Reliance Corporate Bond Fund: Nearly double digit returns since the NFO

Credit Opportunities funds, sometimes also known as corporate bond funds, are similar to short term debt funds. While short term debt funds are good investment options over a one to two years investment horizon for conservative investors with little or no interest rate risk, credit opportunities funds lock in a few percentage points of additional yield, again with limited interest rate risk, by investing in slightly lower rated corporate bonds. As such, investors looking for slightly higher returns over a two to three year period can consider credit opportunities funds. Reliance Corporate Bond Fund, a credit opportunities fund, has given nearly double digits, 9.8% returns, since the NFO of the fund nearly 20 months back in 2014. Despite the slightly lower credit rating of the bonds in the credit opportunities fund portfolio compared to a say a short term debt fund portfolio, the overall credit quality of good credit opportunities funds is quite high. In fact, Securities Exchange Board of India has been reviewing and tightening norms of investment in corporate bonds by mutual funds since August 2015, when a particular Asset Management Company (not Reliance Mutual Fund) faced some issues with respect to downgrade of a corporate bond in its portfolio. Reliance Corporate Bond Fund has not been impacted by ratings downgrades that have affected some other debt funds in the past 7 to 8 months. 96% of the fund’s bond portfolio is rated AA and above (with over 84% of the portfolio rated AAA, denoting highest safety). In the last one year, the fund has given 8.1% trailing annualized returns and has beaten the benchmark CRISIL Composite bond index by a comfortable margin.

Reliance Corporate Bond Fund Overview

The scheme was launched in June 2014 and has an AUM of nearly र 1,230 crores. The expense ratio of the fund is 1.58%. The minimum investment in this scheme is र 5,000. Prashant Rimple and Jahnvee Shah are the fund managers of this scheme. In addition to the usual growth and annual dividend options, the scheme also has quarterly dividend option and bonus options.

To understand the risk return characteristics of Reliance Corporate Bond Fund, let us quickly recap two debt fund investment strategies that we have discussed several times earlier in our debt fund blogs.

Debt fund managers employ two different kinds of investment strategy:-

Hold till Maturity:

This is also known as accrual strategy, by which the fund invests in certain types of fixed income securities (or bonds) and hold them till maturity of the bond, earning the interest offered by the bond over the maturity period.Duration Calls:

Using this strategy the fund manager, takes a view on the trajectory of interest rates. Bond prices go up when interest rate falls and declines when interest rate goes up. When interest increases duration call strategy will give a lower return, and when they decrease the same strategy will give higher returns.

Let us understand the risks involved with debt investments. There are, primarily, two kinds of risks associated with debt funds:-

Interest Rate risk:

Interest rate risk has opposite effect on hold to maturity strategy versus duration calls. Typically, a fund manager who employs a hold to maturity strategy will invest in short term bonds. If interest rates go up, the fund manager will be able to lock in higher yields with a hold to maturity strategy in short term bonds. On the other hand, the fund manager taking duration calls will invest in long term bonds because bond prices are inversely related to interest rates. Therefore, accrual based short term debt funds and credit opportunities funds have lower interest rate risks. As such the interest rate risk of Reliance Corporate Bond Fund is limited to a large extent because the average maturity of the bonds in the fund’s portfolio is about 4.3 years, which while being slightly higher than average maturities for credit opportunities funds’ portfolios, is much lower than the portfolios of long term debt funds. The chart below shows the rolling returns of the Reliance Corporate Bond Fund (Growth Option) versus the benchmark CRISIL Composite bond index. Rolling returns are the returns of the scheme taken for a specified period on every day. In this chart we are showing returns on every day since the inception of the fund and comparing it with the benchmark. Rolling returns is the best measure of a fund's performance. Trailing returns have a recency bias and point to point returns are specific to the period in consideration. Rolling returns, on the other hand, measures the fund's absolute and relative performance across all timescales, without bias. The orange line shows the annual rolling returns of Reliance Corporate Bond Fund and the black line shows the annual rolling returns of the benchmark CRISIL Composite bond index.

![Income Funds - The rolling returns of the Reliance Corporate Bond Fund (Growth Option) versus the benchmark CRISIL Composite bond index Income Funds - The rolling returns of the Reliance Corporate Bond Fund (Growth Option) versus the benchmark CRISIL Composite bond index]()

Source: Advisorkhoj Rolling Returns Calculator

You can see that the fund had been giving double digit rolling returns till about October, and the rolling returns of the fund have declined since then. This shows some interest rate sensitivity of the fund, because the bond yields have been creeping up since October, as discussed in our blog post, What debt mutual fund investors should do in 2016. However, you can see that the decline in rolling returns of the fund is lesser than the index, which shows limited interest rate sensitivity of the fund compared to the index. Over a sufficiently long investment of 2 to 3 years, we can see an improvement (decline) in the trajectory of bond yields with the improvement in the macro-economic fundamentals of India and therefore expect good returns from this fundCredit Risk:

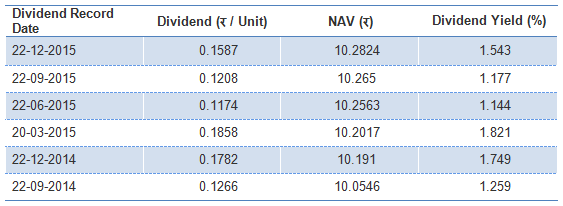

Credit risk is the risk of default by the borrower. In case of debt funds, it is risk of default by the bond issuer, either with respect to interest payment or principal repayment or both. For credit opportunities funds like Reliance Corporate Bond Fund credit risk is an important factor. We should understand how credit risk works in terms of risk and return. Credit rating agencies like CRISIL and ICRA in India rate fixed income securities based on their credit risk. Higher the credit rating, lower the yield but the risk is also lower. Let us understand how credit rating scale works. The table below describes the credit rating scale used by CRISIL to rate debt securities.

![Income Funds - Describes the credit rating scale used by CRISIL to rate debt securities Income Funds - Describes the credit rating scale used by CRISIL to rate debt securities]()

We should understand that, just because a bond’s credit rating is not AAA, it does not mean that it will default in interest or principal re-payment. AA rated bonds also offer high capital safety while giving a higher yield or interest. We should understand that credit risk should not be a concern for the investors in Reliance Corporate Bond Fund, since the 96% of the portfolio is invested in AAA or AA rated papers denoting high credit quality.

Yield to Maturity Reliance Corporate Bond Fund

Yield to maturity (YTM) is the return which the debt fund will get by holding the securities in its portfolio to maturity. The YTM of the fund portfolio is 10% and the modified duration is 3 years. This implies that if there are no changes to the fund portfolio, it can give a return of 10% over the next years before expenses. Investors investing in credit opportunities funds should try to match their investment horizon with the modified duration of the fund portfolio. If there is a big mismatch between the investment horizon of the investor and the modified duration of the fund portfolio, then the return expectation of the investor may not be met.

Outlook for the fund over the next 2 to 3 years

We have discussed a number of factors that will affect debt fund returns over the next year or so in our blog post, What debt mutual fund investors should do in 2016. Overall, many economists and global rating agencies expect the macros of our economy to improve in the next fiscal year and going forward, the current global and domestic risks notwithstanding. Reliance Corporate Bond Fund will benefit from its portfolio strategy and improvement in macro-economic fundamentals in three ways:-

- The high accrual income of the fund, as indicated by the 10% YTM, will enable investors to earn income over the investment horizon.

- When bond yields and interest rates decline, Reliance Corporate Bond Fund investors will benefit by the way of the capital appreciation of the bonds in the fund’s portfolio. When bond yields and interest rates decline bond prices go up. If interest rate goes down by 1%, the returns of the fund may go up by as much as 3%, since the modified duration of the fund portfolio is 3 years. Modified duration measures the sensitivity of a fund to interest rate movements. If the modified duration of a bond is 1, it means that if there is a 1% decrease in interest rates the price of the bond will go up by 1%, over and above the interest paid by the bond.

- As the macro-economic environment improves, some lower rated bonds in the fund’s portfolio may get upgraded. When bonds get upgraded their price goes up, leading to further capital appreciation.

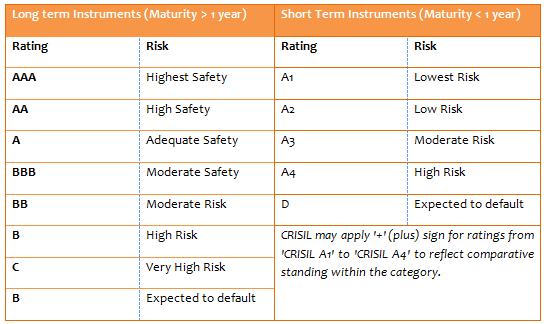

Dividend Pay-out Track Record of Reliance Corporate Bond Fund

Though it has been less than two years since the launch of Reliance Corporate Bond Fund, the fund has had a good quarterly dividend pay-out track record, as shown in the table below.

Conclusion

Reliance Corporate Bond Fund is a good investment option for conservative investors over a 2 to 3 years investment horizon. In light of the recent SEBI norms, investors should monitor the developments in the debt fund space and consult with their financial advisors if Reliance Corporate Bond Fund is best suited for their short and medium term investment needs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty Next 50 Index Fund

Apr 22, 2025 by Advisorkhoj Team

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund