Axis NIFTY IT Index Fund: Investing Option Looking at the Future

Axis AMC has now launched its NFO: Axis Nifty IT Index Fund. The NFO period is from 27-Jun-2023 to 11-Jul-2023. The fund’s objective is to provide returns before expenses that correspond to the total returns of the NIFTY IT TRI subject to tracking errors. The Nifty IT index comprises of the 10 largest IT companies in India. Hitesh Das will be managing the fund. He has over 12 years of experience in asset management.

Why invest in IT?

Impact of Technology in the modern age: Technology has become a necessity in modern life. There is an impact of technology in everything that we do. Technology has made a big mark in our lives, from ordering food, looking for a house, travelling, or communicating to banking. The transformative power of technology in our day-to-day lives and industrial growth is tremendous. There’s no turning back from technology now. Our dependence on IT for the necessities of life is constantly growing and ever-lasting.

Capturing the Growth Potential of the Indian IT Industry: Over the past 2 and half decades, the Indian IT industry has emerged as a key player on the global stage, providing a wide range of IT services including, technology operations, software development, research, development and digital solutions. According to NASSCOM (National Association of Software and Service Companies), the Indian IT and Business Process Management (BPM) industry is expected to continue.

Stable and Consistent Growth: The IT sector in India has demonstrated consistent growth and resilience over the years. Even during challenging economic conditions, the sector has shown robustness and adaptability. According to the Government of India’s “Digital India” initiative, the IT industry has been a key driver of economic growth and employment generation. By investing in the Nifty IT Index Fund, investors can potentially benefit from the sector’s stability and steady performance.

Exposure to Global Demand and Innovation: Indian IT companies are renowned globally for their expertise, innovation, and cost-effectiveness. They cater to a diverse client base spanning multiple industries and geographies. These companies often serve as technology partners for businesses worldwide, providing software development, cloud computing, data analytics, and artificial intelligence services.

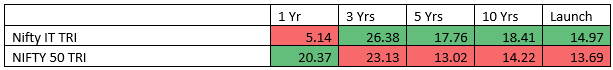

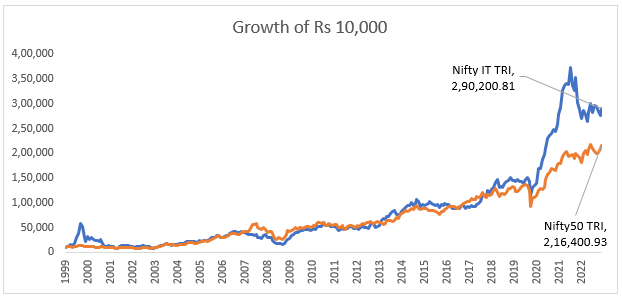

Superior investment performance: Over the longer term the IT Index has done better than the Nifty 50 Index.

Source: advisorkhoj.com; Returns as on - 26-06-2023 in %

Though the Nifty IT TRI Index has underperformed the Nifty 50 TRI in the last one-year, looking over longer-term returns like 5-10 years clearly shows the better performance of the Nifty IT Index TRI.

Source: mutualfundtools.com

Nifty IT Index: Construction Methodology & History

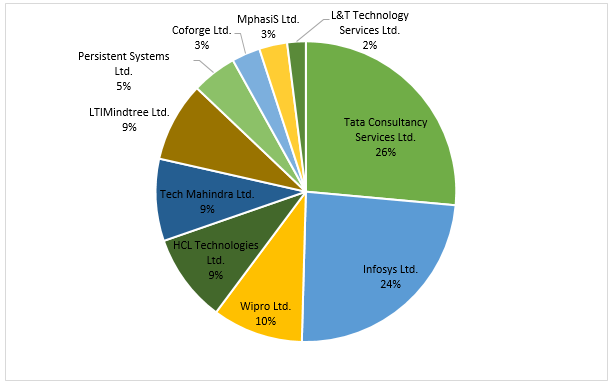

The Nifty IT index captures the performance of Indian IT companies. The Nifty IT Index comprises 10 companies listed on the National Stock Exchange (NSE). The Nifty IT index is computed using the free float market capitalisation method with a base date of Jan 1, 1996, indexed to a base value of 1000, wherein the level of the index reflects the total free float market value of all the stocks in the index relative to a particular basemarket capitalization value. The base value of the index was revised from 1000 to 100 with effect from May 28, 2004.

Companies in this index have over 50% of their turnover from IT-related activities like IT Infrastructure, IT Education and Software Training, Telecommunication Services and Networking Infrastructure, Software Development, Hardware Manufacturer, Vending, Support and Maintenance.

The composition of the Nifty IT Index is shown in the chart below.

Source: Nifty Indices factsheet; as on 31-May-2023.

Why invest in the Axis Nifty IT Index Fund?

Exposure to one of the fastest growing industry sectors globally: Investing in the Nifty IT Index Fund offers a unique opportunity for investors to gain exposure to India’s thriving information technology (IT) sector. As India continues to establish itself as a global technology hub, the Nifty IT Index Fund enables investors to participate in the growth and potential of the sector. Investing in the Nifty IT Index Fund exposes investors to the global demand for IT services and technological advancements.

Passive Fund Management: Fund managers of actively managed schemes must be overweight/ underweight on some stocks relative to the benchmark. As a result, some unsystematic risk (stock-specific risk) is created in addition to market risk in actively managed funds. On the other hand, Index funds invest in a basket of securities that mirror the market index. Hence, there is no unsystematic risk; they are subject only to market risks.

Low cost: The Total Expense Ratios TERs of index funds are much lower than actively managed mutual funds. To outperform an index fund tracking the same market benchmark index, an actively managed fund will have to beat the benchmark by a margin higher than the difference in TERs of the two funds. For example, if the TER of an index and an active fund is 0.1% and 2%, respectively, then the active fund will have to beat the benchmark by more 1.9% to outperform the index fund. For the same level of performance of the underlying portfolio, lower costs mean high returns for investors.

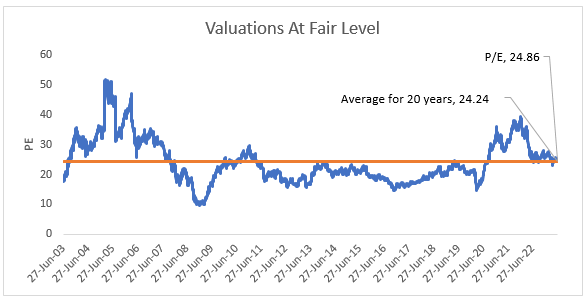

Reasonable Valuations of the Nifty IT Index at current levels: Current valuations of the Nifty IT index have come down from higher levels to the average of the long-term valuation. Investors can use this opportunity (Axis Nifty IT Index Fund NFO) to build a position in this sector.

Who should invest in Axis Nifty IT Fund?

- Investors who want capital appreciation in the long term by investing in the IT sector

- In our view, investors with investment horizons of 5 years or longer should invest in IT Index Funds

- Investors should have a high to very high risk appetite for these funds

- Investors not looking for active fund management and prefers passive investing style (reasons mentioned above)

- Investors holding the view that the IT sector will do well in the medium to long term.

Investing in the Axis Nifty IT Index Fund allows investors to tap into India’s thriving IT sector, significantly contributing to economic growth. With the sector’s consistent performance, global recognition, and government support, the Axis Nifty IT Index Fund offers exposure to a diversified portfolio of IT companies, capturing the growth potential of this dynamic industry.

Investors should consult their financial advisors if Axis Nifty IT Index Fund suits their investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team