Optimize your Asset Allocation with Balanced Mutual Funds

We have discussed earlier in our blog that, asset allocation is the most important aspect of financial planning (please see our article, Asset Allocation strategies for different age groups). A number of studies have proven investing according to asset allocation principles and rebalancing the portfolio on a regular basis, gives excellent returns and is the most effective way of meeting your financial goals. Asset allocation depends on the age, investment horizon, income and financial goals on the investor. Though there are no hard and fast rules for asset allocation, some commonly used asset allocation guidelines suggest 70% equity and 30% allocations, for investors between 30 to 40 years of age. Some asset allocation guidelines suggest that even investors in the age group of 40 to 50 years of age can opt of 70% equity and 30% debt allocations. Balanced funds which have 65 – 70% of their portfolio invested in equities and the rest in fixed income securities are excellent investment options for such investors.

Advantages of Balanced Funds

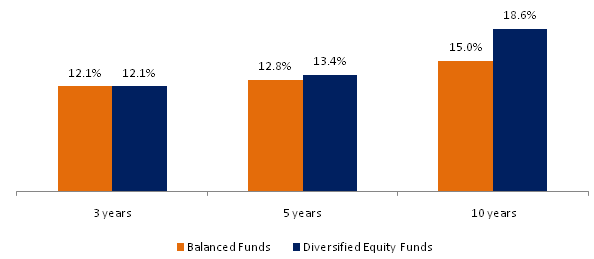

- On a risk adjusted basis top performing balanced funds have delivered excellent returns compared to equity mutual funds. The chart below shows the comparison of average annualized returns of diversified equity and balanced funds categories over the 3 years, 5 years and 10 years time periods. Returns based on July 17 NAVs.

While the difference in returns between diversified equity and balanced funds categories over 3 and 5 year time periods have not been significant, the volatility of returns is much lower for balanced funds compared to diversified equity fund. The chart below shows the comparison of annualized standard deviation of average monthly returns diversified equity and balanced funds categories over the 3 years, 5 years and 10 years time periods.

- Balanced funds provide investors the benefit of automatic portfolio rebalancing. Why is portfolio rebalancing important? Since assets have different rates of returns, over a period of time the asset allocation of your portfolio deviates from your target asset allocation. So from time to time, you need to rebalance your portfolio so that your portfolio is aligned with your target asset allocation. Let us understand this with the help of an example. Let us assume you have investment corpus of Rs 5 lacs. Your target asset allocation, as per your age, income and investment horizon is 70% equity & 30% debt. Accordingly, you have invested Rs 3.5 lacs in an equity fund and Rs 1.5 lacs in an income fund (or debt fund). Let us further assume that the equity fund gives an annual return of 15% and the income fund gives a return of 8%. The table below shows the growth of your investment.

We can see in this example that by year 5 the equity allocation has increased to 76% and debt allocation has decreased to 24%, because the equity and debt investments have been growing at different rates. However, this has caused your portfolio to deviate from your asset allocation target and exposed your portfolio to higher risks. If the deviation from your target exceeds a certain tolerance band, you should re-balance your portfolio either by making fresh debt investment or by booking part profits in your equity investments and reinvesting in debt. This re-balancing happens automatically in balanced funds. Suppose a balanced fund has 70% exposure to equity and 30% to debt. If the market rises sharply causing the equity allocation to increase to 80%, the fund manager will sell 10% of the equity holdings to bring back the equity exposure to 70%. On the other hand, if the market falls the fund manager will buy more stocks to maintain the 70% exposure to equities.

- Since long term capital gains is tax exempt for equity oriented schemes, you get tax free returns on the debt component of your equity oriented balanced funds. Balanced funds are among the very few schemes where the return on the debt investment is tax free. Fixed deposit interest is taxable at the income tax slab rate of the investor. Even debt funds returns held for less than 3 years will be taxable at the income tax slab rate of the investor, as per the new Budget. Debt funds returns held for more than 3 years will be taxed at 20% with indexation.

Comparison of returns of balanced fund versus combination of equity fund and fixed deposit

Will you be better off constructing your own balanced portfolio or investing in balanced funds? Let us analyze with the help on an example. Let us assume your asset allocation target is 70% equity and 30% debt. We will examine two investment options:-

- You constructed your own balanced portfolio, by selecting top performing diversified equity fund and investing 70% of your investible corpus in the fund. You invested the balance 30% in a fixed deposit. For the equity portion we have chosen ICICI Prudential Dynamic Plan, a diversified equity fund. ICICI Prudential Dynamic Plan has given nearly 19% annualized returns over the last 5 years. Your investment period was the last 5 years.

- You invested your investible corpus in a top performing balanced fund. We have chosen a top performing balanced fund from the ICICI Prudential stable. Our balanced fund selection is ICICI Prudential Balanced fund. Like ICICI Prudential Dynamic Plan, the ICICI Prudential Balanced Fund has also given excellent returns over the last 5 years. Since ICICI Prudential Balanced fund has equity exposure target of around 70%, your asset allocation target would have been met. As in option 1, your investment period was the last 5 years.

Let us now see how the returns compare after 5 years. The table below shows the return on the portfolio of the equity fund and fixed deposit.

Let us now compare the above with the return on the balanced fund investment.

We can see that the return on the balanced fund is Rs 1.08 lacs higher than the portfolio of the equity fund and fixed deposit. What if you had invested in a good long term income fund instead of fixed deposit in option 1? Sure, the return would be higher if you had invested in an income fund, since it is more tax efficient than a fixed deposit. However, the return on the balanced fund would still be higher

Conclusion

Balanced funds are excellent investment long term investment options. They can help you meet your asset allocation targets, help you with automatic rebalancing of your portfolio and are more tax efficient. If you have a more aggressive asset allocation target, combine your balanced fund investment with a large cap equity fund or a mid cap fund. If you have a conservative asset allocation target you can consider monthly income plans, which are another variant of balanced funds, for conservative investors (please see our article, Top 5 Mutual Fund Monthly Income Plans). However, as with all mutual fund investments, it is imperative that you select a top performing balanced fund. Difference in the performance of a fund in top quartile and bottom quartile is significant. You should consult with your financial adviser, if balanced funds are suitable for your investment portfolio.

Queries

-

What is the benefit of mutual fund STP

Aug 29, 2019

-

How much to invest to meet target amount of Rs 2 Crores

Aug 26, 2019

-

Can I achieve my financial goals with my current mutual fund investments

Aug 24, 2019

-

Can you tell me return of various indices

Aug 19, 2019

-

What would be the post tax return on different investments

Aug 18, 2019

-

Which Principal Mutual Fund scheme will be suitable for my retirement corpus

Aug 16, 2019

-

What is the minimum holding period for availing NCD interest

Aug 4, 2019

Top Performing Mutual Funds

Recommended Reading

Fund News

-

Mirae Asset Investment Managers (India) Pvt. Ltd. IFSC branch launches Mirae Asset Global Allocation Fund IFSC at Gift City

Apr 21, 2025 by Mirae Asset Mutual Fund

-

Axis Mutual Fund joins ONDC Network to Expand Access to Mutual Fund Investments

Apr 18, 2025 by Axis Mutual Fund

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Quality 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

Nippon India Mutual Fund launches Nippon India Nifty 500 Low Volatility 50 Index Fund

Apr 18, 2025 by Advisorkhoj Team

-

RBI Monetary Policy: RBI changes policy stance and lowers rate

Apr 9, 2025 by Axis Mutual Fund