Top and Best 5 Balanced Mutual Funds for investment in 2016

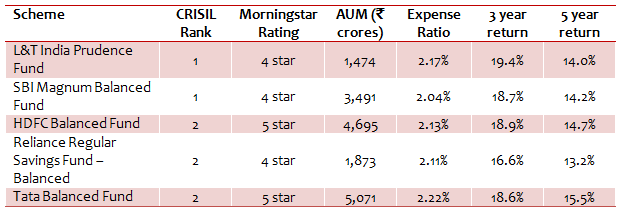

Balanced Mutual Funds are hybrid equity oriented mutual fund schemes. These funds usually invest 65 – 75% of their portfolio in equity securities and the remaining portion in debt or money market securities. The hybrid portfolio moderates the fund volatility to a certain degree while enabling potential wealth creation in the long term. Since at least 65% of the portfolio is invested in equity or equity related securities, balanced funds are subject to equity taxation. Long term capital gains, for investment period of more than 1 year, is tax exempt. Short term capital gains, for investment periods of less than 1 year, is taxed at 15%. Dividends from balanced fund schemes are also tax free. In our article, Why Balanced Funds may be the best investments for new mutual fund investors? we had seen that while volatilities of balanced funds are considerably lower than equity funds, balanced funds also produce superior risk adjusted returns. In this article, we will review the Top 5 Balanced Mutual Fund Schemes based on CRISIL’s mutual fund rankings for the quarter ended December 31 2015. All the balanced funds in our selection have been ranked 1 (very good performer) or 2 (good performer) by CRISIL. Each of these funds has also been given either 4-star or 5-star rating by Morningstar, a globally renowned mutual fund research firm. The table below shows the top 5 Balanced Mutual Fund Schemes based on CRISIL and Morningstar ratings.

Source: CRISIL, Morningstar, Advisorkhoj Research (returns are based on Mar 21 2016 NAVs)

L&T India Prudence Fund

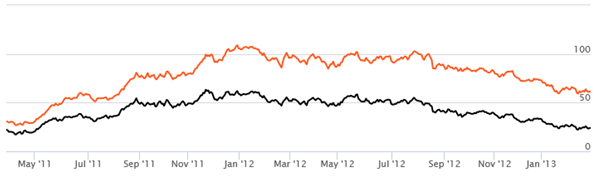

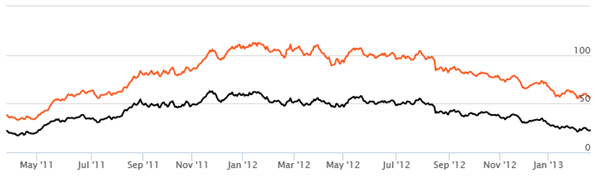

L&T India Prudence Fund is the youngest fund in our selection. It has been an outstanding performer in the last few years. The 3 year trailing returns of this fund was 19.4% and the 5 year trailing returns was 14%. The fund has an AUM base of र 1,474 crores and an expense ratio of 2.17%. While the fund’s volatility is higher than the average, the fund has also produced risk adjusted returns measured in terms of Sharpe Ratio. The asset allocation of L&T India Prudence Fund is 69% equity and 31% debt and money market. The equity portfolio is biased towards large cap stocks. Large cap stocks account for 68% of the fund’s equity portfolio. The chart below shows the 3 year rolling returns of the L&T India Prudence Fund (orange line) versus the benchmark index, CRISIL Balanced Fund index (black line) over the last 5 years.

Source: Advisorkhoj Research

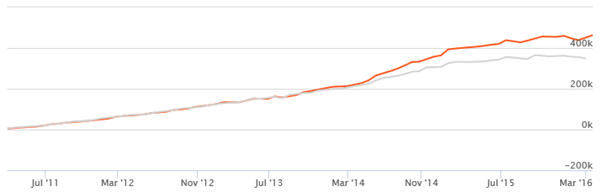

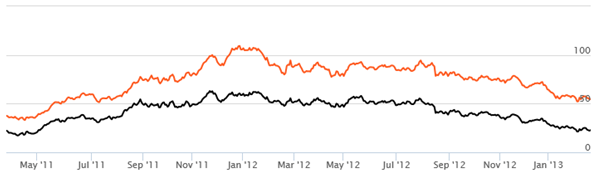

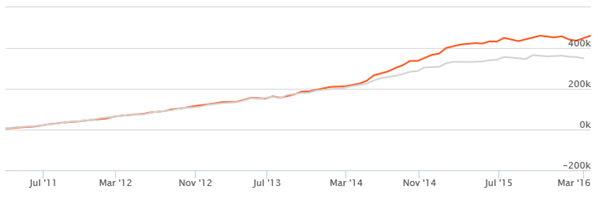

You can see the fund has consistently outperformed versus the benchmark index. The chart below shows the returns of a र 5,000 monthly SIP in L&T India Prudence Fund over the last 5 years.

Source: Advisorkhoj Research

With a cumulative investment of र 305,000 in the fund your investment value today would be र 463,000 and profit of over र 158,000.

SBI Magnum Balanced Fund

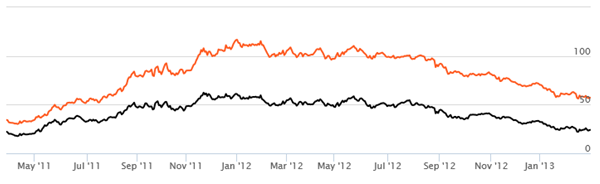

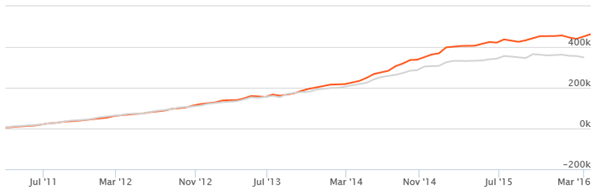

While L&T India Prudence Fund is the youngest fund in our selection, the SBI Magnum Balanced Fund, along with Tata Balanced Fund, are the oldest funds in our selection. It is also one of the oldest Balanced Fund schemes in India, over 20 years old. The 3 year trailing returns of this fund was 18.7% and the 5 year trailing returns was 14.2%. The fund has an AUM base of र 3,491 crores and an expense ratio of 2.02%. While the fund’s volatility is higher than the average, the fund has also produced risk adjusted returns measured in terms of Sharpe Ratio. The asset allocation of SBI Magnum Balanced Fund is 69% equity and 31% debt and money market. The equity portfolio is balanced across market capitalization segments. Large cap stocks account for 51% of the fund’s equity portfolio, while small and midcap stocks account for 49%. The chart below shows the 3 year rolling returns of the SBI Magnum Balanced Fund (orange line) versus the benchmark index, CRISIL Balanced Fund index (black line) over the last 5 years.

Source: Advisorkhoj Research

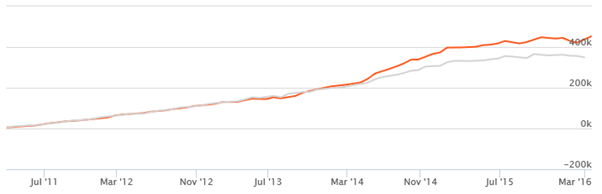

You can see the fund has consistently outperformed versus the benchmark index. The chart below shows the returns of a र 5,000 monthly Systematic Investment Plan (SIP) in SBI Magnum Balanced Fund over the last 5 years.

Source: Advisorkhoj Research

With a cumulative investment of र 305,000 in the fund your investment value today would be र 463,000 and profit of over र 158,000.

HDFC Balanced Fund

This is a very popular balanced fund from the HDFC Mutual Fund stable. The 3 year trailing returns of this fund was 18.9% and the 5 year trailing returns was 14.7%. The fund has an AUM base of र 5,071 crores and an expense ratio of 2.13%. While the fund’s volatility is higher than the average, the fund has also produced risk adjusted returns measured in terms of Sharpe Ratio. The asset allocation of HDFC Balanced Fund is 67% equity and 33% debt and money market. The equity portfolio has a large cap bias, with large cap stocks account for 63% of the fund’s equity portfolio. The chart below shows the 3 year rolling returns of the HDFC Balanced Fund (orange line) versus the benchmark index, CRISIL Balanced Fund index (black line) over the last 5 years.

Source: Advisorkhoj Research

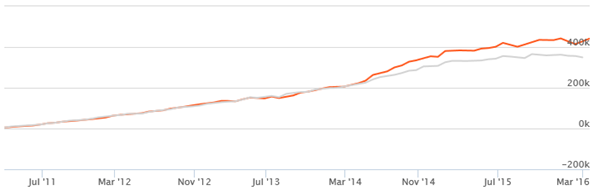

You can see the fund has consistently outperformed versus the benchmark index. The chart below shows the returns of a र 5,000 monthly SIP in HDFC Balanced Fund over the last 5 years.

Source: Advisorkhoj Research

With a cumulative investment of र 305,000 in the fund your investment value today would be र 453,000 and profit of over र 148,000.

Reliance Regular Savings Fund – Balanced Option

Reliance Regular Savings Fund – Balanced Option is another strong performer. The 3 year trailing returns of this fund was 16.6% and the 5 year trailing returns was 13.2%. The fund has an AUM base of र 1,873 crores and an expense ratio of 2.11%. While the fund’s volatility is higher than the average, the fund has also produced risk adjusted returns measured in terms of Sharpe Ratio. The asset allocation of Reliance Regular Savings Fund - Balanced Option is 68% equity and 32% debt and money market. The equity portfolio has a large cap bias, with large cap stocks account for 80% of the fund’s equity portfolio. The chart below shows the 3 year rolling returns of the Reliance Regular Savings Fund – Balanced Option (orange line) versus the benchmark index, CRISIL Balanced Fund index (black line) over the last 5 years.

Source: Advisorkhoj Research

You can see the fund has consistently outperformed versus the benchmark index. The chart below shows the returns of a र 5,000 monthly SIP in Reliance Regular Savings Fund - Balanced Option over the last 5 years.

Source: Advisorkhoj Research

With a cumulative investment of र 305,000 in the fund your investment value today would be around र 442,000 and profit of nearly र 137,000.

Tata Balanced Fund

The Tata Balanced Fund, along with SBI Magnum Balanced Fund, is the two oldest funds in our selection. They are also among the oldest Balanced Fund schemes in India, more than 20 years old. The 3 year trailing returns of this fund was 18.6% and the 5 year trailing returns was 15.5%. The fund has an AUM base of र 1,873 crores and an expense ratio of 2.22%. While the fund’s volatility is higher than the average, the fund has also produced risk adjusted returns measured in terms of Sharpe Ratio. The asset allocation of Tata Balanced Fund is 71% equity and 29% debt and money market. The equity portfolio has a large cap bias, with large cap stocks account for 65% of the fund’s equity portfolio. The chart below shows the 3 year rolling returns of the Tata Balanced Fund (orange line) versus the benchmark index, CRISIL Balanced Fund index (black line) over the last 5 years.

Source: Advisorkhoj Research

You can see the fund has consistently outperformed versus the benchmark index. The chart below shows the returns of a र 5,000 monthly Systematic Investment Plan (SIP) in Tata Balanced Fund over the last 5 years.

Source: Advisorkhoj Research

With a cumulative investment of र 305,000 in the fund your investment value today would be र 461,000 and profit of nearly र 156,000.

Dividend Pay-out Track Record

All the funds in our selection have excellent dividend pay-out track record. L&T India Prudence Fund and Tata Balanced Fund have monthly dividend options, while HDFC Balanced Fund and Reliance Regular Savings Fund – Balanced Option has quarterly dividend options. You can check the historical dividend paid by these funds by going to our MF Research section, Historical Dividends. Just type a few letters of the scheme name and select the appropriate options. You should remember that the mutual funds cannot assure dividend pay-out either with respect to the amount of payout or the frequency of pay-out.

Conclusion

In this blog post, we have reviewed the top 5 Balanced Mutual Fund Schemes based on CRISIL and Morningstar ratings. These funds have excellent performance along with regular dividend pay-out track record and should appeal also to investors who need regular cash flows from their investments. Investors should consult with their financial advisors if these funds or other Balanced Mutual Funds are suitable for their investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Top 10 Equal Weight Index Fund

Apr 7, 2025 by Advisorkhoj Team