Axis Arbitrage Fund: A good short term investment in this market condition

Short term yields in financial market

After the outbreak of the first wave of COVID-19 the Reserve Bank of India pumped massive amount of liquidity in the financial system, to support the economy. As a result the yields of short term debt and money market instruments have remained low. As per CRISIL, the yields of Commercial Papers and Certificates of Deposits, maturing in 1 to 3 months, remained below RBI’s repo rate of 4% (as on 31st January 2022). In the last one month, S&P BSE Liquid Rate Index gave 0.28% return (source: Advisorkhoj Research). During times when yields of overnight or liquid funds are low, arbitrage funds may provide an alternative investment options for parking your short term funds for a few months to a year.

What are arbitrage funds?

These funds aim to make risk-free profit by exploiting price difference of the same underlying asset in different segments. The most common form of arbitrage, known as cash and carry arbitrage, is between the cash and the F&O market. The arbitrageur aims to lock in risk-free profits by taking opposite (long and short) positions in cash and futures market. There is no risk for the investors because irrespective of market movements (up or down), the price in cash and futures market converges on expiry of the futures contract. Let us understand this with an example.

Suppose the price of the share of a company today in the spot or cash market is Rs 100 and the price of the February futures contract of the company in the F&O market is Rs 110. If you buy 1000 shares of the company in the cash market and sell 1000 futures, you will lock in a gross profit of Rs 10,000 today itself. On expiry of the February futures contract on 24th February 2022, the spot and futures price will converge. You will still make a net profit of Rs 10 per share and Rs 10,000 in total by simply squaring off both the positions in the cash and futures market. The expiry price is irrelevant. Suppose the expiry price is Rs 120. You will make a profit of Rs 20 per share by selling the shares that you bought for Rs 100 in the cash market. On the other hand, you will make a loss of Rs 10 per share in your futures. The net profit for you will be Rs 10 per share or Rs 10,000 on 1,000 shares. What if, the price of the share falls to Rs 90 on expiry date? You will make a loss of loss of Rs 10 per share you bought in cash market but you will make a profit of Rs 20 per future. Your net profit per share will again be Rs 10 or Rs 10,000 on 1,000 shares.

Axis Arbitrage Fund

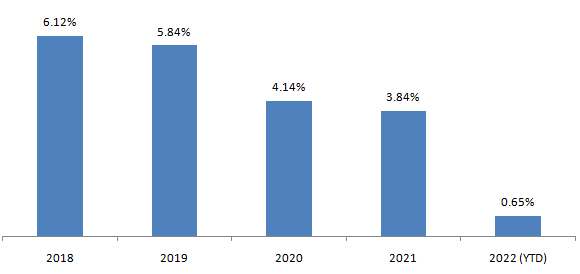

Axis Arbitrage Opportunities Fund is one of the best performing arbitrage funds in the last 1 year. The scheme was launched in August 2014 and has around Rs 4,139 crores of Assets under Management. The expense ratio of this fund is 1.05%. The chart below shows the annual returns of the fund over the last 5 years.

Source: Advisorkhoj Research (as on 13th February 2022)

Downside Risk

The chart below shows the monthly returns of Axis Arbitrage Funds over the past nearly 50 months or so (more than 4 years). You can see that the in the last 49 months, Axis Arbitrage Fund gave negative monthly returns in only 2 months (less than 5% of instances). This shows that Axis Arbitrage Fund is a well managed arbitrage scheme. Furthermore, the average monthly return over the last nearly 50 months was 0.41%, which is significantly higher than your usual savings bank monthly yield.

Source: Advisorkhoj Research (as on 31st January 2022)

Taxation of arbitrage funds

One of the biggest benefits of investing in arbitrage funds is the tax advantage. Arbitrage funds are taxed as equity schemes. Short term capital gains (investment holding period of less than 12 months) are taxed at 15% (plus applicable surcharge and cess). Long term capital gains (investment holding period of more than 12 months) are tax exempt up to Rs 1 lakh and taxed at 10% (plus applicable surcharge and cess) thereafter.

Why invest in Arbitrage Fund?

- The RBI in its last monetary policy review meeting has indicated that it would like to continue its accommodative policy (keeping interest rates low) to support economic growth revival in the post COVID scenario.

- The yields of short term money market instruments are likely to remain low in the near term, unless RBI changes its monetary policy stance.

- Arbitrage funds may provide investors, opportunities to get higher yields on their short term funds without taking higher risks. These schemes provide high degree of capital safety.

- Arbitrage funds usually give higher returns in momentum driven markets. The sentiment in the market is bullish after the Union Budget of 2022. Though sentiments have turned negative in the last few days due to the geo-political concerns, the market expects bullishness to return if there is a peaceful resolution of Ukraine / Russia crisis in the near future.

- Arbitrage funds also provide fairly high liquidity because arbitrage trading positions are usually squared off within a month. However, sometimes fund managers may take positions in longer dated futures (e.g. futures in series expiring next month or next 2 months) to get higher returns. In our view, you should have at least 3 months investment tenures for arbitrage funds.

- Arbitrage funds are much more tax efficient than short term fixed income investment options.

Why invest in Axis Arbitrage Funds?

- One of the best performing arbitrage funds in recent years

- Stable returns

- Low downside risk

Who should invest in Axis Arbitrage Funds?

- Investors looking to park their surplus funds

- Investors looking for relatively high capital safety.

- Investors with 3 months to 1 year investment tenures

Investors should consult with their financial advisors if Axis Arbitrage Fund is suitable for their short term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team