Understanding the post Budget rally: Key domestic economic factors and the 2016 Budget

In our post Understanding the post Budget market rally: Will it be sustainable we discussed several technical factors leading up to the post budget rally and some important levels that investors should keep a watch on. We had mentioned in our post that 7,500 to 7,600 will be an important resistance level for the Nifty. Nifty is currently trading a little above 7,500. In our post Understanding the post Budget rally: How the global factors can impact it we had discussed some important global factors that have shaped equity market movements since the beginning of this year and that these factors will continue to be very important in determining how the markets around the globe, including India, performs over the next few months. We had discussed that investors should track crude oil prices and the US economic outlook because we believe that these two factors will be more important than other factors as far as risk sentiments in the equity markets are concerned. In the final part of this series, we will discuss key domestic factors that led to India underperforming relative to other markets. We will also discuss the 2016 Budget to understand its potential impact on the economy and the stock market.

India was the one of the worst performing markets in the last one year

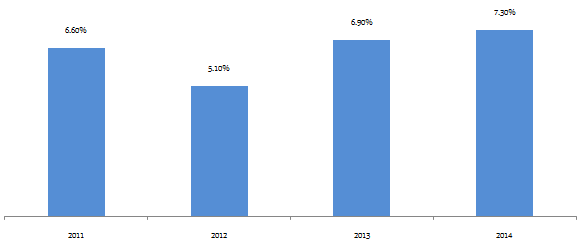

One thing that I observed following the Indian stock market and the investor sentiments over the last 15 years is that, the investor sentiments swing from one extreme to another. While this is to a certain extent true for most equity markets around the world, in India it is more extreme than other markets. In 2014 the Sensex rose by 30% making it one of the best performing markets in the world. Was the 30% increase in Sensex justified by economic fundamentals? The chart below shows the GDP growth rates of India from 2011 to 2014.

Source: World Bank

It is true that the Indian economy grew at a faster pace in 2014 compared to the earlier years, but does that justify a 30% rise in the Sensex? Finance theory tells us that, the price of a stock is a reflection of its future earnings (EPS) growth expectations and not the past performance. You can see that we have highlighted growth expectations, because that is the key in stock prices. In 2014 we had the Lok Sabha elections and the election results were hailed by many market commentators as historic. The market rallied on the expectation that the BJP led NDA government would fast-track reforms and accelerate economic activity. However, was the 30% rally misplaced optimism? To understand this better, let us look at P/E ratio of the Nifty over the last few years. The bar chart shows the P/E ratios of Nifty on December 31 of each from 2010 to 2014.

Source: National Stock Exchange

P/E ratio of a stock in simple terms is how much price you are willing to pay to buy र 1 of EPS of the stock. A P/E ratio of 20 implies that you are willing to र 20 to buy र 1 of EPS of the stock. In other words, a high P/E ratio means that you expect earnings to grow at a fast rate. We will not discuss at what P/E ratio is the market overvalued and what ratio it is undervalued, because there are multiple views on this topic especially in an emerging economy like India. However, it is clear that if the P/E ratio expands, it means that the investors are expecting faster earnings growth. Between 2013 and 2014 the P/E ratio of Nifty expanded by more than 13%. Therefore, it implies that investors were expecting to grow at a much faster rate than the previous years. It is reasonable to expect earnings growth to pick up in the future, but is it reasonable to expect for earnings to grow at more than 20% any time in the near future? Nifty EPS for FY 2015 - 2016 is expected to grow in single digits only. In fact the last quarterly results were awful, to say the least. Earnings fell on a year on year basis in Q3 FY 2016. Disappointing corporate earnings coupled with weak global sentiments caused the Nifty to fall by more than 20% from its 52 week high. India was one the worst performing equity markets in 2015. Was the 20% fall in 2015 - 2016, an over-reaction just like the 30% rally in 2014? As discussed earlier, the investor sentiments swing from one extreme to another in India.

Corporate Earnings will be key to the revival of equity market in India

The corporate earnings story in India in FY 2015 - 2016 has to be understood in the macroeconomic context. We saw that India’s GDP grew at 7.3% in FY 2014 – 2015. GDP growth is expected to accelerate to 7.6% in FY 2015 - 2016. CPI inflation declined to 5.4%. The RBI cut interest rates by 125 basis points in 2015. The government spent large sums on money on infrastructure development. Despite all the positives, the market was more than 20% down on a year on year basis going into the Budget day. While global factors were largely responsible for the decline in our stock market, weak corporate earnings also had an important role in the decline. If the increase in Government spending and lower inflation does not lead to increase in corporate revenues and profits, we will not see the market going back to its all time high. The earnings outlook in FY 2016 – 2017 does not look very optimistic. Many brokerage houses have downgraded FY 2016 – 2017 earnings growth estimates to single digits. Investors should therefore closely watch the Q4 results in April.

Impact of the Budget

There are multiple views on the Budget. Some commentators have said that this Budget reminded them of the Budgets in the UPA days. Others have hailed this is a very good budget, one that addresses the most important issues that the country is facing. While there are positives and negatives in all Budgets, the fact is that the market rebounded 10% from the 52 week intraday low after the Budget. While positive global cues helped the markets, the Budget also had a role to play. We will not get into a detailed discussion on the budget in this post. We will only stick to the most important points of the budget as it relates to the market.

In our opinion, the single most important point in the Budget that helped the market was that the Government stuck to its fiscal deficit target for FY 2016 - 2017. Though the Finance Minister spent only a few minutes in his hours long Budget speech on the fiscal deficit target, this was viewed as a huge positive by investors, especially foreign institutional investors (FIIs). In months leading to the Budget, there was an expectation among many investors that the Government would relax the fiscal deficit target for FY 2016 – 2017 to boost economic growth and also higher government expenditure related to the implementation of the 7th Central Pay Commission and the One Rank One Pension recommendations. Let us understand why fiscal deficit is so important. Fiscal deficit means that government spends more than it earns. How does it spend more than it earns? It does so by borrowing money from the public. When the Government borrows more money it has to pay higher interest rates. Therefore, the interest rates in the economy go up. Higher interest rates have a negative impact on the corporate sector. As their borrowing costs go up, companies borrow less and therefore they postpone capex spending or spend less. Home loan interest rates increase and therefore there is less demand for homes. Higher fiscal deficit and interest rates have an impact on exchange rate. Foreign investors are attracted by the higher interest rates offered by the Government and therefore they buy Government bonds. This can cause the Rupee to appreciate and make our exports less attractive. Overall, high interest rates are not good for the economy in the long term. The alternative view is that, higher fiscal deficit allows the Government to spend more. Increased government spending can attract higher private spending, which in turn can boost economic growth. The George W Bush administration allowed the US fiscal deficit to increase from 1.4% in 2001 to 5.3% in 2004. The expansionary fiscal policy of the Bush administration had a good affect on the US economy, as private spending also increased and the stock market grew at a rapid pace from 2002 to 2006. However, the theory that increased Government spending leads to higher private spending does not always hold true. In fact in FY 2014 - 2015 the Indian Government spent a lot of money on infrastructure development but it did not attract corporate investments.

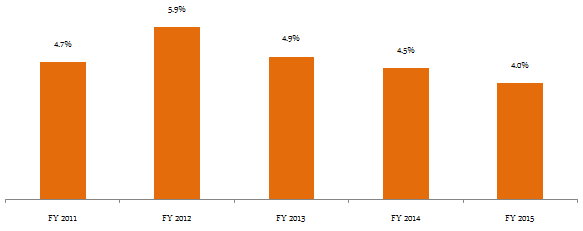

India had embarked on the course of fiscal consolidation even before the NDA Government took office in 2014. The chart below shows the fiscal deficit of India as a percentage of GDP from FY 2011 to FY 2015.

Source: Reserve Bank of India

You can see that the fiscal deficit has been reducing as a percentage of GDP since FY 2012 – 2013. As per the fiscal consolidation the fiscal deficit target for FY 2016 – 2017 was set at 3.5% of the GDP. The fact that the Finance Minister has stuck to the target, shows the Government’s belief in the strength of the Indian economy and also commitment to fiscal discipline. Investors also believe that by sticking to the fiscal consolidation roadmap, the Government has created room for the Reserve Bank of India to cut interest rates in FY 2017. Fiscal policy has an impact on monetary policy. Higher Government spending means increased supply of money in the economy, which in turn means that inflation will go up. On the other hand, reducing fiscal deficit means tightening money supply which can then incentivize the Reserve Bank of India to increase money supply by reducing interest rates without impacting inflation. Lower interest rates will incentivize more demand for loans and boost economic growth. Some economists are expecting 50 basis points reduction in the repo rates by the RBI in FY 2017. The Government’s commitment to fiscal discipline and the room for RBI to loosen monetary policy are both viewed very positively by the rating agencies and foreign investors. In fact, post the Budget we have seen good delivery based buying in the stock market by the Foreign Institutional Investors, reversing their earlier trend.

The other big positives coming out of the Budget were results of fear mongering by bears before the Budget being unfounded. There were rumours in the market before the Budget that, the holding period for long terms capital gains for equities would be increased from 1 year to 3 years and that the service tax would be increased from 14% to 18%. The Finance Minister did nothing of that sort. The Finance Minister announced a number of tax proposals. Some were positive, especially for tax payers in the lower income categories and first time home buyers, while others were negative, e.g. for the Automotive sector. While a lot of discussions have taken place in the media on the tax proposals, the fact is that, the market was not expecting much in terms of lower taxes anyways given the fiscal challenges which the Government faces.

One criticism of the Budget by some commentators is that, this Budget looks a lot like the UPA-2 Budgets. They say that, the Government missed out a big opportunity to announce big bang reforms, especially in a year, when the BJP does not have much at stake as far as state elections are concerned. I think that, this criticism may be partially justified but one also has to understand the economic situation in the country, especially the rural sector, when the Finance Minister rose to make his Budget speech. The agricultural sector is facing a crisis like situation, after two back to back years of deficit monsoon. The distress which the Indian farmer faces and instances of farmer suicides was something the Government simply could not to ignore. Therefore something had to be done and was done. The substantially higher budgetary allocations to the rural sector and the possibility of a good monsoon after 2 bad years can go a long way in reviving our rural economy and increase in rural consumption demand. Many brokerage houses are recommending stocks related to rural sector and rural consumption to their clients.

One apparently valid criticism of the Budget is that, the Government has not done much for the stressed assets situation in the banking industry, especially the public sector banks. Many market experts think that the र 25,000 crores in the Budget for public sector banks is too little, given the size of the stressed asset problem. The Finance Minister did say that, if more money is required, he will find it and give it to public sector banks. The bigger issue is that, do we know how big the NPA problem is. Every quarterly results show that the NPA problem is worsening. We hear that the size of bad loans is nearly र 2.5 lakh crores. NPA is something investors should watch out for in quarterly results over the coming months and quarters.

As far as local factors are concerned, investors should keep track of the following this year, to get a sense of the direction of market movement:-

- Corporate Quarterly Results (especially Banks)

- RBI policy announcements and 10 year Government Bond yields

- Monsoon

Conclusion

For the major part of this financial year, bears made money simply by selling on rallies. Over the past week or so, it has been a buy on dips market, rather than sell in rallies. It seems that the bulls have now taken control over the market. We are seeing buying by FIIs also in the past one week. Large cap stocks have outperformed midcap stocks in the post budget rally. This was expected, as discussed many times in our blog. Has the market turned a corner in the last one week or so? For the time being, based on global and Indian markets, both equity and commodities, it seems that the sentiments are no longer as negative as they were one month back. How long will this rally continue? We have discussed various factors in our three part series, Understanding the post Budget market rally: Will it be sustainable, Understanding the post Budget rally: How the global factors can impact it and this post. Investors should track the various factors discussed in these articles to be informed about the future direction of equity market.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Motilal Oswal Mutual Fund launches Motilal Oswal Diversified Equity Flexicap Passive Fund of Funds

Jan 2, 2026 by Advisorkhoj Team

-

Mr. Navneet Munot's 'Person of the Year 2025'

Dec 31, 2025 by HDFC Mutual Fund

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team