Birla Sun Life Medium Term Plan: A great investment for short and medium term

There is growing awareness of mutual funds in our country among retail investors. Retail mutual fund folios grew by over 15 lacs, a new record, in the quarter ending September 30, 2015. This was the fourth successive record quarter on quarter retail mutual fund volume growth. However, the vast majority of retail investors in India associate mutual funds with only equity as an asset class. The reality is that mutual funds offer a large variety of products that cater to a wide spectrum investment needs and risk profile. There is very little awareness of debt mutual funds among retail investors. As far as short term or medium term low risk investment is concerned, bank fixed deposit is almost an automatic choice for most retail investors. However, over the past one year, fixed deposits interest rates have come down by 1%, making it challenging for investors who rely on fixed deposit interest as a source of income. On the other hand, if you look at the performance of debt mutual funds, you will see that across the entire range of investment tenures, mutual funds in different debt categories have given significantly higher returns than fixed deposits. Fixed deposits are risk free investments with assured returns, while debt funds have an element of risk associated with it. However, risks involved in debt funds are very different from risks involved in equity funds. The risks involved in debt funds are not only much less than that of equity funds, but it is also easier to understand, once we grasp the concepts related to debt investments. As such, if you understand the risk return characteristics of debt funds and you can make appropriate investment choices, you can get significantly higher returns on your short term to medium investments. In this blog, we will review a great debt fund scheme for short and medium investments, Birla Sun Life Medium Term Plan.

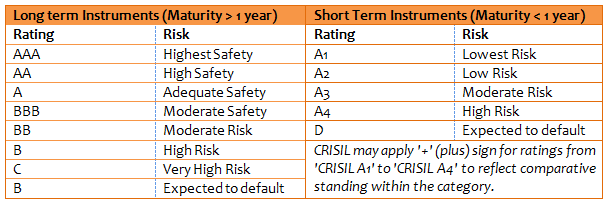

The chart below shows the trailing annualized returns of Birla Sun Life Medium Term plan and average category returns of Short Term Debt Funds over 1 year, 2 years and 3 years investment tenures.

Compare this with the post tax interest on your fixed deposits. Birla Sun Life Medium Term Plan would have given you much higher returns than your Fixed Deposit interest. You should also note that, over investment tenures of three years or more debt mutual funds are much more tax efficient than fixed deposits but more about that later.

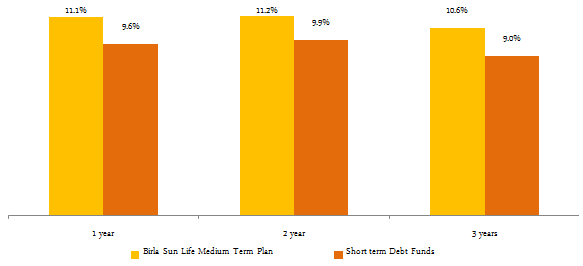

The chart below shows, the annual returns of Birla Sun Life Medium Term Plan and Short Term Debt Funds category since 2011. Again we can see Birla Sun Life Medium Term has outperformed the Short Term Debt Funds category and posted double digit returns almost every year.

Fund Overview

Birla Sun Life Medium Term Plan is a short term debt fund, but if more accurately categorized, it falls in the category of, what is known in mutual fund parlance as, Credit Opportunities Fund. Short term debt funds are debt mutual fund schemes which invest in fixed income securities of average maturities ranging between 2 to 3 years. The fund managers employ a predominantly accrual (hold to maturity) strategy for these funds. Credit opportunities fund are a type short term debt funds, where the fund managers lock in a few percentage points of additional yield by investing in slightly lower rated corporate bonds. Despite the slightly lower credit rating of the bonds in the credit opportunities fund portfolio, credit risk should not be a concern for the investor because the funds invest in papers rated A and higher. We will discuss more about the risk later. The scheme was launched in March 2009 and has an AUM of nearly र 4,500 crores. The minimum investment in this scheme is र 5,000. Investors should note that the fund has an exit load of 2% for withdrawals within 1 year and an exit load of 1% for withdrawals within 2 years. Therefore, the ideal investment tenure for this fund is 2 to 3 years. Maneesh Dangi is the fund manager of this scheme.

Risk and Return

As discussed earlier, it is important that we understand the risks involved in debt funds, so that we able to take the most appropriate investment decisions. But before we discuss risks, we should discuss how debt funds generate returns. Since debt funds invest in fixed income securities, they employ two different kinds of investment strategy:-

- Hold till Maturity: This is also known as accrual strategy, by which the fund invests in certain types of fixed income securities (or bonds) and hold them till maturity of the bond, earning the interest offered by the bond over the maturity period.

- Duration Calls: Using this strategy the fund manager, takes a view on the trajectory of interest rates. Bond prices go up when interest rate falls and declines when interest rate goes up. When interest increases duration call strategy will give a lower return, and when they decrease the same strategy will give higher returns.

Let us understand the risks involved with debt investments. There are, primarily, two kinds of risks associated with debt funds:-

- Interest Rate risk: Interest rate risk has opposite effect on hold to maturity strategy versus duration calls. Typically, a fund manager who employs a hold to maturity strategy will invest in short term bonds. If interest rates go up, the fund manager will be able to lock in higher yields with a hold to maturity strategy in short term bonds. On the other hand, the fund manager taking duration calls will invest in long term bonds because bond prices are inversely related to interest rates. The longer the maturity of a bond, higher is the change in its price with change in interest rates. Therefore, short term debt funds which invest in short maturity fixed income securities, have lower interest rate risks. On the other hand, long term debt fund which invest in long maturity fixed income securities have higher interest rate risk. Since the Birla Sun Life Medium Term Plan is a short term debt fund with an average maturity of less than 3 years, the interest rate risk is low.

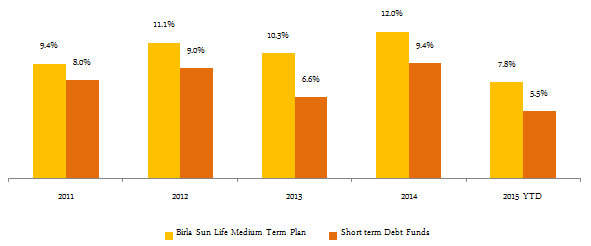

- Credit Risk: Credit risk is the risk of default by the borrower. In case of debt funds, it is risk of default by the bond issuer, either with respect to interest payment or principal repayment or both. We should understand how credit risk works in terms of risk and return. Credit rating agencies like CRISIL and ICRA in India rate fixed income securities based on their credit risk. Higher the credit rating, lower the yield but the risk is also lower. Let us understand how credit rating scale works. The table below describes the credit rating scale used by CRISIL to rate debt securities.

![Debt Short Term Funds - Long term Instruments and Short Term Instruments Debt Short Term Funds - Long term Instruments and Short Term Instruments]()

We should understand that, just because a bond’s credit rating is not AAA, it does not mean that it will default in interest or principal re-payment. AA rated bonds also offer high capital safety while giving a higher yield or interest. We should understand that credit risk should not be a concern for the investors in good Credit Opportunities Fund because the funds usually invest in papers rated A and higher. In fact, on an average, majority of the bonds in the fund portfolios of Credit Opportunities Funds are rated AAA and AA.

The average maturities of the fixed income securities in the portfolio of credit opportunities funds are in the range of 2 – 3 years. The fund managers hold the bonds to maturity and so there is very little interest rate risk. Good credit opportunities funds have given double digit returns in the recent past. Around 69% of Birla Sun Life Medium Term Plan’s portfolio fixed income securities are rated AA and above, implying high safety of capital. 100% of the fund’s portfolio is invested in securities rated A and above. Therefore, we can assume that both the interest risk and credit risk of Birla Sun Life Medium Term Plan is quite low.

Let us now understand two other important concepts related to debt investments.

- Yield to Maturity: Yield to maturity (YTM) is the return which the debt fund will get by holding the securities in its portfolio to maturity. For example if a debt fund’s portfolio has a YTM of 10% and a duration of 2 years, it means that, assuming no change to the portfolio, the fund will give 10% returns, as long it holds the securities in its portfolio till they mature. i.e. for 2 years. While the YTM of the fund may change over time, depending on the yields of the securities which the fund adds to its portfolio, over a short to medium term horizon, the YTM provides an indication of the kind of returns, which the fund is likely to get over the maturity period of the securities in its portfolio. The YTM of Birla Sun Life Medium Term Plan is 9.84% based on its September end portfolio. While the YTM of the fund may change over time, it is not likely to change substantially, in a short time frame. Investors should monitor the YTM of short term debt funds on a continuous basis and make appropriate adjustments accordingly.

- Average Maturity: This is in simplest terms, is the average time period till all the fixed income securities in the fund’s portfolio matures and principal is repaid. During the maturity tenure, fixed income securities receive the interest payment, also known as coupon payments. Once you know the yield to maturity and average maturity of a debt fund, you can estimate how much income you can get, assuming no changes to the fund’s portfolio. The average maturity of Birla Sun Life Medium Term Plan is 2.6 years. The current YTM of the fund is 9.84%. This implies that, if you hold your investment in the fund for 2.6 years, assuming no changes in the portfolio, you can expect to earn an annualized return of 9.84% over the investment tenure. However, it is important to reiterate that the YTM of a debt fund is only indicative and the actual returns may be higher or lower based on the securities in the fund’s portfolio.

Income Tax Considerations

While fixed deposit interests are taxed as per the income tax rate of the investor, the tax treatment of debt mutual funds is different. If the investment tenure in debt mutual funds is less than 3 years, then the income from debt funds is taxed as per the income tax rate of the investor. On the other hand, if the investment tenure in debt mutual funds is more than 3 years, then the capital gains are taxed at 20% with indexation benefit. With indexation benefit, your purchase price is indexed at the rate of cost of inflation index in the year of redemption relative to the cost of inflation index in the year of purchase of units. Dividends in debt mutual funds are paid after withholding dividend distribution tax. For debt mutual funds, dividend distribution tax is around 28%. Therefore, for investors in the highest tax bracket, dividend option may be more tax efficient, if your investment tenure is less than 3 years.

Conclusion

In this blog, we have discussed several important factors related to short and medium term debt investments. We have also discussed why Birla Sun Life Medium Term Plan is a great investment option for short and medium term investments. Investors should consult with their financial advisors if Birla Sun Life Medium Term Plan is best suited for their short and medium investment needs.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Zerodha Mutual Fund launches Zerodha Nifty Short Duration G Sec Index Fund

Dec 26, 2025 by Advisorkhoj Team

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team