Why you cannot ignore debt mutual funds in your investment portfolio

For most retail investors in India, mutual funds are related to equity investments. Retail participation in debt mutual funds in India is relatively quite low. As per AMFI data (January 2019), assets under management (AUM) of individual investors in equity oriented schemes is more than double of AUM in debt oriented schemes (including liquid funds). Equity AUM of individual investors is also growing faster on a year on year basis compared to debt mutual fund AUM. The low share of debt mutual funds in retail investor portfolios is primarily due to lack of awareness, but investors should know that debt mutual funds offer solutions for a wide range of investment needs, tenors and risk appetites.

Why you should consider debt mutual funds for your portfolio?

Asset Allocation

: Asset allocation is the mix of your investment portfolio in different asset classes like equity, fixed income, gold etc. It is one of the most important aspects of investing. There are several benefits of asset allocation.- In absence of asset allocation, investors invest in an ad-hoc manner. Asset allocation will ensure that you invest in disciplined manner for different financial goals.

- Asset allocation aligns your portfolio to your financial goals across different time horizons, e.g. short term goals, medium goals and long term goals. While you can afford to take high risks for your long term goals, you want low investment risk for your short term goals.

- Debt mutual funds are lower risk assets compared to equity funds and along with equity funds. Debt funds along with equity funds play a vital role in ensuring optimal asset allocation.

Risk diversification

: Risk optimization is a corollary of asset allocation. Asset allocation diversifies risk and optimizes risk / returns across different market conditions. If your portfolio comprises entirely of equity funds, a bad bear market can wipe out years of gains. On the other hand, if you have both equity and debt funds in your portfolio in optimal proportions then only the equity portion of your portfolio is subject to stock market volatility; debt mutual funds provide stability and income in bear markets. While volatility can never be wished away in market linked instruments like mutual funds, the inclusion of debt funds in your investment portfolio reduces overall portfolio volatility in uncertain times. Risk diversification enables you to remain invested for longer periods of time and enhance your returns.Superior returns compared to traditional fixed income

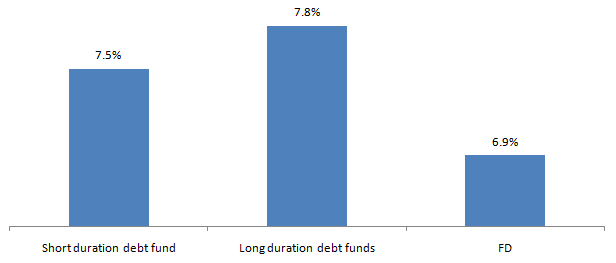

: Debt mutual funds are market linked investments and are therefore, subject to interest rate and credit risks. Debt funds do not assure fixed returns, like the traditional fixed income investment options like Bank FDs and Government small savings schemes. It is true that 2017 and 2018 were difficult years for debt funds, but if we look at past 1 year returns, certain debt fund categories like long duration funds, money market funds, low duration funds etc. have outperformed bank FDs (please see our tool, Mutual Fund Category Monitor). If you look at 1 year rolling returns of some debt fund categories over longer periods across different interest rate scenarios then you will see that debt funds have historically outperformed FDs on a pre-tax basis. The chart below shows the 1 year rolling returns of short duration and long duration funds versus FD interest rates over the last 5 years.

![1 year rolling returns of short duration and long duration funds versus FD interest rates 1 year rolling returns of short duration and long duration funds versus FD interest rates]()

Source: Advisorkhoj Research

Liquidity

: Liquidity should be one of the most important considerations in your financial planning. Debt funds provide superior liquidity to your portfolio. Money market mutual funds like overnight fund and liquid funds have no exit load. You can redeem your funds at any time without any penalty. Redemption requests are processed and credited to your bank account within 24 hours. Other types of money market mutual funds like ultra-short duration funds, money market funds etc. also have short exit load periods and are more liquid compared to other mutual funds.Tax Advantage

: Debt mutual funds enjoy considerable tax advantage compared to bank FDs over 3 years plus investment periods. Banks FD interest is taxed as per the income tax rate of the investor, while long term (investment held for more than 3 years) capital gains in debt funds are taxed at 20% after allowing for indexation benefits.

Let us explain the tax advantage of debt funds with an example -

Suppose you deposited Rs 10 Lakh in bank FD three years back at an interest rate of 7% per annum (with quarterly compounding). The total accrued interest over the FD term will be around Rs 230,000. You will have to add the interest income to your total income in your Income Tax Returns and the interest income will be taxed as per income tax rate. Let us assume that you are in the 30% income tax bracket. Ignoring cess, you will have to pay tax of Rs 69,430 on your income and your post tax income will be Rs 1.62 Lakhs.

Let us now assume you invested in the same amount (Rs 10 Lakh) in a debt mutual fund 3 years back. Let us further assume that you got an annualized return of 7%. Your investment value after 3 years will be Rs 125,000. If your investment holding period is more than 3 years, you will be allowed to index your cost of purchase based on cost inflation index in the year of redemption and cost inflation index in the year of acquisition (purchase).

- Cost Inflation Index in 2018-19 (year of redemption): 280

- Cost Inflation Index in 2015-16(year of acquisition): 254

- Indexed Cost of purchase = Investment Amount X (Cost Inflation Index in the year of redemption) / (Cost Inflation Index in the year of acquisition) = 10 X 280/254 = 11.02 Lakhs

- Long term capital gains (after indexation) = 12.25 – 11.02 = 1.23 Lakhs

- Long term capital gains tax (@20%) = 1.23 X 20% = Rs 24,530

- Post Tax Income = Rs 2 Lakhs

You can see that the investment in debt funds, your tax obligation for the same income is much less than bank FDs. On a post-tax basis, debt funds are likely to give much superior returns than bank FDs.

Conclusion

In this blog post, we discussed why debt mutual funds should be part of your investment portfolios. Debt funds will help you optimize your asset allocation, diversify risks, add liquidity and get superior post tax returns. There are a large variety of debt funds with different risk / return profiles. Not all debt funds will be suitable for you. You should select debt funds based on your risk appetite and investment tenor. You should consult with a financial advisor before investing in debt funds to understand which funds will be suitable for your investment needs.

Mutual Fund Investments are subject to market risk, read all scheme related documents carefully.

RECOMMENDED READS

LATEST ARTICLES

Quick Links

Our Funds

POST A QUERY