How to increase the returns from your Money Back Life Insurance Plans

In our previous article, Choosing between Endowment and Money Back Life Insurance Plans, we had seen that the money back life insurance plans offer very low returns, compared to other investment products. Money back plans return money, usually as a fixed percentage of the sum assured, to the insured during the term of the policy at some regular frequency (e.g. 5 years). The balance sum assured and bonuses are paid on the maturity of the money back policy. They are suitable for those insurance buyers, who need income from their life insurance plans at a regular frequency to meet planned expenditures as per their financial plans. However, instead of using the money back during the policy term for regular or planned expenses, if you re-invest it you can get higher returns from your money back plan. In some cases the returns will be even higher than endowment plans. In this article we will discuss, how.

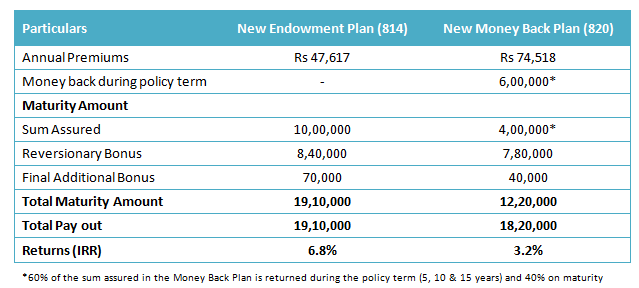

For our analysis, let us revisit the example discussed in our previous article, Choosing between Endowment and Money Back Life Insurance Plans. We had chosen two new plans from LIC, the New Endowment Plan (# 814) and the New 20 year Money Back Plan (# 820). We had assumed that the insured is 30 years old and wants a sum assured of Rs 10 lakhs. The policy term is assumed to be 20 years. Since the New Endowment Plan (812) and the New Money Back Plan (820) are new plans launched by LIC this year, for the purpose of our analysis, we assumed the bonus rates for the New Endowment Plan and the New Money Back Plan to be the same as the other endowment and money back plans of LIC. The 2013 reversionary bonus rates for the LIC endowment and money back plans were Rs 42 and Rs 39 per thousand of sum assured per annum respectively. Final additional bonus for endowment and money back plans was Rs 70 and Rs 40 per thousand of sum assured respectively. The table below shows the maturity amounts, the total payouts and returns of the New Endowment and Money Back Plans.

The return from the money back plan is lower than the return from the Endowment Plan. The reason for lower returns is as follows:-

- The premium of the money back plan is much higher than the endowment plan

- The bonus of the money back plan is lower than the bonus of the endowment plan

- The money back during the policy term is used for regular consumption or some planned expenditures. It does not earn returns

Now, if instead of using the money back during the policy term for regular consumption or planned expenditures, you re-invest fixed income or equity investment, you have the potential of earning higher returns. We will examine three re-investment options, debt / fixed income, hybrid and equity for the money back during the policy term and estimate the returns.

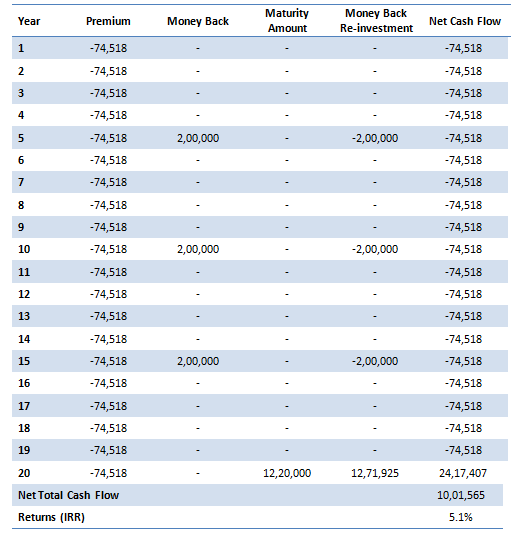

Re-investment of money back in fixed income or debt investments

For the re-investment of Rs 2 lakhs money back each in years 5 and 10, we have chosen tax free infrastructure bonds. These tax free bonds are currently offering coupons of 8 – 9% (please refer to our article, Tax Free Bonds: A smart option to lock in higher post tax yields. For our analysis we have assumed yield of 8%. Since the minimum maturity of tax free bonds is 10 years, for the money back received in year 15, we chosen an FD with 8% interest rate. The FD income however, is taxable.

The re-investment of money back is virtually risk free, because the tax free bonds are backed by the Government and have excellent credit ratings. The return from the money back plan with re-investment is 5.1%. This is certainly higher than the return from the money back plan without reinvestment. But how does it compare with the return from the endowment plan? The return from the endowment plan, in the above example is 6.8% versus 5.1% from the money back plan with re-investment in fixed income. Therefore, you are still better off with an endowment plan compared money back plan with re-investment in fixed income. What if you got better higher yields from the fixed income re-investment? Even with a yield of 10%, which is difficult to get, endowment plan is a better option.

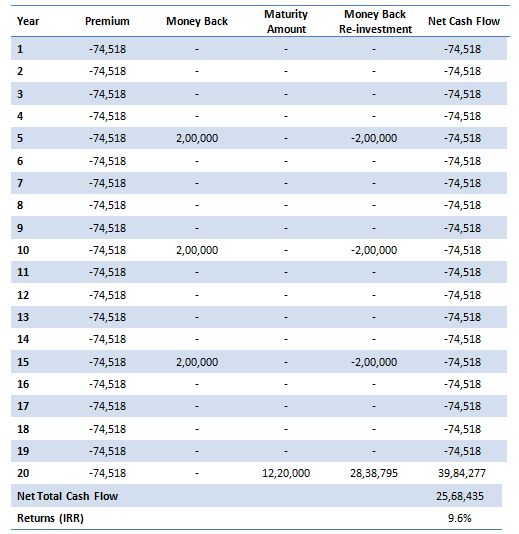

Re-investment of money back in hybrid investments like balanced funds

In this strategy, we have chosen top performing balanced funds for the re-investment of Rs 2 lakhs money back each in years 5, 10 and 15. Balanced funds are hybrid debt and equity funds, with 60 – 70% of the portfolio invested in equities and the rest in fixed income securities, which reduces the overall portfolio risk considerably. On a risk adjusted basis top performing balanced funds have delivered excellent historical returns in excess of 15% (please refer to our article, Is Balanced Funds an alternative to Equity Mutual funds). Let us assume we will get 15% return on our re-investment.

We can see that the return from the money back plan with re-investment in good balanced funds is much higher at 9.6%. With this strategy you can beat the return from endowment plan. But it is important to select a top performing balanced fund to get maximum returns.

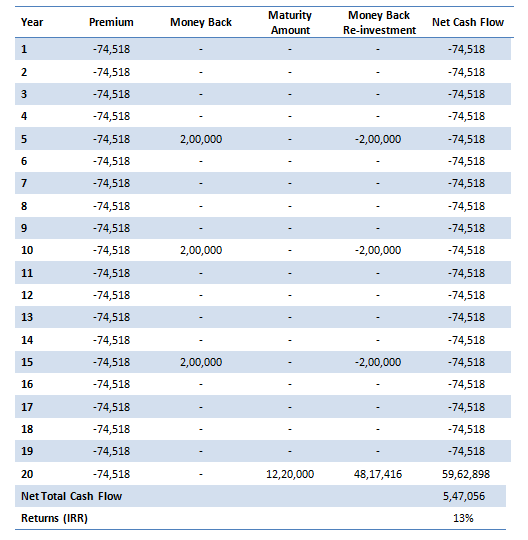

Re-investment of money back in high quality diversified equity fund

In this strategy, we have chosen high quality diversified equity funds for the re-investment of Rs 2 lakhs money back each in years 5, 10 and 15. Top performing diversified equity funds have given long term returns, well in excess of 20%. Let us assume we will get 20% return on our re-investment.

We can see that the return from the money back plan with re-investment in high quality diversified equity funds is much higher at 13%. Please refer to our article, Consistent Performers: Top 10 consistent performers in equity funds (Part 1 of 1), for examples top consistent diversified equity funds as per CRISIL’s latest ranking. We should reiterate that, equity oriented mutual funds are subject to market risks.

Conclusion

In this article, we have seen that by re-investing the money back received during the policy term we can earn higher returns from money back plans. The returns increase with risk. Clearly defining financial investment objectives and creating a financial plan to meet those objectives is always helpful before making a decision on insurance and investment plans.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team