Principal Large Cap Fund: 10 years of solid performance from this top rated mutual fund

Principal Large Cap Fund recently completed 10 years. If you invested र 1 lac in the Principal Large Cap fund growth option in its NFO, your investment would have grown nearly to र 4.5 lacs by November 13, 2015. Since inception the fund gave a compounded annual return of 16.2%, which is a very strong performance by any standard by this mutual fund scheme. The chart below shows the 3 year rolling returns of the fund since inception. Rolling returns are the absolute returns of the scheme taken for a specified period on every day/week/month and taken till the last day of the duration. We have chosen 3 years as the rolling returns time period because it is always recommended that long term investors should hold equity funds for at least 3 years. In this chart we are showing returns on every day during the specified period and comparing it with the benchmark. The orange line shows the 3 year rolling returns of Principal Large Cap Fund (Growth Option) and the black line shows the 3 year rolling returns of the benchmark BSE 100.

Source: Advisorkhoj Research

We can see that the fund has consistently given more than 50% absolute 3 year returns (14.5% on an annualized based) since the September – October of 2011 onwards. In fact even with the recent volatility in the market, the 3 year rolling returns are still quite high.

If we compare the annual returns of Principal Large Cap Fund since inception with that of the large cap funds category we will see that the fund has outperformed the category almost every year except the two bear market years in 2008 and 2011. This is another hallmark of a strong performer.

Source: Advisorkhoj Research

Risk and Return

If we look at the risk adjusted returns we can see that, Principal Large Cap Fund scores quite strong versus the large cap funds category. The volatility of the fund measured in terms of standard deviation of monthly returns is lower with respect to that of the category. On the other hand we have seen that the fund has outperformed the category, in terms of 3 year rolling returns. The Sharpe Ratio of the fund at 0.65 is higher than that of the category.

The fund is well diversified in terms of company concentration, with the top 5 stocks accounting for a little over 25% of the portfolio value. Though the fund portfolio has a bias towards cyclical sectors, with banking and financial institutions comprising the largest sector composition in the fund portfolio, it also has substantial allocations to defensive sectors like IT and Pharmaceuticals.

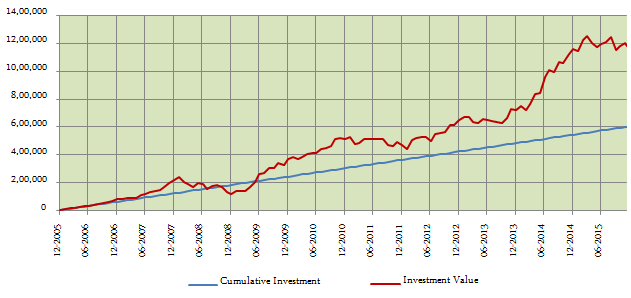

The chart below shows returns of र 5,000 monthly Systematic Investment Plan (SIP) in Principal Large Cap Fund, Growth Option, since inception. The SIP date has been assumed to be the first working day of the month. By investing र 5,000 monthly, the investor would have accumulated nearly र 11.7 lacs with a cumulative investment of र 6 lacs only.

Source: Advisorkhoj Research

Future Outlook

The last one year has not been good for large cap stocks and funds. Returns of large cap funds have been flat to slightly negative over the past one year. Principal Large Cap Fund is also no exception to the market trend. However, the future outlook of the Principal Large Cap Fund appears to be bright. Many market experts are of the opinion that large cap stocks are likely to outperform small and midcap stocks over the next 2 to 3 years. Small and midcap stocks, experts say, have run up quite a lot and the valuation gap does not exist now. As per an Economic Times report a few days back, two years back the average Price Earnings ratio (P/E) of large cap stocks was around 15 while that of midcap stocks was around 10, whereas now average P/E of large cap stocks is around 21 while that of midcap stocks is around 24. On the other hand, there a few market voices, though smaller in numbers, which say that midcaps may continue to outperform large cap stocks over the next 12 to 15 months. Their outlook is based on the fact that, even though the market has been exceptionally volatile this year, the midcap stocks have not corrected sharply during declines and have bounced back quicker whenever the market rallied from the lows. We must factor in both these viewpoints and continue to have allocation to midcap funds as well. However, purely based on valuation fundamentals, it appears that large cap funds may outperform midcap funds over the medium term. From a portfolio construction perspective, Principal Large Cap Fund has around 65% of its portfolio invested in the cyclical sectors. While some cyclical sectors like banking and finance have taken a beating over the past one year, these sectors are likely to outperform other sectors, when we see a revival of capex spending and domestic consumption. The trajectory of interest rates in the medium term is also likely to help the cyclical sectors. We are already seeing structural improvements in our macro-economic fundamentals. While that has not translated in corporate earnings growth in a meaningful, market experts are of the view that we are likely see an uptick in the FY 2017. As such, we think that the future outlook of Principal Large Cap Funds is very positive based on the factors discussed above.

Conclusion

Principal Large Cap Fund has completed 10 years of solid performance. Investors can consider Principal Large Cap Fund for investment towards their long term financial goals either through the SIP or lump sum modes. You should consult with your financial advisor, if Principal Large Cap Fund is suitable for your investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team