Axis Quant Fund: Unleashing the Power of Data

In the investment world, quantitative analysis has revolutionized the way financial decisions are made. Generally, quant funds utilize complex mathematical models and algorithms to make investment decisions. These funds harness the power of data, statistics, and computer programming to identify patterns, trends, and opportunities in the financial markets.

Quant funds in India represent funds that employ quantitative strategies to generate returns. Unlike traditional fund managers who rely on a combination of quantitative and subjective analysis, quant funds employ systematic, algorithmic rule-based approaches. In this article, we will review a quant fund whose upturn in performance has caught our attention.

Axis Quant Fund was launched on 01-Jul-2021. The fund’s Assets under Management (AUM) stood at Rs 1,001.25 crores on 30-Jun-2023.

Axis Asset Management Company

The Axis MF AMC was incorporated back in October 2009. Axis AMC is a joint venture between Axis Bank and UK-based asset management company Schroders plc. Axis Bank is the third largest private bank in India. Meanwhile, Schroders plc is headquartered in London. With over 200 years of history, Schroeder manages over GBP 500 billion in assets across 19 countries across Europe, America, Asia and the Middle East.

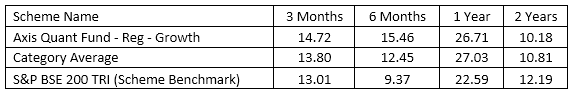

Performance

It is recommended that Investors of equity funds should monitor a fund’s performance at least after more than five years as the short-term performance of these funds can be volatile. Since the fund has not completed the requisite year, we are looking at the recent performance. The fund’s recent performance has improved. It has impressively outperformed the category average (all the quant funds in the mutual fund industry) and the benchmark. Although, over two years, the fund has been underperforming both the benchmark and the category average, this recent outperformance gives hope that the streak of outperformance will continue.

Source: Advisorkhoj.com. Data as on - 17-07-2023

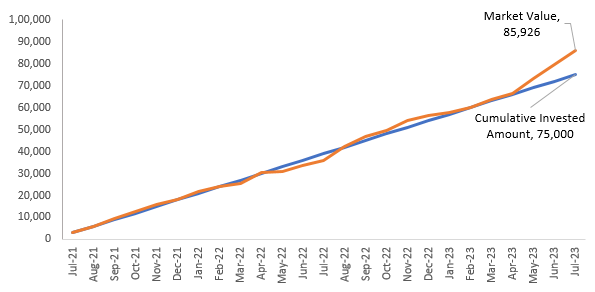

The SIP returns of the fund since inception is impressive. With Rs 3,000 monthly SIP (cumulative investment of Rs 75,000), and this investment’s market value would be at Rs 85,926 (as on 17th July 2023). This would translate to a XIRR of 14.2% returns.

Source: Advisorkhoj.com. Data as on - 17-07-2023

Investment Strategy of Axis Quant Fund

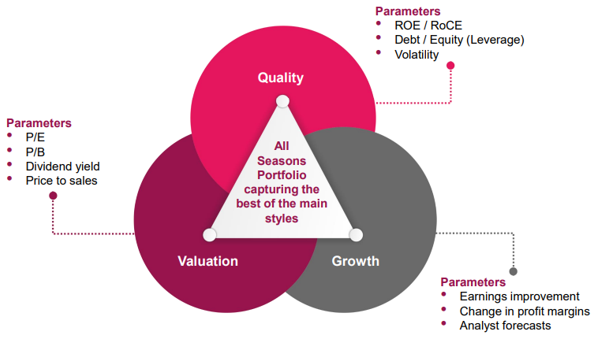

The fund aims to leverage Axis AMC’s fundamental research base and strategically use quantitative data to offer a unique investment strategy through Axis Quant Fund. The fund aims to identify Quality stocks in combination with the tenets of Growth and Value. The approach focuses on selecting a portfolio of Quality stocks with good potential of Growth at a Reasonable Price (GARP). What is most fascinating is to look at the metrics that the fund manager has built into system.

Source: Axis MF | Given above is an indicative list of parameters used

While Quality and Valuation parameters are more historical and backwards looking, the growth parameters also have some forward-looking metrics – Analyst forecast and earnings improvement. The parameters are interesting, and so is the approach to selecting the stocks. The stocks are selected on a combined scoring between the three parameters. While the weightage is not mentioned, it is safe to assume that quality and growth may have higher allocation considering the overarching philosophy of the AMC. Stock level constraints are based on the stock’s liquidity, which ensures that the fund can easily sell the stock to meet the redemption requests.

The quant model used in the fund is reviewed & monitored on a pre-defined frequency. Ad-hoc rebalancing takes place only in case of exceptional situations (adverse news, management or Board issues, and material litigation issues).

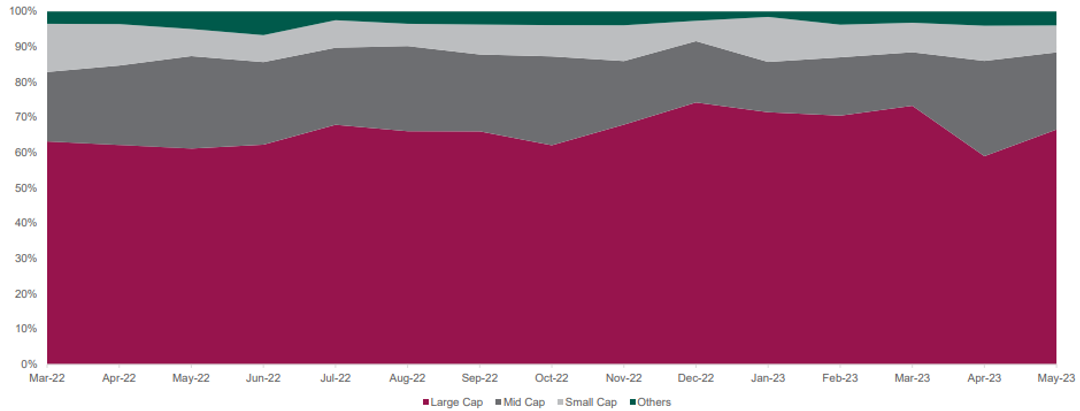

The fund’s benchmark is S&P BSE 200 TRI. The benchmark index is important in deciding stock and sector exposure in the fund's model. The portfolio-building logic has multiple criteria to ensure the fund is not skewed on a stock or sector. The fund’s history is not very long, but in a little over a year’s history, it seems the fund has a large-cap bias.

Source: Axis MF

Suggested reading – Quality investing can produce superior outcomes for long-term investors

Fund Manager’s experience and expertise

Three fund managers are managing the scheme, Ashish Naik, Vinayak Jayanath and Karthik Kumar. Ashish Naik has 15 years of experience in financial markets. He has been managing this fund since 4th May 2022. Vinayak Jayanath has over 6 years of experience in the financial market. He has been managing this fund since 17th January 2023. Karthik Kumar has joined the fund management of this scheme on 3-Jul-2023. He has over 15 years of experience in the financial markets and has previous experience managing the quant strategy in the AIF for Axis AMC. This addition will bring better process and research capabilities to the Quant Fund.

Why invest in Axis Quant Fund?

- The strategy will appeal to investors looking to diversify their existing portfolio of funds through a rules based and data driven approach to investing.

- A unique proposition of a fundamentally driven quantitative approach.

- Very little human bias in portfolio management

- A systems driven approach to portfolio management can produce more consistent investment outcomes for investors over long investment horizons

- Diversified portfolio across sectors and market capitalisation

Who may consider the Axis Quant fund?

- Investors are seeking capital appreciation or wealth creation over long investment horizons.

- You should have a high-risk appetite for this fund.

- You should have minimum 5-year investment tenure for this fund.

- You can invest in this fund in a lump sum or Systematic Investment Plan (SIP) based on your investment needs and financial situation.

- Also investors who prefer actively managed funds may consider this fund as an addition to their core equity portfolio.

Suggested reading – How SIP works for investors in any life stage

Consult a financial advisor who can provide personalised guidance based on your circumstances and suggest if Axis Quant Fund is suitable for you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team