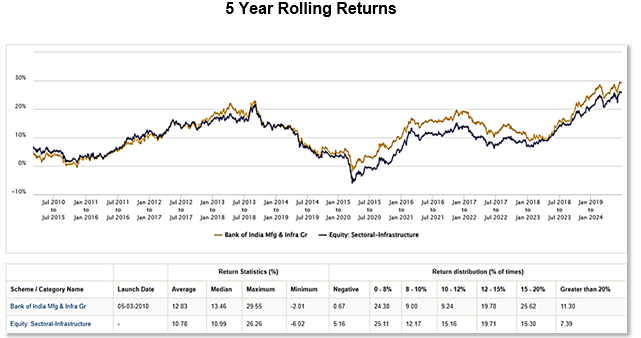

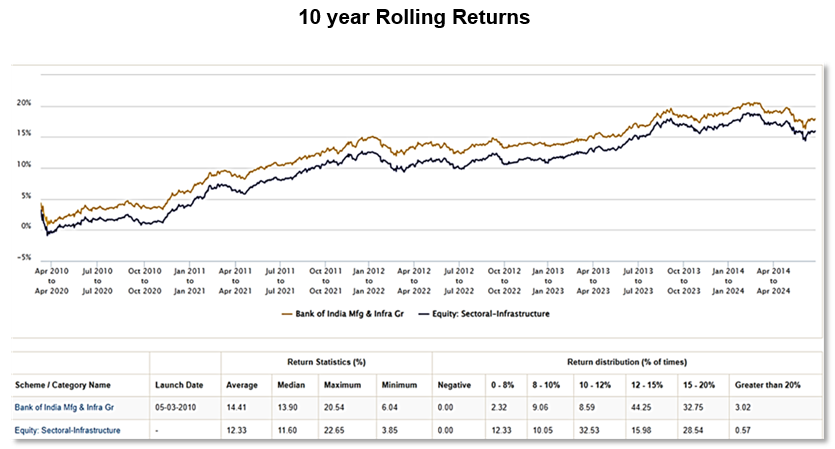

Rolling Returns

The 3-year, 5-year and 10 year rolling returns of the fund reveals that the fund has consistently performed above its category in the longer periods. This signifies that the fund is suitable for long term investment goals as it takes a longer term for manufacturing and infrastructure industries to give favorable returns. Given below are the charts showing the 5 year and 10 year rolling returns of the fund since its inception as on 31st May 2024.

Source: Advisorkhoj Research (as on 31st May 2024)

Source: Advisorkhoj Research (as on 31st May 2024)

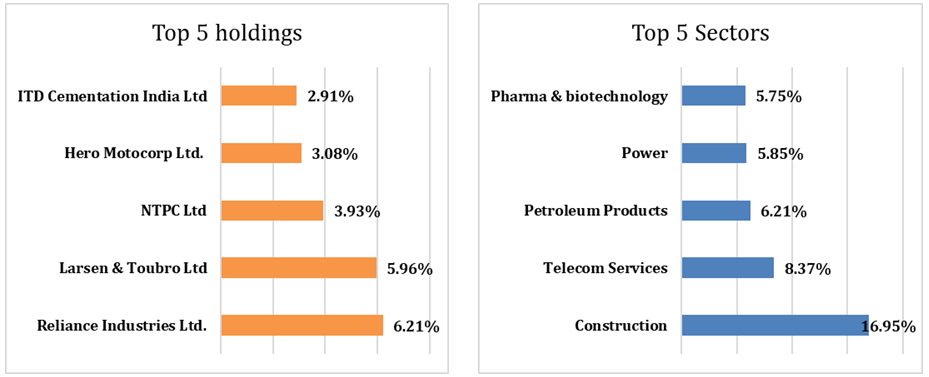

Portfolio Construct

The fund has a small cap bias with 37.62% of its fund allocation into small caps followed by 30.97% and 28.67% in Large Cap and Mid cap stocks respectively. The remaining 2.74% is invested in Government bonds and TBs as well as other money market instruments.

The top 5 holdings and sectors of the fund are as follows

Source: Fund Factsheet 31st May 2024

Why should you invest in the Bank of India Manufacturing and Infrastructure Fund?

- The fund aims to tap businesses that are expected to gain multi-fold with the implementation of Government policies and reforms.

- Infrastructure and manufacturing will play a key role in the Government's vision of making India a developed country - Viksit Bharat.

- India's potential to be a global manufacturing hub is integral to the India Growth Story. India stands to gain from the global supply chain realignments e.g. China + 1 strategy, especially in industries like electronics, pharma, automobiles etc.

- Industrial growth of an economy is heavily dependent on infrastructure development. Therefore, the infra sector will play a key role in the India Growth Story.

- The Bank of India Manufacturing and Infrastructure Fund gives you an opportunity to participate in the India Growth Story.

Who should invest in the Bank of India Manufacturing and Infrastructure Fund?

The scheme would be more suitable for investors who are desirous of increasing their exposure to manufacturing & infrastructure sector in their personal equity portfolio. Thus, this Scheme could act as a "top up" over existing investments of such investors in diversified equity funds. As such the scheme is suited to:

- Investors looking for long term capital appreciation through Infrastructure themes

- Investors with a very high-risk appetite.

- Investors with an investment horizon of minimum 5 years.

- Investors looking for tactical Allocation to the overall equity portfolio.

Consult with your financial planner or mutual fund distributor to understand if the Bank of India Manufacturing and Infrastructure Fund is suited to your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team