Canara Robeco Infrastructure Fund: The Best Thematic Infrastructure Mutual Fund

In the bull market years of 2006 and 2007 many investors gravitated to infrastructure mutual funds in the hope of getting extraordinarily high returns in a very short time. In fact, infrastructure funds did give outstanding returns during those years, with some top performing infrastructure funds giving over 100% returns in 2007. However, the financial crisis in 2008 dashed the hopes of many infrastructure fund investors. While almost all equity categories were badly mauled in the financial crisis, infrastructure funds were the worst hit with many funds making losses of 60 – 70%. In 2009 and 2010, these funds again recovered very well and recouped almost all the losses made in 2008. Come 2011 and these funds were again amongst the worst hit. While the Sensex itself fell more than 20%, infrastructure funds as a category made average losses of over 30%. The rough ride for infrastructure funds caused investors to turn away from these funds and financial advisors asking their clients to avoid investing in these funds. Many of these financial advisors had pushed infrastructure funds aggressively in the first place in 2007. In 2012, these funds recovered but again underperformed in 2013. 2014 was a great year for markets overall, but it was particularly good for infrastructure funds. Infrastructure funds as a category gave nearly on an average 60% returns in that year and top performing infrastructure funds like Canara Robeco Infrastructure Fund gave close to 70% returns. 2015 was again a very challenging year for the market and for infrastructure funds as well. We went this bit of history to help you understand the characteristics of infrastructure funds. Infrastructure funds are thematic funds, which imply that they invest in a smaller set of sectors and stocks, as opposed to a diversified equity mutual fund. Therefore, these funds have far greater exposure to sector specific risks compared to diversified equity funds. Further, individual sectors within the infrastructure theme are highly cyclical in nature which means that the impact of an economic downturn is particularly severe on these sectors. On the other hand, infrastructure stocks and funds do exceptionally well during periods of high economic growth.

Should you invest in infrastructure funds?

An article published in The Economist journal in 2014 suggests that the gap in global infrastructure spending was $1 Trillion. By now the gap will surely have widened further, given the weakness in the global economy. If you thought that infrastructure is only an emerging economy problem, you will be surprised to know that even the largest economy in the world, the United States has a huge infrastructure deficit. As far as India is concerned, we know how bad the situation is because all of us face severe infrastructure related problems on a day to day basis. The NDA Government has done some good things on the infrastructure front, particularly railways, roads, ports etc in the last one year, but I think everybody, including the Government, agrees that a lot more could have been done and will have to be done. We know that infrastructure uplift requires a huge amount of political will because it involves very difficult issues. The problems notwithstanding, infrastructure growth is critical for economic growth in our country. Even if we spend a small fraction of the Economist estimate of $1 Trillion global infrastructure gap here in India over the next few years, the impact on revenues, earnings and consequently share prices of the companies in the infrastructure sector will be huge in the long term. The current market correction presents a good opportunity to long term investors who like to time their entry to earn higher returns in infrastructure funds. Share prices of many good companies in the infrastructure sectors like cement, power, transportation etc are trading at 20 to 40% below their 52 week high. Deep market corrections in the past were good opportunities to invest in infrastructure sector. In fact, if you invested र 1 lac in Canara Robeco Infrastructure Fund at the depth of the bear market in 2008, by now (February 9, 2016) your investment value would have been र 3.8 lacs (more than 20% compounded annual returns), despite the bear markets for infrastructure sectors in 2011 and 2015.

Many financial advisors are of the opinion that, investors need to time their entry and exit from sector funds including infrastructure in order to earn good returns. I have a different opinion with respect to infrastructure funds. Firstly, timing entry and exit is easier said than done; even expert investors find it extremely difficult to time the market. The volatility of share prices of infrastructure stocks make timing even more difficult. Secondly, infrastructure spending takes place over a long time period and is invariably, particularly private sector investments, tied to economic growth. Thirdly, if you believe in the India Growth Story, it is not going to happen overnight. Let us understand this with the help of the most illustrious of all examples, China. China’s current problems notwithstanding, it was the fastest growing economy in the world in the last 30 years. Average real GDP growth in China over the last 35 years had been 9.7% per annum. This phenomenal growth was achieved on the back of massive infrastructure spending. China’s infrastructure spending as a percentage of GDP (on an average about 9% of GDP) has historically been one of the highest in the world. While India may not have to follow the China model of economic growth, what we are trying to underscore here is the linkage between infrastructure spending and long term secular economic growth. To get the best returns from their infrastructure fund investments, investors should be prepared for the long haul and not jump ship when they encounter volatility.

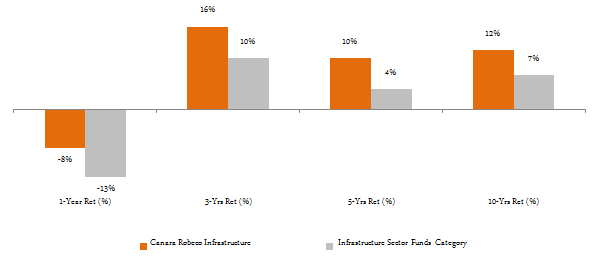

Canara Robeco Infrastructure Fund is the top performing infrastructure fund in the last 3 to five years. CRISIL has assigned Rank 1 to this scheme and Value Research has given this a 5 star rating. The chart below shows the trailing returns of Canara Robeco Infrastructure Fund over various time scales.

Source: Advisorkhoj Research

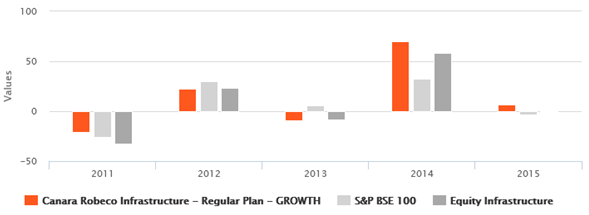

You can see that this fund has outperformed the category across all time-scales. The chart below shows the annual returns of the fund over the last 5 years.

Source: Advisorkhoj Research

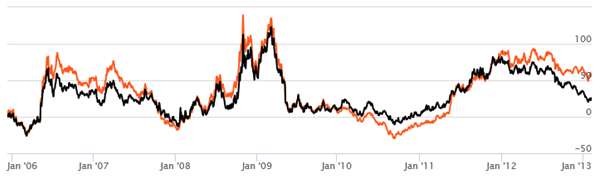

You can see that the fund outperformed the Infrastructure Equity Funds category in both bear markets and bull markets. This is the hallmark of a well managed fund. The chart below shows the 3 year rolling returns of the Canara Robeco Infrastructure Fund since inception. The orange line is the 3 year rolling returns of the scheme while the black line is the 3 year rolling returns of the benchmark BSE 100 index.

Source: Advisorkhoj Research

You can see that the fund outperformed BSE-100 during the bull market years and underperformed during the bear market years. This is to be expected, as discussed before, and therefore, investors should hold this fund over a long investment horizon to get the best returns.

Fund Overview

The scheme was launched in December 2005. It has र 112 crores of assets under management. The expense ratio of the scheme is 2.75%. Yogesh Patil is the fund manager of Canara Robeco Infrastructure Fund. The scheme has given 13% compounded annual returns since inception.

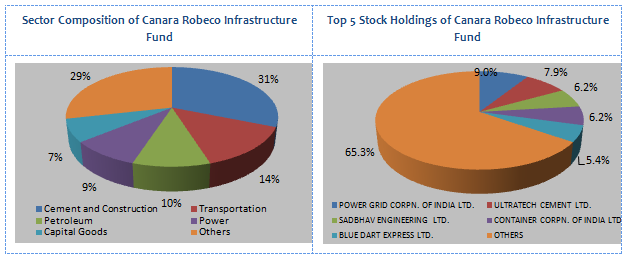

Portfolio construction

Apart from the strong relative outperformance across different market conditions, one of the things we like about this fund is that, the fund manager has stayed true to the infrastructure investing theme. If you look at the portfolios of various infrastructure funds in the market, you will notice that the fund managers of these schemes are quite liberal with respect to their interpretation of infrastructure theme. You will find many infrastructure sector schemes with substantial exposure to banks. While those fund managers can argue that banks with exposure to the infrastructure sector also fall in the category of infrastructure themes, I can on the other hand simply invest in banking funds or diversified equity funds with large allocation to banking and I am sure, I can find many such schemes. Canara Robeco Infrastructure Fund has less than 3% exposure to banking and finance. More than 70% of the fund portfolio is invested in core infrastructure sectors like Cement and Construction, Transportation and Logistics, Oil and Gas, Power, Industrial Capital Goods etc. In terms of company concentration the fund is fairly well diversified with the top 5 holdings accounting for only 35% of the fund portfolio.

Source: Advisorkhoj Research

The other great thing about the fund portfolio is that the fund manager holds nearly 13% of the portfolio value in cash and cash equivalents. Many investors view schemes with higher than normal holding in cash as a reflection of the fund manager’s pessimistic view on the market. But for a thematic infrastructure fund, especially in the volatile market conditions that we are seeing right now, the fund manager can tactically take advantage of price corrections and get excellent returns for investors. So in our view this is a plus for Canara Robeco Infrastructure Fund.

Returns

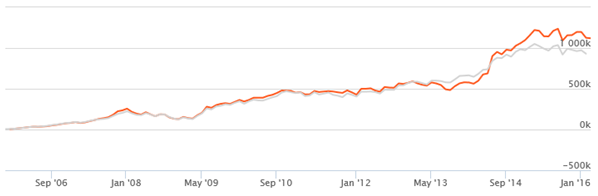

The chart below shows the growth of र 1 lac lump sum investment in the fund during the NFO.

Source: Advisorkhoj Research

Some financial advisors are of the opinion that, lump sum is the best mode of investment for thematic funds, because investment in thematic funds involve market timing. However, the SIP or Systematic Investment Plan performance of Canara Robeco Infrastructure Fund since inception has been quite good. With a र 5000 monthly SIP in the scheme since inception, you could have accumulated र 11.2 lacs, with an investment of just over र 6.1 lacs.

Source: Advisorkhoj Research

Conclusion

Investors should be careful about how they position thematic funds in their investment portfolio. These funds should not form the core of your investment portfolio. However, if you understand the risk return characteristics of thematic infrastructure funds, they can give a booster to your portfolio in terms of returns over a long investment horizon. When selecting thematic infrastructure funds, investors must pay attention to fund manager’s investment style, track record, consistency of performance and their own investment horizon. Investors should consult with their financial advisors if Canara Robeco Infrastructure Fund is suitable for their investment portfolios.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund launches Axis Gold and Silver Passive FOF

Dec 10, 2025 by Advisorkhoj Team

-

Jio BlackRock Mutual Fund launches JioBlackRock Arbitrage Fund

Dec 9, 2025 by Advisorkhoj Team

-

Tata Mutual Fund launches Tata BSE Multicap Consumption 50:30:20 Index Fund

Dec 9, 2025 by Advisorkhoj Team

-

Edelweiss Mutual Fund launches Edelweiss Silver ETF Fund of Fund

Dec 8, 2025 by Advisorkhoj Team

-

Abakkus Mutual Fund launches Abakkus Liquid Fund

Dec 8, 2025 by Advisorkhoj Team