Single Premium or Regular Premium Life Insurance Policy: Which is more beneficial for you

There are both advantages and disadvantages associated with buying single premium versus regular premium life insurance policies. In a single premium insurance policy, the entire premium is paid up front, whereas in a regular premium policy, the premium is paid at regular intervals (yearly, half yearly, quarterly etc over the term of the life insurance policy). In this article, we will discuss the various considerations in selecting single premium insurance plans versus regular premium insurance plans.

Affordability:

At the very outset, let us discuss the most important consideration, which is affordability. The premium amount of single premium insurance plan is much larger than regular premium amount. Therefore, you need to evaluate whether you have the funds available to buy a single premium plan. Usually, one opts for single premium insurance plans, if they have lump sum funds from their investments or other sources. On the other hand, payments for regular premium plans are much smaller in amount compared to single premium plans, and are paid from regular savings of the insurance buyer. For example, let us assume that you are 30 years old and want to buy an insurance cover or sum assured of Rs 20 lakhs and a policy term of 20 years. The premium of single premium endowment plan (No. 817) from Life Insurance Corporation of India (LIC) will be Rs 10.35 lakhs. The annual premium of the regular endowment plan (New Endowment Plan, No. 814) from LIC for the same sum assured and policy term will be little over Rs 95,000.Total premium and return on investment over the policy term:

The total premium payable for single premium insurance plan is lower than that of the regular premium plan. The total premium payable is less in a single premium plan because there are no costs associated with discontinuation of premium, renewal commissions & expenses etc for the life insurance company in a single premium plan. The other important reason for the premium to be lower in a single premium plan is the time value of money. Continuing with our above example, the total premium payment for the single premium endowment plan from LIC (for 30 year old insured, Rs 20 lakhs sum assured and 20 year policy term) is Rs 10.35 lakhs. The annual premium of the regular endowment plan is Rs 95,000. Therefore, over the policy term, the total premium payment in the regular plan will be Rs 19 lakhs. This is almost double the amount of the single premium plan. On the face of it the economics of the single premium plan seems very attractive. But is it really that attractive? Let us not forget the time value of money. The annualized return on investment is more appropriate measure for comparing single premium plans and regular premium plans. To calculate the annualized return on investment of both the plans, we need to estimate the maturity amount. We need to make some assumptions here. Let us assume that the bonus rates of both the plans is Rs 40 per thousand of sum assured, based on historical reversionary bonus rates declared by LIC. Let us further assume that the final additional bonus (FAB) is Rs 70 per thousand of sum assured, based on historical FAB rates declared by LIC. Let us now estimate the maturity amount.

Let us now calculate the annualized return on investments in both the plans. Let us start with the single premium endowment plan.![]()

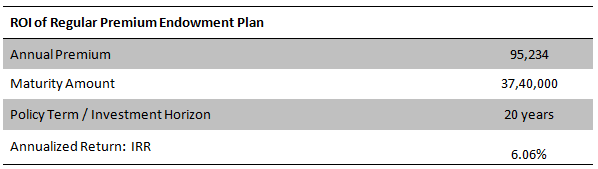

Let us now calculate the annualized return on investment in the regular premium endowment plan. Since the premium is paid at regular intervals through the policy term, we have to use Internal Rate of Return (IRR) to calculate annualized return on investment.![]()

We can see that the return of single premium endowment plan is a little higher (by 0.6%) than the regular premium endowment plan. However, the difference is not as dramatic, as had seemed by just comparing the total premiums payable. Nevertheless, purely from a returns perspective, you should opt for the single premium insurance, if you can afford it.![]()

Convenience:

A single premium life insurance plan eliminates the risk of policy lapsing, if the premiums are not paid within the due date or even the grace period. If your policy lapses, due to non payment of premium, you may have to buy another life insurance policy at a much higher premium. The single premium plan eliminates such hassles. This feature is particularly beneficial if you have a term plan, because in a term plan you have no survival benefit. However, there is a flipside as well. A single premium plan takes away the flexibility benefits of surrendering or discontinuing your policy, since the premium has already paid up-front. The surrender charges in single premium plans are much higher than the regular premium plans.Risk:

If you opt for a non traditional plan, like ULIPs, in a single premium policy, a much larger up-front investment is exposed to market risks. If you are investing in market linked plans or ULIPs through a single premium plan, you should ensure that your risk exposure is consistent with your risk profile. ULIPs are flexible insurance and investment products that allow you to allocate your investment to assets of different risk classes, through the fund switching facility. This facility will help you, align your ULIP investment with your risk profile. Usually though, for a majority of investors who are less active, it is advisable to invest in ULIPs through regular premium plans, as opposed to single premium plan. You should discuss with your financial adviser, if you should invest in ULIPs through single premium plans or regular premium plans.Tax Savings:

Life insurance premiums qualify for tax savings under Section 80C of the Income Tax Act. In a single premium insurance policy, you can avail of 80C benefits only once. However, with a regular premium policy you can avail 80C benefits throughout the policy term. Continuing with our example, if you buy the single premium LIC endowment policy, you will be able to claim Rs 1 lakh of 80C deduction only once. On the other hand, if you go for the regular premium endowment policy, you will be able to claim Rs 95,234 deduction every year till the end of the policy term. If you are in the 30% tax bracket, over the policy term of 20 years, this will result in a tax saving of Rs 5.7 lakhs. This is much higher than the Rs 30,000 tax savings you get by investing in the single premium endowment policy. However, if you have enough 80C tax saving investments apart from your single life insurance policy, like Employee Provident Fund, PPF, ELSS, home loan principal repayment, other life insurance policies etc, to meet your 80C limits, then you will not lose out by opting for single premium endowment policy

Conclusion

In this article, we have discussed advantages and disadvantages associated with buying single premium versus regular premium life insurance policies. Which is more beneficial for you? As discussed in this article, it depends on your personal financial situation. You should consult with your financial or insurance adviser, whether single premium life insurance plan or regular premium life insurance plan is more suitable for you.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team

-

Reciprocal Tariffs: Casting a wider net

Apr 7, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Energy Opportunities Fund

Apr 3, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty 500 Momentum 50 ETF FOF

Apr 3, 2025 by Advisorkhoj Team