Axis Equity Saver Fund: Aiming for 40% equity

The fund Axis Equity Saver fund was launched on 14-Aug-2015. The Fund invests in equity shares, bonds and arbitrage opportunities. The AUM of Axis Equity Saver Fund is ₹911.57 Cr as of 30-Jun-2023. And its exposure is 39.56% is Net Equity, 28.45% is hedged and 31.99% in Debt.

Axis Equity Saver has three fund managers: Ashish Naik, R Sivakumar and Aditya Pagaria.

Equity Savings Fund Category

As per SEBI’s scheme categorisation, funds in the equity savings category should have unhedged equities between 10-50%, and beyond that, the equity should be hedged. Now as rules set the finance ministry state that a mutual fund will not qualify for equity taxation if its gross equity is less than 65% on aggregate. Hence, to satisfy both conditions, the funds in this category have to keep a part of the portfolio hedged. This leaves approximately 30-35% for debt. Considering the margin that has to be kept for hedging and the cash for operational purposes, most funds in the category will have approximately 20-25% available for debt investment.

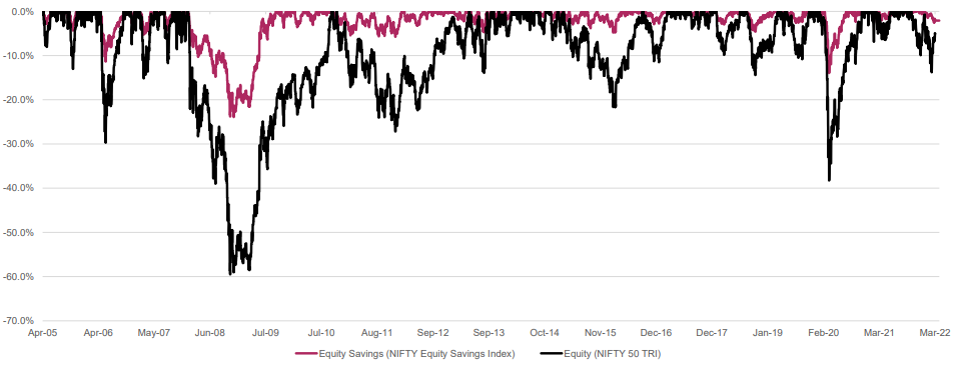

For investors, the benefit of investing in this segment is that it reduces the downside volatility compared to pure equity.

Source: Axis Equity Saver Presentation

Performance

On a 1 yr rolling return its performance has been a mixed bag against the category average, it has been an outperformer against the category average in both the 2yrs and 3yrs rolling returns.

2 Yr Rolling Returns of the fund vs the category average (since the inception of the fund)

Source: Advisorkhoj.com

3 Yr Rolling Returns of the fund vs the category average (since inception of the fund)

Source: Advisorkhoj.com

Looking at these patterns it is clear that the fund may be considered by investors over a 2-3 period.

Investment Strategy

As the fund has three parts – Equities, Arbitrage and Debt; therefore, all three parts must be separately studied.

Source: MFI360; Monthly portfolios.

Equity: The fund has maintained an actively approach to the portfolio. As an AMC, the fund house philosophy is to invest in high quality stocks using a bottom-up stock-picking approach. The fund manages unhedged Equity Allocation between 35-45%. The fund follows a Multi-cap strategy with a large cap bias. Although month of May and June, it has increased its allocation towards mid- and small-cap. In a note, the team stated that the allocation towards Mid and Small caps would depend on the attractiveness of the market opportunities. The note also hinted that the fund will have benchmark-aware weights and targets to beat the benchmark through stock selection.

Fixed Income: The fund manager aims for active management to capture interest rate cycles by dynamically managing the funds’ duration. Top-Down Investment Approach determines the Allocation and Duration. Comfort on Domestic and Global Macros will play an important role in debt allocation. The strategy aims to capitalise on the yield curve dynamics and spreads between asset classes. The allocation is high-quality bias investments, which are heavily concentrated into High-Grade assets (GSECS / SDLs / AAA PSUs / AAA Pvts). The investments are heavily concentrated in the 2-5yr Duration in line with the fund strategy of Stable Returns with lower volatility. The allocation in Debt and money market instruments will be around 20% - 35%.

Hedged Equity/Arbitrage: The fund will seek to earn regular income predominantly by deploying cash in Cash futures arbitrage trades. The allocation will range between 25% to 40%.

Source: MFI360; Monthly portfolios.

The fund has seen an allocation shift from IT to Banks and Construction materials. According to the note, ‘Given the volatile macro, IT services demand will remain muted. Moreover, IT sector valuations continue to remain elevated vs historical trends. Banks and Construction materials are at better valuations and should benefit, given the strength in credit growth and govt capex.’

Why Invest in Axis Equity Saver Fund?

- Long-term quality-biased approach to equity investing.

- Disciplined approach to debt portfolios

- The fund targets 20-40% in unhedged equities, 20-60% in hedged equities and 20-35% in fixed-income instruments. Thus, the fund will have lower volatility compared to pure equity funds.

Who Should Invest in Axis Equity Saver Fund?

- Individuals with an investment horizon of about 2-3 years or so

- Investors’ looking to take a higher risk than debt funds but less than an equity fund.

- Investors looking for parking of funds for less than 3 yrs but more than 1 yr.

- Investors looking for a single fund that would allow them less than 50% of equity participation while maintaining equity taxation.

Consult a financial advisor who can provide personalised guidance based on your circumstances and suggest if Axis Equity Saver is suitable for you.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team