Top 7 Diversified Flexi Cap Mutual Funds in 2015: Part 2

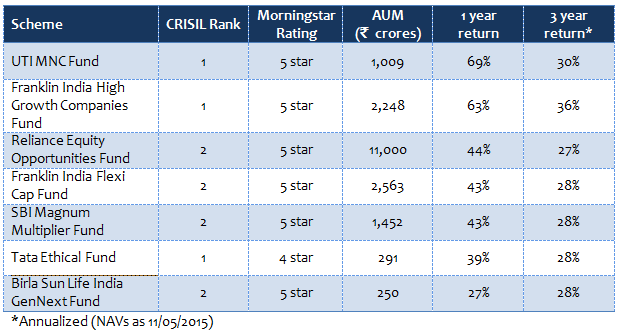

In this two part series, we selected top 7 Flexi Cap Funds based on CRISIL’s mutual fund ranking and Morningstar ratings. Each of these funds has delivered outstanding performance both in the short term and also over a longer time horizon. Each of the 7 Flexi Cap or Multi Cap funds in our selection has been ranked either 1 or 2 by CRISIL and rated either a 5 star or 4 star by Morningstar. In our previous part of this series, Top 7 diversified Flexi Cap Funds in 2015: Part 1 we had reviewed three of the best flexi cap funds, UTI MNC Fund, Franklin India High Growth Companies Fund and Reliance Equity Opportunities Fund. In this part, we will review the other top Flexi Cap funds. To recap, the table below shows the top 7 flexi cap funds from our selection.

Franklin India Flexi Cap Fund

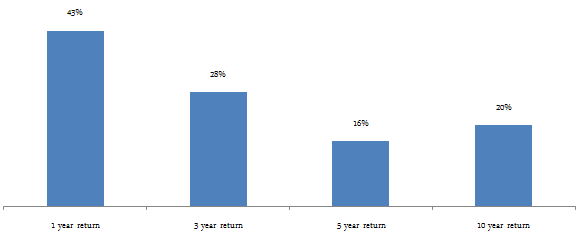

Franklin India Flexi Cap Fund is another very well known fund from the Franklin Templeton stable, with over र 2,500 crores of assets under management. The expense ratio of the fund is 2.3%. The volatility of the fund is on the lower side relative to diversified equity funds in general. The chart below shows the trailing returns of the Franklin India Flexi Cap Fund over 1, 3, 5 and 10 year period.

To get a sense of how this fund has performed across different market cycles, we have compared the annual returns of the fund with CNX 500 index from 2007 to 2014.

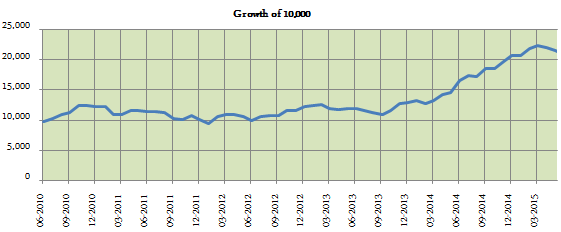

The chart below shows growth of र 10,000 lump sum investment in Franklin India Flexi Cap fund over the last 5 years. र 10,000 invested in the fund five years back would have grown to over र 21,000 (as on 11/5/2015).

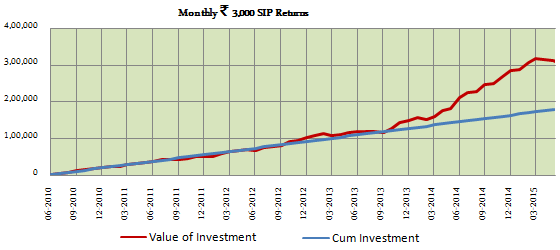

The chart below shows the returns of र 3,000 SIP in Franklin India Flexi Cap fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.1 lacs while the investors would have invested only र 1.8 lacs.

SBI Magnum Multiplier Fund

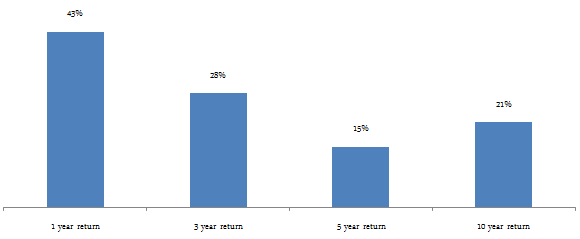

This is one of the oldest mutual fund schemes in the country outside the Unit Trust stable. The fund was launched in 1993 and has over र 1,450 crores of assets under management. The expense ratio of the fund is 2.6%. The volatility of the fund is on the lower side relative to diversified equity funds in general. The chart below shows the trailing returns of the SBI Magnum Multiplier fund over 1, 3, 5 and 10 year period.

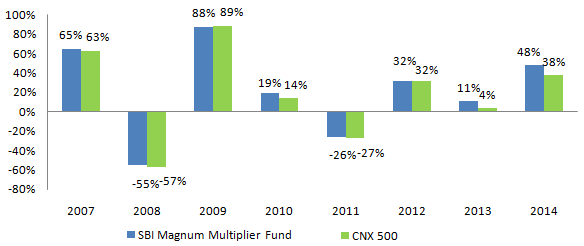

To get a sense of how this fund has performed across different market cycles, we have compared the annual returns of the fund with CNX 500 index from 2007 to 2014.

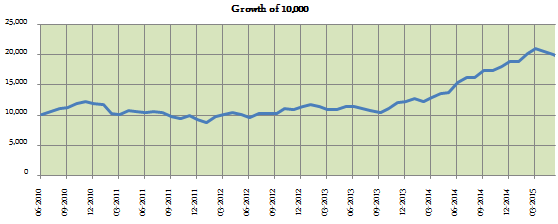

The chart below shows growth of र 10,000 lump sum investment in SBI Magnum Multiplier Fund over the last 5 years. र 10,000 invested in the fund five years back would have doubled in value to almost र 20,000 (as on 11/5/2015).

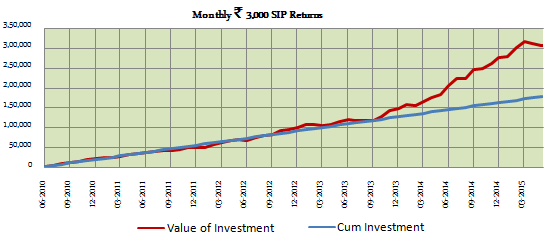

The chart below shows the returns of र 3,000 SIP in the SBI Magnum Multiplier fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.1 lacs while the investors would have invested only र 1.8 lacs.

Tata Ethical Fund

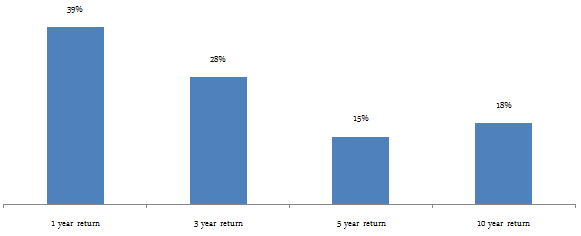

In our article, Some of the best smaller sized equity funds, we had discussed that despite its small AUM base (र 291 crores), Tata Ethical Fund is one of the best performing equity funds, relative to its peer set. The expense ratio of the fund is 3%. The investment mandate of the fund has ensured that the volatility of the fund, over the last 3 years, is significantly lower than the volatilities of diversified equity funds in general. The chart below shows the trailing returns of the fund over 1, 3, 5 and 10 year periods.

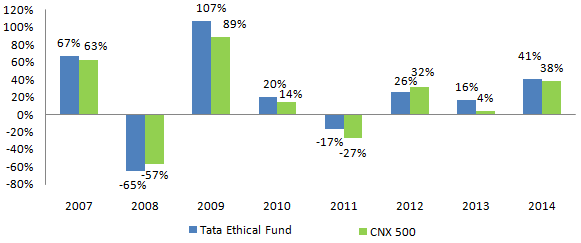

The chart below shows the annual returns of the Tata Ethical Fund over different market cycles from 2007 to 2014.

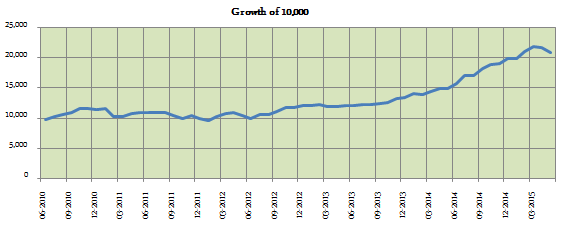

The chart below shows growth of र 10,000 lump sum investment in Tata Ethical fund over the last 5 years. र 10,000 invested in the Tata Ethical fund five years back would have grown to nearly र 21,000 (as on 11/5/2015).

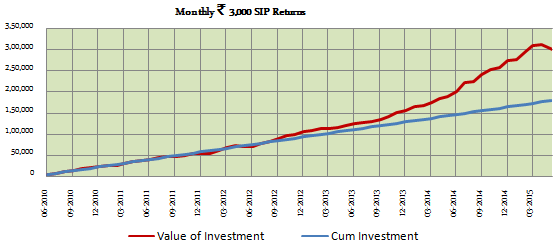

The chart below shows the returns of र 3,000 monthly SIP in the Tata Ethical Fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.1 lacs while the investors would have invested only र 1.8 lacs.

Birla Sun Life India GenNext Fund

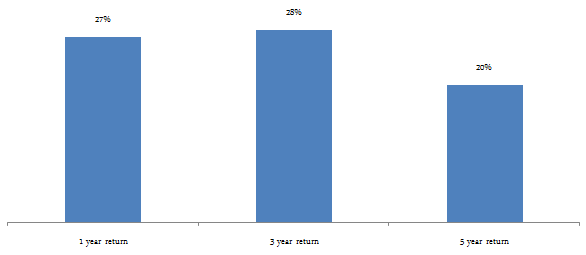

In our article, Some of the best smaller sized equity funds, we had also noted that Birla Sun Life India GenNext Fund is one of the best performing diversified equity fund, despite its small AUM base of र 250 crores. The expense ratio of the fund is 2.8%. The volatility of the fund is lower than the volatilities of diversified equity funds in general. The chart below shows the trailing returns of the fund over 1, 3, and 5 year periods.

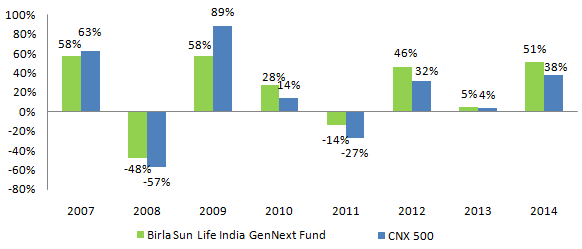

The chart below shows the annual returns of the Birla Sun Life India GenNext fund over different market cycles from 2007 to 2014.

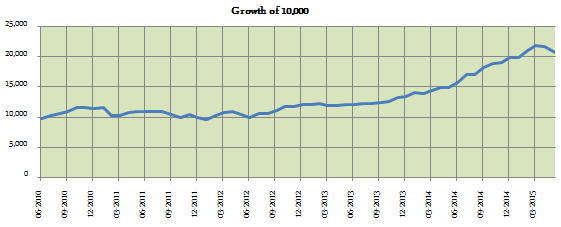

The chart below shows growth of र 10,000 lump sum investment in Birla Sun Life India GenNext Fund over the last 5 years. र 10,000 invested in the fund five years back would have grown to over र 25,000 (as on 11/5/2015).

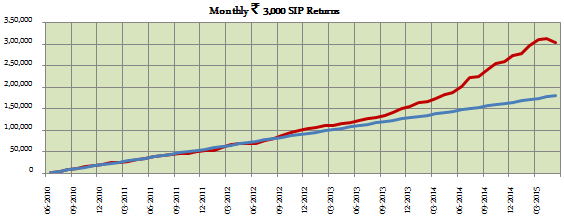

The chart below shows the returns of र 3,000 monthly SIP in the Birla Sun Life India GenNext Fund started 5 years back. The SIP date is assumed to be the first working day of the month.

The total value of the SIP investment as on 11/5/2015 was र 3.2 lacs while the investors would have invested only र 1.8 lacs.

Conclusion

We had discussed number of times on our blog that diversified Flexi Cap or Multi Cap funds are one of the best investment options for retail investors over a long time horizon. In this 2 part series, we reviewed some of the best flexi cap funds. Investors should consult with their financial advisors if these Flexi Cap funds are suitable for the investment portfolios.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Edelweiss Mutual Fund launches Edelweiss BSE Internet Economy Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

Bajaj Finserv Mutual Fund launches Bajaj Finserv Nifty 50 Index Fund

Apr 25, 2025 by Advisorkhoj Team

-

SBI Mutual Fund launches SBI Income Plus Arbitrage Active FOF

Apr 23, 2025 by Advisorkhoj Team

-

Motilal Oswal Mutual Fund launches Motilal Oswal Infrastructure Fund

Apr 23, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Gilt Fund

Apr 23, 2025 by Advisorkhoj Team