Bank of India Balanced Advantage Fund: One of the best performing balanced advantage funds in last 3 years

High volatility has rocked the market over the past few weeks. While the long term outlook for Indian equities remains strong, investors should be prepared for volatility in the short term. Asset allocation can provide stability to your investment portfolio in uncertain market conditions. The strong rally in 2023 had taken the market to record highs, but at the same time has raised concerns about valuations. In such conditions, dynamic asset allocation or balanced advantage funds, which manage their asset allocation dynamically based on relative valuations or market levels can be suitable investment options for investors who want a stable investment experience. In this article, we will discuss about Bank of India Balanced Advantage Fund, one of Top 3 balanced advantage funds in the last 3 years.

About BOI Balanced Advantage Fund

The fund was launched around 10 years back and has given 14.5% CAGR returns in the last 3 years (see the chart below). You can see that the fund performance was comparable with Nifty, even though risk profile of the fund is significantly lower than Nifty or a pure equity fund.

Source: Advisorkhoj Research, as on 14th May 2024

Downside risk limitation by BOI Balanced Advantage Fund

One the main reasons for investing in hybrid funds is to reduce portfolio volatility. That is why we urge you to consider both risks and returns when investing in hybrid funds. The table below shows some of biggest drawdowns (market corrections) since the inception of BOI Balanced Advantage Fund. You can see that BOI Balanced Advantage Fund had much smaller corrections compared to Nifty. In other words, the fund was able to limit downside risk of investors in volatile market conditions, while giving returns comparable to Nifty over sufficiently long investment horizon. This shows that the robustness of the dynamic asset allocation strategy of the fund.

Source: Advisorkhoj Research, as on 14th May 2024

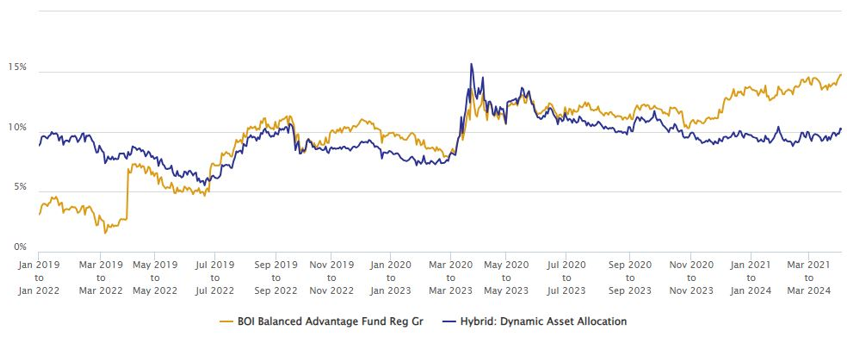

Rolling returns versus peers

The chart below shows the 3 year rolling returns of Bank of India Balanced Advantage Fund over the last 5 years or so (since 1st January 2019) versus the dynamic asset allocation funds category average. We are showing 3 year rolling returns since investors should have minimum 3 year investment tenures for Balanced Advantage Funds. You can see that the fund was able to beat the category average fairly consistently over 3 year investment tenures across different market conditions. The average rolling return of Bank of India Balanced Advantage Fund for 3 year investment tenure was 9.73% (versus category average rolling return of 9.37%). The median rolling return of Bank of India Balanced Advantage Fund for 3 year investment tenure was 10.65% (versus category median rolling return of 9.37%).

Source: Advisorkhoj Rolling Returns, as on 30th April 2024

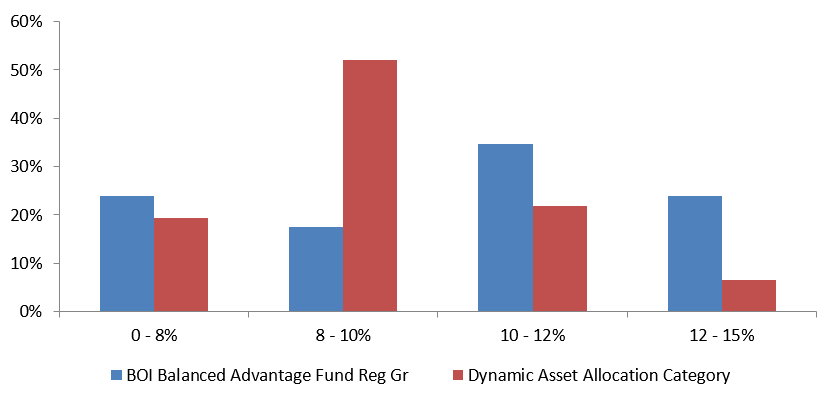

Superior consistency in giving double digit returns

The chart below shows the 3 year rolling return distribution of Bank of India Balanced Advantage Fund versus the dynamic asset allocation funds category average. You can see that Bank of India Balanced Advantage Fund was able to give 10%+ CAGR returns much more consistently compared to the peer funds in the dynamic asset allocation funds category.

Source: Advisorkhoj Rolling Returns, as on 30th April 2024

Top 2 quartiles performer in the Balanced Advantage Fund category

The table below shows the annual quartile ranking of Bank of India Balanced Advantage Fund since its launch. You can see that the fund has been able to claim a spot in the top 2 quartiles for the last 3 consecutive years. The fund had underperformed from 2016 to 2021, but has made a strong recovery since then. We will continue to monitor if the fund is able to retain its place in the upper quartiles in the coming years.

Source: Advisorkhoj Quartile Ranking, as on 30th April 2024

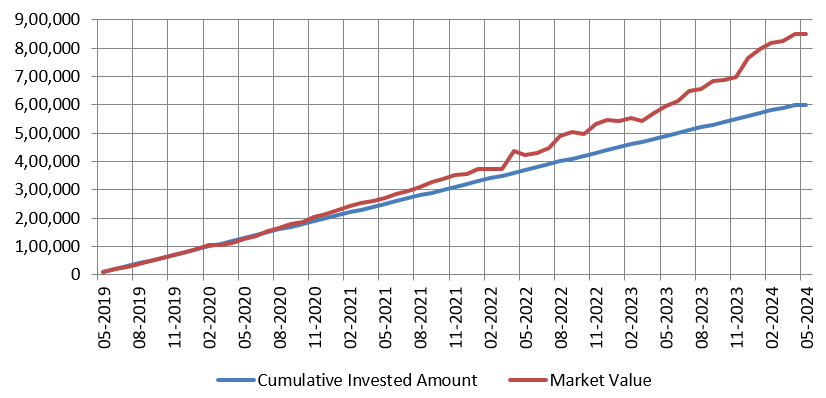

SIP Returns

The chart below shows the growth of Rs 10,000 monthly SIP in Bank of India Balanced Advantage Fund over the last 5 years. With a cumulative investment of Rs 6 lakhs, you could have accumulated a corpus of more than Rs 8.5 lakhs. The SIP XIRR over the last years was nearly 14%.

Source: Advisorkhoj SIP Returns, as on 14th May 2024

Why invest in Bank of India Balanced Advantage Fund?

- The equity market has been volatile for the past several weeks, even before Lok Sabha polling started. Election has contributed to increasing the volatility. You should expect volatility to continue till results are declared.

- From the perspective of global macros, inflation has been stubborn in the US raising concerns about timing of rate cuts. Inflation has been higher than expected even in India, mainly due to food prices.

- The US economy is expected to slow down when the current interest rate cycle ends and the new cycle begins. Though economists expect the US economy to avoid recession (soft landing), the extent of slow down in the US is a risk factor for global equities.

- Valuation is a source of concern for investors. In February, SEBI issued an advisory regarding froth building up in valuations of midcap and small cap stocks. FIIs have been net sellers in 2024.

- In these market conditions Balanced Advantage Funds can be suitable investment options for investors who are not comfortable with high volatility.

- Bank of India Balanced Advantage Fund has a strong track record of delivering risk adjusted returns.

Who should invest in Bank of India Balanced Advantage Fund?

- Investors looking for capital appreciation and income over long investment tenures

- Investors with moderately high risk appetites

- Investors with minimum 3 year investment tenures depending on your investment need.

- You can invest either in lump sum or SIP

- Suitable investment option for first time investors

Investors should consult their financial advisors or mutual fund distributors if Bank of India Balanced Advantage Fund is suitable for their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Active Momentum Fund

Jul 8, 2025 by Advisorkhoj Team

-

Quant Mutual Fund launches Quant Equity Savings Fund

Jul 8, 2025 by Advisorkhoj Team

-

Axis Mutual Fund Launches Axis Services Opportunities Fund: A New Thematic Offering to Capture India's Services-Led Growth Story

Jul 5, 2025 by Axis Mutual Fund

-

Sundaram Mutual announces the launch of The Sundaram Multi Factor Fund

Jul 5, 2025 by Sundaram Mutual Fund

-

JM Financial Mutual Fund launches JM Large and Mid Cap Fund

Jul 4, 2025 by Advisorkhoj Team