Sundaram Rural India Fund: This thematic Mutual Fund aiming good long term returns

This month we are focusing on thematic mutual funds. We have covered top performing banking and infrastructure funds. In this article, we will review Sundaram Rural India Fund, a thematic fund focused on the rural development in India. The fund was launched in 2006 with the objective of generating consistent long term returns by investing in companies benefiting from rural India's transition. We know that the rural economy has always been a priority area for governments both the centre and in the states. It is also a good long term investment theme. India is known to be domestic consumption driven economy and rural consumption will play a very important role in the India growth story since large sections of our population live in the rural areas. As per IMRB, rural consumption grew at a faster pace than urban consumption in the last few years. In 2014 urban consumption growth outpaced rural consumption, however in the first half of 2015 rural consumption again grew faster than urban consumption. In fact from 2010 to 2014, the rural consumption theme played out very well in terms of investment returns. Over this period Sundaram Rural India Fund gave 82% returns. Even in the challenging market conditions of 2015 the fund gave positive returns, when many large cap oriented diversified equity funds gave negative returns. The fund has र 518 crores of assets under management. The expense ratio of the fund is slightly on the higher side at ratio of 2.96%. S. Krishna Kumar and Avinash Agarwal are the fund managers of Sundaram Rural India Fund. CRISIL has assigned Rank 2 (good performer) to this fund. Morningstar has a 4 star rating for this fund.

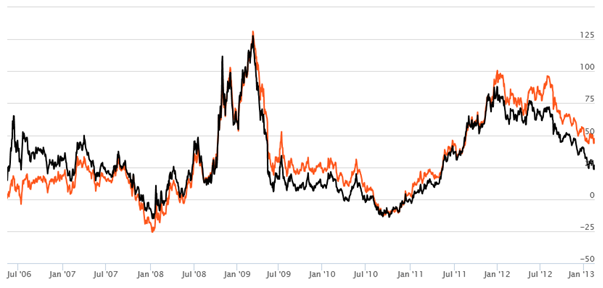

The chart below shows the three year rolling returns of the fund since inception. The orange line shows the next 3 years returns of the Sundaram Rural India Fund at any point of time since inception till date. The black line shows next 3 years returns of the benchmark index BSE – 100. We have chosen a three rolling return period because one should have a long investment horizon for this fund. You can see in the chart below that after an initial period of underperformance, Sundaram Rural India Fund has consistently been outperforming the benchmark from 2009 onwards. Also you can see in the chart below that, except the bear market period of 2011, the performance differential between the fund and the benchmark is fairly stable. This is usually the hallmark of prudent and consistent approach to fund management.

Source: Advisorkhoj Rolling Returns

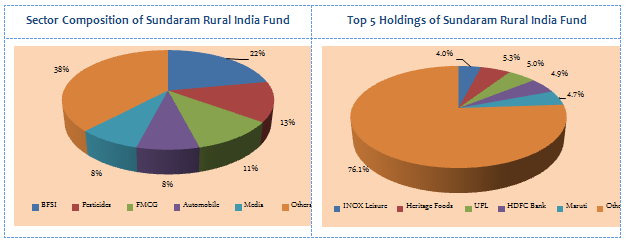

Portfolio Construction of Sundaram Rural India Fund

Some investors have the misconception that consumption is a purely defensive play. The consumption theme is actually broader than just Fast Moving Consumer Goods (FMCG). With improving per capita income and lifestyles, the consumption theme also includes consumer durables, paints, automobiles, entertainment, banking and non-banking financial companies etc. In fact the sector allocation of Sundaram Rural India Fund is biased towards cyclical sectors like banking and finance, pesticides, automobiles, capital goods etc. Rural consumption is a structural story, both in terms of growth and nature, will unfold over the long term and can offer compounding returns to investors. In terms of company concentration the fund is well diversified, when the top 5 holdings, Heritage Foods, United Phosphorus, HDFC Bank, Maruti Suzuki and Inox accounting for 24% of the portfolio value.

Source: Advisorkhoj Research

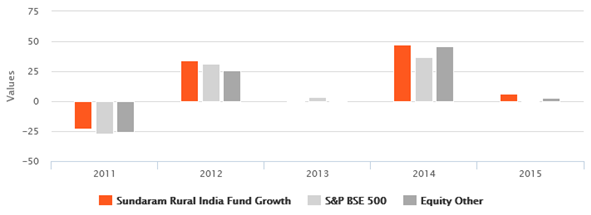

Performance of Sundaram Rural India Fund

The chart below shows the annual returns of Sundaram Rural India Fund over the last 5 years. We can see that the fund outperformed its benchmark and other specialty equity funds on a fairly consistent basis.

Source: Advisorkhoj Research

The chart below shows the NAV movement of Sundaram Rural India Fund versus the benchmark over the last 5 years. The orange line shows the NAV movement of the fund and the gray line shows the NAV movement of the benchmark index, BSE – 500. The blue line below shows the NAV movement of the fund since inception.

Source: Advisorkhoj Research

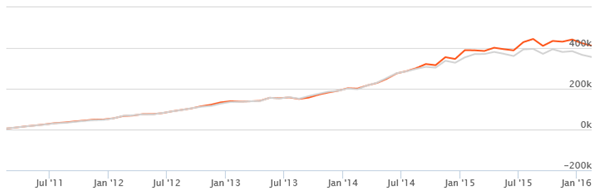

The chart below shows the returns of monthly SIP of र 5,000 in Sundaram Rural India Fund (Growth Option) over the past 5 years. The orange line shows the investment values of the SIP over the past 5 years. With a monthly SIP of र 5,000 in Sundaram Rural India Fund (Growth Option), you could have accumulated a corpus of र 4.1 lacs with an investment of just around र 3 lacs.

Source: Advisorkhoj Research

The chart below shows the growth of र 1 lac lump sum investment in Sundaram Rural India Fund (Growth Option) over the past 5 years.

Source: Advisorkhoj Research

In terms of volatility measures, the annualized standard deviation of the Sundaram Rural India Fund is lower than the average volatilities of the diversified equity funds.

Conclusion

In our earlier articles on thematic funds, we had discussed that these funds should be positioned properly in your investment portfolio. As such, these funds should not form the core of your investment portfolio, but allocation to certain themes can enhance your overall portfolio returns. Investors should also understand that all thematic funds are not the same in terms of risk return characteristics. Some investors have the misconception that all thematic funds are riskier than diversified equity funds. While thematic funds which are focused on only one or two sectors, especially cyclical sectors like banking and finance, are more risky than diversified equity funds, funds which are based on a broader theme may not be riskier than diversified equity fund. In fact, we have discussed that the volatility of the Sundaram Rural India Fund is actually lower than average volatilities of diversified equity funds. The other misconception is that, you have to always time your entry and exit from a thematic fund. Again this is a sweeping generalization and does not apply to all themes. Sundaram Rural India Fund is based on theme of rural development, which is an important component of the long term secular India Growth Story. The rural development theme will both be a driver and a beneficiary of industrial and economic growth of India. As such you should have a long investment horizon for this fund. Investors should consult with their financial advisors if Sundaram Rural India Fund is suitable for their investment portfolios.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team