6 guidelines to select the right Mutual Fund for you

How do you select mutual fund schemes for your investments? Most investors only check past performance. While returns are an important consideration for investing in mutual funds, there are other important factors you need to keep in mind to achieve your investment objectives. In this article, we will discuss six such aspects of investing that have been highlighted by Nippon India Mutual Fund’s recent investor education campaign.

What are the six pillars of investing?

- Consistency over spurts

- Importance of a Strong Investment Process

- Risk Management in Mutual Funds

- What’s your Goal?

- Hassle-free investment experience is important

- Ethical Investing

Let us discuss each of these pillars of investing.

- Consistency over spurts

Because investors get impressed by recent results, some investment managers tend to choose short term themes which give transient returns but may not be in the long-term interest of the investors.

You should choose an asset manager that believes in consistent long-term results rather than short-term bursts of overperformance. But how to check this? One way to see if returns are consistent is to compare with the benchmark over time (see the chart below). A fund may have delivered consistent returns for one or two years but not have performed well over five or ten years. You should compare a fund’s performance versus a benchmark over sufficiently long investment periods. Which funds can deliver more consistent returns? A mutual fund with strong processes and risk management is more likely to deliver consistent returns.

Source: Advisorkhoj Research, Disclaimer: These schemes are only an example.

You may like to read: How does one select a good Mutual Fund - Importance of a Strong Investment Process

Investors often get attracted to schemes with great short-term performance or those run by a star Fund Manager and/or Fund House. Run by star fund managers. But what is also true is that people managing the fund can change; they can have an off day, and they can be biased towards a particular theme while making decisions. Your fund may give a superlative performance in a bull market, making the fund manager look very impressive for a few quarters. Fund management is both an art and a science. The art part relates to people i.e. the fund manager, and the science part refers to the processes involved. While people and processes are important, people must work within the process framework to avoid human biases and errors. The fund manager’s objective is to beat the market benchmark returns and create alpha for investors. The fund manager achieves this by allocating funds within the broader framework set by the fund house. Funds driven by strong processes are less likely to witness extreme variations in returns.

Source: Advisorkhoj Research, These schemes are taken as an example only.

- Risk Management in Mutual Funds

Risk and returns are interrelated in investments. Higher returns often come with higher risks. Risk management is, therefore, a critical element in managing performance and providing a good investment experience to the customer. There are different kinds of risk in mutual funds, such as Market risk, Concentration risk, Credit risk, Interest rate risk, and Inflation risk.

The right kind of risk management process helps mitigate it and facilitates the team to take the right kind of risks. A mutual fund with a strong risk management framework is more likely to generate consistent returns. - What’s your Goal?

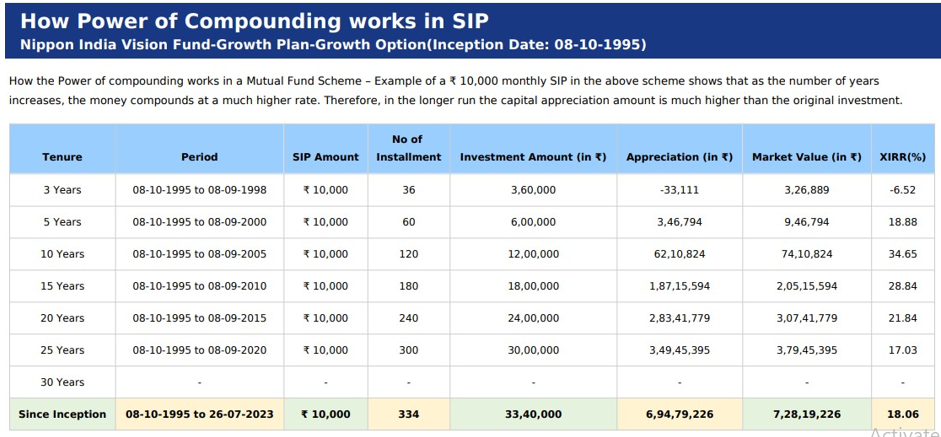

In mutual funds growth options, the profits made by the scheme are re-invested in the scheme. Over long investment horizons, the re-invested profits can be much larger than your initial investment. Your investment can grow exponentially over long investment tenures due to the power of compounding. However, many investors are unable to get the benefits of compounding due to a lack of discipline e.g. getting influenced by market movements, being unable to control expenses etc. How to remain disciplined in investing? The answer is goal-based investment. One is more like to stay invested when the investments are tied to a goal. Hence as an astute investor, you should link your investments to a financial goal and keep investing in a disciplined way until it is time for the goal to be achieved. This will help you stay focused on the goal without being impacted by market volatility or other distractions.

Source: Advisorkhoj Research. This is for illustration purposes only.

You may like to read: How passive investing makes a lot of sense for long term SIP investor - Hassle-free investment experience

The main purpose of mutual fund investments is to get returns in capital appreciation or income. That said, your investment experience is also important. Making mutual fund investments should not be stressful or troublesome. Before selecting a fund, you should get the following information from your friends or your mutual fund distributor about the fund house.

- If you are new to mutual funds, you must complete your KYC. Try to get information on the KYC process (online or offline) of the fund house or the registrar and transfer agent (RTA)

- How smooth is the onboarding process with the fund house as a customer?

- Does the fund house address queries, complaints, etc., promptly?

- How responsive is the customer service team of the fund house or RTA to various service requests, e.g. bank change, address change, phone number/email address change etc.

- Will the fund house send you regular updates about your investments, market etc?

These aspects, when taken care, helps an investor stay focused towards achieving their financial goals. - Ethical investing

Global sustainability challenges such as flood risk, ozone layer depletion, rising sea water levels, extreme weather, forest wildfires, clean water crises etc., are new risk factors that investors may have yet to consider. How companies treat their customers and employees are also new risk factors that investors should consider. ESG is the acronym for environmental, social and corporate governance. In investments, ESG refers to the impact of these three factors viz. environmental, social and corporate governance, on the sustainability of a company’s financial performance. By investing in ESG companies, you are not only doing your bit for our planet and future generations, but you can also get potential superior risk-adjusted returns.

Conclusion

In this article, we have discussed Nippon India Mutual Fund’s 6 pillars of investing framework for making mutual fund investments. Along with fund performance, you can use this framework to invest in mutual funds for a better overall investment experience.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV and New Age Automotive ETF FOF

Mar 28, 2025 by Advisorkhoj Team

-

UTI Mutual Fund launches UTI Income Plus Arbitrage Active Fund of Fund

Mar 21, 2025 by Advisorkhoj Team

-

ICICI Prudential Mutual Fund launches ICICI Prudential Nifty EV & New Age Automotive ETF FOF

Mar 21, 2025 by Advisorkhoj Team

-

Angel One Mutual Fund launches Angel One Nifty 1D Rate Liquid ETF Growth

Mar 20, 2025 by Advisorkhoj Team

-

Zerodha Mutual Fund launches Zerodha Overnight Fund

Mar 19, 2025 by Advisorkhoj Team