How Mutual Fund SIPs created wealth in the last 15 years: Diversified Equity Funds

Mutual Fund Systematic Investment Plans or SIPs were introduced in India way back in 1993 by Franklin Templeton Mutual Fund. Since then investing through SIPs have come a long way according to data provided by Association of Mutual Funds in India (AMFI). The current SIP book is around 1.32 Lakhs Crores and the industry is adding around Rs 5,000 Crores per month through SIPs. That means, in another two years we can expect the mutual fund industry SIP book to be doubled.

The data further shows that mutual fund industry added on an average 6.36 Lakh SIP accounts every month during the FY 2016-17. Also, during the same period Rs 43,921 Crores were collected through SIPs.

If you crunch long term industry data of equity mutual fund returns, there is no doubt Mutual Fund SIPs have created immense wealth for the investors who remained invested for the long term. There are a number of advantages of investing through SIPs which we will explore here –

Wide choice of funds

– Mutual funds SIPs offer a wide array of schemes belonging to various categories of funds. You can start a SIP in a fund suiting your risk profile, investment horizon and fund objectives.

No need to time the market

– It is impossible to time the markets as you do not know how it will behave. By investing a fixed amount on a fixed date every month, you are investing at high and low points of the market and thus benefiting from rupee cost averaging.

Flexible investments

– Mutual Fund SIPs are very flexible. There are no restrictions and penalties on regular SIP payments and withdrawals. You can start a SIP with a monthly investment of as low as Rs 500 anytime. Similarly, you can stop the SIPs anytime you wish, in case you do want to continue.

Disciplined approach

– SIPs bring disciplined approach to investing. By investing a fixed amount every month from your investible surpluses you can build a big corpus for the future. Investing in SIPs is habit forming and helps you invest the money which otherwise you would often spent on things that are not required.

Tax efficient

– Investing in equity mutual funds, either through SIP or lump sum is most tax efficient. Long term (investments held for more than one year) capital gains are tax free. Dividends received from equity mutual funds are also tax free. Moreover, SIPs in ELSS Mutual Funds helps you save taxes under Section 80C of The Income Tax Act 1961 (maximum Rs 150,000 per annum).

In this article, we will look at how SIPs in diversified equity funds have created long term wealth for the investors in the last 15 years. In case you want to know why invest in diversified equity funds, we suggest you read this article - Investing in diversified equity funds is a safer option.

For this article, we have selected 10 diversified equity funds that have given the best returns in the 15 years. You can see the full list here. Having selected the above funds, however, we are neither recommending these funds to start new SIPs nor trying to prove a point that these are the best funds. This is just to illustrate you how long term investments in SIPs, have created wealth for the investors and if you have not yet started a SIP for yourself then this is high time you should start one!

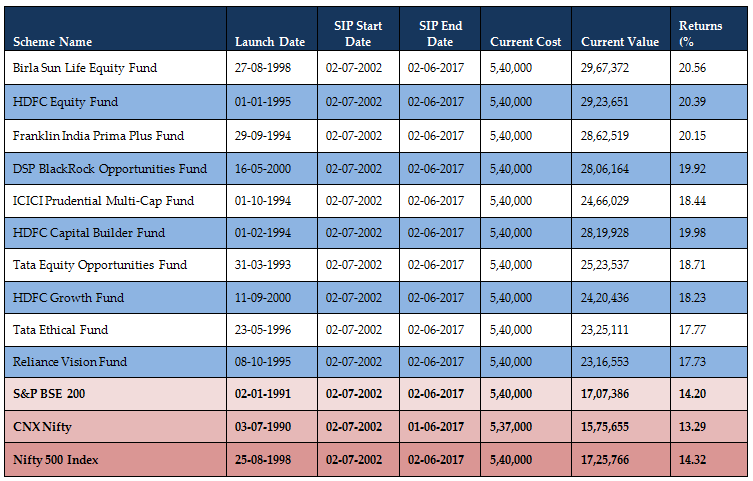

Here is the list of top diversified equity funds which have given the most returns in the last 15 years if one had invested in them through SIPs -

Source: Advisorkhoj SIP returns

Each of the funds in our selection (Regular plan – Growth option) has given SIP returns ranging from 17.50 – 20.50%. Since SIP investments are made over a period of time, the method of calculating SIP returns is different from that of Lump Sum investments. SIP returns are calculated by a methodology called XIRR, which is a variant of Internal Rate of Return (IRR). XIRR is similar to IRR, except that XIRR can calculate returns on investments that are not necessarily strictly periodic.

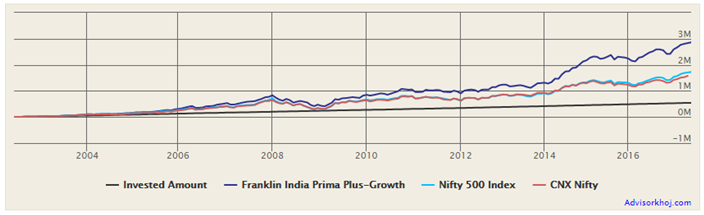

For our examples, we have assumed a monthly SIP of Rs 3000 only, made on 2nd of every month in the funds that we have selected above (based on the returns generated by them). The SIP start date was 15 years back in July 2002. Over this period, the investor would have invested Rs 5.40 lakhs through monthly instalment of Rs 3,000.

As you can see above, the investors would have accumulated Rs 23.16 Lakhs to Rs 29.67 Lakhs against an investment of Rs 5.40 Lakhs only in the last 15 years. These top 10 SIP funds have beaten their respective benchmarks and CNX NIFTY Index with a huge margin. The same amount, i.e. Rs 3,000, if invested in CNX NIFTY would have given you only Rs 15.75 Lakhs against Rs 23.16 Lakhs generated by the 10th fund in the above list! SIPs in these top 10 funds would have given you annualized 3 to 7% more returns than CNX NIFTY, NIFTY 500 Index and S&P BSE 200.

Let us now discuss 5 Funds selected by us in more details –

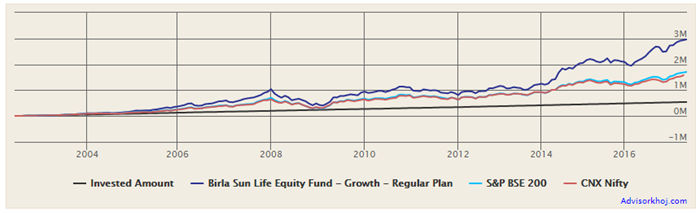

Birla Sun Life Equity Fund:

This is one the top performing funds in the current charts also. Launched in 1998, the fund has an AUM of Rs 5,287 Crores and has given 24.92% annualised returns since launch. The fund is managed by Anil Shah who has chosen financial, Metals, Energy, FMCG and Healthcare as top 5 sectors to invest for this fund.

Source: Advisorkhoj SIP returns

If you had started a monthly SIP of Rs 3000 in Birla Sun Life Equity Fund way back in July 2002, by now you would have accumulated nearly Rs 29.67 lakhs corpus, with an investment of only Rs 5.40 lakhs. Over the 15 year period the compounded annual returns on your SIP investments in this fund would be over 20%.

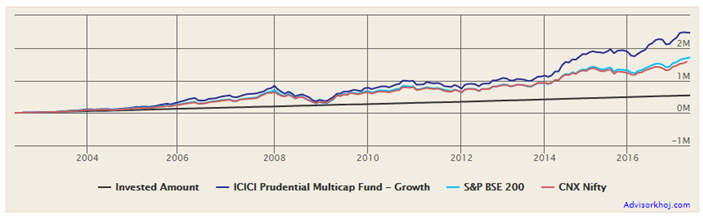

ICICI Prudential Multi-Cap Fund:

This is one of thepopular funds from ICICI Prudential Mutual fund stable. Launched in 1994, the fund has an AUM of Rs 2,668 Crores and has given over 15% annualised returns in the last 22 years. The fund is managed by George Heber Joseph and Atul Patel who have chosen financial, construction, Services, Technology and Healthcare as top 5 sectors to invest for this fund.

Source: Advisorkhoj SIP returns

If you had started a monthly SIP of Rs 3000 in ICICI Prudential Multi-Cap Fund way back in July 2002, by now you would have accumulated nearly Rs 24.66 lakhs corpus, with an investment of only Rs 5.40 lakhs. Over the 15 year period the compounded annual returns on your SIP investments in this fund would be over 18%.

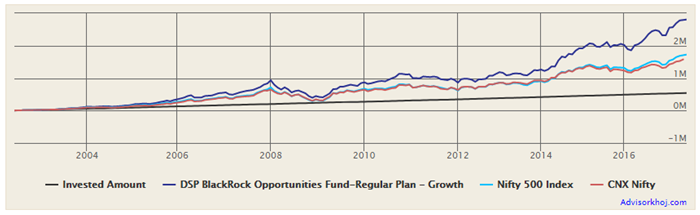

DSP BlackRock Opportunities Fund:

This is one of theTop performing funds from DSP BlackRock Mutual fund stable. Launched in May 2000, the fund has just completed 17 years and has an AUM of Rs 2,344 Crores and has given over 19% annualised returns in the last 17years. The fund is managed by renowned fund manager, Rohit Singhania who has chosen financial, Energy, construction, FMCG and Metals as top 5 sectors to invest for this fund.

Source: Advisorkhoj SIP returns

If you had started a monthly SIP of Rs 3000 in DSP BlackRock Opportunities Fund way back in July 2002, by now you would have accumulated nearly Rs 28.06 lakhs corpus, with an investment of only Rs 5.40 lakhs. Over the 15 year period the compounded annual returns on your SIP investments in this fund would be close to close to 20%.

HDFC Capital Builder Fund:

This is one of the popular funds from HDFC Mutual Fund stable.Launched in Feb 1994, the fund has just completed 23 years and has an AUM of Rs 1,566 Crores and has given around 15% annualised returns since inception. The fund is managed by Miten Lathia, who has chosen financial, Energy, construction, Technology and Healthcare as top 5 sectors to invest for this fund.

Source: Advisorkhoj SIP returns

If you had started a monthly SIP of Rs 3000 in HDFC Capital Builder Fund way back in July 2002, by now you would have accumulated nearly Rs 28.19 lakhs corpus, with an investment of only Rs 5.40 lakhs. Over the 15 year period the compounded annual returns on your SIP investments in this fund would be close to close to 20%.

Franklin India Prima Plus:

This is one of thetop rated and marquee funds in the diversified equity fund category. Launched by Franklin Templeton Mutual Fund way back in 1994, the fund has a long history of consistent performance and has a big AUM of Rs 10,964 Crores. The fund has given over 19% annualised returns since inception. The fund is managed jointly by veteran fund managers, Anand Radhakrishnan and R Janakiraman. The top 5 sectors that the fund has invested in are financial, automobile, construction, Technology, GMCG and Healthcare.

Source: Advisorkhoj SIP returns

If you had started a monthly SIP of Rs 3000 in Franklin India Prima Plus way back in July 2002, by now you would have accumulated nearly Rs 28.63 lakhs corpus, with an investment of only Rs 5.40 lakhs. Over the 15 year period the compounded annual returns on your SIP investments in this fund would be over 20%.

Rolling returns of the 5 diversified equity Funds

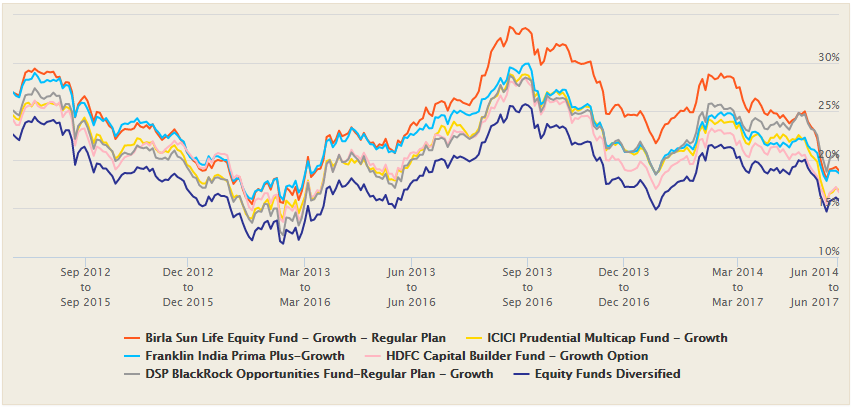

So far we have seen how Diversified equity funds have created wealth for investors in the last 15 years. We have also seen how the 5 funds, from 5 different fund houses, analysed by us were true wealth creators. Let us now see how these 5 funds are doing now?

Source: Advisorkhoj Rollin Return Chart

As you can see in the above rolling return chart, all the 5 funds in our selection continue to beat their benchmark returns (the deep blue line) in the last 5 years. We have taken 3 years period for the rolling return as we feel that one should have a minimum 3 years investment horizon if investing in equity mutual funds. Therefore, we can conclude that if you have SIPs in these funds, you should continue with your investments in the long run while reviewing the individual performances at least every 1 or 2 years.

Conclusion

In this article, we have seen how Systematic Investment Plans or SIPs in diversified equity funds have created wealth for the investors who stayed invested in the long termSIPs. SIPs benefit from the power of compounding, and therefore the earlier we start our SIPs and longer we stay invested, the greater is the potential for wealth creation. However, it is important to select good funds for your SIPs. You should consult your financial adviser who can help you select good funds that is suitable according to your risk profile.

You may also refer to Top Consistent Mutual Fund Performers section in our research section of the website wherein we have picked the consistent funds from various categories.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team