Best Small and Midcap Mutual Funds for SIP in the last 5 years

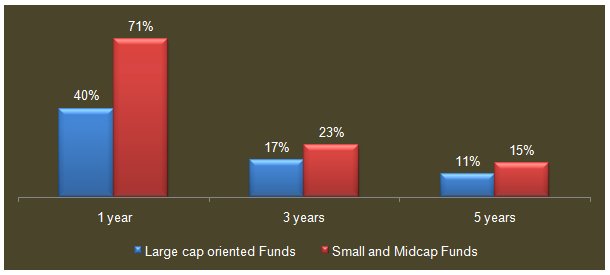

In our previous article, Best Diversified Equity funds for SIP in the last 5 years, we had looked at the top 10 diversified equity funds in terms of 5 year Systematic Investment Plan (SIP) returns. Small and midcap funds are inherently more volatile than large cap oriented funds, but have the potential to provide higher returns in the long term. SIPs take advantage of volatility by averaging out the rupee cost of the units purchased and therefore especially effective for investing in small and midcap funds. Small and midcap funds have outperformed large cap oriented funds in terms of trailing returns over the last 5 year period. See last 1 year, 3 years and 5 years trailing annualized returns for large cap oriented and small & midcap funds in the chart below.

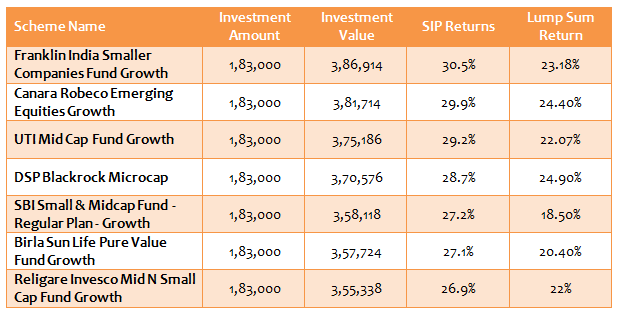

In this article, we will look at the best performing SIPs in small and midcap equity funds in the last five years. For our analysis, we have assumed a monthly SIP amount of र 3,000 made on the 1st of every month. The start date of the SIPs has been assumed to be October 1, 2009. The SIP returns have been calculated as on October 10, 2014. Please note that, for the purpose of our analysis, we have considered regular plans only. We have excluded funds which have an asset base of less than र 100 crores. Here is the list of top 7 small and midcap funds for systematic investment plans, based on the last 5 year SIP returns.

With just a र 3,000 monthly SIP (र 1.8 lacs cumulative over the period) in these small and midcap funds, the investors would have accumulated र 3.6 – 3.9 lacs in the last five years. The SIP returns of these funds are in the range of 27 – 30%. The SIP returns in these funds have beaten the lump sum returns during this period, by taking advantage of the volatility of midcap funds through the mechanism of rupee cost averaging. By investing a fixed amount every month, the SIP investor buys less number of units if the market goes up and more units if the market goes down.

Conclusion

In this article, we have looked at the top 7 small and midcap equity funds in terms of 5 year SIP returns. These SIPs have given very high returns in the range of 27 – 30% SIP returns during this period. Investors should consult with their financial advisors regarding the suitability of these funds for their SIPs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team