Aditya Birla Sun Life Equity Fund: One of the most consistent multi cap mutual funds

While large cap mutual funds are seen as all-weather funds, diversified multi-cap equity mutual funds, which invest in stocks across different market cap segments and industry sectors, are seen by many investment experts as the ideal investment choices for investors who have slightly higher risk appetites and want to have limited number of mutual fund schemes in their portfolios.

Having a large number of mutual funds in your portfolio does not necessarily improve your risk diversification or enhance your portfolio performance. On the contrary, it is more likely than not, that your portfolio performance may suffer if you have many funds in your portfolio, if some funds in your portfolio underperform in different market conditions. The other challenge of having a large number of mutual funds in your portfolio is to balancing the portfolio risk because different funds have different risk profiles. While large cap mutual funds are less risky than midcap mutual funds, investors also like the high returns which midcap mutual funds provide in favorable market conditions. Finally, if you have more funds in your portfolio, it takes more time to monitor and manage your portfolio.

Diversified multi-cap equity mutual funds combine the best qualities of large and midcap mutual funds – they can limit downside risks in volatile markets and at the same time, give superior returns compared to large cap funds in the long term. Investors should, however, note that multi-cap funds have a higher risk profile than large cap funds and therefore, you should have moderately aggressive to aggressive risk capacities when you invest in multi-cap mutual funds. In this post, we will review a top performing multi-cap fund from the Aditya Birla Sun Life stable, Aditya Birla Sun Life Equity Fund.

As mentioned regularly in our blog, we think that, performance consistency is one the most significant attributes of a good mutual fund scheme – a scheme that has performed consistently in the past, is more likely to the perform well in the future too. In Advisorkhoj, we have a built a tool, which identifies the most consistent mutual funds in different product categories. To identify most consistent performers in a particular category, we have looked at annual quartile ranking of mutual funds over the last 5 years and assigned consistency scores to funds based on the quartile ranks. Funds which have been consistently in the top 2 quartiles have got the highest consistency scores. Funds, whose performances were in the lower quartiles,in any year in the last 5 years, get lower consistency scores. In the last 4 years, Aditya Birla Sun Life Equity Fund ranked in the top two performance quartiles in 3 years out of.

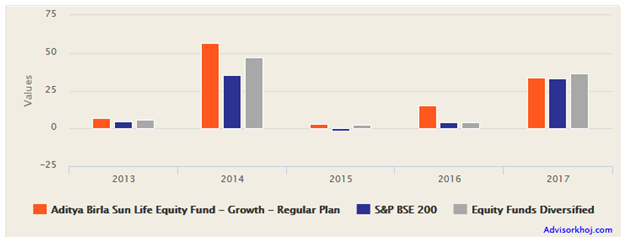

The fund gave a whopping 21.5% trailing CAGR return in the last 5 year period ending September 29, 2017. The chart below shows the annual returns of the fund over the last 5 years.

Source: Advisorkhoj Research

Aditya Birla Sun Life Equity Fund was launched in 1998 and has given more than 24% CAGR returns since inception. The fund has Rs 8,500 crores of Assets under Management and the expense ratio of the fund is 2.22%. The chart below shows the NAV movement of the fund over the last 5 years.

Source: Advisorkhoj Research

Anil Shah is the fund manager of this scheme since 2012. The chart below shows the performance of the scheme versus the benchmark since Mr Shah took over the management of the scheme.

Portfolio Construction

As per the mandate of the fund, fund manager invests in the large, mid and small-cap companies. In fact, this freedom to invest across market segment is one of the advantages of these funds. And this is where this fund works like a football team, where you have attacking players, defensive players and midfield players (who contribute in both offense and defense). Depending on the conditions of the game and the strategy, the managers would decide whether to use more defenders to play a defensive game to get a good result in difficult conditions or use offensive players to get the best results when the conditions are favorable.

Like the coach of a football team, the fund manager of Aditya Birla Sun Life Equity Fund also uses these different market cap categories as different types of players in different conditions. If he feels, small and midcap stocks are poised for big times, he would decide to buy them more and play an attacking game. Similarly, if he feels that the valuations in small-cap and midcap stocks are expensive and the risky game is not going to pay off, he would deploy the less risky stocks – large-cap stocks and play a defensive game. The charts below show the top sector and stock concentrations of Aditya Birla Sun Life Equity Fund.

Source: Advisorkhoj Research

SIP and Lump Sum returns of Aditya Birla Sun Life Equity Fund

The chart below shows the growth of Rs 5,000 monthly SIP in Birla Sun Life Equity Fund over the last 5 years (period ending September 30, 2017).

Source: Advisorkhoj Research

You can see that, with a cumulative investment of Rs 3 Lakhs, you could have made a profit of nearly Rs 2.3 Lakhs in the last 5 years.

The chart below shows the growth of Rs 1 Lakh lump sum investment in Aditya Birla Sun Life Equity Fund in the last 5 years (period ending September 30, 2017).

Dividend Track Record

Aditya Birla Sun Life Equity Fund has an excellent dividend pay-out track record. The fund has paid dividends every year since 2000, except in 2008.

Conclusion

Within a year’s time, Aditya Birla Sun Life Equity Fund will celebrate its 20th anniversary. The fund has a strong wealth creation track record. Diversified equity multi-cap funds are suitable for a long term investment objectives like retirement planning, children’s education and marriage, wealth creation etc. These funds can be volatile in the short term and therefore, investors need to have a high risk appetite. However, in the long term, the effect of volatility is relatively small and the investors benefit through the power of compounding and hence, good diversified equity multi-cap funds like Aditya Birla Sun Life Equity Fund are ideal for wealth creation and other long term financial objectives. Investors should discuss with their financial advisors if Aditya Birla Sun Life Equity Fund is suitable for their long term investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

HDFC Mutual Fund launches HDFC CRISIL IBX Financial Services 3 to 6 Months Debt Index Fund

Apr 28, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Silver ETF Fund of Fund

Apr 28, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team