Bank of India Flexi Cap Fund: 3X returns in less than 4 years

Bank of India Flexi Cap Fund is the best performing Flex cap fund in the last 1 year. The fund has maintained its position among the top 3 funds in terms of last 3-year returns. It is a remarkable achievement for a fund that was launched just around 4 years back in June 2020. If you invested Rs 1 lakh in the fund at inception, the value of your investment will be Rs 3.11 lakhs (as on 16th April 2024). Since its inception it has given a CAGR of 34.91%.

Why should you invest in Flexi Cap Funds?

Flexi Cap funds are diversified equity mutual fund schemes which invest across market cap segments. Fund managers have the flexibility of managing market cap allocations as per their investment strategy and market outlook. There are several reasons why flexi cap funds are suitable for long term investments.

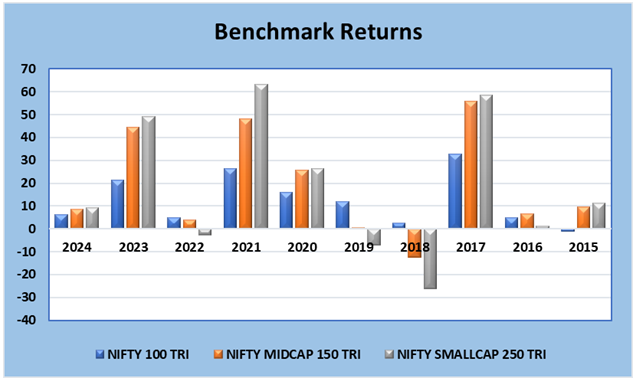

- Winners rotate across market cap segments: One market cap segment cannot keep out performing or underperforming across all market conditions or investment cycles. Historical data shows that winners rotate across different market cap segments – see the chart below. Flexi Cap fund managers can generate more consistent returns by managing allocations in different market cap segments across investment cycles based on their market outlook.

Source: NSE, Advisorkhoj Research (as on 16th April 2024). Large Cap: Nifty 100 TRI, Midcap: Nifty Midcap 150 TRI, Small Cap: Nifty Small Cap 250 TRI. Disclaimer: Past performance may or may not be sustained in the future.

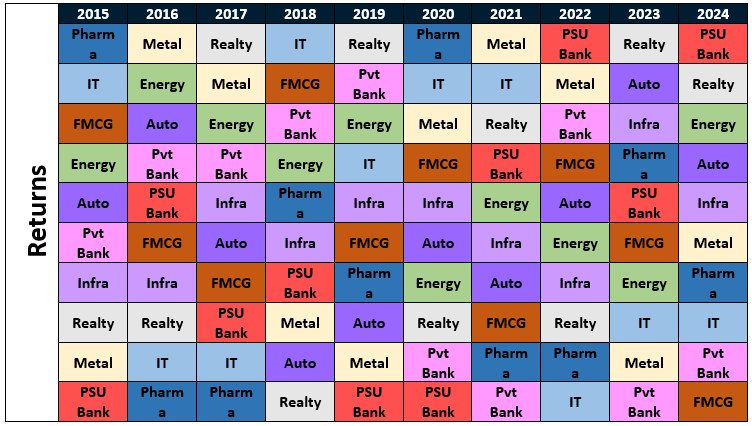

- Winners rotate across industry sectors: Like market cap segments, winners also keep rotating across industry sectors (see the chart below). Some sectors may outperform in some quarters or years, and others may outperform in other quarters or years. Flexi Cap funds diversify across industry sectors and can change sector allocations based on top down or bottoms up approach depending on the strategy of the fund manager.

Source: National Stock Exchange sector indices, as on 16th April 2024. Disclaimer: Past performance may or may be sustained in the future.

- Suitable for investors who want to rely on the fund manager’s expertise to determine the asset allocation to different market capitalization segments, depending on market conditions.

Bank of India Flexi Cap Fund

The Bank of India Flexi Cap Fund was launched in June 2020. The fund had an AUM of Rs 743.44 Crores as on 31st March 2024 managed by the fund manager Mr Alok Singh. The benchmark for the fund is S&P BSE 500 TRI. The Total Expense Ratio (TER) of the fund (regular plan) is 2.28%.

Performance of the fund

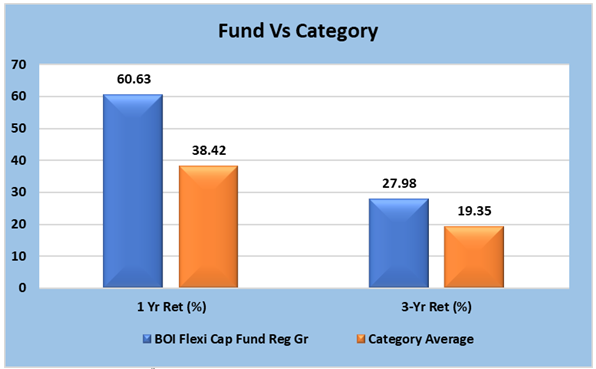

BOI Flexi Cap fund outperformed the category average returns by a significant margin over last 1 and 3 years (see chart below), putting it among the top 3 Flexicap funds in the last 3 years and the best performing Flexicap fund in the last one year.

Source: Advisorkhoj research as on 16th April 2024 Disclaimer: Past performance may or may not be indicative of future performance.

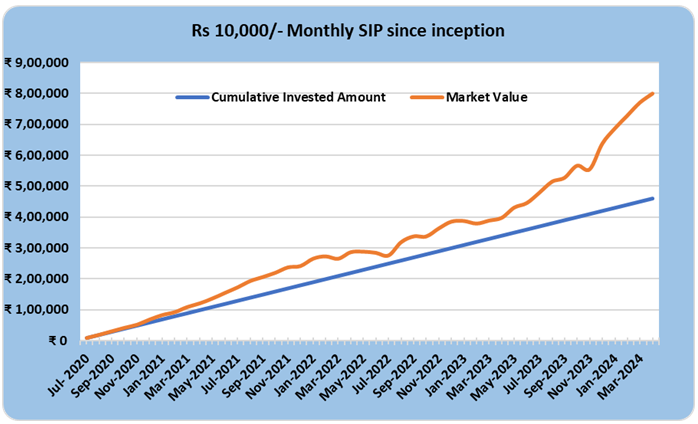

Wealth creation - SIP and Lump sum returns

An SIP of Rs 10,000/- invested monthly in the BOI Flexi Cap Fund since its inception would have grown to Rs 8.08 lakhs as on 16th April against a cumulative investment of Rs 4.6 lakhs (see the chart below).

Source: Advisorkhoj research as on 16th April 2024, Disclaimer: Past performance may or may not be indicative of future performance

A lumpsum of Rs 10,000/- invested in the fund at its inception would have appreciated to Rs 31,145/- giving a CAGR of 34.91% beating the benchmark index (S&P BSE 500) which gave a CAGR return of 27.45% CAGR over the same period (as on 16th April 2024).

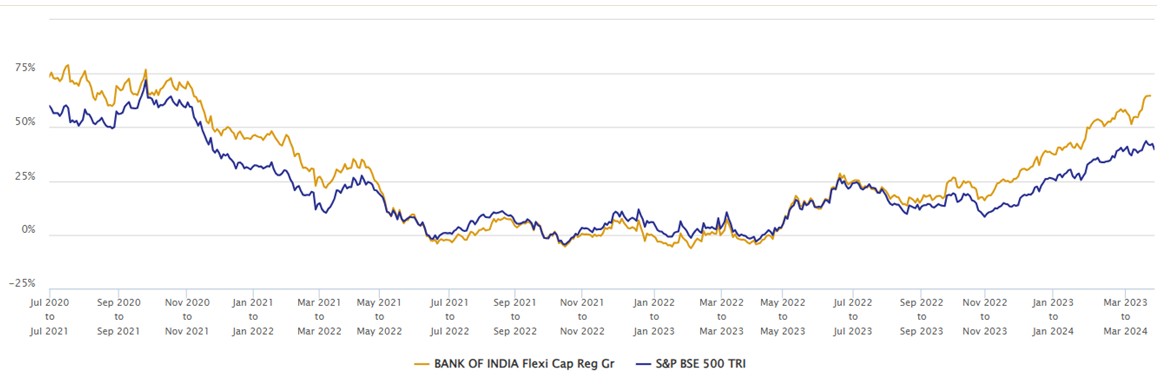

Rolling Returns: Fund Vs Benchmark

The 1 year rolling return of the Bank of India Flexi Cap Fund against its benchmark S&P BSE 500 since the inception of the fund, reveals that the fund has outperformed the benchmark most of times, except 2022-23. The fund gave 20%+ returns over 1 year investment tenures in 53.13% of the observations.

Source: Advisorkhoj Research as on 16th April 2024

Quartile Performance

The Bank of India Flexi Cap fund is one of the best performing funds in its category and has always featured in the top two quartiles since its inception. For the last 2 years the fund has been in the top quartile.

Source: Advisorkhoj research as on 16th April 2024

Market Capture Ratio – Superior risk / return

The up market capture ratio of the fund is 1.27 while the downmarket ratio is at 1.04. This means showing that the fund’s performance was 27% better than the benchmark in up market (months in which the market was up). At the same time, the fund’s performance in bearish markets (months in which the market was down) was almost the same (slightly lower) as the market benchmark index. In other words, the fund was able to deliver higher returns versus the market benchmark index without taking excessive risks – superior risk adjusted returns. The fund gave an alpha of 6.45% and its Sharpe ratio is 1.37 (Advisorkhoj Research as on 16th April 2024).

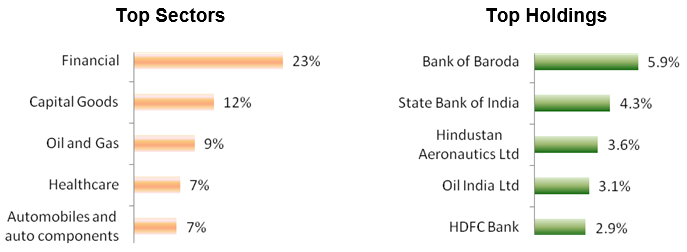

Portfolio positioning of the Bank of India Flexi Cap fund

The investment objective of the scheme is to generate long term capital appreciation by investing predominantly in equity and equity-related securities across various market capitalisation segments. The fund has a large cap bias in its portfolio and invests across various market cap segments and industries offering diversification to the investors. The midcap and small cap asset allocation of BOI Flexi Cap is comparatively more higher compared to the peer average. The investment strategy has the potential to earn greater alpha over sufficiently long investment horizon (across investment / market cycles).

(Source: Fund Factsheet as on 31st March 2024)

Why invest in the BOI Flexi Cap Fund now?

The equity market has turned volatile in the last few days. There are concerns about the timing of rate cuts in the US, rising tensions and geo-political risks in the Middle East, impact of prolonged high interest rates on the global economy, stretched valuations etc. At the same time, the long term outlook for the Indian economy and Indian equities is bright. As per IMF forecasts, India is expected to be the best performing economy among G-20 countries, which will attract greater FII investments to India in the medium to long term. The India Growth Story is intact and will benefit investments across all market cap segments, especially the broader market (e.g. midcaps, small caps). The investment strategy of BOI Flexi Cap Fund may have to potential to deliver superior risk adjusted returns over sufficiently long investment horizons (3 – 5 years+). The recent correction may provide attractive investment opportunities for long term investors. The strong performance track record of BOI Flexi Cap Fund strengthens our confidence in the future potential of BOI Flexi Cap Fund over long investment horizons.

Who should invest in the Bank of India Flexi Cap Fund

- Investors looking for capital appreciation to align with their long-term financial goals.

- Those who have an investment window of at least 5 years.

- Investors who can handle high to very high risk associated with equity market investment.

- Investors who wish to get an exposure to all the market cap segments without taking the hassle of determining their portfolio allocation between each of them.

- You can invest either in lump sum or SIP depending on your financial situation and investment needs.

- If you have an investible corpus but are worried about short term volatility, you can invest in your corpus in Bank of India Liquid Fund and transfer fixed amounts at regular intervals (e.g. monthly) to Bank of India Flexi Cap Fund over the next 3 – 6 months or longer through Systematic Transfer Plan to take advantage of market volatility through Rupee Cost Averaging.

Consult your mutual fund distributor or financial advisor to find out if Bank of India Flexi Cap fund is suited for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

UTI Mutual Fund launches UTI Multi Cap Fund

Apr 29, 2025 by Advisorkhoj Team

-

HDFC Mutual Fund launches HDFC CRISIL IBX Financial Services 3 to 6 Months Debt Index Fund

Apr 28, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Silver ETF Fund of Fund

Apr 28, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team