Strong outperformance by Canara Robeco Balanced Fund

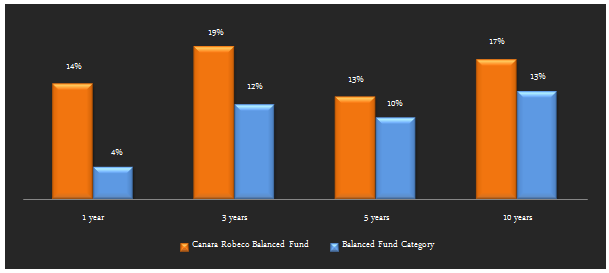

Balanced Mutual funds are ideal investment options for investors with moderate risk tolerance, especially during periods of high volatility in equity markets. Canara Robeco Balanced Fund has delivered exceptionally strong outperformance in the last 1 year. Even in terms of last 3 years, 5 years and 10 years trailing returns, Canara Robeco Balanced Fund’s outperformance relative to the Balanced Fund category has been quite strong. Since June 2015, the fund has also been paying regular monthly dividends. The chart below shows the annualized trailing returns of Canara Robeco Balanced Fund and the average trailing returns of Balanced Fund category over the last 1, 3, 5 and 10 years (NAVs as on October 29, 2015).

Fund Overview

The Canara Robeco Balanced fund is suitable for investors looking for long term capital appreciation with moderate levels of risk. The fund has over र 400 crores of assets under management. The expense ratio of the fund is slightly on the higher side at 2.8%. The fund managers of this scheme are Avnish Jain and Krishna Sanghvi. Morningstar has a 4 star rating for this fund.

Rolling Returns

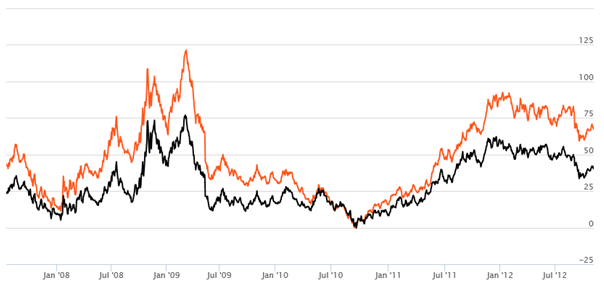

The chart below shows the 1 year rolling returns of Canara Robeco Balanced since the inception of the fund. Rolling returns are the total returns of the scheme taken for a specified period on every day/week/month and taken till the last day of the duration. In this chart we are showing returns on every day during the specified period and comparing it with the benchmark. Rolling returns is the best measure of a fund’s performance. The orange line shows the 1 year rolling returns of Canara Robeco Balanced Fund (Growth Option) and the black line shows the 1 year rolling returns of the benchmark, CRISIL Balanced Fund Index.

Source: https://www.advisorkhoj.com/mutual-funds-research/rolling-returns

We can see that the fund has consistently beaten its benchmark index. We can also see that, the three year rolling returns of Canara Robeco Balanced Fund has never been negative. Since the middle of 2011 onwards the fund has consistently given over 50% 3 year returns, which on an annualized basis, implies over 14% compounded annual returns for the investors. That is why this fund is a great investment option for investors with moderate risk tolerance levels.

Portfolio Composition

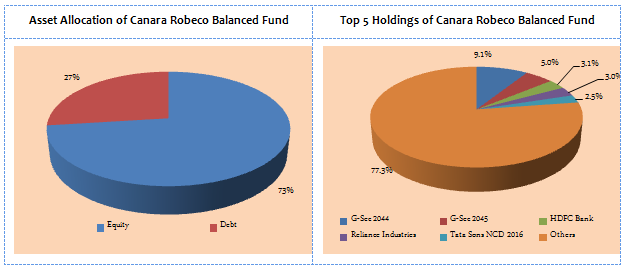

In terms of portfolio construction equity comprises 74% of the portfolio mix, while debt comprises 27%. The fund has midcap bias with a high growth focus. In terms of sector allocation of the equity portfolio, the fund has a bias for cyclical sectors. With the improvement of the macro-economic condition in India and revival of earnings growth in Indian companies cyclical stocks are likely to give good returns in the next few years. The fund is well diversified, with the top 5 stock holdings accounting for around 23% of the fund’s portfolio. The debt portion of the portfolio has an average maturity of 5 – 6 years and hence has a high sensitivity to interest rate risk. With interest rates are expected to come down in the coming quarters, one can expect good returns from the debt portfolio of the fund as well.

Risk & Return

From a risk perspective, the volatility of the fund is slightly on the higher side. However, on the basis of risk adjusted returns, as measured by Sharpe Ratio, the fund has outperformed the balanced fund category. The fund has given 12.73% compounded annual returns since inception. र 1 lac investment in the NFO of the fund (growth option) would have grown to around र 11.4 lacs by October 29, 2015.

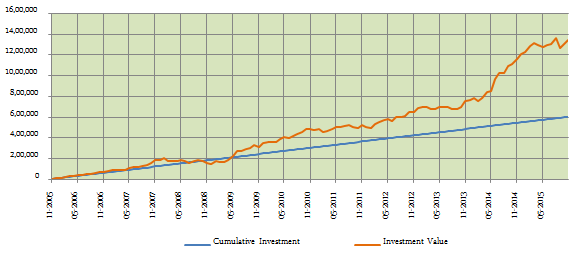

The chart below shows the returns over the last 10 years of र 5000 monthly SIP in the Canara Robeco Balanced Fund (growth option). The SIP date has been assumed to first working day of the month.

The chart above shows that a monthly SIP of र 5,000 started 10 years back in the fund would have grown to over र 13.3 lacs by Octber 28 2015, while the investor would have invested in total only र 6 lacs. The Systematic Investment Plan return of the fund over the last 10 years is over 15%

Conclusion

Canara Robeco Balanced Fund has delivered strong performance over the last 10 years. Its outperformance has especially been strong over the last 3 years. Investors with moderate risk profiles may consider this product for their retirement planning and other long term financial objectives, through systematic investment plans or lump sum route. Investors should consult with their financial advisors, if this scheme is suitable for their financial planning objectives.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Groww Mutual Fund launches Groww Nifty Chemicals ETF

Dec 26, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty Next 50 ETF

Dec 19, 2025 by Advisorkhoj Team

-

DSP Mutual Fund launches DSP Nifty 500 Index Fund

Dec 19, 2025 by Advisorkhoj Team

-

Kotak Mahindra Mutual Fund launches Kotak Nifty Next 50 ETF

Dec 18, 2025 by Advisorkhoj Team

-

The Wealth Company Mutual Fund launches The Wealth Company Gold ETF

Dec 16, 2025 by Advisorkhoj Team